Understanding Ontario's Planned Manufacturing Tax Credit Expansion

Table of Contents

Key Features of the Expanded Ontario Manufacturing Tax Credit

The current Ontario Manufacturing Tax Credit offers a valuable incentive to businesses investing in manufacturing activities within the province. However, it has limitations. The current rate, eligibility criteria (specific types of manufacturing and minimum investment levels), and application process can present challenges for some businesses.

The proposed changes aim to address these limitations and significantly enhance the program's impact. The planned expansion is expected to include: an increased credit rate, expanded eligibility criteria encompassing new sectors, and changes to investment thresholds, making it more accessible to a wider range of manufacturers.

Specific improvements anticipated include:

- Higher percentage tax credit: A substantial increase in the percentage of eligible expenses that will be credited, leading to greater financial benefits for businesses.

- Lower investment thresholds for eligibility: Reducing the minimum investment required to qualify, allowing smaller and medium-sized enterprises (SMEs) to participate more readily.

- Inclusion of previously excluded manufacturing sub-sectors: Expanding the program to encompass sectors like food processing, advanced materials manufacturing, and potentially others, broadening its reach and stimulating growth across diverse industries.

- Streamlined application process: Simplifying the application process to make it quicker and easier for businesses to access the credit, reducing administrative burdens.

Eligibility Requirements for the Expanded Ontario Manufacturing Tax Credit

To qualify for the expanded Ontario Manufacturing Tax Credit, businesses must meet specific criteria. While precise details await the official program announcement, we can anticipate that eligibility will hinge on factors such as: the type of manufacturing activity undertaken, the level of capital investment, location within Ontario, and potentially employment targets.

The expanded program may introduce new eligibility requirements or modify existing ones. For example, there could be specific industry classifications that qualify, mandated capital expenditure minimums, employment creation or retention targets, or stipulations regarding the geographic location of the manufacturing facility within Ontario.

Key eligibility factors likely to be considered:

- Types of eligible manufacturing activities: A clear definition of the manufacturing processes and industries eligible for the tax credit. This list may be expanded under the proposed changes.

- Minimum investment requirements (capital expenditures): The minimum amount of investment in eligible equipment, technology, or facilities required to qualify for the credit. This threshold is expected to be lowered in the expanded program.

- Location requirements (e.g., specific regions of Ontario): The program may incentivize investment in specific regions of Ontario to support economic development in those areas.

- Employment targets or commitments: Requirements regarding job creation or retention may be included to ensure the credit supports employment growth.

- Documentation needed for application: Detailed information about the types of documentation required to support the application, such as financial statements, project proposals, and evidence of eligible expenses.

Benefits and Impact of the Expanded Ontario Manufacturing Tax Credit

The expanded Ontario Manufacturing Tax Credit is poised to have a significant positive impact on Ontario's manufacturing sector and the broader provincial economy. The increased accessibility and financial incentives offered will stimulate investment, foster job creation, and strengthen Ontario's competitiveness on the global stage.

This initiative aims to attract both domestic and foreign investment, leading to the modernization and technological advancement of manufacturing facilities. The resulting economic ripple effect will boost innovation, productivity, and overall economic growth in the province.

Expected positive impacts include:

- Increased investment in Ontario's manufacturing sector: Attracting new investments and stimulating further growth within existing businesses.

- Job creation and retention: Supporting employment opportunities across various manufacturing industries and regions.

- Attracting new businesses to Ontario: Making Ontario a more attractive location for manufacturers, both domestically and internationally.

- Boosting competitiveness of Ontario manufacturers: Enhancing the ability of Ontario manufacturers to compete in global markets.

- Modernization and technological advancements in manufacturing: Facilitating adoption of new technologies and improved efficiency.

How to Apply for the Expanded Ontario Manufacturing Tax Credit

Once the expanded program is launched, businesses will be able to apply for the Ontario Manufacturing Tax Credit. The exact application process will be outlined by the Ontario government. However, expect a streamlined online application portal. You should gather the necessary documentation well in advance of the application deadline.

The application process is likely to involve these steps:

- Gather necessary documentation: This will include financial statements, project proposals, and supporting documentation demonstrating eligible expenses.

- Complete the application form: Carefully fill out the online application form, ensuring accurate and complete information.

- Submit application online or via mail: Submit your completed application through the designated online portal or via mail (if applicable).

- Review application status: Regularly check the status of your application through the online portal.

- Contact support for inquiries: Reach out to the relevant government agency if you have any questions or require assistance. Contact information will be readily available on the program's official website.

Conclusion

The expansion of the Ontario Manufacturing Tax Credit is a significant initiative designed to revitalize and strengthen the province's manufacturing sector. By increasing the credit rate, expanding eligibility, and simplifying the application process, the government aims to attract investment, create jobs, and enhance Ontario's economic competitiveness. Understanding the key features and eligibility requirements is crucial for businesses looking to capitalize on this opportunity.

Don't miss out on this opportunity to leverage the expanded Ontario Manufacturing Tax Credit for your business. Stay informed about the program launch and application process to maximize your eligibility for this valuable incentive. Learn more about the Ontario Manufacturing Tax Credit and begin planning your application today!

