Is Uber Stock Recession-Resistant? A Deep Dive

Table of Contents

Uber's Business Model and its Resilience

Uber operates on a powerful dual-sided marketplace model, connecting riders seeking transportation or delivery services with drivers and delivery personnel. This core business model, combined with its diversification, offers potential resilience during economic downturns. Uber Eats, its food delivery service, provides another revenue stream less directly tied to discretionary spending on transportation. During economic uncertainty, individuals may reduce spending on non-essential travel but still rely on cost-effective food delivery options. This dual-sided nature, offering both ride-sharing and delivery services, provides a degree of insulation against economic shocks.

- High switching costs: Users accustomed to the Uber app face high switching costs, making it difficult to transition to competitors.

- Network effects: The larger Uber's network becomes, the more valuable it is to both riders and drivers, strengthening its market position.

- Price optimization: Uber has the ability to adjust pricing strategies during economic downturns to maintain demand and profitability.

Historical Performance During Recessions

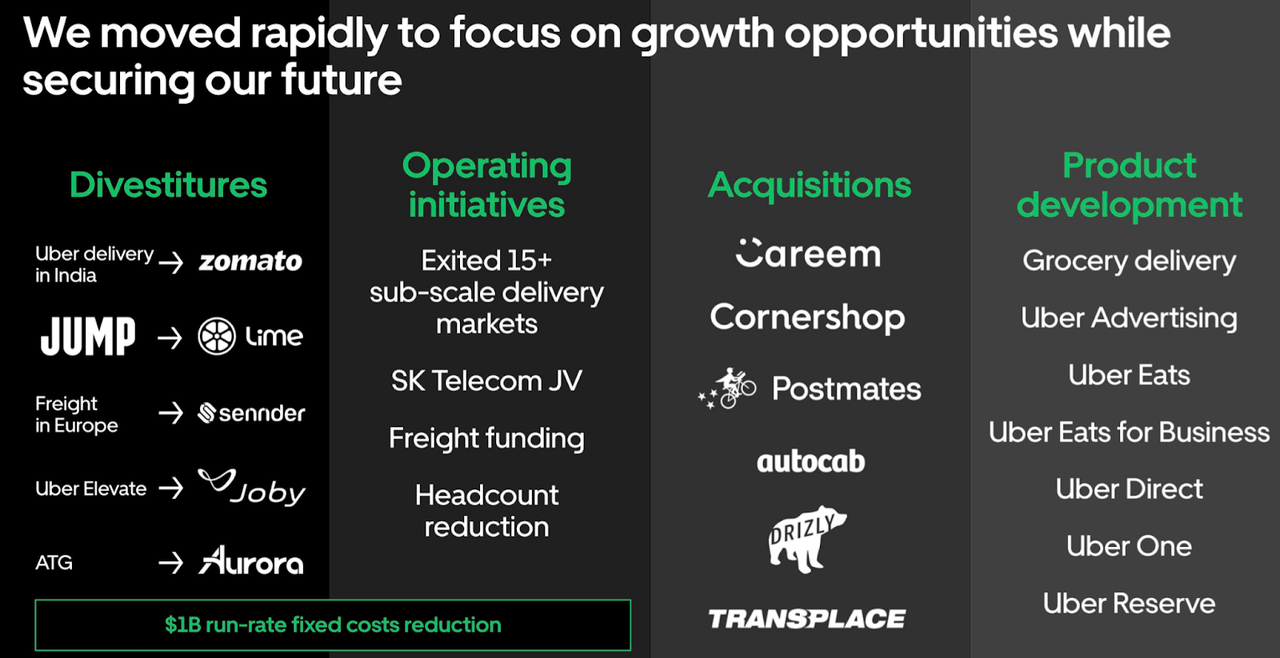

Analyzing Uber's stock performance during previous economic downturns is crucial for assessing its recession-resistance. While Uber is a relatively young publicly traded company, its performance during the initial stages of the COVID-19 pandemic offers some insight. While initially impacted, the company adapted quickly, showcasing the adaptability of its business model. A comprehensive comparison with its performance relative to the S&P 500 or other market indices during that period would offer a better understanding of its resilience. Further research into its revenue and earnings during that period is essential.

