A$3.7 Billion Acquisition: Gold Fields Expands With Gold Road Purchase

Table of Contents

Deal Details and Financial Implications

Gold Fields agreed to acquire all outstanding shares of Gold Road Resources for a total consideration of A$3.7 billion. The payment structure involved a combination of cash and shares, offering a significant premium to Gold Road shareholders. This premium reflected the strategic value Gold Road's assets brought to Gold Fields. The acquisition will undoubtedly impact Gold Fields' financial profile. While increasing its debt levels, it also significantly boosts Gold Fields' earnings per share (EPS) and overall market capitalization in the long term, solidifying its position as a major player in the global gold mining industry. Leading financial advisory firms were instrumental in structuring and facilitating this complex transaction.

- Acquisition Price: A$3.7 billion

- Payment Structure: A mix of cash and shares (specific breakdown to be added once publicly available)

- Premium to Gold Road Shareholders: (Specific percentage to be added once publicly available)

- Financial Implications for Gold Fields: Increased debt, projected EPS growth, enhanced market capitalization.

- Financial Advisors: (Names of financial advisors involved to be added once publicly available) Keywords: Acquisition price, merger cost, financial implications, Gold Road shareholders, debt financing, earnings per share, market capitalization.

Strategic Rationale Behind the Acquisition

Gold Fields' acquisition of Gold Road Resources is driven by a clear strategic vision. This merger allows Gold Fields to:

- Access High-Quality Gold Assets: Gold Road possesses significant high-grade gold deposits in Australia, adding substantial reserves to Gold Fields' existing portfolio.

- Expand into New Geographical Regions: The acquisition strengthens Gold Fields' presence in the prolific Australian gold mining region, geographically diversifying its operations.

- Realize Synergies: Combining operations should lead to significant synergies, including operational efficiencies and cost reductions. This includes potential benefits from shared infrastructure and expertise.

- Strengthen Gold Production and Reserves: The combined entity will boast a significantly larger gold production capacity and reserves, enhancing Gold Fields' long-term growth prospects.

Keywords: Strategic acquisition, synergy, resource expansion, geographic diversification, gold production, gold reserves, operational efficiency.

Impact on Gold Road Resources and its Operations

The acquisition marks a new chapter for Gold Road Resources. While integration will undoubtedly lead to changes, Gold Fields has committed to a smooth transition for Gold Road's employees. The future projects under development by Gold Road are expected to continue, leveraging Gold Fields' expertise and resources. The integration process itself presents challenges, including aligning operational strategies and integrating different corporate cultures. A clear communication strategy from Gold Fields will be essential to manage expectations and ensure a successful merger.

- Employee Impact: Gold Fields has indicated a commitment to retaining Gold Road's skilled workforce.

- Operational Changes: Gradual integration of operations, streamlining processes for efficiency.

- Future Projects: Existing projects are expected to continue and benefit from Gold Fields' resources.

- Management Transition: (Details to be added once publicly available) Keywords: Integration process, operational changes, employee impact, future projects, management transition.

Market Reaction and Industry Analysis

The announcement of the Gold Fields acquisition was met with a generally positive market reaction. Gold Fields’ stock price experienced (positive/negative – to be added based on actual market data) movement, reflecting investor sentiment. Analysts have largely viewed the acquisition favorably, citing its strategic merit and potential for long-term value creation. The deal also has implications for the broader gold mining industry, potentially triggering increased merger and acquisition activity and heightened competition for high-quality gold assets. Competitors may respond by seeking similar acquisitions or focusing on organic growth strategies. The ongoing volatility of the gold price will further influence the success of this acquisition.

- Market Reaction: (Detailed analysis of stock price movements and market commentary)

- Analyst Commentary: (Summary of expert opinions on the deal)

- Industry Implications: Increased M&A activity, competition for assets, potential impact on gold prices.

- Competitor Analysis: (Analysis of potential competitor responses) Keywords: Market reaction, stock price, analyst commentary, industry implications, competitor analysis, gold price.

Conclusion: The A$3.7 Billion Gold Fields Acquisition: A New Chapter in Australian Gold Mining

The A$3.7 billion acquisition of Gold Road Resources by Gold Fields represents a significant strategic move, boosting Gold Fields' gold reserves, production capacity, and geographic diversification. The financial implications are substantial, with potential for increased earnings and market capitalization despite increased debt. The integration process will require careful management, but the long-term prospects for the combined entity appear promising. This merger is a pivotal moment for the Australian gold mining sector, signaling further consolidation and potentially influencing global gold market dynamics.

Call to action: Stay informed about the integration process and future developments in the Gold Fields and Gold Road Resources acquisition. Follow us for further updates on this significant gold mining merger and other important developments in the Australian gold market. Learn more about the impact of this A$3.7 billion acquisition on the gold industry.