Featured Posts

-

V Mware Costs To Skyrocket 1050 At And Ts Concerns Over Broadcom Deal

May 07, 2025

V Mware Costs To Skyrocket 1050 At And Ts Concerns Over Broadcom Deal

May 07, 2025 -

Julius Randles Impact A Shift In Timberwolves Fan Sentiment

May 07, 2025

Julius Randles Impact A Shift In Timberwolves Fan Sentiment

May 07, 2025 -

Randles Performance A Turning Point For Timberwolves Fans

May 07, 2025

Randles Performance A Turning Point For Timberwolves Fans

May 07, 2025 -

The Reason Behind Zendayas Sisters No Show At Tom Hollands Wedding

May 07, 2025

The Reason Behind Zendayas Sisters No Show At Tom Hollands Wedding

May 07, 2025 -

Delocalisation Du Repechage Lnh Analyse D Une Decision Controversee

May 07, 2025

Delocalisation Du Repechage Lnh Analyse D Une Decision Controversee

May 07, 2025

Latest Posts

-

Six Month Trend Reversal Binance Bitcoin Buyers Outnumber Sellers

May 08, 2025

Six Month Trend Reversal Binance Bitcoin Buyers Outnumber Sellers

May 08, 2025 -

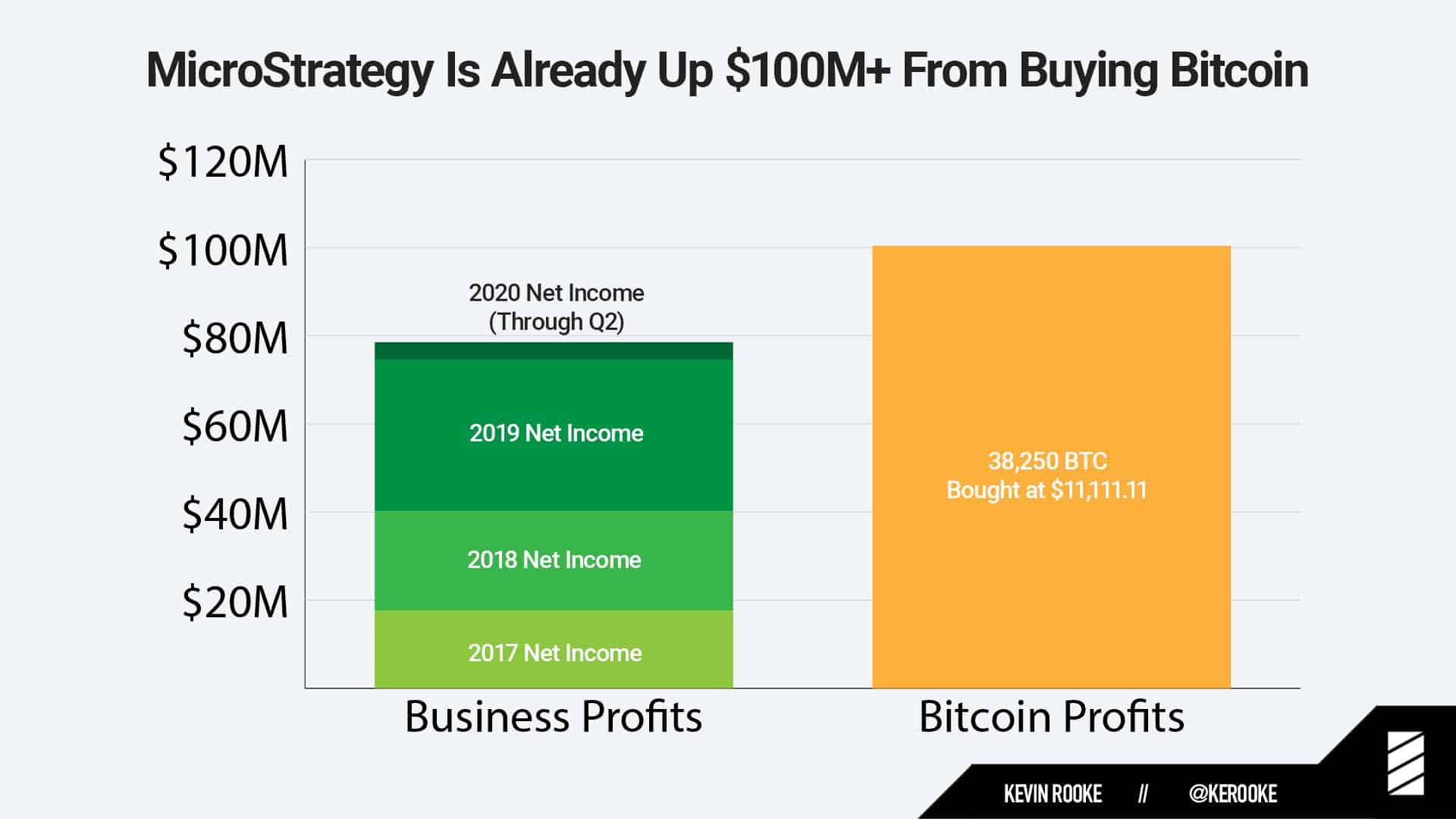

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025 -

Bitcoin Buying Volume On Binance Exceeds Selling For First Time In Half A Year

May 08, 2025

Bitcoin Buying Volume On Binance Exceeds Selling For First Time In Half A Year

May 08, 2025 -

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025 -

Binance Bitcoin Buying Volume Surpasses Selling After Six Months

May 08, 2025

Binance Bitcoin Buying Volume Surpasses Selling After Six Months

May 08, 2025