Why Uber Stock Might Weather An Economic Downturn

Table of Contents

Uber's Price Sensitivity and the Recessionary Consumer

Shifting Consumer Spending

During economic downturns, consumers prioritize essential services and carefully scrutinize their spending. This is where Uber’s price sensitivity becomes a significant advantage. Compared to car ownership, which involves substantial costs like gas, insurance, maintenance, and depreciation, Uber offers a considerably more affordable alternative. This cost-effective transportation becomes even more appealing to budget-conscious consumers during a recession.

- Lower cost compared to car ownership: Eliminating the high fixed costs associated with car ownership makes Uber a compelling option, especially during times of financial constraint.

- Flexibility and convenience: The ease and convenience of requesting a ride, without the commitment of car ownership, are crucial in uncertain times.

- Appeal to budget-conscious consumers: Uber's ability to offer various pricing tiers and promotional offers allows it to cater to price-sensitive consumers seeking affordable transportation. This "recession-proof business model" strategy could prove highly effective.

The Resilience of Uber Eats Amidst Economic Uncertainty

Demand for Food Delivery

While discretionary spending may decrease during an economic slowdown, the demand for food delivery services like Uber Eats tends to remain relatively resilient. This is because the convenience factor often outweighs cost concerns for many consumers.

- Convenience factor outweighs cost concerns: Even during tough economic times, the convenience of having food delivered directly to your door remains a significant draw.

- Increase in home-based consumption: Economic uncertainty can lead to increased time spent at home, boosting the demand for food delivery services.

- Potential for increased demand for budget-friendly meal options: Uber Eats can adapt to changing consumer needs by promoting more affordable meal options, further enhancing its resilience. The "Uber Eats resilience" in such scenarios is noteworthy.