Featured Posts

-

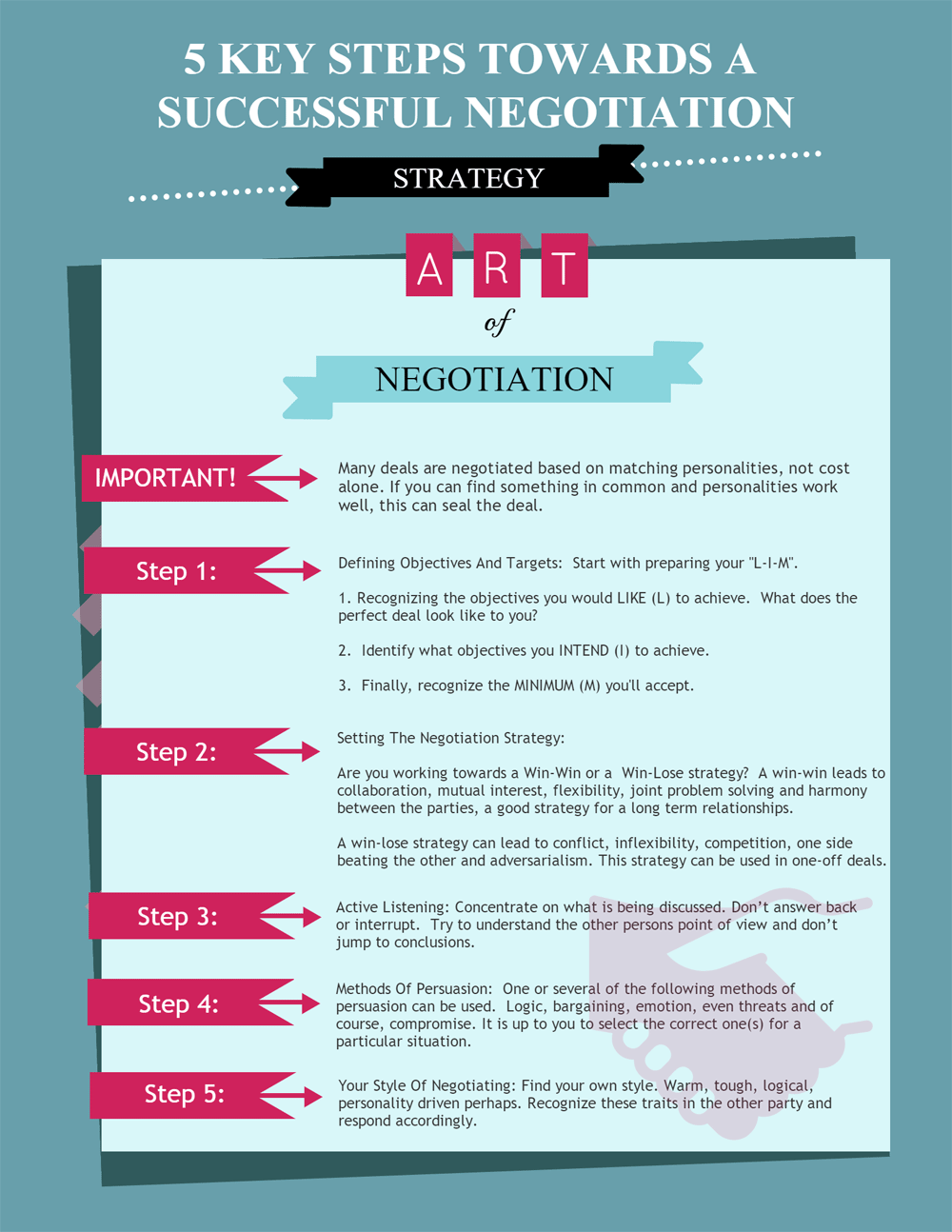

Trumps Negotiation Style Winning Strategies And Pitfalls To Avoid

May 06, 2025

Trumps Negotiation Style Winning Strategies And Pitfalls To Avoid

May 06, 2025 -

Kontrakt Nitro Chem Polscha Otrimaye 310 Mln Vid S Sh A

May 06, 2025

Kontrakt Nitro Chem Polscha Otrimaye 310 Mln Vid S Sh A

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers Full Frontal Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers Full Frontal Scene

May 06, 2025 -

Ai Powered Digest Turning Repetitive Scatological Documents Into Engaging Poop Podcasts

May 06, 2025

Ai Powered Digest Turning Repetitive Scatological Documents Into Engaging Poop Podcasts

May 06, 2025 -

Celtics Vs 76ers Prediction Expert Picks Odds And Best Bets Feb 20 2025

May 06, 2025

Celtics Vs 76ers Prediction Expert Picks Odds And Best Bets Feb 20 2025

May 06, 2025

Latest Posts

-

Halle Bailey The Target Of Ddgs Dont Take My Son

May 06, 2025

Halle Bailey The Target Of Ddgs Dont Take My Son

May 06, 2025 -

Ddg Fires Shots At Halle Bailey In Dont Take My Son Diss Track

May 06, 2025

Ddg Fires Shots At Halle Bailey In Dont Take My Son Diss Track

May 06, 2025 -

Ddgs Dont Take My Son A Deeper Look At The Halle Bailey Diss Track

May 06, 2025

Ddgs Dont Take My Son A Deeper Look At The Halle Bailey Diss Track

May 06, 2025 -

The Dont Take My Son Diss Track Ddg Vs Halle Bailey

May 06, 2025

The Dont Take My Son Diss Track Ddg Vs Halle Bailey

May 06, 2025 -

Ddgs Dont Take My Son Diss Track Sparks Controversy Aimed At Halle Bailey

May 06, 2025

Ddgs Dont Take My Son Diss Track Sparks Controversy Aimed At Halle Bailey

May 06, 2025