UK Taxpayers Over £23,000: Understanding Your HMRC Letter

Table of Contents

Many UK taxpayers earning over £23,000 receive correspondence from HMRC throughout the year. Understanding these letters is crucial to ensure accurate tax payments and avoid penalties. This comprehensive guide breaks down common HMRC communications for those earning above this threshold, helping you navigate the process with confidence. We'll cover everything from tax return reminders and tax code changes to understanding National Insurance contributions and responding to HMRC correspondence effectively.

Common Reasons for HMRC Letters (Over £23,000 Earners):

Tax Return Reminders & Deadlines:

The self-assessment tax return process applies to many individuals earning over the £23,000 threshold, particularly the self-employed, contractors, and those with additional income sources beyond PAYE employment. The deadline for submitting your self-assessment tax return is typically 31 January following the tax year (6 April to 5 April).

- Penalties for Late Submission: Late submission can result in significant penalties. These penalties can increase the longer the return is overdue.

- Online Submission: HMRC strongly encourages online submission through their website. This is the quickest and most efficient method.

- HMRC Support: HMRC provides various support resources, including online guides, helplines, and online chat to assist with completing and submitting your tax return. Don't hesitate to utilize these resources if you need help.

Changes to Tax Code:

Your tax code dictates how much Income Tax is deducted from your salary via PAYE (Pay As You Earn). Changes to your tax code can occur due to various reasons, such as:

- Changes in your income (e.g., promotion, new job, or reduced earnings).

- Tax relief claims (e.g., marriage allowance, pension contributions).

- Adjustments made by HMRC based on previous tax returns or other information they hold.

Examples of Tax Code Changes:

- A higher tax code means more tax will be deducted from your salary.

- A lower tax code means less tax will be deducted.

- An incorrect tax code may lead to overpayment or underpayment of tax.

Tax Adjustments and Underpayments:

HMRC might contact you if they identify an underpayment of tax. This could be due to errors in your tax return, changes in your circumstances, or discrepancies in the information they hold.

- Resolving Underpayments: You'll need to pay the outstanding tax as soon as possible to avoid further penalties.

- Penalties for Underpayment: Ignoring an underpayment notice can result in significant penalties and potential further HMRC investigation. Addressing the issue promptly is crucial.

National Insurance Contributions:

National Insurance Contributions (NICs) fund state benefits such as the NHS and the state pension. Earnings above £23,000 typically fall under Class 1 and possibly Class 4 NICs (if self-employed).

- Class 1 NICs: Deducted from employment earnings.

- Class 4 NICs: Paid by self-employed individuals on their profits.

- Income Changes: Changes to your income directly impact the amount of National Insurance you contribute.

