Binance Bitcoin Buying Volume Surpasses Selling After Six Months

Table of Contents

H2: Analyzing the Shift in Binance Bitcoin Trading Volume

H3: Data and Figures:

The surge in Binance Bitcoin buying volume is undeniable. Data from [Insert reputable data source, e.g., CoinMarketCap, Binance's own data, etc.] shows a significant increase in buy orders compared to sell orders starting [Insert Date]. Specifically:

- Percentage Increase: Buying volume on Binance increased by [Insert Percentage]% compared to the average daily volume during the preceding six months.

- Key Dates: The most significant spike in buying activity occurred on [Insert Date(s)], coinciding with [Mention any relevant news or events].

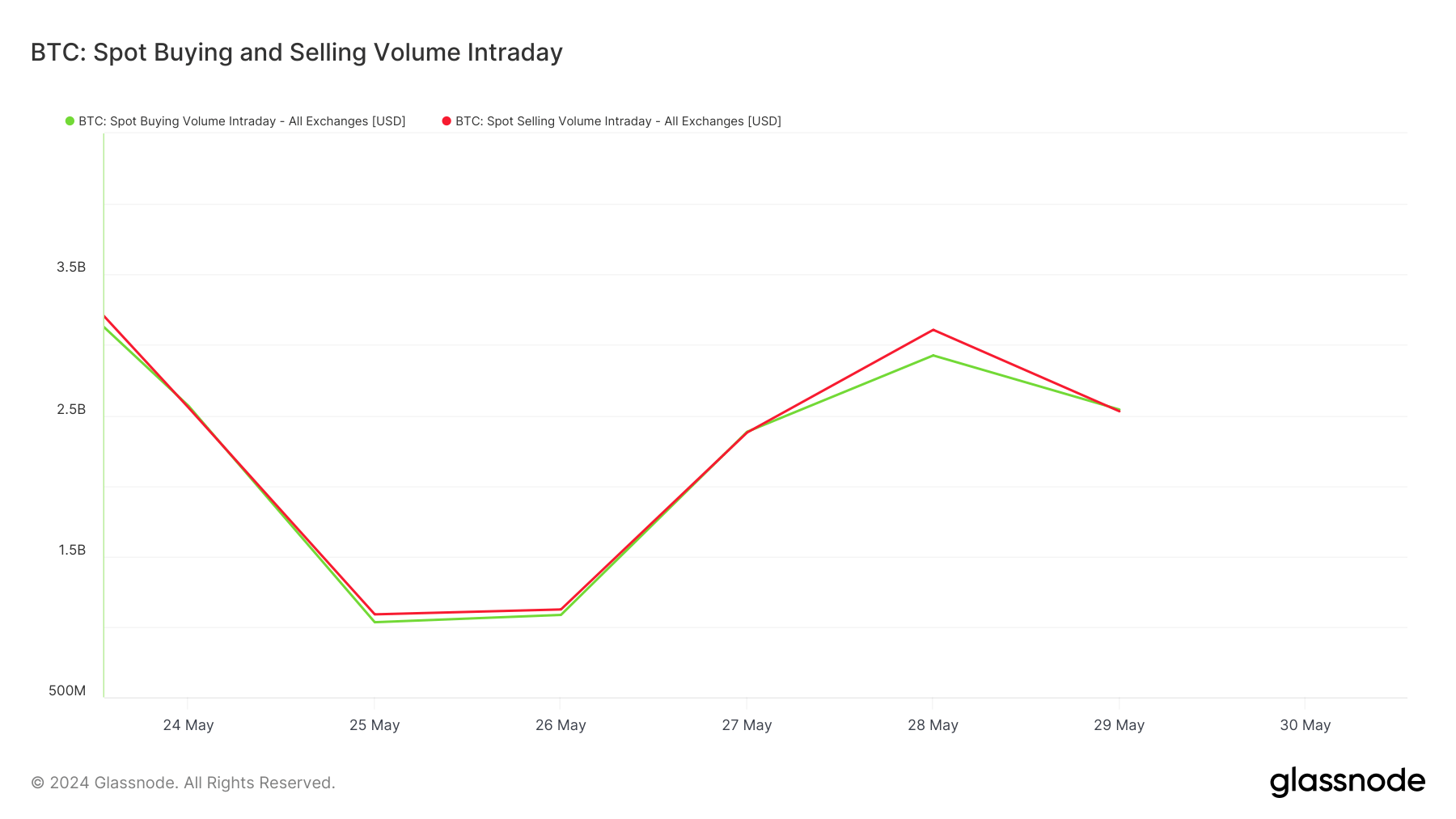

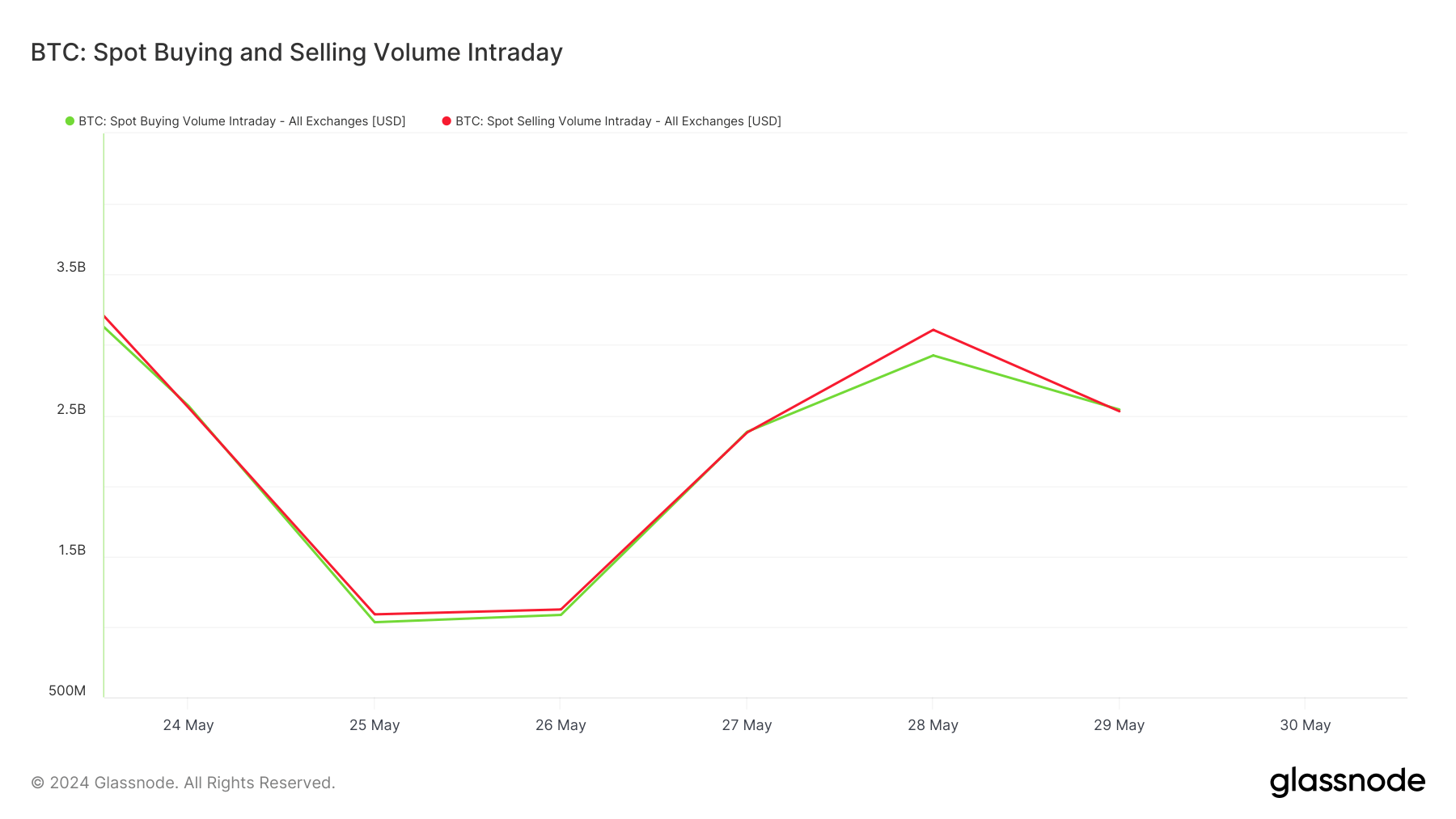

- Weekly Averages: Weekly average buying volume surpassed selling volume for the first time in six months on [Insert Date], with a [Insert Number]% increase compared to the previous week. (Include a relevant chart or graph visually displaying this data).

