MicroStrategy Vs Bitcoin In 2025: Which Is The Better Investment?

Table of Contents

Understanding MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's Core Business

MicroStrategy is primarily a business intelligence company, providing software and services for data analytics and enterprise performance management. Its revenue streams are largely derived from software licenses, cloud services, and consulting. While it holds a strong position in its niche market, its overall size and revenue are dwarfed by the value of its Bitcoin holdings, making Bitcoin a significant factor in evaluating its future performance as a stock.

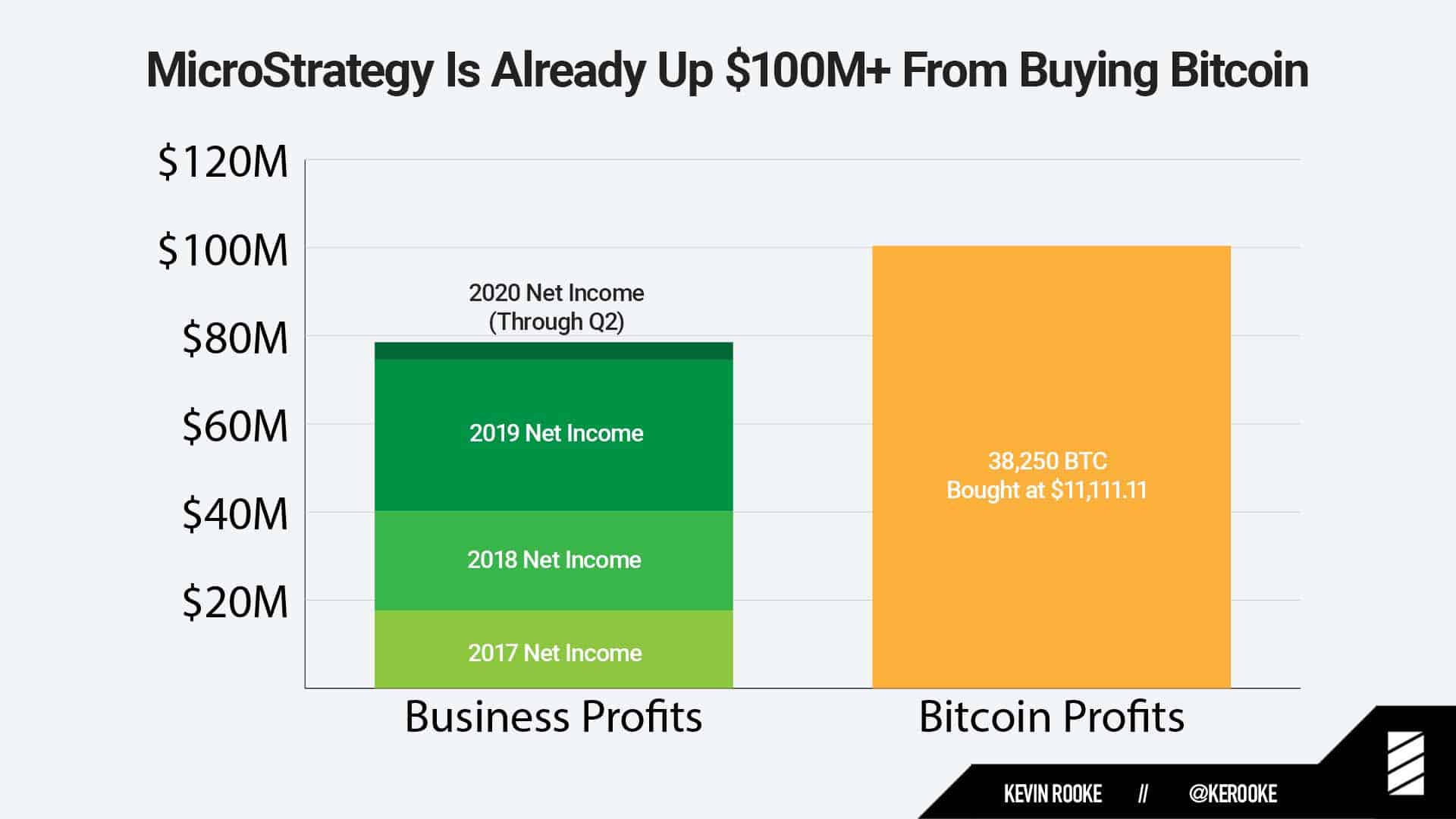

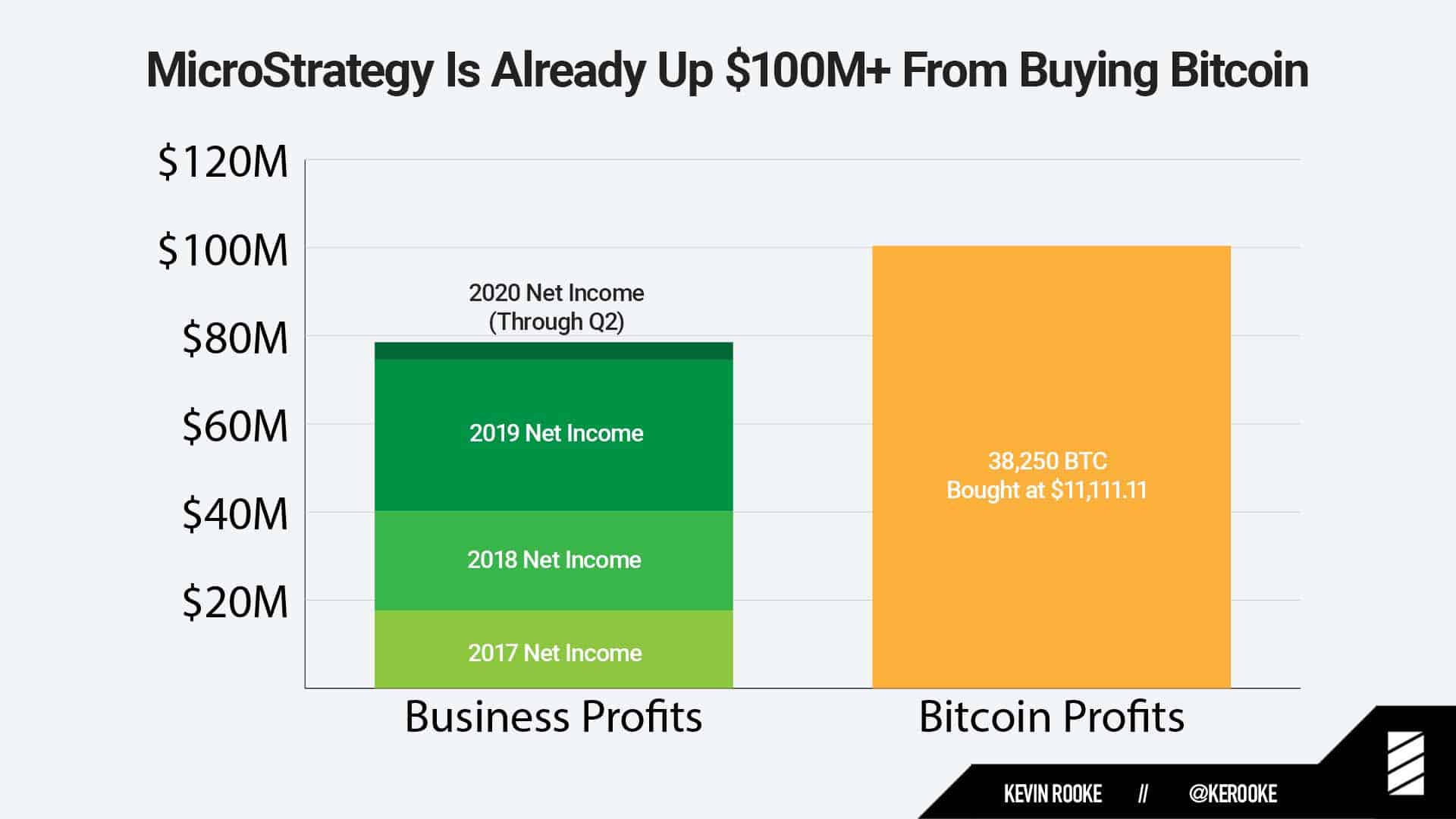

MicroStrategy's Bitcoin Strategy

MicroStrategy's bold strategy of acquiring and holding Bitcoin as a treasury reserve asset has garnered significant attention. As of [Insert Current Date], MicroStrategy holds approximately [Insert Number] Bitcoin, representing a substantial portion of its overall assets. This strategy positions the company's success significantly with the price fluctuations of Bitcoin.

- Risk of Bitcoin Price Dependence: MicroStrategy's stock price is heavily correlated with the price of Bitcoin. A significant drop in Bitcoin's value could severely impact MicroStrategy's financial health and stock price.

- Impact of Volatility: The inherent volatility of Bitcoin creates substantial uncertainty for MicroStrategy's investors. Sudden price swings can lead to significant gains or losses, making it a high-risk investment.

- Future Strategies: MicroStrategy's future approach to Bitcoin remains uncertain. They might increase their holdings, explore Bitcoin-related ventures, or potentially adjust their strategy depending on market conditions and regulatory changes.

Analyzing Bitcoin's Future Potential in 2025

Bitcoin's Technological Advancements

The Bitcoin network is constantly evolving. The Lightning Network, for instance, aims to improve transaction speed and reduce fees, making Bitcoin more suitable for everyday transactions. Further technological advancements could enhance Bitcoin's scalability, security, and overall usability, potentially driving increased adoption.

