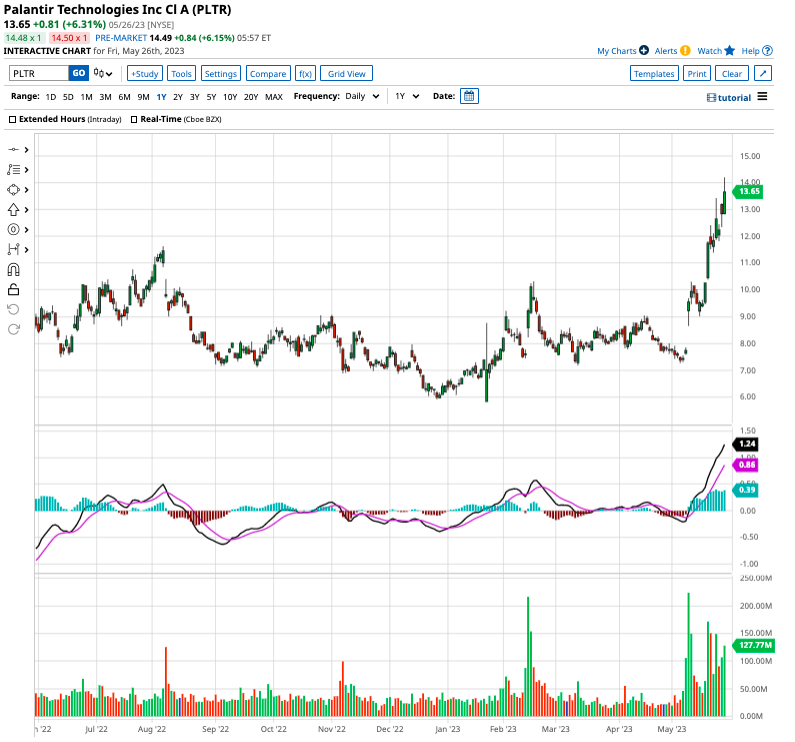

Is A 40% Increase In Palantir Stock Realistic By 2025?

Table of Contents

Palantir's Current Financial Performance and Growth Potential

Palantir's recent financial reports offer a mixed bag. While revenue growth has been impressive, profitability remains a work in progress. Understanding this duality is crucial for any PLTR stock prediction. Key growth drivers include expanding government contracts, significant inroads into the commercial sector, and the increasing adoption of its Foundry platform.

- Revenue growth rate analysis (YoY, QoQ): Examining the year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth rates reveals the trajectory of Palantir's top-line performance. Consistent, high growth rates suggest a strong foundation for future price appreciation. However, deceleration in growth would signal potential headwinds.

- Profitability margins and trends: Analyzing gross and operating margins helps gauge Palantir's efficiency and ability to translate revenue into profit. Improving margins are a positive indicator for long-term investor confidence and potential PLTR stock price increases.

- Customer acquisition and retention rates: High customer acquisition and retention rates point towards a sticky customer base and a sustainable revenue stream, bolstering the case for a bullish Palantir stock prediction.

- Market share within relevant sectors: Assessing Palantir's market share in government and commercial sectors provides context for its future growth potential. Dominating or expanding market share contributes positively to stock price appreciation.

Market Factors Influencing Palantir Stock Price

Macroeconomic factors significantly impact Palantir's stock price, as with any technology stock. Geopolitical events and competitive pressures also play a role.

- Impact of rising interest rates on tech stocks: Rising interest rates generally lead to lower valuations for growth stocks like Palantir, as investors seek higher returns in safer investments. This is a significant headwind for any PLTR stock prediction.

- Influence of government spending on defense and intelligence budgets: Palantir's significant government contracts make its performance highly sensitive to fluctuations in government spending. Increased budgets translate to increased revenue, while budget cuts have the opposite effect.

- Competitive analysis (comparison with similar companies): Analyzing Palantir's competitive landscape – companies like Databricks, Snowflake, and others offering similar big data analytics – is crucial. Intense competition can suppress PLTR stock price.

- Potential regulatory risks: Changes in regulations, particularly concerning data privacy and security, can significantly impact Palantir's operations and stock price.

Analyst Predictions and Investor Sentiment

Analyzing analyst ratings and investor sentiment provides valuable insights into market expectations for Palantir stock.

- Summary of key analyst ratings (buy, hold, sell): A consensus of "buy" ratings from leading financial analysts generally suggests optimism towards Palantir's future performance. Conversely, a preponderance of "sell" ratings indicates caution.

- Average price target from analysts: The average price target from analysts provides a quantitative estimate of future stock price expectations. A high average price target supports a bullish Palantir stock prediction.

- Recent investor sentiment surveys and polls: Surveys and polls gauging investor sentiment – bullish or bearish – offer a qualitative perspective on the market's overall outlook for Palantir.

- Impact of major news releases on stock price: Analyzing the impact of major news releases (earnings reports, new contracts, etc.) on PLTR stock price reveals how the market reacts to specific events.

Risks and Challenges to a 40% Increase

Despite the potential for growth, significant hurdles could prevent a 40% increase in Palantir stock by 2025.

