Understanding Key Price Levels For Apple Stock (AAPL)

Table of Contents

Identifying Support and Resistance Levels in AAPL Stock

What are Support and Resistance Levels?

Support and resistance levels are crucial price points on an Apple stock chart that often act as barriers to price movement. Support levels represent prices where buying pressure is strong enough to prevent further price declines. Conversely, resistance levels mark prices where selling pressure is significant, hindering upward momentum. These levels are not merely technical boundaries; they represent significant psychological barriers for traders, influencing their buying and selling decisions.

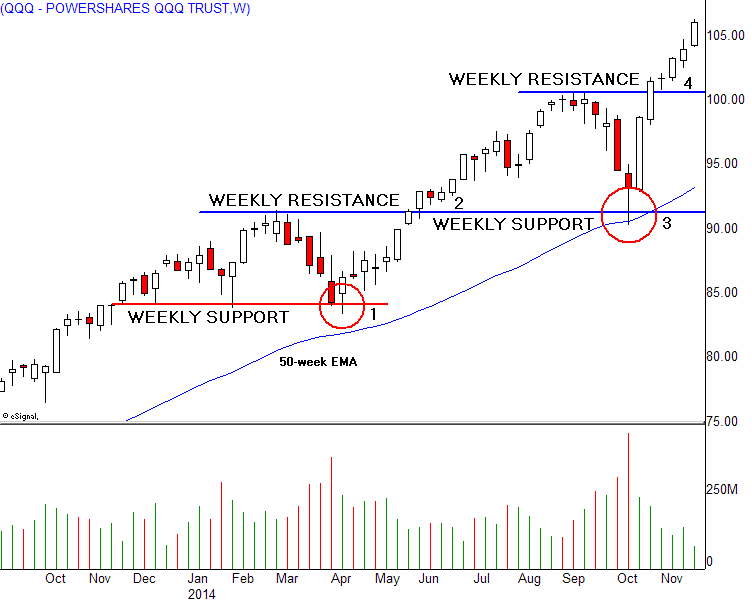

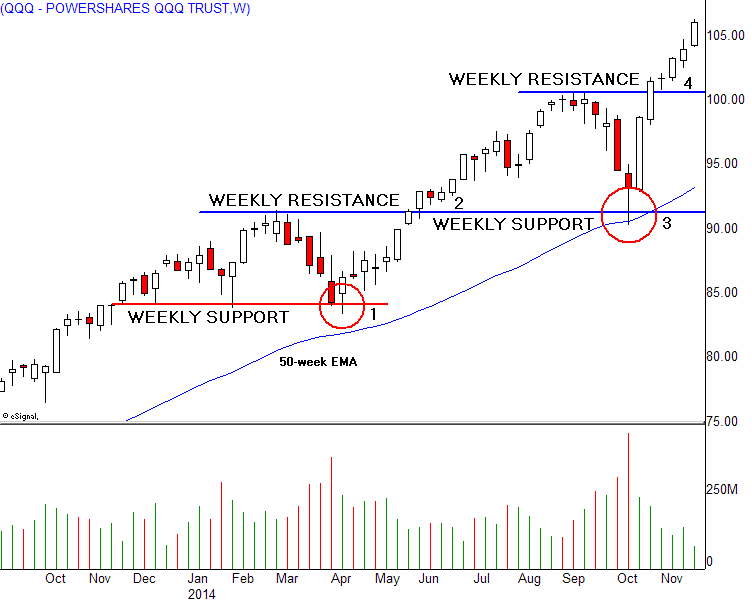

A visual representation (a sample chart would be inserted here showing support and resistance levels on an AAPL chart). Technical indicators, such as moving averages (e.g., 50-day and 200-day moving averages) and pivot points, can help identify potential support and resistance levels. These indicators smooth out price fluctuations, revealing underlying trends and potential turning points.

Key Historical Support and Resistance Levels for AAPL

Analyzing past performance can provide valuable insights into potential future price movements. Here are a few significant historical support and resistance levels for AAPL:

- $150: Strong support level observed in Q4 2022 following a market correction driven by concerns about inflation and global economic slowdown. The price found support here due to strong underlying fundamentals and positive investor sentiment regarding future product releases.

