AbbVie (ABBV) Raises Profit Outlook On Strong New Drug Sales

Table of Contents

Strong Performance of Key New Drugs Fuels AbbVie's Growth

AbbVie's impressive revenue growth is undeniably fueled by the outstanding performance of its key new drugs, Rinvoq and Skyrizi. These innovative treatments have solidified AbbVie's position within the competitive pharmaceutical landscape, particularly within the immunology and oncology sectors. Their success represents a significant boost to AbbVie's overall revenue and market share.

-

Rinvoq and Skyrizi Sales Growth: Both drugs have experienced phenomenal sales growth, exceeding initial projections. While precise figures may vary depending on reporting periods, their contribution to AbbVie's bottom line is substantial and clearly visible in the company's recent financial reports.

-

Market Segment Success: Rinvoq and Skyrizi have demonstrated exceptional success in various market segments, including rheumatoid arthritis, psoriatic arthritis, and Crohn's disease. Their efficacy and safety profiles have contributed to increased market penetration.

-

Competitive Advantages: These drugs boast several competitive advantages, including superior efficacy compared to existing treatments, improved safety profiles, and convenient administration methods. These factors have propelled their rapid adoption by patients and healthcare providers.

Revised Profit Outlook and Financial Projections for AbbVie

The strong sales of Rinvoq and Skyrizi have directly resulted in AbbVie revising its profit outlook upwards. The company's updated financial guidance indicates a significant increase in earnings per share (EPS) and adjusted revenue. This positive revision reflects the company’s confidence in its continued growth trajectory.

-

Previous vs. Revised Forecast: While the exact figures will be available in official company statements, the upward revision represents a considerable increase compared to the previous forecast, signaling robust financial health.

-

Financial Guidance for Future Quarters: The revised outlook provides a clearer picture of AbbVie's financial projections for the coming quarters and the fiscal year. This positive guidance reassures investors about the company's sustained financial performance.

-

Impact on AbbVie's Stock Price: The announcement of the revised profit outlook has already had a positive impact on AbbVie's stock price, reflecting investor confidence in the company’s future prospects.

Impact on AbbVie's Stock and Investor Sentiment

The market reacted enthusiastically to AbbVie's positive news. The announcement led to an immediate surge in the company's stock price, reflecting a positive shift in investor sentiment.

-

Stock Price Surge: The percentage increase in AbbVie's stock price following the announcement underscores the significant impact of the raised profit outlook on investor confidence.

-

Analyst Ratings and Recommendations: Financial analysts have largely responded positively to the news, with several adjusting their ratings and recommendations for AbbVie stock. Many are now suggesting a "buy" rating based on their analysis of the company’s future performance.

-

Overall Investor Sentiment: Overall investor sentiment surrounding AbbVie has become considerably more optimistic due to the strong performance of its new drugs and the resulting positive revision of profit forecasts.

Long-Term Implications and Future Outlook for AbbVie

The success of Rinvoq and Skyrizi is not just a short-term boost; it lays a strong foundation for AbbVie's long-term growth. The company's robust research and development (R&D) pipeline further strengthens its future outlook.

-

Key Drugs in the Pipeline: AbbVie continues to invest heavily in R&D, with a promising pipeline of new drugs under development. This ongoing commitment ensures a sustainable growth strategy for years to come.

-

Market Threats and Opportunities: While AbbVie faces competition in the biopharmaceutical industry, its innovative treatments, strong brand recognition, and commitment to R&D position it favorably to navigate the competitive landscape and seize new market opportunities.

-

Long-Term Growth Prospects: Given the current success of Rinvoq and Skyrizi and the promising prospects of its R&D pipeline, AbbVie appears well-positioned for sustained long-term growth.

Conclusion

AbbVie's impressive performance, driven by the robust sales of its new drugs Rinvoq and Skyrizi, has resulted in a significantly raised profit outlook and a positive market reaction. This success underscores the importance of these innovative treatments for AbbVie's future growth trajectory. The company's commitment to research and development further strengthens its position in the competitive biopharmaceutical industry. Stay informed about AbbVie (ABBV) stock and its performance through continued monitoring of financial news and analysis to make informed investment decisions.

