Understanding The GOP's Proposed Changes To Student Loan Programs

Table of Contents

Proposed Changes to Income-Driven Repayment (IDR) Plans

Current Income-Driven Repayment (IDR) plans, such as REPAYE, ICR, and PAYE, are designed to make student loan repayment more manageable by basing monthly payments on a borrower's income and family size. However, these plans have limitations. Many borrowers find that their payments are still substantial, and the path to loan forgiveness, often after 20-25 years, can be lengthy and complex. Forgiveness under these plans also often comes with tax implications.

The GOP has proposed various modifications or replacements for these IDR plans. These proposals often include stricter income verification processes, potentially making it more difficult for borrowers to qualify for lower payments. Furthermore, shorter repayment periods and higher minimum payments are frequently suggested, significantly altering the repayment trajectory for many.

- Potential Effects on Borrowers:

- Increased monthly payments for many borrowers, impacting their budgets and financial stability.

- Reduced likelihood of loan forgiveness, leaving borrowers with significant debt burdens for extended periods.

- Potential for longer repayment periods despite higher monthly payments, due to the reduced ability to pay down the principal.

- Increased risk of default, leading to damaged credit scores and potential wage garnishment.

Reforms to Student Loan Forgiveness Programs

Existing student loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), offer debt relief to borrowers working in public service or specific professions after a period of consistent payments. These programs aim to incentivize individuals to pursue careers in critical sectors.

The GOP generally holds a critical stance on expansive student loan forgiveness programs. Proposals range from significant restrictions on eligibility to complete elimination of these initiatives. The argument often centers on the cost to taxpayers and concerns about fairness to those who did not pursue higher education.

- Consequences of Proposed Changes:

- Loss of potential loan forgiveness for millions of borrowers who had planned for and relied upon these programs.

- Increased burden of student loan debt for public service employees and other eligible borrowers, discouraging careers in these fields.

- Potential impact on specific professions reliant on loan forgiveness, potentially leading to workforce shortages in critical areas like healthcare and education.

Changes to Federal Student Loan Programs Themselves

The GOP may also propose changes to the structure and availability of federal student loan programs. This could involve reducing federal funding for student loans, leading to a contraction in the overall availability of federal aid. Increased interest rates are another potential area of reform, making borrowing more expensive and increasing the overall cost of higher education. Changes to eligibility requirements could also limit access to federal student loans for certain groups of students.

- Potential Effects:

- Increased cost of higher education for students, potentially making college less accessible to many.

- Reduced access to higher education for low-income students who rely heavily on federal aid.

- A potential shift towards private student loans, which often carry less favorable terms, higher interest rates, and fewer consumer protections.

Impact on Different Borrower Demographics

The proposed GOP changes to student loan programs are unlikely to impact all borrowers equally. Low-income borrowers and minority borrowers are likely to be disproportionately affected, facing greater financial hardships and further exacerbating existing inequalities in access to higher education. Borrowers in specific fields, such as public service or teaching, which already face workforce shortages, could be particularly impacted by changes to loan forgiveness programs.

- Differential Impacts:

- Greater financial burden for low-income individuals, potentially hindering their ability to repay loans and achieve financial stability.

- Exacerbation of existing inequalities in access to higher education, limiting opportunities for students from disadvantaged backgrounds.

- Potential negative impacts on specific professions already facing workforce shortages, leading to further challenges in crucial sectors.

Conclusion

The GOP's proposed changes to student loan programs represent a significant policy shift with potentially far-reaching consequences for millions of borrowers. Understanding these proposals, their potential impacts, and their implications for different demographics is crucial. By analyzing the changes to income-driven repayment plans, loan forgiveness programs, and the structure of federal student loans themselves, we can better assess the future of student debt in America. It's essential to stay informed about these evolving proposals and engage in a thoughtful discussion about the future of GOP student loan changes and their long-term effects on access to higher education and the financial well-being of borrowers. Understanding the nuances of these proposed student loan reforms is key to advocating for responsible and equitable policies.