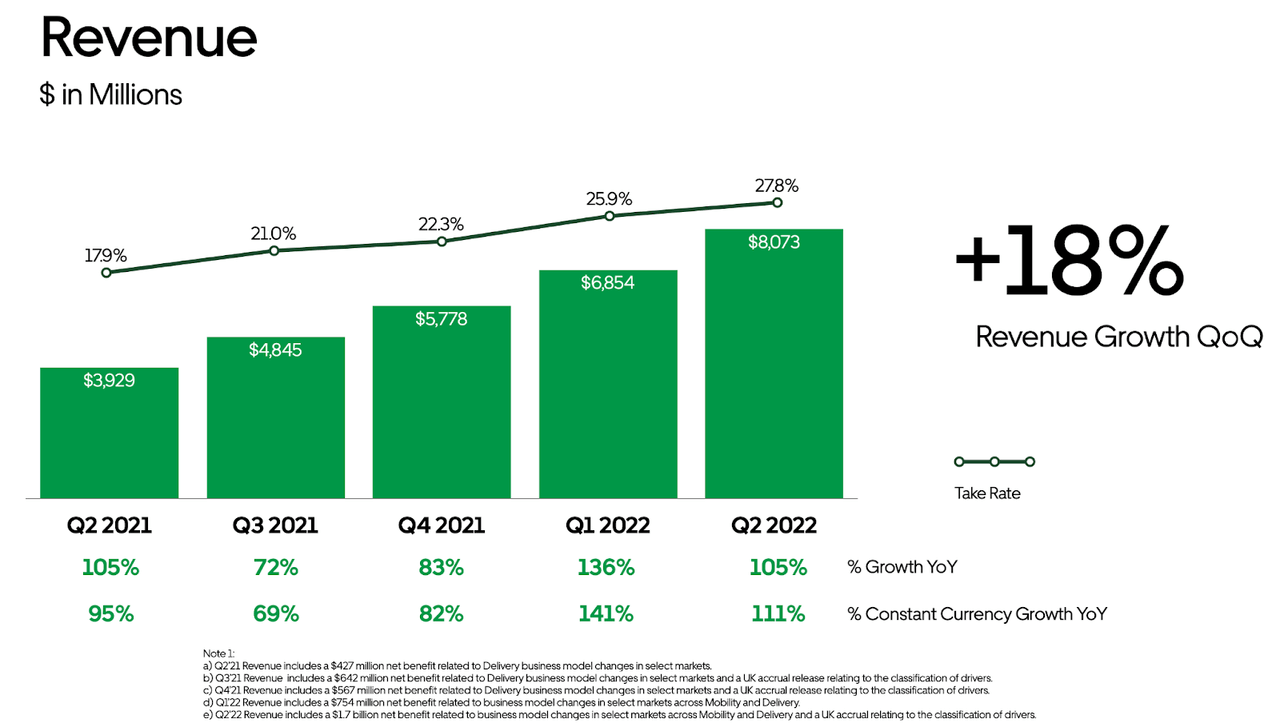

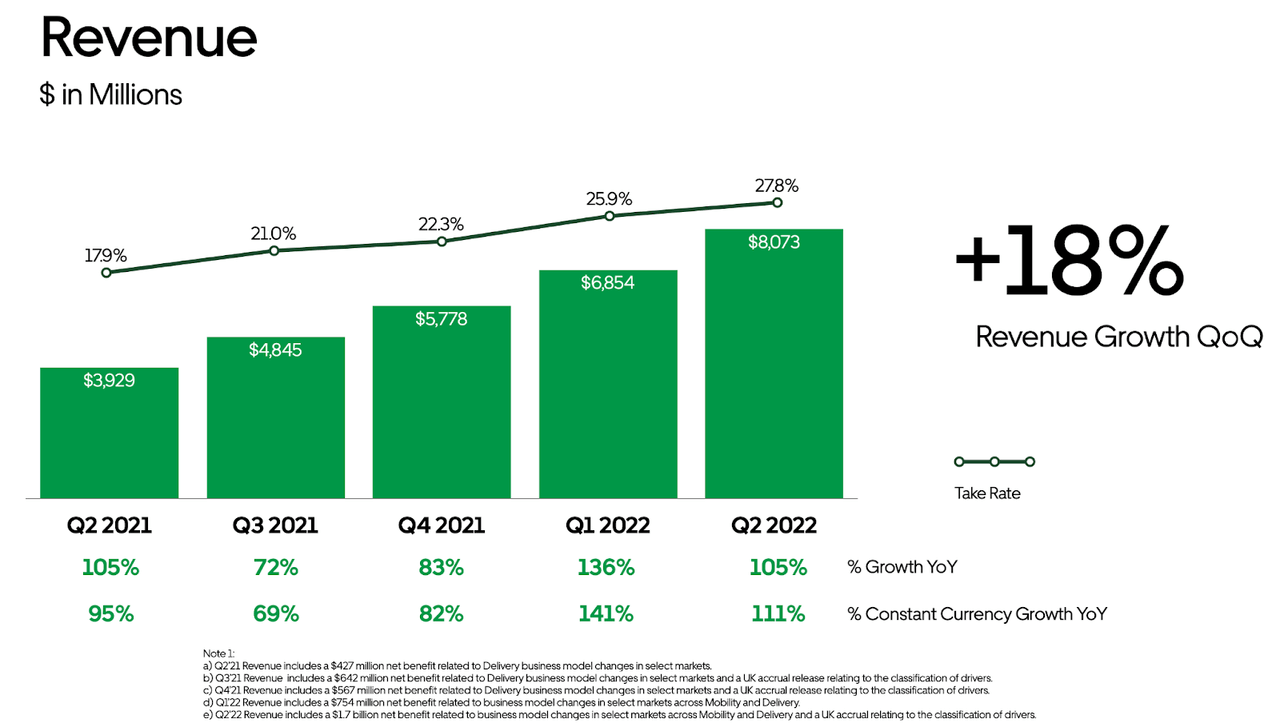

Uber's Diversified Revenue Streams

Beyond Ridesharing

Uber’s diversification beyond its initial ridesharing service is another key factor contributing to its potential resilience. The company has expanded into freight, delivery services (Uber Eats), and is actively investing in autonomous vehicles.