- Stock price behavior: A detailed examination of Uber stock price fluctuations during past economic slowdowns is needed to identify trends.

- Benchmark comparison: Comparing Uber's performance to the S&P 500, or other relevant indices, provides context for evaluating its relative resilience.

- Financial analysis: Analyzing Uber's revenue and earnings reports during economic downturns is essential to understanding its financial health and resilience.

Factors Affecting Uber's Recession Resistance

Several factors can significantly impact Uber's recession-resistance. Inflation, for instance, affects both rider behavior (reduced discretionary spending) and driver behavior (increased operational costs). Fluctuations in fuel prices directly impact Uber's operational costs and profitability, potentially squeezing margins. Government regulations and potential policy changes further add to the complexity of predicting its resilience.

- Inflationary impact: Rising inflation can curb consumer spending on ride-sharing and delivery, potentially impacting Uber's revenue.

- Fuel price sensitivity: Significant fuel price increases can directly impact Uber's profitability, necessitating adjustments to pricing or operational strategies.

- Regulatory landscape: Government regulations and any policy changes affecting ride-sharing and delivery services can profoundly impact Uber's operations and financial performance.

Alternative Investments and Comparisons

To evaluate Uber stock's suitability as a recession-resistant investment, comparing it to other potential options is essential. Investors may consider established companies in similar sectors, such as logistics or transportation, to gauge relative risk and reward. Comparing Uber's risk profile and potential returns against these alternatives is vital for informed decision-making. This necessitates assessing the investor’s risk tolerance and developing a suitable investment strategy.

- Sector comparison: Analyzing comparable companies within the transportation and delivery sectors helps assess Uber's competitive positioning.

- Risk tolerance: Understanding one's risk tolerance and investment goals is paramount before investing in Uber stock or any other asset.

- Portfolio diversification: Diversification across different asset classes and sectors is crucial for mitigating risk within an investment portfolio.

Conclusion: Is Uber Stock a Recession-Resistant Investment?

Uber's dual-sided marketplace model and diversification into food delivery offer potential resilience during economic downturns. However, factors like inflation, fuel prices, and regulatory changes significantly influence its performance. While its adaptability and large market share are advantages, its historical data during previous recessions requires further scrutiny. A balanced perspective acknowledges both its potential for resilience and inherent risks.

Therefore, further research into Uber stock's recession-resistance is crucial before making any investment decisions. Thoroughly assess the risks and rewards before committing to an Uber investment. Consider diversification within your portfolio and consult with a financial advisor to tailor your investment strategy to your risk tolerance and financial goals. Smart economic downturn investing requires careful consideration of all available information, including alternatives to Uber stock and other recession-proof stocks.

Featured Posts

-

Industrialnye Parki Strategii Dlya Dostizheniya Uspekha V Usloviyakh Vysokoy Konkurentsii

May 17, 2025

Industrialnye Parki Strategii Dlya Dostizheniya Uspekha V Usloviyakh Vysokoy Konkurentsii

