French CAC 40 Index: Negative Close On Friday, Stable Weekly Performance

Table of Contents

Friday's Negative Close: A Deeper Dive into the Market's Movement

Factors Contributing to the Decline

Friday's downturn in the CAC 40 can be attributed to a confluence of factors impacting market sentiment. Understanding these elements is crucial for navigating the complexities of the French stock market.

- Global Market Trends: A slight downturn in other major global indices, such as the Dow Jones and the DAX, likely contributed to a negative spillover effect on the CAC 40. This interconnectedness underscores the impact of international economic news on even seemingly isolated markets.

- Specific Company Performance: Several key CAC 40 companies reported disappointing earnings or issued negative guidance, impacting their stock prices and subsequently dragging down the overall index. For instance, [Insert example of a company and its percentage change, linking to a relevant news source].

- Sector-Specific News: Negative news within specific sectors, such as a decline in energy prices or concerns about the financial sector, can disproportionately affect the CAC 40. The energy sector, for example, experienced a [percentage]% drop due to [reason].

- Geopolitical Events: Ongoing geopolitical uncertainties and escalating tensions in various parts of the world often create market volatility and risk aversion, leading investors to pull back from riskier assets. [Mention a relevant geopolitical event and its potential impact on market sentiment].

Analyzing the Impact of Individual Stocks

The negative close on Friday wasn't solely driven by broad market trends; specific companies played a significant role. Analyzing the performance of individual stocks within the CAC 40 offers a more granular understanding of the market's movement. For example, [Company A] saw a [percentage]% drop, while [Company B] experienced a more modest [percentage]% decline. This divergence in performance highlights the importance of individual stock analysis alongside overall index trends. Further research into these companies' individual performance reveals underlying factors contributing to the overall CAC 40 decline.

Weekly Performance: A Picture of Resilience Amidst Friday's Volatility

Overview of the Weekly Trend

Despite Friday's dip, the CAC 40 demonstrated remarkable resilience throughout the week. The overall weekly change was a relatively modest [percentage]%, highlighting the market’s ability to absorb short-term shocks. This contrasts with the previous week's [percentage]% change, demonstrating a degree of stability. This resilience suggests a degree of underlying strength in the French economy and the long-term outlook for many of the companies represented in the index.

Key Sectors Driving Weekly Stability

Certain sectors performed well during the week, offsetting some of Friday’s losses. The [sector name] sector, for instance, showed significant growth, driven by [reason]. This sector's positive performance highlights the importance of diversification within the CAC 40 and offers potential investment opportunities for those seeking more stable returns. The strong performance of this and other sectors emphasizes the importance of analyzing individual sector trends when considering the overall index performance.

Looking Ahead: Predictions and Investment Strategies for the CAC 40

Short-Term Outlook

The short-term outlook for the CAC 40 remains somewhat uncertain, given the recent volatility. Close monitoring of global market trends and any further news impacting key CAC 40 companies is crucial. A cautious approach is advised in the short term.

Long-Term Outlook

The long-term outlook for the CAC 40 remains positive, based on the underlying strength of the French economy and several key growth sectors. However, investors should always be mindful of potential risks.

Investment Implications

Investors should carefully consider their risk tolerance and investment goals before making any decisions regarding the CAC 40. Diversification across different sectors and asset classes is recommended, alongside thorough due diligence on individual companies.

Conclusion: Navigating the Fluctuations of the French CAC 40 Index

Friday's negative close on the CAC 40, while noticeable, did not overshadow the index's relatively stable weekly performance. Several factors, including global market trends, individual company performance, and sector-specific news, contributed to the overall market movement. Understanding these influences is vital for investors seeking to navigate the complexities of the French stock market. Stay updated on the latest CAC 40 index movements to make informed investment decisions. Learn more about investing in the French CAC 40 and analyze the CAC 40 performance for better investment strategies.

Featured Posts

-

Kyle Walkers Night Out Annie Kilner Spotted On Solo Errands

May 25, 2025

Kyle Walkers Night Out Annie Kilner Spotted On Solo Errands

May 25, 2025 -

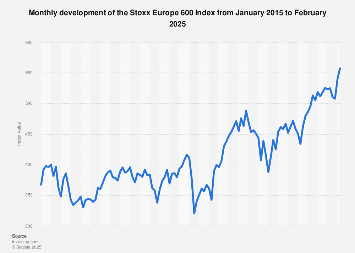

16 Nisan 2025 Avrupa Borsalari Analizi Stoxx 600 Ve Dax 40 In Durumu

May 25, 2025

16 Nisan 2025 Avrupa Borsalari Analizi Stoxx 600 Ve Dax 40 In Durumu

May 25, 2025 -

Woody Allen Sexual Abuse Accusations Reignited Following Sean Penns Backing

May 25, 2025

Woody Allen Sexual Abuse Accusations Reignited Following Sean Penns Backing

May 25, 2025 -

Czy Porsche Cayenne Gts Coupe Spelnia Oczekiwania Test Drogowy

May 25, 2025

Czy Porsche Cayenne Gts Coupe Spelnia Oczekiwania Test Drogowy

May 25, 2025 -

Walker Peters To Leeds Transfer Speculation Intensifies

May 25, 2025

Walker Peters To Leeds Transfer Speculation Intensifies

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025