The Impact Of US Tariffs On Shein's London Stock Market Listing

Table of Contents

Shein's Reliance on US Markets

Shein's substantial presence in the US market makes it acutely vulnerable to tariff increases. The company's considerable revenue stream from American consumers represents a significant portion of its overall financial performance, making it highly susceptible to shifts in US trade policy.

Market Share and Revenue Dependence

Precise figures regarding Shein's US sales remain undisclosed, yet reports suggest a substantial market share, particularly among younger demographics. This dependence on the US market translates directly into a heightened sensitivity to tariff fluctuations. Even a modest increase in tariffs on imported garments can significantly erode profit margins, impacting the overall profitability showcased to potential investors.

- Quantifying the Impact: While exact figures are unavailable publicly, analysts estimate that a significant percentage (potentially exceeding X%) of Shein's revenue originates from the US market. This makes the US market crucial to Shein's financial health.

- Profit Margin Squeeze: Increased tariffs directly translate to higher production costs, inevitably squeezing profit margins. This reduced profitability is a major concern for potential investors assessing Shein's long-term viability.

- Consumer Behavior Shift: Higher prices due to tariffs may lead to a shift in consumer behavior. American consumers might opt for cheaper alternatives or reduce their overall spending on fast fashion, impacting Shein's sales volume.

The Impact of Increased Tariffs on Production Costs

Shein's ultra-fast fashion business model hinges on exceptionally low production costs. Primarily sourcing its garments from China, the company leverages economies of scale and efficient supply chains to offer consumers incredibly low prices. Increased US tariffs disrupt this delicate balance.

Sourcing and Manufacturing

The imposition of higher tariffs drastically inflates Shein's production costs, challenging its core competitive advantage. This forces the company to make critical decisions regarding its sourcing and manufacturing strategies.

- Sourcing Diversification: Shein might explore diversifying its sourcing locations, potentially shifting some production to countries with more favorable trade agreements with the US. This strategy, however, comes with its own set of logistical and operational challenges.

- Competitive Advantage Erosion: Increased costs directly erode Shein's competitive advantage, making it more difficult to maintain its price leadership in the fast-fashion market. Competitors with more diversified sourcing or established domestic production may gain a significant edge.

- Price Increases to Offset Costs: Shein might attempt to pass on some of the increased costs to consumers through price increases. However, this strategy risks alienating its price-sensitive customer base and potentially losing market share.

Investor Sentiment and Valuation Concerns

The uncertainty surrounding US tariffs presents a significant risk factor that investors will carefully consider when evaluating Shein's IPO. This uncertainty can negatively influence investor sentiment and ultimately impact Shein's valuation.

Risk Assessment by Investors

Potential investors will meticulously assess the risks associated with Shein's heavy reliance on the US market and its exposure to tariff volatility. The impact on Shein’s valuation will be a key concern.

- Reduced Investor Interest: Uncertainty surrounding future tariffs may deter investors seeking stable, predictable returns. The perceived risk associated with Shein's business model could lead to lower demand for its shares during the IPO.

- Valuation Impact: The potential for reduced profitability due to tariffs will inevitably lead to a lower valuation during the IPO process. Investors will discount the company's future earnings to reflect the increased uncertainty.

- Mitigation Strategies: To address investor concerns, Shein may need to demonstrate a clear strategy for mitigating the impact of tariffs, potentially involving diversification of sourcing, negotiation with the US government, or other risk management strategies.

Alternative Strategies and Mitigation Tactics

Shein is not without options. The company can explore various strategic maneuvers to lessen the blow of US tariffs and bolster its IPO prospects.

Navigating the Tariff Landscape

Shein must actively explore strategies to mitigate the impact of tariffs and protect its profitability. This requires careful consideration and proactive planning.

- Manufacturing Relocation: Relocating some or all of its manufacturing operations outside of China, perhaps to countries with preferential trade agreements with the US, could significantly reduce tariff burdens. However, this involves substantial costs and logistical challenges.

- Negotiation with US Government: Shein could attempt to negotiate with the US government to secure more favorable trade terms or exemptions from certain tariffs. This requires significant political and diplomatic expertise.

- Alternative Pricing Strategies: Shein could employ dynamic pricing strategies, adjusting prices based on demand and tariff fluctuations, to maintain profitability without alienating its customers. This requires sophisticated market analysis and forecasting.

Conclusion

The impact of US tariffs on Shein's London Stock Market listing is a multifaceted issue with potentially significant consequences. The combination of increased production costs, reduced profitability, and the potential for negative investor sentiment presents considerable challenges. Shein's ability to effectively navigate this complex landscape will significantly influence its success in achieving a favorable valuation and securing a successful IPO. Understanding the intricacies of this interplay is crucial for both investors and industry observers alike.

Call to Action: Stay informed about the ongoing developments in international trade policy and their effects on global fashion brands. Further research into the interplay between US tariffs and Shein's business model is essential for making informed decisions regarding investment and the future of fast fashion. Continue to monitor the impact of US tariffs on Shein's London Stock Market listing to understand its full effect on the company's future.

