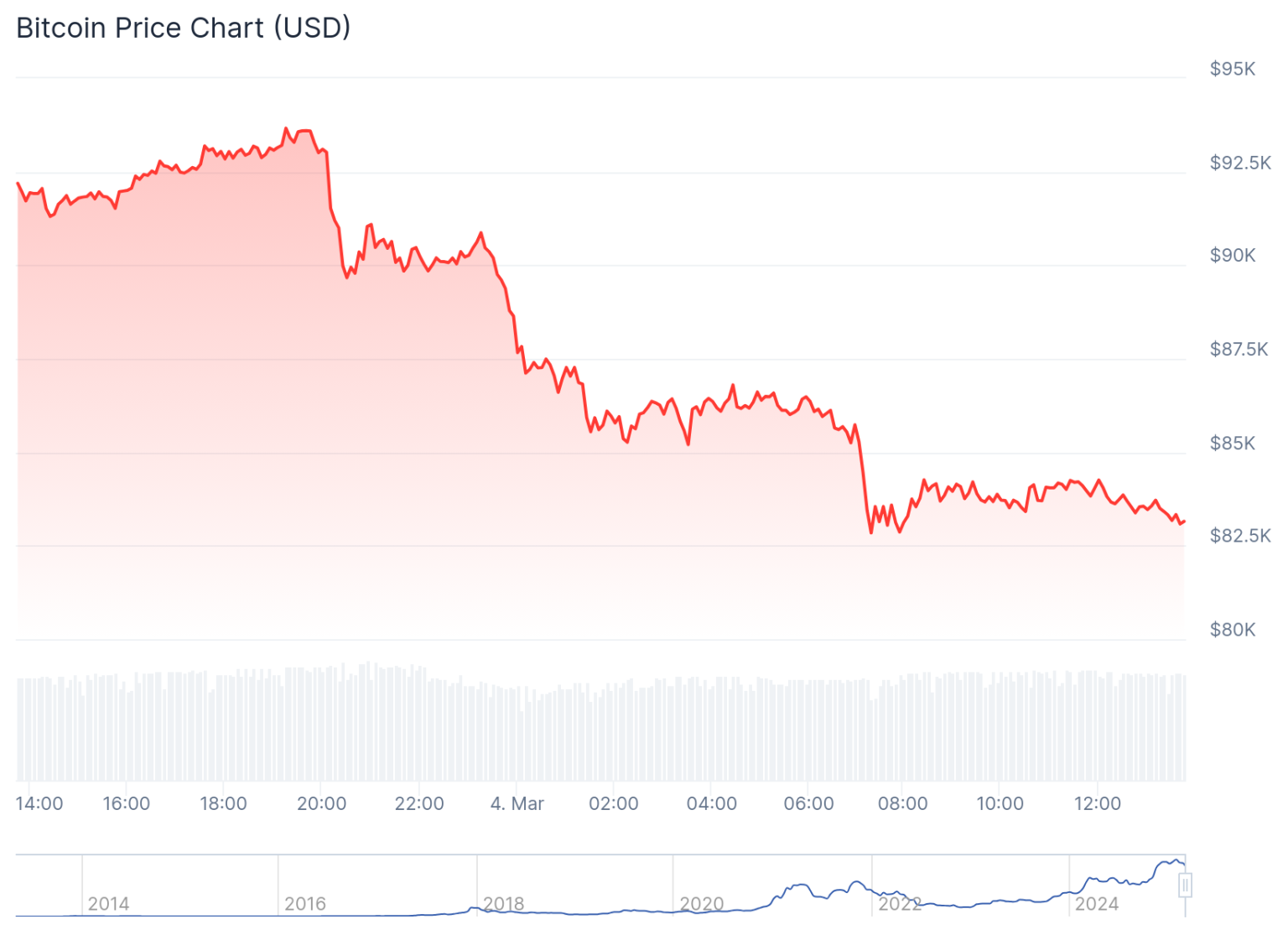

Amsterdam Stock Market Crash: 7% Plunge Amidst Trade War Fears

Table of Contents

The Amsterdam stock market suffered a significant setback today, plummeting 7% amidst growing concerns over escalating global trade tensions. This sharp decline underscores the vulnerability of even robust markets to international trade disputes and highlights the uncertainty impacting global investment strategies. This article delves into the causes behind this dramatic crash, its immediate consequences, and what investors can expect in the coming days and weeks.