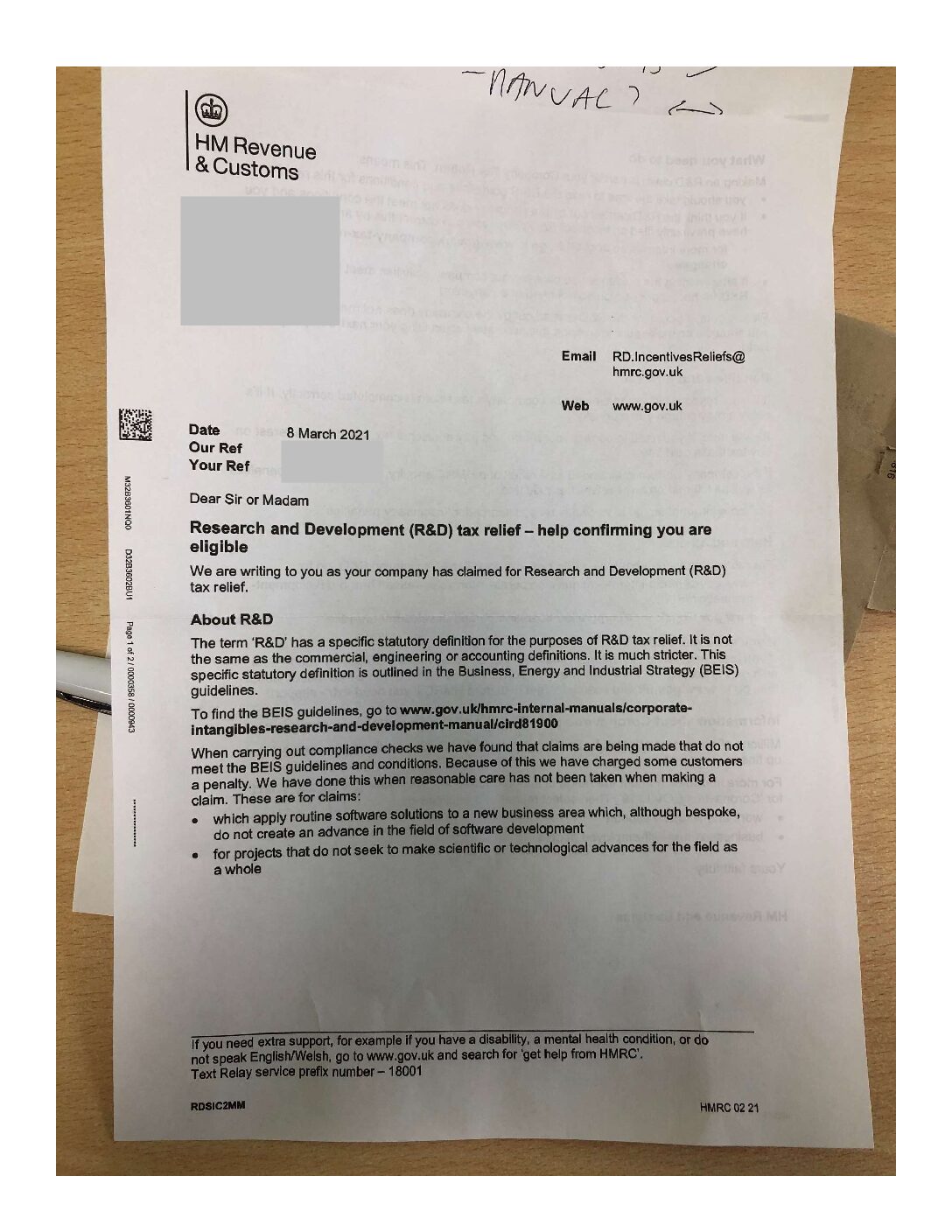

Understanding Your HMRC Letter:

Deciphering the Language:

HMRC letters often use specific terminology. Understanding this jargon is essential to interpreting the information correctly.

- Common Abbreviations: Familiarize yourself with common abbreviations such as PAYE, NICs, SA (Self-Assessment), and others.

- Key Phrases: Pay close attention to phrases like "tax liability," "outstanding payment," "adjustment," and "penalty."

Identifying the Next Steps:

Each HMRC letter will outline the required actions and deadlines. Carefully review:

- Key Instructions: Look for clear instructions on what you need to do.

- Deadlines: Pay close attention to any deadlines for responding or making payments.

- Reference Numbers: Note any reference numbers for future correspondence.

Seeking Help and Further Information:

If you're struggling to understand your HMRC letter or need further assistance, several options are available:

- HMRC Helpline: Contact the HMRC helpline for telephone assistance.

- Online Chat: Use the HMRC online chat function for quick queries.

- Tax Advisor: Consider seeking professional tax advice from a qualified accountant or tax advisor.

Conclusion:

Understanding your HMRC correspondence is vital, especially for UK taxpayers earning over £23,000. Promptly addressing tax return reminders, tax code changes, and potential underpayments prevents penalties and ensures compliance. If you have received an HMRC letter, take the necessary steps outlined above. Understanding your HMRC letters and acting promptly can save you significant time, money, and stress. Learn more about managing your UK tax efficiently and understanding your HMRC letters.