- $175: A key resistance level breached in Q1 2023, signaling a potential shift in market sentiment and increased investor confidence. This breakthrough was fueled by strong earnings reports and positive forecasts.

- $200: This level acted as both support and resistance at different points in 2023, highlighting its significance. Breaches of this level often indicated significant market shifts.

Understanding the market context surrounding these levels is critical. For example, the $150 support in Q4 2022 coincided with a period of general market uncertainty, while the breach of $175 in Q1 2023 was fueled by positive news regarding Apple's product pipeline and financial outlook.

Analyzing Apple Stock Price Trends and Predicting Future Levels

Using Technical Analysis to Predict Apple Stock Prices

Technical analysis involves studying past market data – specifically price and volume – to identify patterns and predict future price movements. Indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands provide signals about momentum, trend strength, and potential reversals. Interpreting these indicators in conjunction with support and resistance levels enhances prediction accuracy. For example, a bullish divergence (RSI rising while price falls) near a support level could suggest a potential price bounce.

Fundamental Analysis and its Impact on AAPL Stock Price

Fundamental analysis focuses on evaluating the intrinsic value of a company by examining its financial health, business model, and competitive landscape. For AAPL, key fundamental factors include:

- New product launches: The success of new iPhones, Macs, and other products significantly impacts revenue and investor sentiment.

- Financial performance: Strong earnings, revenue growth, and profit margins drive investor confidence.

- Market competition: Competition from companies like Samsung and Google influences AAPL's market share and profitability.

Understanding these factors is crucial for long-term price predictions. Strong fundamentals usually support higher price levels, while negative news about financial performance or increased competition can exert downward pressure.

Considering Market Sentiment and News Events

Market sentiment (overall optimism or pessimism) significantly influences AAPL's price. Bullish sentiment drives prices up, while bearish sentiment leads to declines. Major news events, including product announcements, earnings reports, and regulatory changes, can create significant short-term volatility. For example, an unexpectedly strong earnings report often leads to a short-term price surge.

Risk Management and Investing in AAPL Based on Price Levels

Setting Stop-Loss Orders and Profit Targets

Effective risk management is paramount. Stop-loss orders automatically sell your AAPL shares when the price falls to a predetermined level (often slightly below a support level), limiting potential losses. Profit targets, set at or slightly above resistance levels, help lock in gains when the price reaches a desired point.

Diversification and Portfolio Management

Never put all your eggs in one basket. Diversify your investments across different asset classes to reduce risk. AAPL should be part of a well-diversified portfolio, rather than your sole investment.

Long-Term vs. Short-Term Investing Strategies for AAPL

Long-term investors focus on the company's fundamental strength and potential for long-term growth. They might buy and hold AAPL shares for years, regardless of short-term price fluctuations. Short-term traders, however, aim to profit from short-term price movements, actively buying and selling based on technical analysis and market sentiment. Understanding support and resistance levels is crucial for both strategies.

Conclusion

Understanding Apple Stock Price Levels is key to successful investing in AAPL. By combining technical and fundamental analysis, monitoring market sentiment, and implementing effective risk management strategies, you can make more informed decisions. Remember to set stop-loss orders and profit targets based on support and resistance levels, and diversify your portfolio. Continuously monitor Apple Stock Price Levels and conduct your own thorough research before making any investment decisions. For further learning on stock market analysis, consider exploring resources like [link to a relevant resource, e.g., Investopedia]. Make informed decisions regarding your AAPL stock price strategy.