May 17, 2025 -

Tom Thibodeaus Post Game 2 Outburst Criticism Of The Refs Following Knicks Loss

May 17, 2025

Tom Thibodeaus Post Game 2 Outburst Criticism Of The Refs Following Knicks Loss

May 17, 2025 -

40

May 17, 2025

40

May 17, 2025 -

Mati Donalda Trampa Meri Enn Maklaud Zhittya Ta Biografiya

May 17, 2025

Mati Donalda Trampa Meri Enn Maklaud Zhittya Ta Biografiya

May 17, 2025 -

Regulatory Challenges Force Uber To Halt Foodpanda Taiwan Acquisition

May 17, 2025

Regulatory Challenges Force Uber To Halt Foodpanda Taiwan Acquisition

May 17, 2025

Latest Posts

-

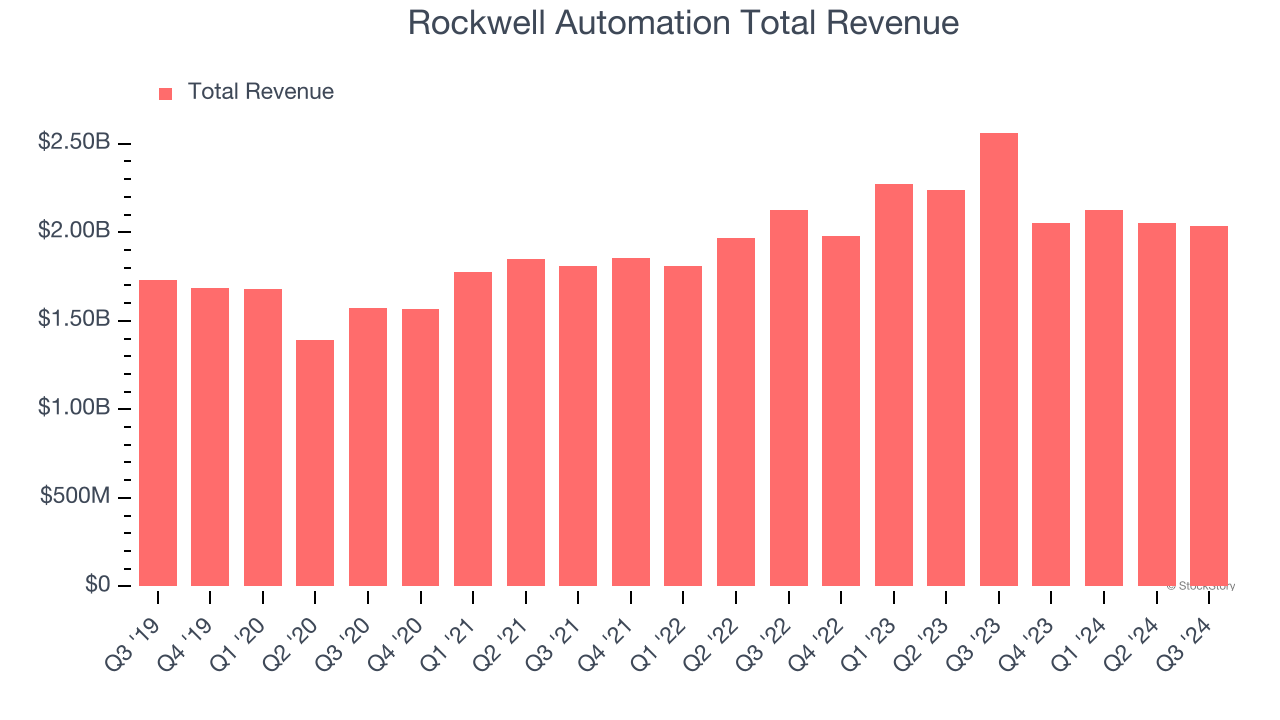

Stock Market Movers Rockwell Automation Angi Borg Warner And Others Post Significant Gains

May 17, 2025

Stock Market Movers Rockwell Automation Angi Borg Warner And Others Post Significant Gains

May 17, 2025 -

Rockwell Automations Strong Earnings Drive Market Rally Analysis Of Wednesdays Gains

May 17, 2025

Rockwell Automations Strong Earnings Drive Market Rally Analysis Of Wednesdays Gains

May 17, 2025 -

Rockwell Automation Earnings Beat Expectations Stock Surge And Market Movers

May 17, 2025

Rockwell Automation Earnings Beat Expectations Stock Surge And Market Movers

May 17, 2025 -

Wednesdays Market Highlights Rockwell Automation And Top Performing Stocks

May 17, 2025

Wednesdays Market Highlights Rockwell Automation And Top Performing Stocks

May 17, 2025 -

Analyzing The Knicks Overtime Loss A Potential Turning Point

May 17, 2025

Analyzing The Knicks Overtime Loss A Potential Turning Point

May 17, 2025