Bitcoin's Adoption and Market Sentiment

By 2025, Bitcoin's adoption could significantly expand among institutional investors and retail users. Growing awareness, increased regulatory clarity (or lack thereof), and further technological advancements could all contribute to increased market sentiment. Conversely, negative regulatory actions or the emergence of superior cryptocurrencies could hinder Bitcoin's growth.

Bitcoin's Price Volatility and Risk Assessment

Bitcoin's price is notoriously volatile, experiencing sharp upswings and downturns. This inherent risk must be carefully considered. Strategies like dollar-cost averaging, where investors regularly invest a fixed amount regardless of price fluctuations, can help mitigate some of this risk.

- Price Predictions (Disclaimer): Predicting Bitcoin's price in 2025 is highly speculative. Various analysts offer different forecasts, ranging from significantly higher to substantially lower values than the current price. Any prediction should be considered with extreme caution.

- Threats to Dominance: Emerging cryptocurrencies with superior technology or more favorable regulatory environments pose a potential threat to Bitcoin's dominance in the cryptocurrency market.

- Long-Term Potential: Many believe Bitcoin has the potential to serve as a long-term store of value and potentially even a medium of exchange, but this remains to be seen and depends heavily on global adoption and regulatory developments.

Direct Comparison: MicroStrategy Stock vs. Bitcoin Investment in 2025

Risk Tolerance and Investment Goals

Choosing between MicroStrategy and Bitcoin hinges on your risk tolerance and investment goals. If you're a risk-averse investor seeking moderate growth, MicroStrategy (despite its Bitcoin exposure) might seem less volatile than a direct Bitcoin investment. However, for investors with a higher risk tolerance seeking potentially higher returns, direct Bitcoin investment might be more appealing.

Diversification and Portfolio Management

Both MicroStrategy and Bitcoin can play a role in a diversified portfolio. However, it's crucial to remember that investing a significant portion of your portfolio in either could result in substantial gains or losses depending on market conditions. Proper diversification is key to managing risk.

Potential Returns and Risks

The potential returns for both investments are significant, but so are the risks. Direct Bitcoin investment offers higher potential returns but also higher volatility, while MicroStrategy's stock performance is heavily influenced by Bitcoin's price but also incorporates the performance of its core business.

- Comparison Table:

| Feature | MicroStrategy Stock | Bitcoin Investment |

|---|---|---|

| Risk | High (due to Bitcoin exposure) | Very High |

| Potential Return | Potentially High (correlated with Bitcoin) | Potentially Very High |

| Liquidity | Relatively High (publicly traded stock) | Relatively High (major exchanges) |

| Transaction Costs | Brokerage fees | Exchange fees, potentially higher |

| Taxation | Varies by jurisdiction | Varies by jurisdiction, complex rules |

- Scenarios: A bull market in Bitcoin would likely benefit both, while a bear market would significantly hurt both. However, MicroStrategy's underlying business provides a small buffer compared to a pure Bitcoin investment.

Conclusion

Choosing between MicroStrategy and Bitcoin in 2025 involves careful consideration of risk tolerance and financial goals. MicroStrategy offers a more indirect exposure to Bitcoin, combined with a traditional business model, whereas direct Bitcoin investment presents significantly higher risks and potentially higher rewards. Both have considerable potential but also carry significant risks.

Key Takeaways:

- MicroStrategy’s stock price is heavily dependent on Bitcoin’s price.

- Bitcoin's price is highly volatile.

- Diversification is crucial for managing risk in both cases.

Call to Action: Thorough research and understanding of your risk profile are essential before investing in either MicroStrategy or Bitcoin. The "better" investment—MicroStrategy vs Bitcoin in 2025—depends on your individual risk profile and financial goals. Do your due diligence before making any decisions concerning MicroStrategy or Bitcoin investment.

Featured Posts

-

Coming Soon Your Guide To The European Digital Identity Wallet

May 08, 2025

Coming Soon Your Guide To The European Digital Identity Wallet

May 08, 2025 -

Raphaels Departure Impact On Nc State Football Recruiting

May 08, 2025

Raphaels Departure Impact On Nc State Football Recruiting

May 08, 2025 -

Rogues Legacy Gambits Latest Weapon Unveiled

May 08, 2025

Rogues Legacy Gambits Latest Weapon Unveiled

May 08, 2025 -

Andor Season 2 Your Essential Guide Before The Premiere

May 08, 2025

Andor Season 2 Your Essential Guide Before The Premiere

May 08, 2025 -

Affleck Applauds Damons Discerning Role Selection

May 08, 2025

Affleck Applauds Damons Discerning Role Selection

May 08, 2025