Understanding High Stock Market Valuations: A BofA Analysis

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's current outlook on market valuations is nuanced, often described as cautiously optimistic or selectively bullish. They don't offer a simple "bull" or "bear" prediction but instead analyze the market through a range of key valuation metrics. These metrics help determine whether current prices are justified by underlying company performance and future growth prospects. BofA utilizes several key metrics:

-

Price-to-Earnings Ratio (P/E): This classic metric compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, indicating potentially high expectations for future growth. BofA's analysis often shows current P/E ratios compared to historical averages and sector benchmarks.

-

Price-to-Sales Ratio (P/S): This ratio compares a company's market capitalization to its revenue. It's particularly useful for evaluating companies with high growth potential but limited or negative earnings. BofA uses P/S ratios to assess the overall market valuation and identify potentially overvalued or undervalued sectors.

-

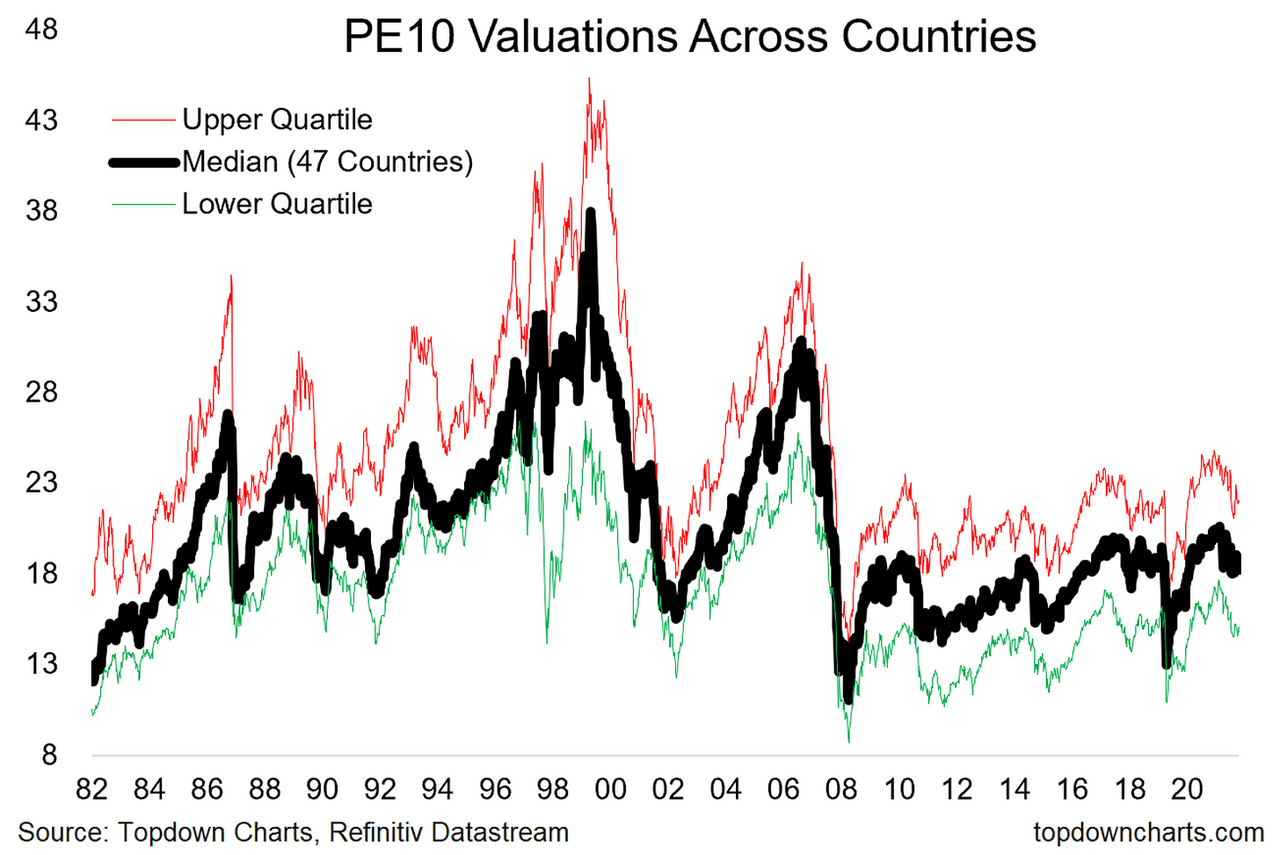

Cyclically Adjusted Price-to-Earnings Ratio (CAPE): Also known as the Shiller P/E ratio, this metric smooths out earnings fluctuations over a 10-year period, providing a longer-term perspective on valuation. BofA often incorporates CAPE into its analysis to account for cyclical economic trends.