Featured Posts

-

Second Typhon Battery Us Army Expands Pacific Presence

May 20, 2025

Second Typhon Battery Us Army Expands Pacific Presence

May 20, 2025 -

Unclaimed Hmrc Refunds Millions May Be Eligible

May 20, 2025

Unclaimed Hmrc Refunds Millions May Be Eligible

May 20, 2025 -

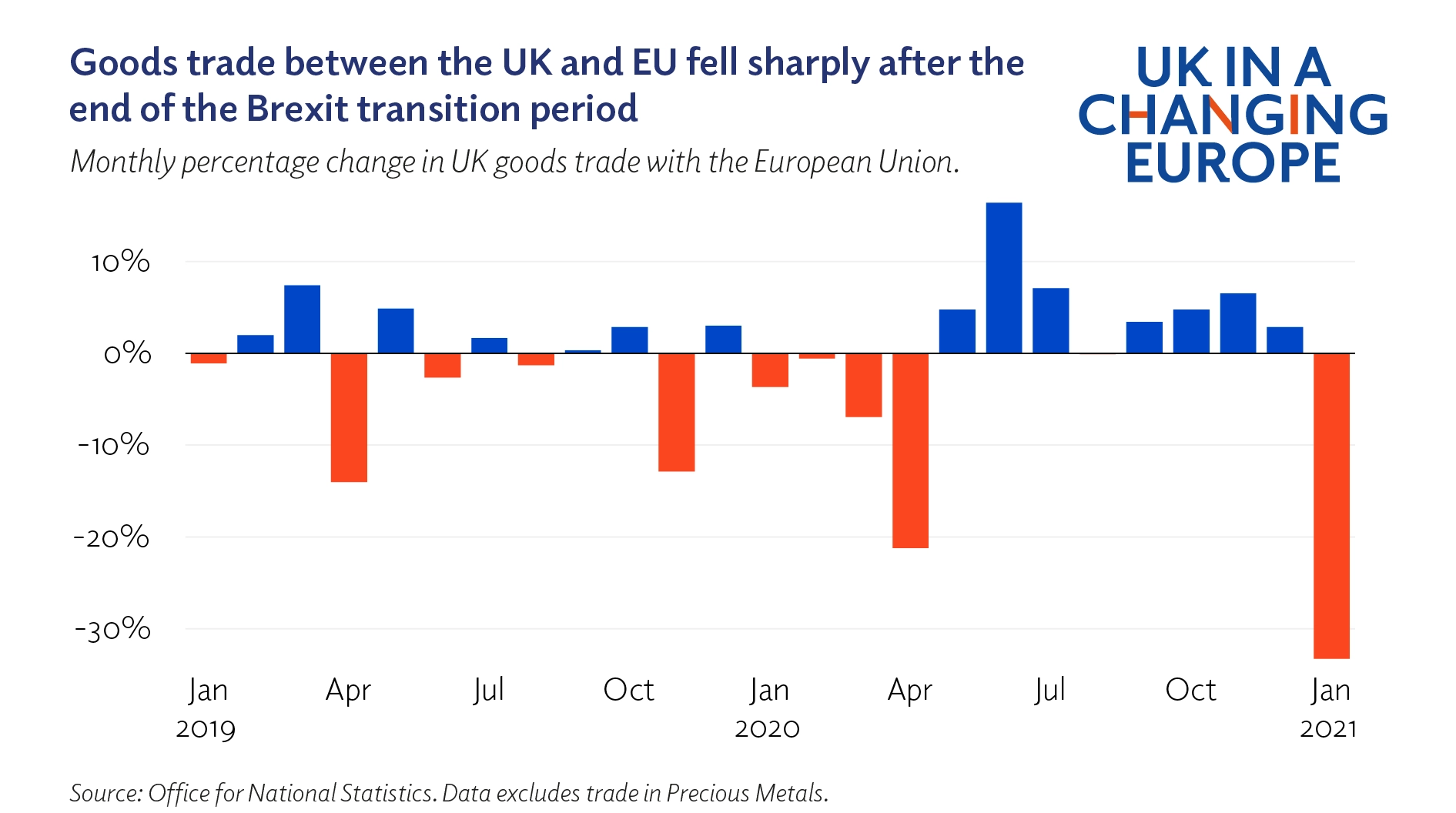

Uk Luxury Industry Brexits Negative Effect On Eu Trade

May 20, 2025

Uk Luxury Industry Brexits Negative Effect On Eu Trade

May 20, 2025 -

K Sepernontas Ta Tampoy Mia Meleti Peri Erota Fygis Kai Syllipsis

May 20, 2025

K Sepernontas Ta Tampoy Mia Meleti Peri Erota Fygis Kai Syllipsis

May 20, 2025 -

L Ia Au Service De L Ecriture Cours Inspires Par Agatha Christie

May 20, 2025

L Ia Au Service De L Ecriture Cours Inspires Par Agatha Christie

May 20, 2025

Latest Posts

-

Uk Luxury Industry Brexits Negative Effect On Eu Trade

May 20, 2025

Uk Luxury Industry Brexits Negative Effect On Eu Trade

May 20, 2025 -

The Impact Of Brexit On Uk Luxury Exports To The European Union

May 20, 2025

The Impact Of Brexit On Uk Luxury Exports To The European Union

May 20, 2025 -

Brexit And The Uk Luxury Goods Sector An Export Analysis

May 20, 2025

Brexit And The Uk Luxury Goods Sector An Export Analysis

May 20, 2025 -

Bof As Analysis Why Current Stock Market Valuations Shouldnt Deter Investors

May 20, 2025

Bof As Analysis Why Current Stock Market Valuations Shouldnt Deter Investors

May 20, 2025 -

Stock Market Valuation Concerns Bof As Analysis And Investor Guidance

May 20, 2025

Stock Market Valuation Concerns Bof As Analysis And Investor Guidance

May 20, 2025