Causes of the Amsterdam Stock Market Crash

Escalating Trade War Concerns

The Netherlands, a major exporter, is highly susceptible to global trade disputes. The current escalation of trade tensions between major economic powers significantly impacts Dutch businesses. Specific concerns include potential tariffs on Dutch agricultural exports to key markets like the US and China, disrupting crucial supply chains and impacting export-oriented sectors like horticulture and manufacturing.

- Example 1: Increased tariffs on Dutch cheese exports to the US could lead to a significant reduction in revenue for Dutch dairy farmers and processors.

- Example 2: Trade restrictions on Dutch semiconductor manufacturing equipment impacting sales to China could cause widespread job losses in the high-tech sector.

- Data: According to the Netherlands Bureau for Economic Policy Analysis (CPB), a 10% increase in tariffs on Dutch exports could result in a [insert estimated percentage]% decrease in GDP growth.

Global Market Volatility

The Amsterdam stock market crash isn't an isolated incident. Global market instability, fueled by geopolitical uncertainty and fluctuating oil prices, plays a significant role. The interconnected nature of global finance means that anxieties in one market quickly ripple across others.

- Example 1: The recent downturn in the Dow Jones Industrial Average and the FTSE 100 are clear indicators of a broader global market correction.

- Example 2: Increased investor uncertainty regarding future economic growth has led to widespread risk aversion, causing a sell-off in various asset classes.

- Investor Sentiment: Negative investor sentiment, driven by fears of a prolonged trade war and economic slowdown, has significantly contributed to the Amsterdam market’s sharp decline.

Impact of Brexit Uncertainty

The lingering uncertainty surrounding Brexit continues to cast a shadow over the Dutch economy. The Netherlands, a close trading partner with the UK, is vulnerable to disruptions in trade flows and supply chains. This uncertainty undermines investor confidence and contributes to market fragility.

- Example 1: Dutch businesses heavily reliant on trade with the UK face increased administrative burdens and potential delays due to new customs regulations.

- Example 2: Uncertainty regarding future trade agreements between the Netherlands and the UK discourages long-term investment and hampers economic planning.

- Data: The Netherlands-UK bilateral trade volume [insert data on current trade volume and potential impact from Brexit].

Impact of the 7% Plunge on the Dutch Economy

Immediate Consequences

The 7% plunge in the Amsterdam stock market has immediate repercussions for Dutch businesses, investors, and consumer confidence. Companies with significant stock market exposure experience immediate losses, potentially leading to job cuts and reduced investment in new projects.

- Example 1: Companies listed on Euronext Amsterdam, particularly those in export-oriented sectors, face reduced valuations and diminished access to capital.

- Example 2: Falling stock prices could trigger a reduction in consumer spending as confidence wanes.

- Expert Quote: "[Quote from a financial analyst on the immediate consequences of the market crash]."

Long-Term Implications

The long-term implications of this market crash extend beyond immediate losses. Sustained economic slowdown, reduced investment, and a decline in consumer confidence could hinder long-term economic growth and stability in the Netherlands.

- Potential Scenarios: Prolonged trade tensions, coupled with Brexit uncertainty, could lead to a prolonged period of slow economic growth, impacting government revenue and potentially requiring fiscal stimulus measures.

- Government Intervention: The Dutch government might intervene through fiscal stimulus or monetary policy adjustments to mitigate the economic impact.