Featured Posts

-

The Visual Storytelling Of Sinners Exploring The Mississippi Delta Through The Lens

Apr 26, 2025

The Visual Storytelling Of Sinners Exploring The Mississippi Delta Through The Lens

Apr 26, 2025 -

Will Ahmed Hassanein Rewrite Nfl History For Egypt

Apr 26, 2025

Will Ahmed Hassanein Rewrite Nfl History For Egypt

Apr 26, 2025 -

Nfl Draft 2024 First Round Kicks Off In Green Bay

Apr 26, 2025

Nfl Draft 2024 First Round Kicks Off In Green Bay

Apr 26, 2025 -

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 26, 2025

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 26, 2025 -

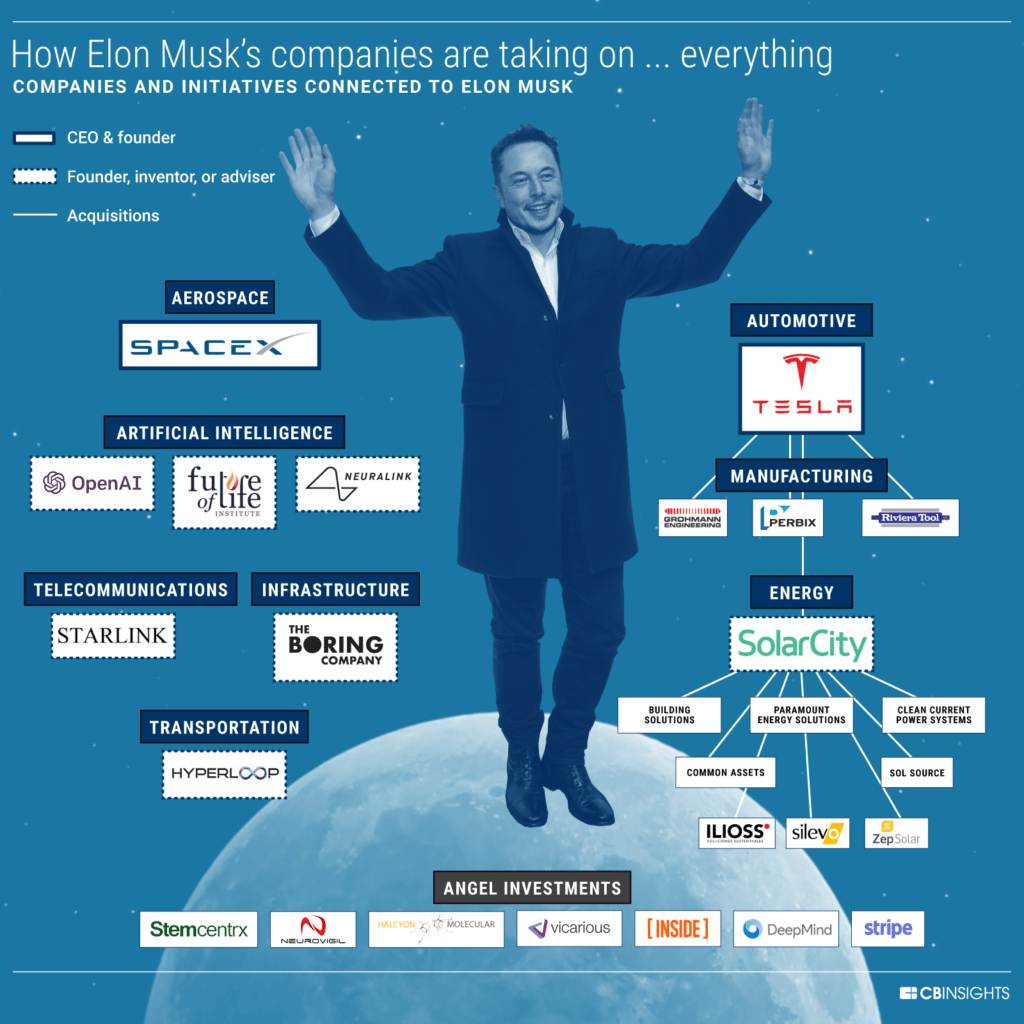

A Side Hustle Access To Elon Musks Private Companies

Apr 26, 2025

A Side Hustle Access To Elon Musks Private Companies

Apr 26, 2025

Latest Posts

-

A Horror Movies Lasting Impact Robert Pattinsons Account

Apr 27, 2025

A Horror Movies Lasting Impact Robert Pattinsons Account

Apr 27, 2025 -

Robert Pattinsons Unexpected Nighttime Companion A Horror Story

Apr 27, 2025

Robert Pattinsons Unexpected Nighttime Companion A Horror Story

Apr 27, 2025 -

Robert Pattinson And The Horror Movie That Kept Him Awake

Apr 27, 2025

Robert Pattinson And The Horror Movie That Kept Him Awake

Apr 27, 2025 -

Robert Pattinsons Sleepless Night Knives Horror And A Frightening Experience

Apr 27, 2025

Robert Pattinsons Sleepless Night Knives Horror And A Frightening Experience

Apr 27, 2025 -

Werner Herzogs Bucking Fastard A Look At The Casting And Story

Apr 27, 2025

Werner Herzogs Bucking Fastard A Look At The Casting And Story

Apr 27, 2025