Featured Posts

-

Coppers Price Increase A Result Of Chinas Trade Policy

May 06, 2025

Coppers Price Increase A Result Of Chinas Trade Policy

May 06, 2025 -

Razdelis Li Patrik Shvartsenegger I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Razdelis Li Patrik Shvartsenegger I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

Analyzing Westpacs Wbc Reduced Profits A Look At Market Pressures

May 06, 2025

Analyzing Westpacs Wbc Reduced Profits A Look At Market Pressures

May 06, 2025 -

Private Credit Jobs 5 Dos And Don Ts To Secure Your Next Role

May 06, 2025

Private Credit Jobs 5 Dos And Don Ts To Secure Your Next Role

May 06, 2025 -

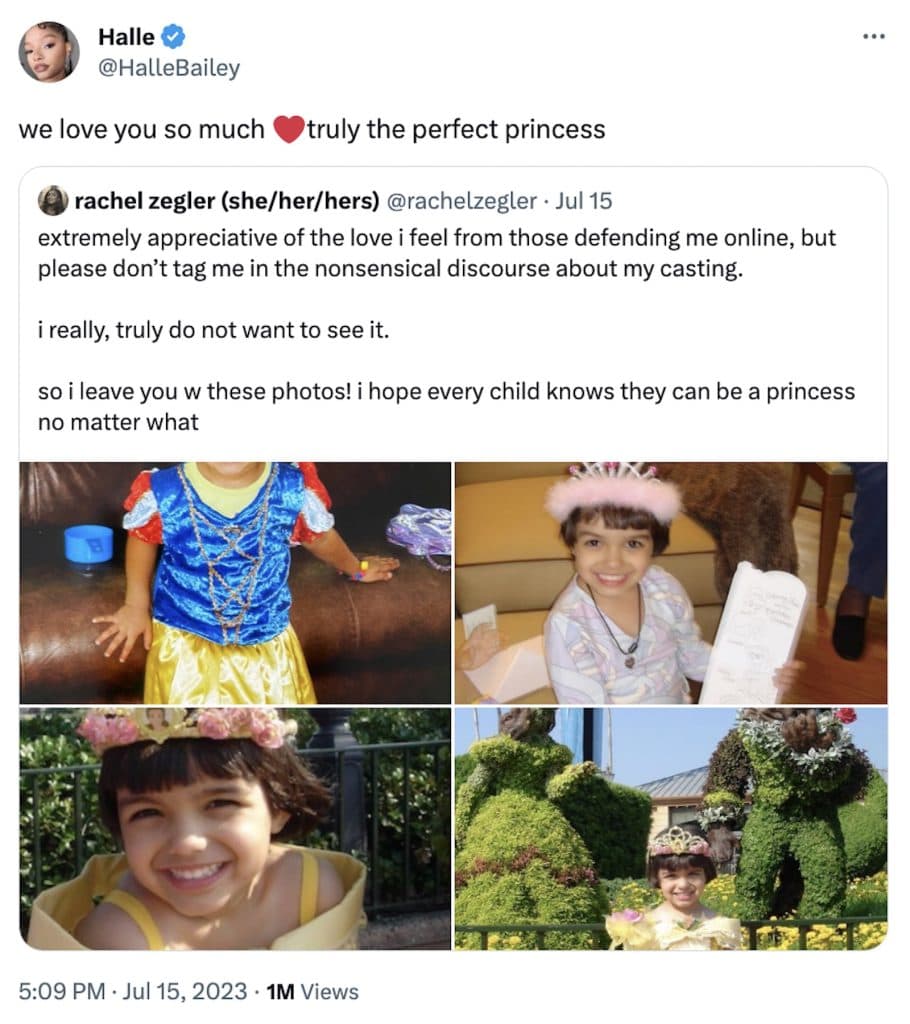

Rather Be Alone Exploring The Success Of Leon Thomas And Halle Baileys Collaboration

May 06, 2025

Rather Be Alone Exploring The Success Of Leon Thomas And Halle Baileys Collaboration

May 06, 2025

Latest Posts

-

Ddg Unleashes Dont Take My Son Diss Track Full Lyrics And Analysis

May 06, 2025

Ddg Unleashes Dont Take My Son Diss Track Full Lyrics And Analysis

May 06, 2025 -

Ddgs Dont Take My Son A Diss Track Aimed At Halle Bailey

May 06, 2025

Ddgs Dont Take My Son A Diss Track Aimed At Halle Bailey

May 06, 2025 -

New Ddg Song Dont Take My Son Ignites Controversy Is Halle Bailey The Target

May 06, 2025

New Ddg Song Dont Take My Son Ignites Controversy Is Halle Bailey The Target

May 06, 2025 -

Ddgs Dont Take My Son A Fiery Diss Track Aimed At Halle Bailey

May 06, 2025

Ddgs Dont Take My Son A Fiery Diss Track Aimed At Halle Bailey

May 06, 2025 -

Ddg Releases Fiery Diss Track Targeting Halle Bailey The Lyrics Explained

May 06, 2025

Ddg Releases Fiery Diss Track Targeting Halle Bailey The Lyrics Explained

May 06, 2025