- Recovery Factors: The speed of recovery depends on several factors including the resolution of trade disputes, the clarity provided by Brexit developments, and the overall global economic outlook.

Investor Reactions and Future Outlook

Investor Sentiment and Strategies

Investors are reacting to the crash with a mix of fear and caution. Many are adopting risk-averse strategies, selling off assets to limit potential losses. Others are seeking diversification opportunities to mitigate risks.

- Investor Responses: Selling, buying on dips (depending on risk tolerance and market outlook), and holding positions are prevalent strategies.

- Diversification Strategies: Investors are looking at diversifying their portfolios across different asset classes and geographical regions to reduce their exposure to specific risks.

- Expert Opinion: “[Quote from a financial expert on investor strategies during market volatility].”

Predictions and Analysis

Predicting the future performance of the Amsterdam stock market is challenging. The path to recovery depends heavily on the resolution of global trade disputes, the clarity of the Brexit situation, and the broader global economic environment.

- Potential Scenarios: A swift recovery is possible if trade tensions ease and investor confidence returns. Conversely, a prolonged period of volatility could lead to further declines.

- Influencing Factors: Resolution of trade disputes, clarity on future UK-EU trade relationships, and global economic growth will significantly influence the market's future performance.

- Recovery Timeline: The recovery timeline is uncertain, but experts suggest [insert potential timeframes for market recovery].

Conclusion

The Amsterdam stock market crash, marked by a significant 7% plunge, reflects the impact of escalating trade war fears, global market volatility, and Brexit uncertainty. These factors have created a challenging environment for Dutch businesses and investors. The immediate consequences include losses for companies, reduced consumer confidence, and potential job losses. The long-term implications could involve slower economic growth and require government intervention. Investor sentiment remains cautious, and strategies are shifting toward risk aversion and diversification. The path to recovery depends on several factors, but a careful monitoring of the Amsterdam stock market and global trade dynamics is crucial.

Call to Action: Stay informed about the evolving situation in the Amsterdam stock market and the global trade landscape. Continue to monitor the effects of this significant Amsterdam stock market crash and adjust your investment strategies accordingly. For the latest updates on the Amsterdam stock market and global trade, [link to relevant resource/news page].

