Economic Uncertainty: The Next Fed Chair's Inheritance From The Trump Administration

Table of Contents

The transition of power always brings a shift in economic priorities and strategies. However, the Trump administration's four years left a particularly profound mark on the US economy, leaving the incoming Fed Chair with a unique set of challenges. This article will analyze the key economic uncertainties inherited, directly linking them to the previous administration's actions and outlining the difficult decisions awaiting the next Fed Chair.

Fiscal Policy Legacy and its Impact on Inflation

The Trump administration's fiscal policies significantly impacted the US economy, leaving a considerable legacy of economic uncertainty for the next Fed Chair. This legacy primarily manifests in two areas: a dramatically increased national debt and the consequences of aggressive trade wars.

Increased National Debt

The significant increase in the national debt during the Trump administration poses a substantial risk to future economic stability. This increase stems from a combination of factors:

- Tax Cuts and Jobs Act of 2017: This legislation significantly reduced corporate and individual income taxes, leading to a substantial decrease in government revenue.

- Increased Government Spending: Simultaneously, government spending increased across various sectors, including defense and social programs, further widening the budget deficit.

The Congressional Budget Office projects a continued rise in the national debt, potentially leading to higher interest rates and inflationary pressures. The impact on long-term economic growth remains uncertain, adding to the economic uncertainty facing the next Fed Chair. For example, the debt-to-GDP ratio increased substantially, potentially crowding out private investment and hindering long-term growth.

Trade Wars and their Economic Consequences

The Trump administration's imposition of tariffs on various imported goods, particularly from China, created significant economic uncertainty. These trade wars disrupted global supply chains, leading to increased prices for consumers and impacting businesses reliant on international trade.

- US-China Trade War: This prolonged trade dispute led to tariffs on hundreds of billions of dollars worth of goods, impacting various sectors of the US economy.

- Tariffs on Steel and Aluminum: These tariffs aimed to protect domestic industries but also led to higher prices for US businesses and consumers.

The uncertainty surrounding future trade relations further complicates the economic outlook. The potential for further escalation or unexpected trade agreements adds to the unpredictability the next Fed Chair must navigate.

Monetary Policy Challenges and the Fed's Response

The next Fed Chair inherits a low-interest-rate environment, a result of both the previous administration's fiscal policies and the global economic slowdown. This presents a unique set of challenges for monetary policy.

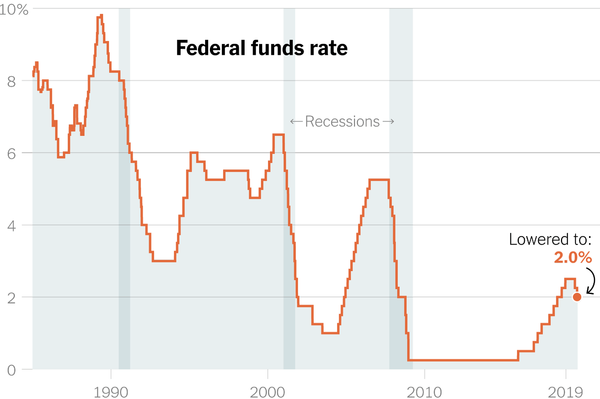

Low Interest Rates and Quantitative Easing

The Fed has employed low interest rates and quantitative easing (QE) to stimulate economic growth in recent years. However, the effectiveness of these measures in addressing the fiscal imbalances created by the previous administration is questionable.

- Quantitative Easing (QE): This involved the purchase of government bonds and other assets to increase the money supply and lower long-term interest rates. While QE helped lower borrowing costs, its long-term impact on inflation and economic growth remains a subject of debate.

- Exiting QE: The challenge of exiting QE policies without triggering significant market volatility adds another layer of complexity for the next Fed Chair.

The limitations of monetary policy in addressing fundamentally fiscal problems are a major concern.

Maintaining Price Stability and Full Employment

The Fed's dual mandate—to maintain price stability and promote full employment—is particularly challenging in the current economic climate. Balancing these two goals becomes increasingly difficult when faced with significant economic uncertainty.