Current market values for these metrics, according to BofA's recent research, often show elevated levels compared to historical averages. (Note: Specific numerical data would need to be sourced from current BofA reports and integrated here with appropriate attribution and charts/graphs. This is a placeholder for such data.) This suggests that the market is pricing in significant future growth and potentially reflects a higher degree of investor optimism.

Factors Contributing to High Stock Market Valuations

Several significant factors contribute to the current high stock market valuations, many of which are reflected in BofA's research:

-

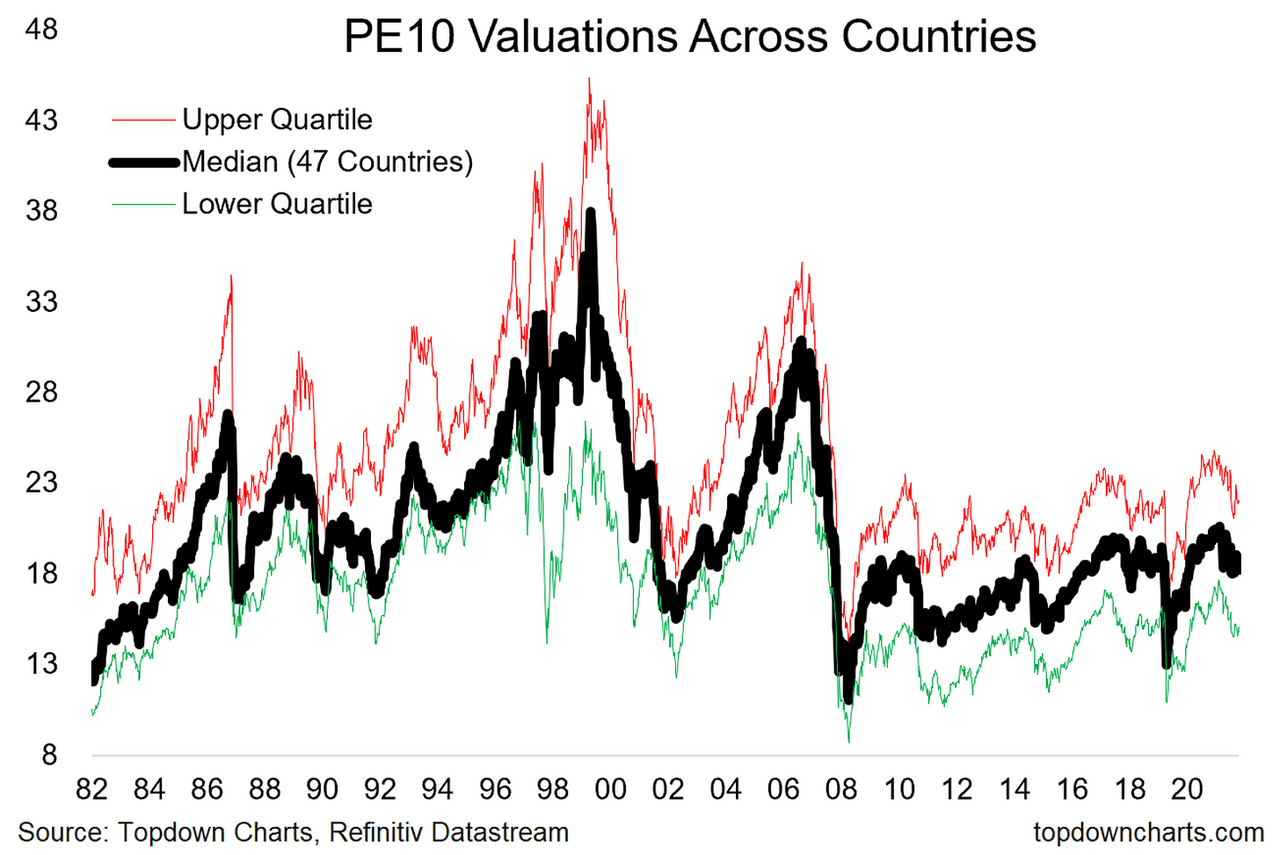

Low Interest Rates: Historically low interest rates make borrowing cheaper for companies and individuals, fueling investment and driving up asset prices, including stocks.

-

Strong Corporate Earnings Growth: Robust corporate earnings, or the expectation thereof, support higher valuations. BofA's analysis often highlights specific sectors demonstrating strong earnings growth.

-

Increased Monetary Supply: Quantitative easing and other monetary policy measures have increased the money supply, pushing investors towards riskier assets like stocks.