Featured Posts

-

The Ultimate Escape To The Country Properties Activities And More

May 25, 2025

The Ultimate Escape To The Country Properties Activities And More

May 25, 2025 -

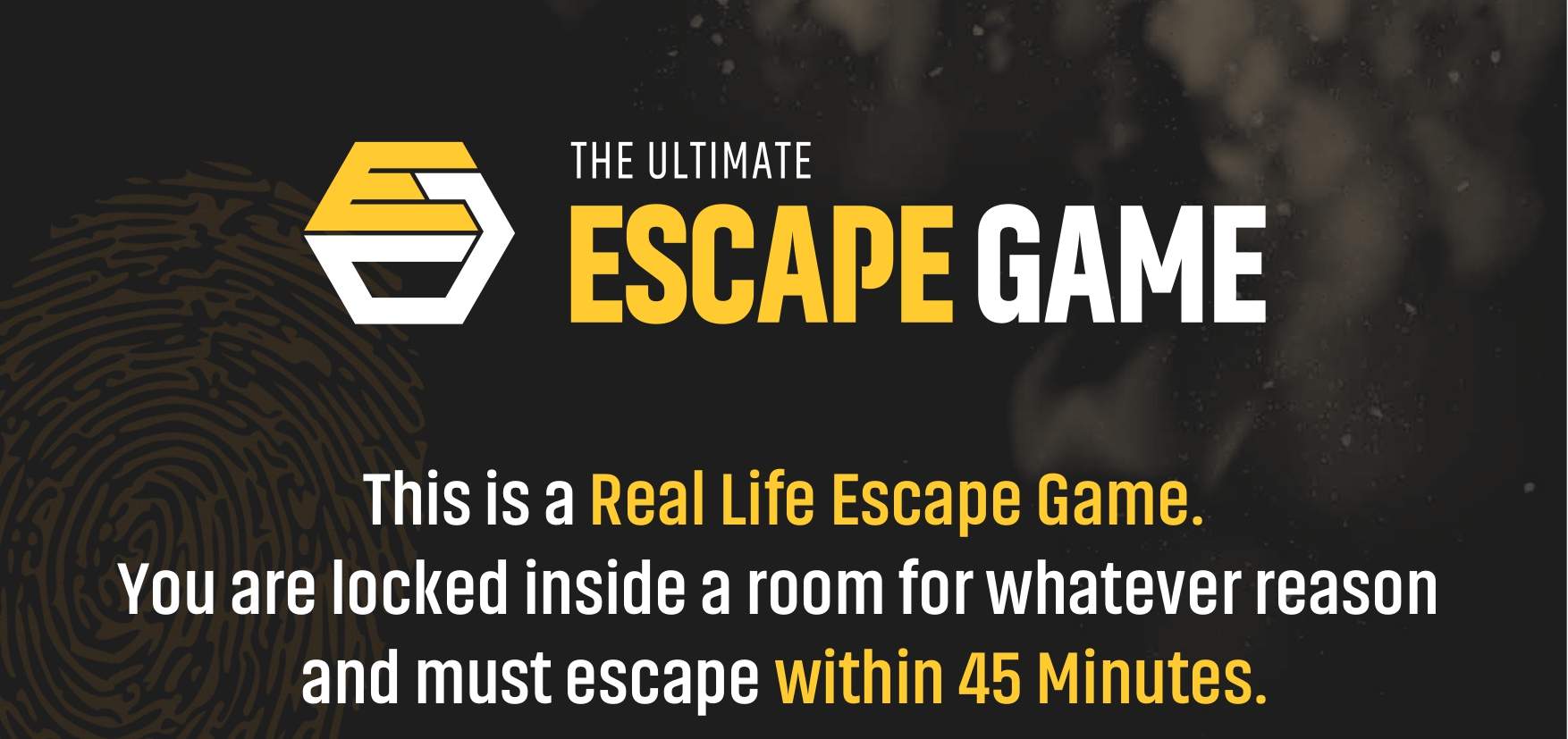

Dreyfus Affair Renewed Calls For Military Promotion 130 Years Later

May 25, 2025

Dreyfus Affair Renewed Calls For Military Promotion 130 Years Later

May 25, 2025 -

Peremozhtsi Yevrobachennya Ostanni 10 Rokiv De Voni Zaraz

May 25, 2025

Peremozhtsi Yevrobachennya Ostanni 10 Rokiv De Voni Zaraz

May 25, 2025 -

Houseboat No Its A Container Ship On A Front Lawn Cnn

May 25, 2025

Houseboat No Its A Container Ship On A Front Lawn Cnn

May 25, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025

Latest Posts

-

16 Million Fine For T Mobile Three Year Data Breach Settlement

May 25, 2025

16 Million Fine For T Mobile Three Year Data Breach Settlement

May 25, 2025 -

Open Ais 2024 Event Easier Voice Assistant Creation Tools Unveiled

May 25, 2025

Open Ais 2024 Event Easier Voice Assistant Creation Tools Unveiled

May 25, 2025 -

Is Elon Musk Selling His Dogecoin Analyzing Recent Market Trends

May 25, 2025

Is Elon Musk Selling His Dogecoin Analyzing Recent Market Trends

May 25, 2025 -

Ai Driven Podcast Creation A New Approach To Scatological Document Analysis

May 25, 2025

Ai Driven Podcast Creation A New Approach To Scatological Document Analysis

May 25, 2025 -

Elon Musks Dogecoin Stance Whats Next For The Cryptocurrency

May 25, 2025

Elon Musks Dogecoin Stance Whats Next For The Cryptocurrency

May 25, 2025