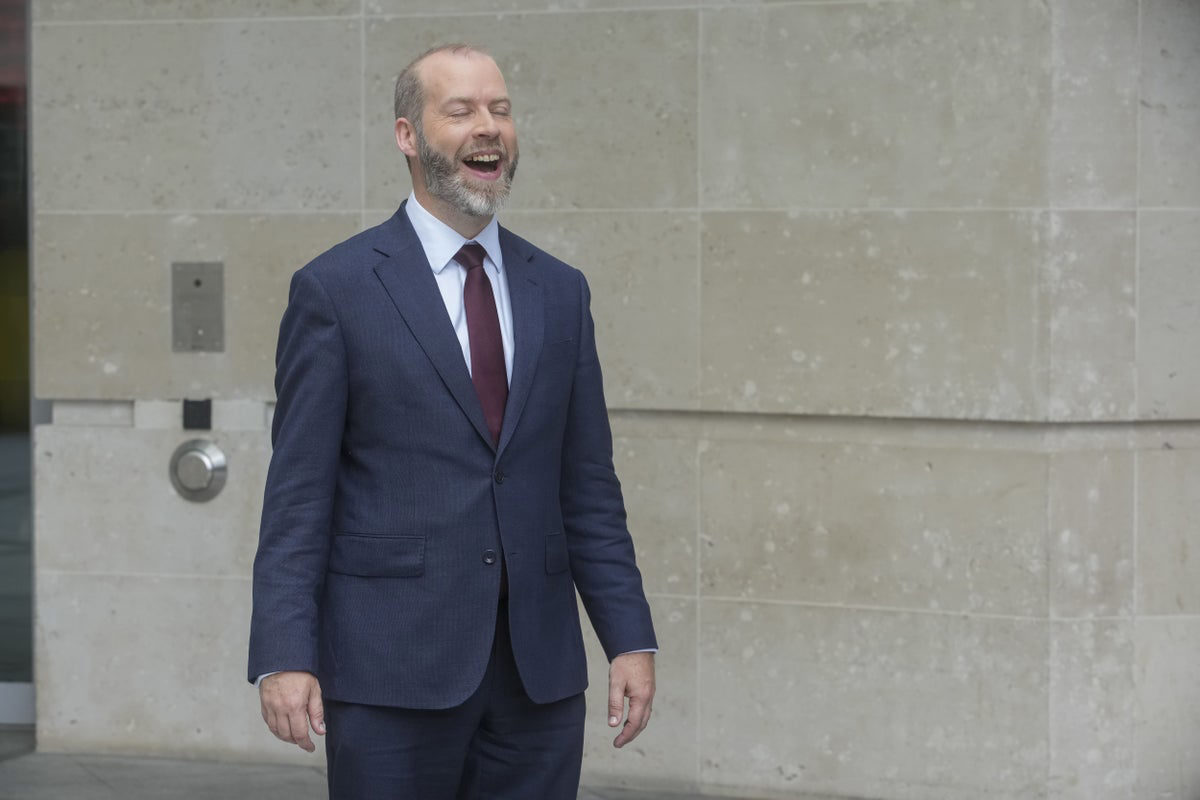

Understanding Greg Abel: Berkshire Hathaway's Next CEO

Table of Contents

Greg Abel's Background and Rise within Berkshire Hathaway

Early Career and Key Experiences

Before joining Berkshire Hathaway, Greg Abel's career showcased a clear trajectory towards leadership in the energy sector and broader business management. His early experiences built a strong foundation for his future success.

- Early Roles: While specific details about his early career may be limited publicly, it's likely he gained experience in areas like finance, operations, or engineering, building the skillset necessary for managing complex organizations.

- Focus on Operational Efficiency: A recurring theme in Abel's career has been his focus on streamlining operations and improving efficiency, a skill highly valued at Berkshire Hathaway.

- Strong Financial Acumen: His ability to manage and analyze financial data is evident in his success leading Berkshire Hathaway Energy. This expertise is vital for making sound investment decisions.

His Role at Berkshire Hathaway Energy

Abel's extensive tenure as CEO of Berkshire Hathaway Energy (BHE) is a cornerstone of his qualifications for the top job. His leadership has transformed BHE into a highly successful and diversified energy company.

- Significant Revenue Growth: Under Abel's leadership, BHE has experienced substantial revenue growth, driven by strategic acquisitions, operational improvements, and expansion into new markets. These KPIs demonstrate his ability to achieve significant financial results.

- Successful Acquisitions & Divestments: He's overseen numerous strategic acquisitions and divestments, demonstrating a keen eye for identifying profitable opportunities and managing risk effectively. These actions have shaped BHE's portfolio and strengthened its position in the energy market.