Featured Posts

-

Rare Porsche 911 S T In Pts Riviera Blue For Sale

May 25, 2025

Rare Porsche 911 S T In Pts Riviera Blue For Sale

May 25, 2025 -

French Cac 40 Index Negative Close On Friday Stable Weekly Performance

May 25, 2025

French Cac 40 Index Negative Close On Friday Stable Weekly Performance

May 25, 2025 -

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 25, 2025

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 25, 2025 -

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 25, 2025

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 25, 2025 -

Classifica Forbes 2025 Ecco Gli Uomini Piu Ricchi Del Mondo

May 25, 2025

Classifica Forbes 2025 Ecco Gli Uomini Piu Ricchi Del Mondo

May 25, 2025

Latest Posts

-

Flash Flood Warning Texas North Central Texas Bathed In Heavy Rain

May 25, 2025

Flash Flood Warning Texas North Central Texas Bathed In Heavy Rain

May 25, 2025 -

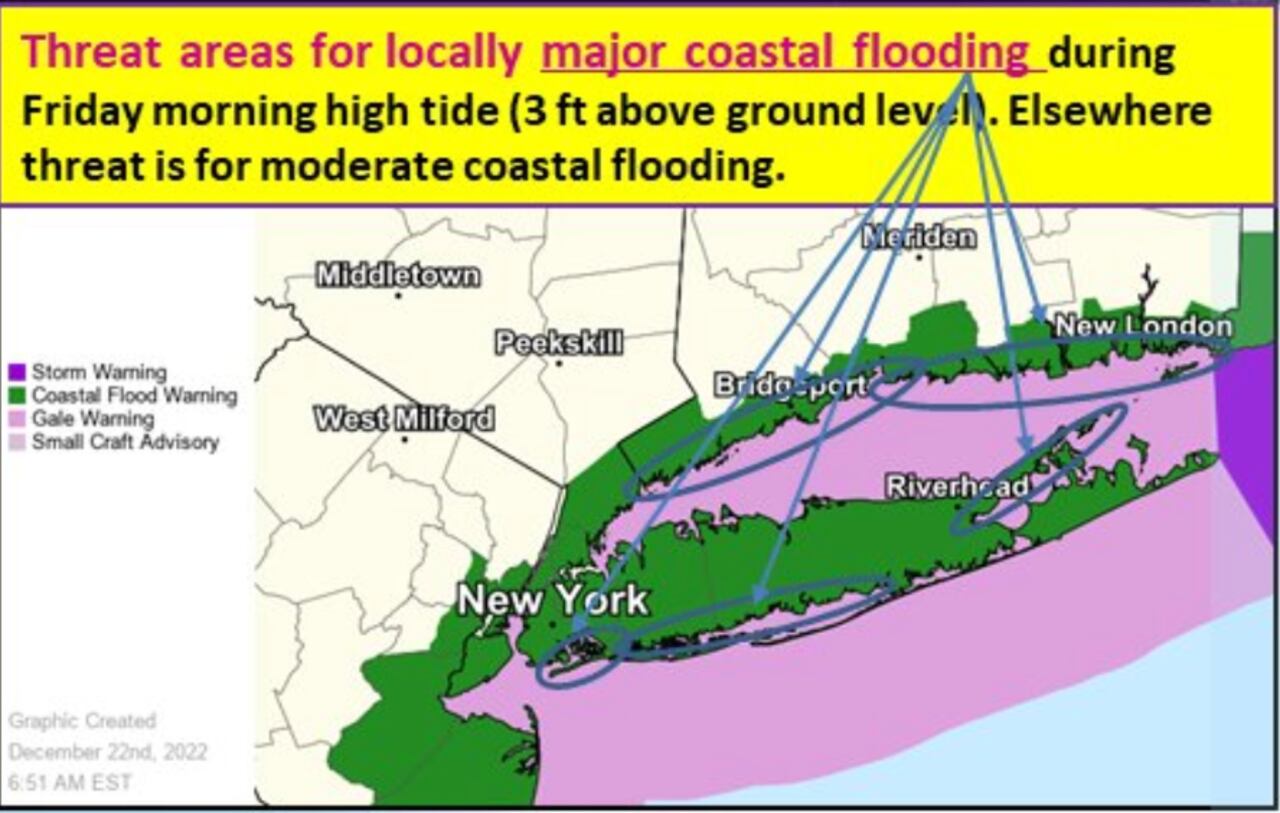

Pennsylvania Coastal Flood Warning Southeast Region Wednesday Update

May 25, 2025

Pennsylvania Coastal Flood Warning Southeast Region Wednesday Update

May 25, 2025 -

Alternative Delivery Services Gaining Traction Amidst Canada Post Challenges

May 25, 2025

Alternative Delivery Services Gaining Traction Amidst Canada Post Challenges

May 25, 2025 -

The Impact Of Canada Posts Performance On The Canadian Delivery Landscape

May 25, 2025

The Impact Of Canada Posts Performance On The Canadian Delivery Landscape

May 25, 2025 -

The Gregor Robertson Housing Plan A Path To Affordability

May 25, 2025

The Gregor Robertson Housing Plan A Path To Affordability

May 25, 2025