-

Technological Advancements: Breakthroughs in technology, particularly in areas like artificial intelligence and renewable energy, have created new growth opportunities and fueled investor enthusiasm for certain tech stocks.

-

Government Stimulus: Government stimulus packages, designed to mitigate economic downturns, have injected liquidity into the market, further contributing to higher valuations.

Risks Associated with High Stock Market Valuations

While high valuations can signal strong economic growth and investor confidence, they also carry inherent risks:

-

Market Corrections or Crashes: Highly valued markets are more susceptible to sharp corrections or even crashes if investor sentiment shifts or unexpected economic events occur. BofA regularly assesses the probability of such events.

-

Lower Future Returns: Investing in a highly valued market can lead to lower future returns compared to investing when valuations are historically low.

-

Vulnerability to Economic Shocks: High valuations make markets more vulnerable to economic shocks, such as interest rate hikes or geopolitical instability.

-

Inflationary Pressures: Rising inflation can erode the purchasing power of future returns, impacting the real value of investments. BofA's analysis incorporates inflation forecasts into their risk assessments.

BofA typically addresses these risks by recommending diversification, emphasizing a long-term investment horizon, and suggesting a cautious approach to certain sectors or assets deemed overvalued.

BofA's Investment Strategies in a High-Valuation Environment

BofA's investment strategies in a high-valuation environment generally emphasize selectivity and risk management. (It's crucial to reiterate that this section is an analysis of BofA's perspective, not financial advice.) They may suggest:

-

Sector-Specific Opportunities: Identifying undervalued sectors or specific companies within overvalued sectors that demonstrate strong fundamentals.

-

Diversification: Spreading investments across different asset classes and sectors to reduce overall portfolio risk.

-

Value Investing: Focusing on companies whose stock prices are considered below their intrinsic value, potentially offering higher returns in the long run.

-

Defensive Stocks: Allocating a portion of the portfolio to defensive stocks, which tend to perform relatively well during economic downturns.

Understanding High Stock Market Valuations: Key Takeaways and Next Steps

BofA's analysis highlights that while high stock market valuations reflect positive economic factors, they also carry significant risks. Key factors driving these valuations include low interest rates, strong corporate earnings, and increased monetary supply. However, investors need to be aware of the potential for market corrections, lower future returns, and vulnerability to economic shocks. BofA generally advises a cautious, selective, and diversified approach to investing in this environment.

Continue your journey towards understanding high stock market valuations by exploring BofA's research reports and other reputable financial sources to make informed investment decisions. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Economic Uncertainty The Next Fed Chairs Inheritance From The Trump Administration

Apr 26, 2025

Economic Uncertainty The Next Fed Chairs Inheritance From The Trump Administration

Apr 26, 2025 -

Cassidy Hutchinson Memoir A Deeper Look Into The January 6th Hearings

Apr 26, 2025

Cassidy Hutchinson Memoir A Deeper Look Into The January 6th Hearings

Apr 26, 2025 -

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 26, 2025

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 26, 2025 -

Chinas Auto Industry A Look At The Future Of Electric Vehicles

Apr 26, 2025

Chinas Auto Industry A Look At The Future Of Electric Vehicles

Apr 26, 2025 -

Abb Vie Abbv Raises Profit Outlook On Strong New Drug Sales

Apr 26, 2025

Abb Vie Abbv Raises Profit Outlook On Strong New Drug Sales

Apr 26, 2025

Latest Posts

-

Un Ano De Salario Para Madres Tenistas El Nuevo Estandar Wta

Apr 27, 2025

Un Ano De Salario Para Madres Tenistas El Nuevo Estandar Wta

Apr 27, 2025 -

Wta Proteccion Salarial Para Tenistas Durante La Licencia De Maternidad

Apr 27, 2025

Wta Proteccion Salarial Para Tenistas Durante La Licencia De Maternidad

Apr 27, 2025 -

La Wta Lidera Licencia De Maternidad Remunerada De Un Ano Para Tenistas

Apr 27, 2025

La Wta Lidera Licencia De Maternidad Remunerada De Un Ano Para Tenistas

Apr 27, 2025 -

Licencia De Maternidad Pagada En La Wta Un Paso Gigantesco Para El Deporte Femenino

Apr 27, 2025

Licencia De Maternidad Pagada En La Wta Un Paso Gigantesco Para El Deporte Femenino

Apr 27, 2025 -

Cuartos De Final Indian Wells El Camino De Cerundolo Tras Las Bajas De Fritz Y Gauff

Apr 27, 2025

Cuartos De Final Indian Wells El Camino De Cerundolo Tras Las Bajas De Fritz Y Gauff

Apr 27, 2025