- Focus on Renewable Energy: Abel has spearheaded BHE's investments in renewable energy sources, positioning the company for long-term sustainability and growth in line with global environmental trends. This demonstrates foresight and alignment with evolving market demands.

Demonstrated Leadership Qualities

Abel's leadership style is characterized by a combination of strategic vision, operational excellence, and a strong commitment to ethical conduct. These attributes are highly valued by Berkshire Hathaway and its investors.

- Strategic Decision Making: Examples of strategic decisions made by Abel at BHE include investments in renewable energy, expansion into new geographic markets, and technological upgrades that have driven efficiency and profitability.

- Team Building and Mentorship: While not always publicly visible, strong leadership includes effective team building. His success at BHE suggests a capacity to cultivate strong teams and mentor future leaders.

- Commitment to Corporate Social Responsibility: Abel's emphasis on sustainability and responsible environmental practices underscores his commitment to broader societal concerns, reflecting Berkshire Hathaway's values.

Abel's Investment Philosophy and Approach

Comparison with Warren Buffett's Style

While it's impossible to fully predict Abel's investment strategy, comparing it to Warren Buffett's reveals potential similarities and differences.

- Value Investing Principles: Abel likely shares Buffett's emphasis on value investing, identifying undervalued companies with strong fundamentals and long-term growth potential.

- Long-Term Horizon: Both leaders prioritize long-term value creation over short-term gains, a cornerstone of Berkshire Hathaway's investment approach.

- Potential Divergence: However, subtle differences might emerge. Abel may be more inclined to embrace technological advancements and emerging industries, potentially diversifying Berkshire Hathaway's investments beyond traditional sectors.

Focus on Long-Term Value Creation

Abel's commitment to long-term value creation is a critical aspect of his leadership philosophy and a key reason he’s seen as Buffett's successor.

- Operational Excellence: His focus on improving operational efficiency at BHE directly translates into long-term value creation. Streamlining processes and optimizing resource allocation generates consistent returns.

- Sustainable Growth: Abel's promotion of renewable energy within BHE reflects a commitment to sustainable growth, ensuring the company's long-term viability and profitability.

- Ethical Investing: An unwavering commitment to ethical investing ensures that profitability is aligned with social responsibility, further promoting long-term value creation.

The Future of Berkshire Hathaway under Greg Abel

Potential Changes and Innovations

Abel's leadership could usher in a new era for Berkshire Hathaway, characterized by several potential changes and innovations.

- Technological Investments: Expect increased investments in technology and tech-related businesses, reflecting global market trends and opportunities.

- Strategic Acquisitions: Abel's experience with acquisitions at BHE suggests a continued focus on strategic acquisitions to expand Berkshire Hathaway's portfolio.

- Increased Diversification: While maintaining core principles, he might pursue diversification beyond traditional sectors, exploring growth opportunities in areas like renewable energy and technology.

Maintaining Berkshire Hathaway's Legacy

Abel faces the challenge of maintaining Berkshire Hathaway's strong reputation and legacy while adapting to evolving market conditions.

- Culture of Ethical Investing: Preserving the company's culture of ethical investing, known for its long-term perspective and commitment to sound business practices, is paramount.

- Shareholder Value: A continued focus on delivering strong returns to shareholders will be crucial in maintaining the confidence of investors.

- Adaptability and Innovation: Abel's success will depend on his ability to adapt Berkshire Hathaway's strategies to the challenges and opportunities of a rapidly changing global economy.

Conclusion

Understanding Greg Abel is essential for anyone interested in the future of Berkshire Hathaway. His proven track record, leadership qualities, and strategic vision position him as a strong successor to Warren Buffett. While some changes are anticipated, his commitment to long-term value and ethical practices suggests a smooth transition and continued success for the company. Learn more about Greg Abel and his potential impact on one of the world's most significant investment firms by exploring further resources and staying updated on Berkshire Hathaway's announcements. Stay informed about the future of Berkshire Hathaway by researching Greg Abel and his upcoming initiatives.