- Risks associated with dependence on government contracts: Over-reliance on government contracts exposes Palantir to the risks of budget cuts, political changes, and shifting priorities.

- Competition from other big data analytics companies: Intense competition from established players and new entrants in the big data analytics market poses a significant challenge to Palantir's growth.

- Potential for slower-than-expected growth in the commercial sector: If Palantir's expansion into the commercial sector falls short of expectations, it could negatively impact its overall growth trajectory and stock price.

- Impact of technological disruptions: Rapid technological advancements could render Palantir's technology obsolete or less competitive, negatively impacting its stock price.

Conclusion: Is a 40% Palantir Stock Increase Realistic by 2025? A Final Verdict

Predicting a 40% increase in Palantir stock by 2025 is challenging. While Palantir demonstrates significant growth potential driven by its strong government contracts and expanding commercial presence, substantial risks remain. Macroeconomic factors, competitive pressures, and potential technological disruptions could significantly impact its performance. A balanced assessment reveals both opportunities and substantial challenges. Therefore, while a 40% increase isn't impossible, it's far from guaranteed. Further research into Palantir stock is recommended. Carefully consider your risk tolerance before investing in Palantir stock. Stay informed about Palantir's performance and market trends to make informed decisions about Palantir stock investment. This analysis should not be considered financial advice.

Featured Posts

-

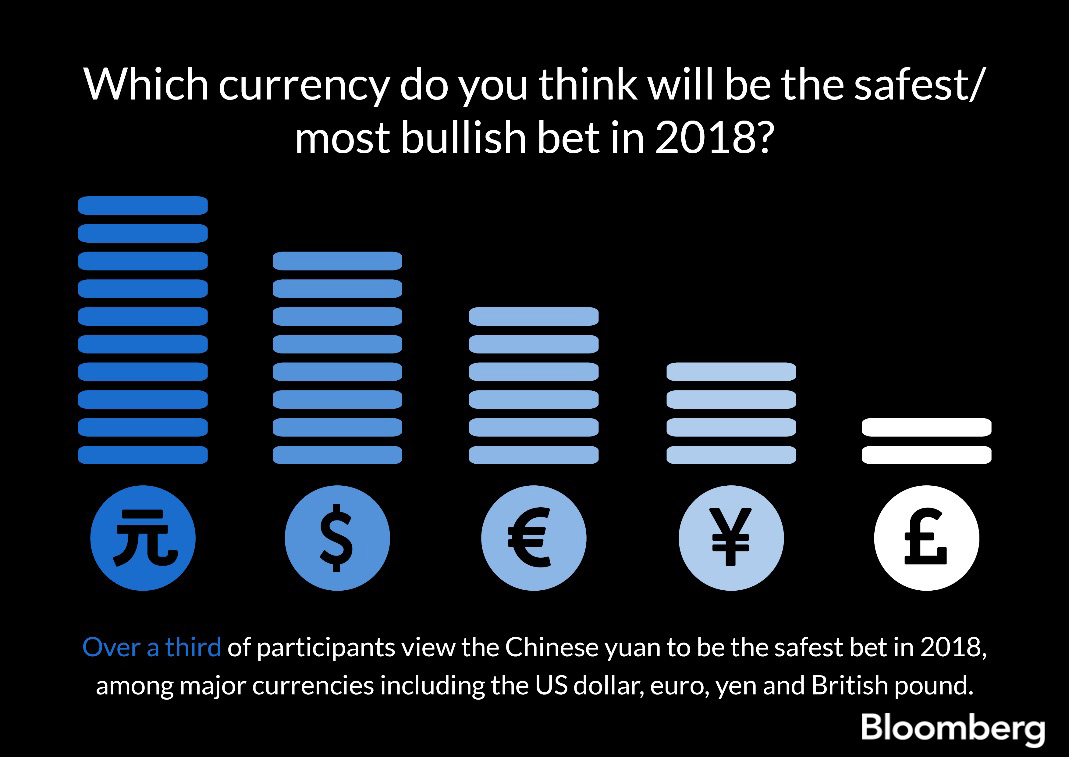

The Real Safe Bet Diversification And Long Term Growth

May 10, 2025

The Real Safe Bet Diversification And Long Term Growth

May 10, 2025 -

Chinas Steel Production Cuts Implications For The Iron Ore Market

May 10, 2025

Chinas Steel Production Cuts Implications For The Iron Ore Market

May 10, 2025 -

What Is A Real Safe Bet In Todays Market Analyzing Investment Options

May 10, 2025

What Is A Real Safe Bet In Todays Market Analyzing Investment Options

May 10, 2025 -

Stock Market Today Sensex Nifty Rally Sectoral Performance

May 10, 2025

Stock Market Today Sensex Nifty Rally Sectoral Performance

May 10, 2025 -

Fin De Serie Pour Dijon Le Psg L Emporte En Arkema Premiere Ligue

May 10, 2025

Fin De Serie Pour Dijon Le Psg L Emporte En Arkema Premiere Ligue

May 10, 2025