Featured Posts

-

Private Lender Refinancing A Guide To Federal Student Loans

May 17, 2025

Private Lender Refinancing A Guide To Federal Student Loans

May 17, 2025 -

North Dakotas Richest Receives Msum Honorary Degree

May 17, 2025

North Dakotas Richest Receives Msum Honorary Degree

May 17, 2025 -

Affordable And Reliable Products That Punch Above Their Weight

May 17, 2025

Affordable And Reliable Products That Punch Above Their Weight

May 17, 2025 -

The Red Carpets Rule Breaking Problem Insights From Cnn

May 17, 2025

The Red Carpets Rule Breaking Problem Insights From Cnn

May 17, 2025 -

Improving Floridas School Lockdown Response Lessons For A Safer Generation

May 17, 2025

Improving Floridas School Lockdown Response Lessons For A Safer Generation

May 17, 2025

Latest Posts

-

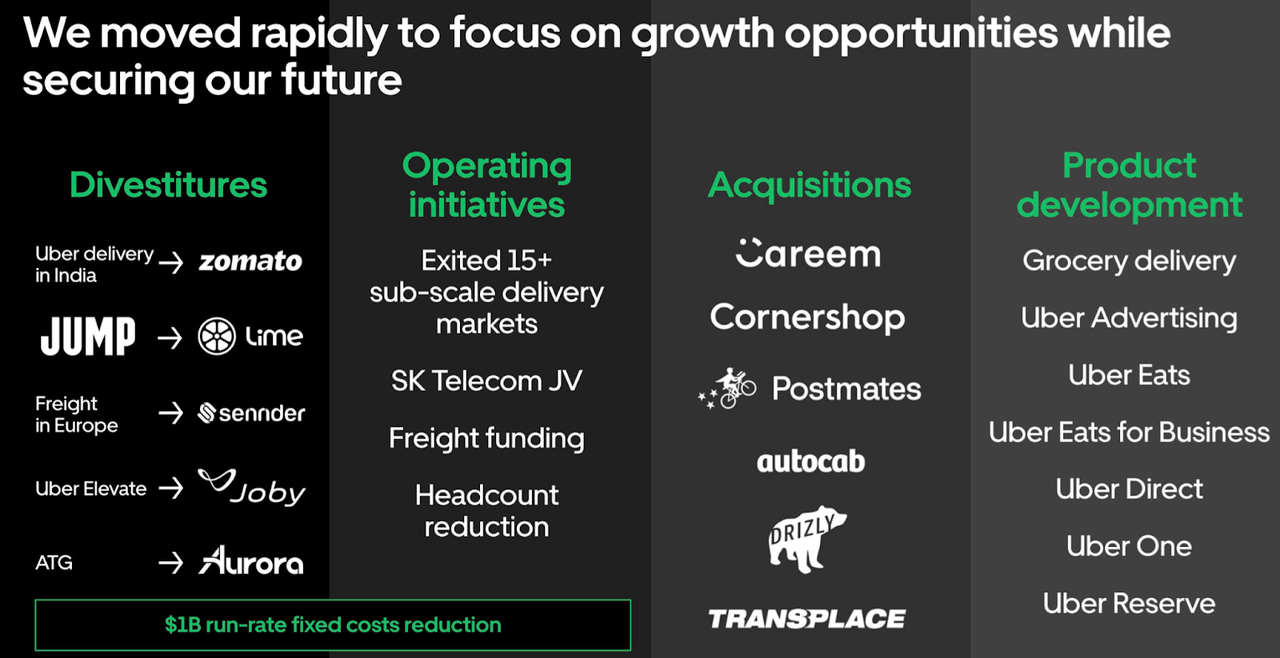

Ubers Resilience Analyzing The Stocks Recession Performance

May 17, 2025

Ubers Resilience Analyzing The Stocks Recession Performance

May 17, 2025 -

Investing In Ubers Self Driving Technology Etf Opportunities

May 17, 2025

Investing In Ubers Self Driving Technology Etf Opportunities

May 17, 2025 -

Taking Your Pet On An Uber In Mumbai A Step By Step Guide

May 17, 2025

Taking Your Pet On An Uber In Mumbai A Step By Step Guide

May 17, 2025 -

Is Uber Stock Recession Resistant A Deep Dive

May 17, 2025

Is Uber Stock Recession Resistant A Deep Dive

May 17, 2025 -

Why Uber Stock Might Weather An Economic Downturn

May 17, 2025

Why Uber Stock Might Weather An Economic Downturn

May 17, 2025