Featured Posts

-

Celtics Vs Knicks Game 1 Playoff Predictions And Betting Analysis

May 06, 2025

Celtics Vs Knicks Game 1 Playoff Predictions And Betting Analysis

May 06, 2025 -

Anchor Brewing Company 127 Years Of Brewing History Concludes

May 06, 2025

Anchor Brewing Company 127 Years Of Brewing History Concludes

May 06, 2025 -

Open Ai 2024 Streamlined Voice Assistant Creation For Developers

May 06, 2025

Open Ai 2024 Streamlined Voice Assistant Creation For Developers

May 06, 2025 -

A 3 7 Billion Acquisition Gold Fields Expands With Gold Road Purchase

May 06, 2025

A 3 7 Billion Acquisition Gold Fields Expands With Gold Road Purchase

May 06, 2025 -

The Impact Of Us Tariffs On Sheins London Stock Market Listing

May 06, 2025

The Impact Of Us Tariffs On Sheins London Stock Market Listing

May 06, 2025

Latest Posts

-

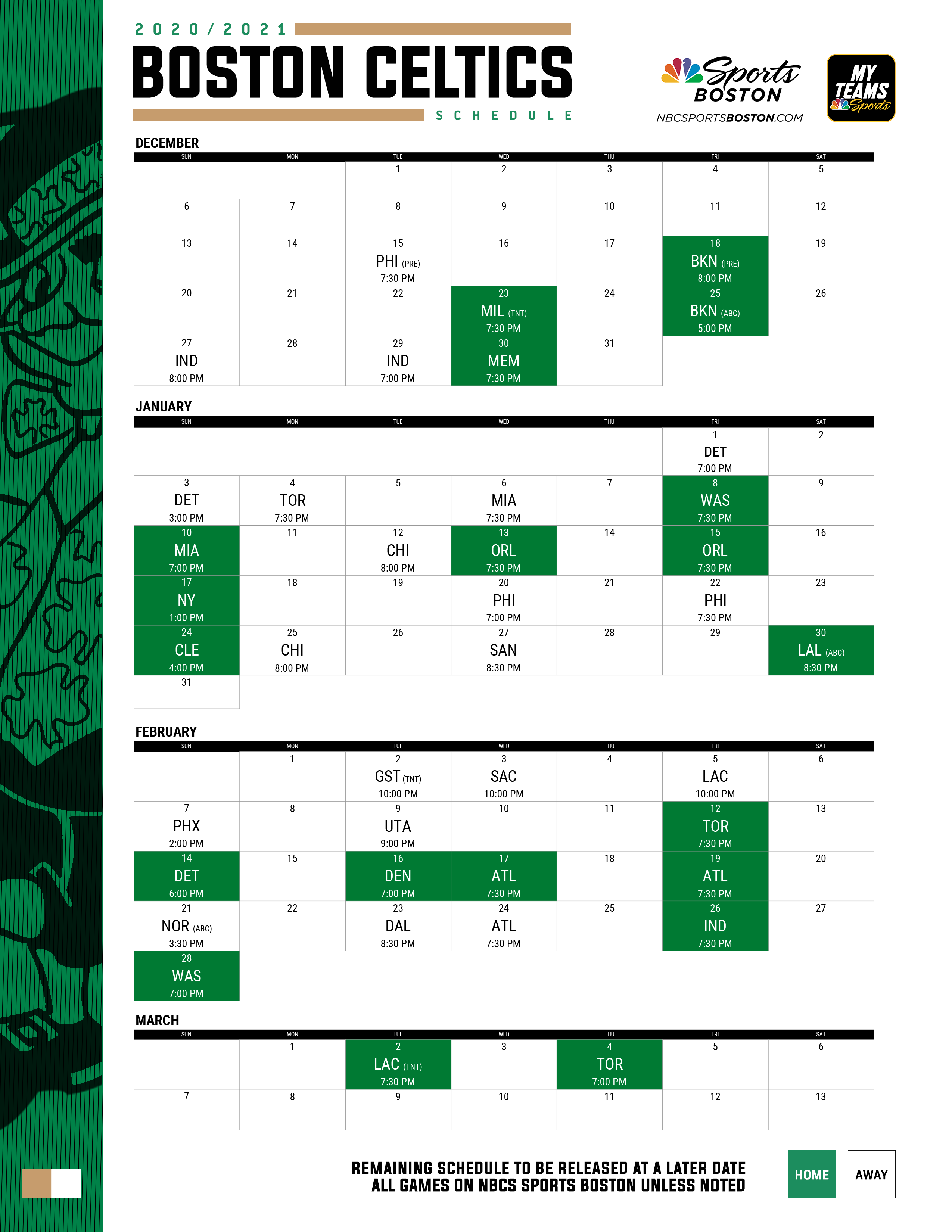

2024 Celtics Playoff Schedule Complete Game Times Vs Orlando Magic

May 06, 2025

2024 Celtics Playoff Schedule Complete Game Times Vs Orlando Magic

May 06, 2025 -

February 10th Celtics Heat Game Tip Off Time Broadcast Details And Live Streams

May 06, 2025

February 10th Celtics Heat Game Tip Off Time Broadcast Details And Live Streams

May 06, 2025 -

Celtics Vs Magic Playoff Schedule Full Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Dates And Times

May 06, 2025 -

Nba Playoffs Game 1 Knicks Vs Celtics Predictions And Best Bets

May 06, 2025

Nba Playoffs Game 1 Knicks Vs Celtics Predictions And Best Bets

May 06, 2025 -

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025