August Deadline: Treasury Signals Potential US Debt Limit Crisis

Table of Contents

The Looming August Deadline and its Implications

The Treasury Department has set August as a critical deadline, indicating that the US government may reach its statutory debt limit by then. Exceeding this limit without Congressional action has severe implications:

-

Potential Consequences of Exceeding the Debt Ceiling: Failure to raise the debt ceiling would prevent the government from borrowing additional funds to meet its existing obligations. This means the US could default on its debt for the first time in history.

-

Treasury Projections and Warnings: The Treasury has issued stark warnings, projecting a potential inability to meet all its financial obligations if the debt ceiling isn't raised promptly. This includes payments to Social Security recipients, military personnel, and other vital government services.

-

Impact on Government Operations and Spending: A default would force drastic cuts to government spending, leading to widespread disruption of essential services and potentially a government shutdown. This would severely impact the economy and the lives of millions of Americans.

-

Potential for a Government Shutdown: Beyond the inability to pay debts, a failure to raise the debt ceiling could also trigger a government shutdown, halting non-essential government functions and further exacerbating the economic crisis. This scenario would further diminish confidence in the US government's ability to manage its finances.

Political Gridlock and the Debt Ceiling Debate

Raising the debt ceiling requires Congressional action, but the process has become increasingly fraught with political gridlock. The ongoing debate highlights deep divisions:

-

Positions of Different Political Parties: Different political parties and factions hold differing views on the debt ceiling, often using it as leverage in broader political negotiations. Finding common ground and achieving a bipartisan solution is proving exceptionally challenging.

-

Potential for Compromise or Continued Stalemate: The potential for compromise remains uncertain. The possibility of a continued stalemate leading to a default is a very real and concerning prospect. Negotiations are ongoing, but a successful outcome is far from guaranteed.

-

Influence of Lobbyists and Special Interest Groups: Lobbyists and special interest groups exert considerable influence on the debt ceiling debate, often pushing for agendas that may exacerbate the political divisions and hinder a swift resolution. Their actions further complicate the already delicate negotiations.

-

Previous Instances of Debt Ceiling Crises: History provides examples of previous debt ceiling crises, some resolved at the last minute, others causing temporary market disruptions. These past events underscore the urgency and potential severity of the current situation and the need for proactive measures.

Economic Consequences of a US Debt Limit Crisis

A default on US debt would have far-reaching and potentially catastrophic economic consequences:

-

Impacts on Global Financial Markets: A US default could trigger a global financial crisis, as the US plays a central role in the global economy. International markets would likely experience significant volatility and potential crashes.

-

Risk of a Credit Rating Downgrade: A default would almost certainly lead to a credit rating downgrade for the US, increasing borrowing costs for the government and potentially for businesses and individuals. This could destabilize the financial system.

-

Impacts on Consumer Confidence and Spending: Uncertainty surrounding the debt limit crisis would likely erode consumer confidence, leading to reduced consumer spending and potentially a recession. This could create a negative feedback loop, impacting economic growth.

-

Effects on Interest Rates and Borrowing Costs: Borrowing costs for both the government and private sector would likely increase significantly, making it more expensive for businesses to invest and individuals to borrow money. This would further dampen economic growth.

-

Potential Job Losses and Economic Recession: The combined effects of reduced consumer spending, increased borrowing costs, and government spending cuts could lead to widespread job losses and a severe economic recession, potentially lasting for years.

Impact on Global Markets and International Relations

The ramifications of a US debt limit crisis extend far beyond US borders:

-

Triggering a Global Financial Crisis: A US default could trigger a cascade of defaults across global markets, leading to a global financial crisis. International investors could lose confidence, leading to widespread panic and selling.

-

Loss of Confidence in the US Dollar: The US dollar's status as the world's reserve currency could be jeopardized, potentially leading to its devaluation and a shift towards alternative currencies. This would impact global trade and finance.

-

Increased International Tensions: A US default could increase international tensions and potentially damage relationships between the US and other countries. It could also embolden adversaries and weaken America's global standing.

Conclusion

The looming August deadline for the US debt limit presents a serious and potentially devastating crisis. Political gridlock, coupled with the Treasury's warnings, paints a concerning picture of potential economic repercussions, both domestically and globally. A default could trigger significant market instability, impacting investor confidence, international relations, and potentially leading to a global recession. The US debt limit crisis demands immediate and decisive action to avert a catastrophic outcome.

Call to Action: Stay informed about the ongoing developments regarding the US debt limit crisis. Understand the potential risks and implications of this situation, and advocate for responsible solutions to avoid a catastrophic US debt limit crisis. Follow reputable news sources for the latest updates on this crucial issue and engage in informed discussions to promote a timely resolution.