- Inflationary Pressures: The increased national debt and potential for supply chain disruptions could lead to inflationary pressures, forcing the Fed to raise interest rates, potentially slowing economic growth and impacting employment.

- Unemployment: Conversely, raising interest rates too aggressively could stifle economic growth and increase unemployment.

Uncertainties in the Global Economy and their Implications

The global economy faces numerous uncertainties that directly impact the US and present significant challenges for the Fed.

Geopolitical Risks

Geopolitical risks, including trade tensions, political instability, and regional conflicts, add another layer of complexity to the economic outlook. These risks can disrupt global supply chains, impact investor confidence, and create volatility in financial markets.

- Global Political Instability: Political uncertainties in various regions of the world can lead to economic disruptions and affect the global demand for US goods and services.

- Trade Tensions: Ongoing trade disputes between major economies continue to create uncertainty and could lead to further disruptions in global trade.

Predicting and mitigating these risks requires a nuanced understanding of international relations and their economic implications.

Technological Disruption and its Impact

Rapid technological change and automation are transforming the labor market and creating both opportunities and challenges for the economy. The Fed must consider the implications of these changes when formulating monetary policy.

- Job Displacement: Automation and technological advancements may lead to job displacement in certain sectors, requiring workforce retraining and adaptation.

- Productivity Growth: Technological innovation can boost productivity and long-term economic growth, but the distribution of these gains needs careful consideration.

The next Fed Chair must navigate these uncertainties and formulate policies that address both the short-term and long-term challenges facing the US economy.

Navigating Economic Uncertainty: The Next Fed Chair's Challenge

The next Federal Reserve Chair inherits a complex and uncertain economic landscape, a direct consequence of the Trump administration's policies. Navigating the increased national debt, the lingering effects of trade wars, and the complexities of global geopolitical risks requires a sophisticated and adaptive approach to monetary policy. Maintaining price stability while promoting full employment will be a significant challenge, demanding careful consideration of the potential conflicts between these two goals. The impact of technological disruption further adds to the multifaceted nature of the economic challenges ahead. Proactive and adaptive monetary policy will be crucial in addressing the legacy of economic uncertainty and fostering sustainable economic growth. We encourage further reading and discussion on this critical topic, particularly concerning the future of monetary policy and the enduring impact of the Trump administration's economic legacy. Understanding "economic uncertainty" is crucial for navigating the complexities of the current financial landscape.

Featured Posts

-

2024 Nfl Draft Green Bays First Round

Apr 26, 2025

2024 Nfl Draft Green Bays First Round

Apr 26, 2025 -

La Fire Victims Face Rental Price Hikes Landlord Practices Under Scrutiny

Apr 26, 2025

La Fire Victims Face Rental Price Hikes Landlord Practices Under Scrutiny

Apr 26, 2025 -

The Crucial Role Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 26, 2025

The Crucial Role Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 26, 2025 -

Florida A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025

Florida A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025 -

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025

Latest Posts

-

Un Ano De Salario Para Madres Tenistas El Nuevo Estandar Wta

Apr 27, 2025

Un Ano De Salario Para Madres Tenistas El Nuevo Estandar Wta

Apr 27, 2025 -

Wta Proteccion Salarial Para Tenistas Durante La Licencia De Maternidad

Apr 27, 2025

Wta Proteccion Salarial Para Tenistas Durante La Licencia De Maternidad

Apr 27, 2025 -

La Wta Lidera Licencia De Maternidad Remunerada De Un Ano Para Tenistas

Apr 27, 2025

La Wta Lidera Licencia De Maternidad Remunerada De Un Ano Para Tenistas

Apr 27, 2025 -

Licencia De Maternidad Pagada En La Wta Un Paso Gigantesco Para El Deporte Femenino

Apr 27, 2025

Licencia De Maternidad Pagada En La Wta Un Paso Gigantesco Para El Deporte Femenino

Apr 27, 2025 -

Cuartos De Final Indian Wells El Camino De Cerundolo Tras Las Bajas De Fritz Y Gauff

Apr 27, 2025

Cuartos De Final Indian Wells El Camino De Cerundolo Tras Las Bajas De Fritz Y Gauff

Apr 27, 2025