- Reduced reliance on a single revenue stream: This diversification mitigates the risk associated with a downturn affecting any one specific sector.

- Opportunities for growth in different sectors: While one sector might be impacted by a recession, others could experience growth or remain stable, providing a buffer for overall revenue. This "multiple revenue channels" strategy is a significant strength.

- Potential for diversification to mitigate risks: Uber’s diverse offerings position it to weather economic storms more effectively than companies reliant on a single product or service.

Potential for Increased Efficiency and Cost-Cutting Measures

Adapting to Economic Conditions

Uber has demonstrated a capacity to adapt to changing economic conditions. Through dynamic pricing adjustments, technological advancements leading to increased efficiency, and potential cost-cutting measures like layoffs or hiring freezes, Uber can effectively manage expenses during economic downturns.

- Dynamic pricing adjustments: Uber's algorithmic pricing can adjust to fluctuating demand, optimizing revenue generation even in challenging economic conditions.

- Technological advancements leading to increased efficiency: Continued investments in technology can streamline operations, reduce costs, and improve overall efficiency.

- Potential for layoffs or hiring freezes: While difficult, such measures can help minimize expenses and maintain financial stability during a recession. This "cost optimization" strategy is crucial for maintaining "operational efficiency."

Conclusion

In summary, Uber stock's potential resilience during an economic downturn stems from its price sensitivity, the enduring demand for Uber Eats, its diversified revenue streams, and its demonstrated ability to adapt and implement cost-cutting measures. These characteristics suggest that Uber might not only survive but potentially outperform other sectors during a recession. Its unique business model makes it a compelling investment option, even in uncertain economic climates. Consider researching Uber stock further; it could be a smart addition to your "recession-proof investments" portfolio. Invest in Uber stock and explore its potential for long-term growth.

Featured Posts

-

Angel Reese Wnba Jersey Your Guide To Opening Weekend Shopping

May 17, 2025

Angel Reese Wnba Jersey Your Guide To Opening Weekend Shopping

May 17, 2025 -

Exclusive Rfk Jr S Hhs Proposal To End Routine Covid 19 Vaccination For Children And Pregnant Women

May 17, 2025

Exclusive Rfk Jr S Hhs Proposal To End Routine Covid 19 Vaccination For Children And Pregnant Women

May 17, 2025 -

Effektivnoe Upravlenie Biznesom V Konkurentnoy Srede Industrialnykh Parkov

May 17, 2025

Effektivnoe Upravlenie Biznesom V Konkurentnoy Srede Industrialnykh Parkov

May 17, 2025 -

Former Fbi Director Comey Faces Conservative Outrage Over Instagram

May 17, 2025

Former Fbi Director Comey Faces Conservative Outrage Over Instagram

May 17, 2025 -

Game 4 Pistons Anger Over Questionable Referee Decision

May 17, 2025

Game 4 Pistons Anger Over Questionable Referee Decision

May 17, 2025

Latest Posts

-

Nba Playoffs Pliris Enimerosi Gia Ta Zeygaria Kai To Programma

May 17, 2025

Nba Playoffs Pliris Enimerosi Gia Ta Zeygaria Kai To Programma

May 17, 2025 -

Watch Celtics Vs Knicks Live Stream Tv Channel Guide

May 17, 2025

Watch Celtics Vs Knicks Live Stream Tv Channel Guide

May 17, 2025 -

Zhizn I Rabota V Dubae Perspektivy Dlya Rossiyan V 2025 Godu

May 17, 2025

Zhizn I Rabota V Dubae Perspektivy Dlya Rossiyan V 2025 Godu

May 17, 2025 -

New York Knicks Suffer 37 Point Rout Thibodeau Calls For Improved Resolve

May 17, 2025

New York Knicks Suffer 37 Point Rout Thibodeau Calls For Improved Resolve

May 17, 2025 -

New Emirates Id Card Fee For Newborn Babies In Uae March 2025

May 17, 2025

New Emirates Id Card Fee For Newborn Babies In Uae March 2025

May 17, 2025