H3: Potential Factors Contributing to the Shift:

Several factors likely contributed to this shift in Binance Bitcoin trading volume. These include:

- Institutional Adoption: Increased institutional investment in Bitcoin may be driving up demand. Large-scale purchases by institutional investors can significantly impact trading volume.

- Regulatory Clarity: Positive regulatory developments in key jurisdictions could be boosting investor confidence and encouraging further investment.

- Macroeconomic Factors: Changes in global macroeconomic conditions, such as interest rate hikes or inflation rates, could be influencing investor allocation towards Bitcoin as a hedge against inflation.

- Bitcoin Price Movements: A sustained period of price stability or even a slight price increase could encourage buyers to enter the market.

- Whale Activity: Significant purchases by large "whale" investors could be artificially inflating buying volume on Binance.

H3: Implications for Bitcoin Price:

The increased Binance Bitcoin buying volume has significant implications for Bitcoin's price.

- Potential Bullish Trend: The sustained surge in buying volume might indicate a potential bullish trend reversal. However, it's crucial to remember that this is not a guaranteed indicator.

- Resistance and Support Levels: Monitoring Bitcoin's price action against key resistance and support levels is vital for gauging the sustainability of the upward trend.

- Future Volume Monitoring: Continued observation of trading volume on Binance and other major exchanges will be crucial to confirming whether this shift represents a sustained trend change.

H2: Binance's Role in the Bitcoin Market

H3: Binance's Market Share:

Binance holds a significant market share in the global cryptocurrency exchange landscape. Its massive trading volume influences Bitcoin's price significantly.

- Dominant Position: Binance consistently ranks as one of the highest-volume exchanges globally, meaning its trading activity significantly impacts overall market sentiment.

- Price Influence: Large buy or sell orders on Binance can cause ripples throughout the market, affecting Bitcoin's price on other exchanges.

H3: Binance's Impact on Investor Sentiment:

Binance's actions and reputation play a considerable role in shaping investor sentiment.

- Exchange Updates: Binance's announcements, such as new listings, initiatives, or partnerships, can influence trading activity and investor confidence.

- User Base: The large and active user base on Binance amplifies market movements, making the exchange a key barometer of overall sentiment.

H2: What This Means for Bitcoin Investors

H3: Risk Assessment:

Investing in cryptocurrencies, including Bitcoin, involves significant risk.

- Past Performance: Remember that past performance is not indicative of future results. Market volatility is inherent in cryptocurrency trading.

- Responsible Investing: Investors should only invest what they can afford to lose and should thoroughly research before making any investment decisions.

H3: Investment Strategies:

The increased Binance Bitcoin buying volume doesn’t automatically signal a guaranteed profit.

- Short-Term Strategies: Short-term traders might consider leveraging the potential upward trend, but with careful risk management.

- Long-Term Strategies: Long-term investors might view this as a positive sign, potentially reinforcing their conviction in Bitcoin's long-term value proposition.

- Diversification: Diversification across different asset classes remains a crucial aspect of risk management in any investment strategy.

3. Conclusion: The Future of Binance Bitcoin Buying Volume and Implications for Investors

The shift in Binance Bitcoin buying volume from a prolonged selling trend to a notable buying surge is a significant development. While it potentially signals a market shift toward a more bullish outlook, it's crucial to remain cautious. The implications for Bitcoin's price and the overall cryptocurrency market remain to be seen. Further monitoring of trading volume, price action, and related news is essential. Stay informed about market trends and conduct thorough research before making any investment decisions. Stay updated on the latest trends in Binance Bitcoin buying volume and continue to monitor the market for informed investment decisions.

Featured Posts

-

How Glen Powell Achieved Peak Physical Condition For The Running Man

May 08, 2025

How Glen Powell Achieved Peak Physical Condition For The Running Man

May 08, 2025 -

Supermans Cinema Con Presentation A Closer Look At Kryptos Story

May 08, 2025

Supermans Cinema Con Presentation A Closer Look At Kryptos Story

May 08, 2025 -

Trump Media And Crypto Com Partner To Launch Etfs Cro Price Soars

May 08, 2025

Trump Media And Crypto Com Partner To Launch Etfs Cro Price Soars

May 08, 2025 -

Andors Showrunner Hints At A Rogue One Recut What We Know

May 08, 2025

Andors Showrunner Hints At A Rogue One Recut What We Know

May 08, 2025 -

Trump On Greenland And China Fact Checking The Presidents Assertions

May 08, 2025

Trump On Greenland And China Fact Checking The Presidents Assertions

May 08, 2025