Featured Posts

-

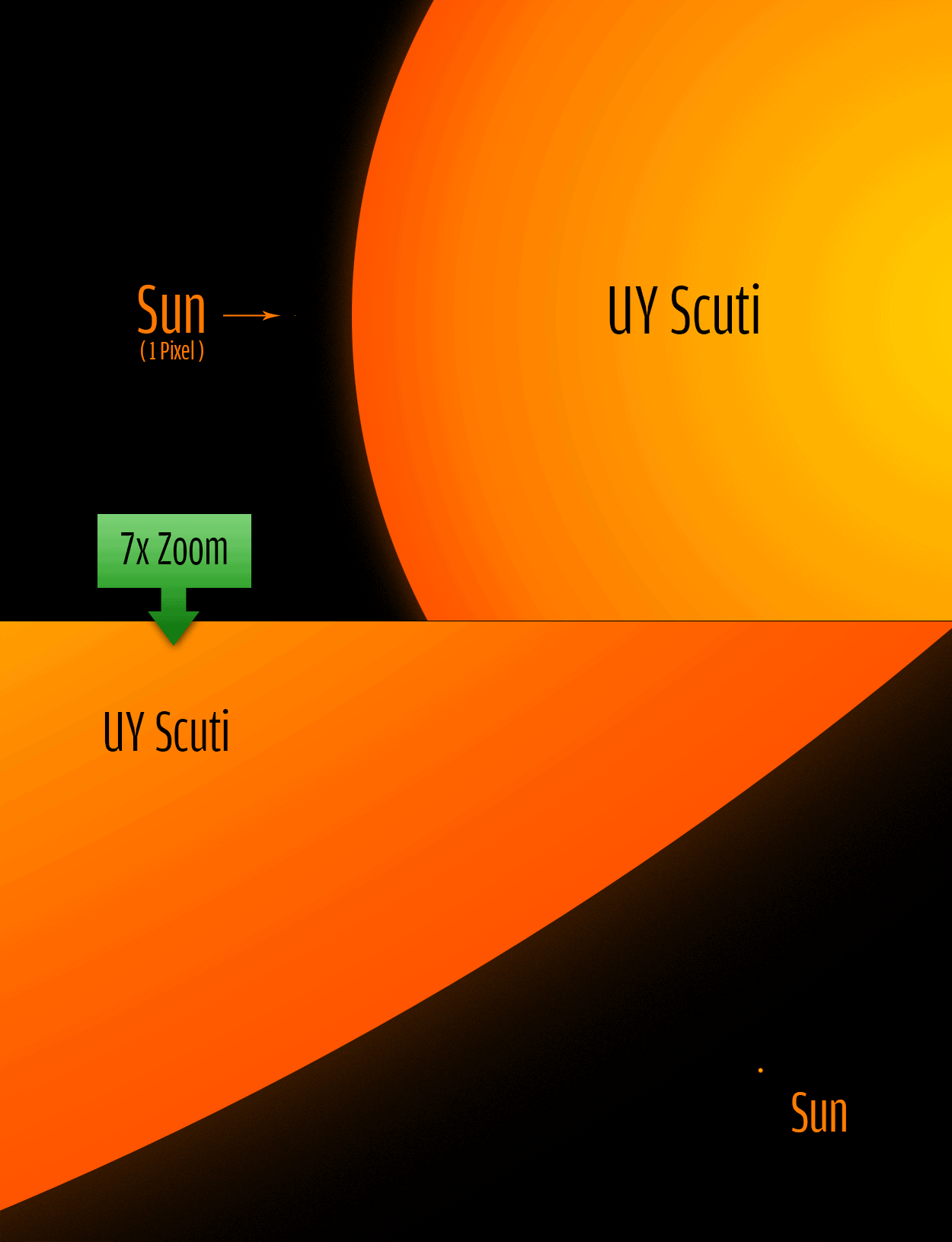

Young Thugs Uy Scuti What We Know About The Upcoming Album Release

May 10, 2025

Young Thugs Uy Scuti What We Know About The Upcoming Album Release

May 10, 2025 -

Strengthening Your Organization Through Effective Middle Management

May 10, 2025

Strengthening Your Organization Through Effective Middle Management

May 10, 2025 -

Broken By Hate Family Demands Justice After Racist Murder

May 10, 2025

Broken By Hate Family Demands Justice After Racist Murder

May 10, 2025 -

5 Key Dos And Don Ts Succeeding In The Private Credit Market

May 10, 2025

5 Key Dos And Don Ts Succeeding In The Private Credit Market

May 10, 2025 -

Calocanes Nottingham Victims Survivors Devastating Account

May 10, 2025

Calocanes Nottingham Victims Survivors Devastating Account

May 10, 2025

Latest Posts

-

Review Anthony Mackies Surprisingly Bland Role In New Family Film

May 11, 2025

Review Anthony Mackies Surprisingly Bland Role In New Family Film

May 11, 2025 -

Anthony Mackie Voices Sneaker In Pedestrian Kids Film A Sneak Peek Review

May 11, 2025

Anthony Mackie Voices Sneaker In Pedestrian Kids Film A Sneak Peek Review

May 11, 2025 -

Sneak Review Anthony Mackie As A Sneaker In New Kids Movie

May 11, 2025

Sneak Review Anthony Mackie As A Sneaker In New Kids Movie

May 11, 2025 -

Nine Months In Space Fact Checking The Cbs News Astronaut Report

May 11, 2025

Nine Months In Space Fact Checking The Cbs News Astronaut Report

May 11, 2025 -

Adam Sandlers Unexpected Oscars 2025 Appearance Analyzing The Outfit Joke And Chalamet Hug

May 11, 2025

Adam Sandlers Unexpected Oscars 2025 Appearance Analyzing The Outfit Joke And Chalamet Hug

May 11, 2025