Unclaimed HMRC Refunds: Millions May Be Eligible

Table of Contents

Common Reasons for Unclaimed HMRC Refunds

Several factors can lead to unclaimed HMRC refunds. Understanding these common reasons is the first step in determining if you're eligible.

Overpaid Income Tax

Overpaying income tax is surprisingly common. This often happens due to changes in circumstances that haven't been correctly reported to HMRC, resulting in an incorrect tax code.

- Incorrect tax code: Your tax code determines how much income tax is deducted from your salary. An incorrect code can lead to either overpayment or underpayment.

- Changes in circumstances not reported: Significant life changes like marriage, divorce, starting a new job, or becoming self-employed can impact your tax code. Failing to notify HMRC of these changes can result in overpayment.

- Multiple employers: If you've worked for multiple employers in a tax year, there's a greater chance of errors in tax code allocation leading to overpayment. Ensure all employers are correctly reporting your earnings.

Self-Assessment Tax Returns

Completing your self-assessment tax return accurately is crucial. Even minor mistakes can lead to overpayment or, conversely, underpayment and potential future refunds.

- Incorrect expenses claimed: Claiming ineligible expenses or overstating allowable expenses is a common mistake.

- Errors in income declaration: Inaccurately reporting your income, whether deliberately or unintentionally, can result in an incorrect tax calculation.

- Missed deadlines: Missing the self-assessment deadline can lead to penalties, but it doesn't necessarily preclude you from claiming a refund if you've overpaid.

PAYE Errors

The PAYE (Pay As You Earn) system, while generally efficient, is not immune to errors. These errors can sometimes result in significant overpayments.

- Incorrect tax code applied: As mentioned above, an incorrect tax code is a leading cause of overpayment, regardless of employment status.

- Changes in employment status not updated: Changes in employment status, such as moving from employed to self-employed, need to be reported promptly to avoid overpayment.

- Processing errors by employer: While rare, errors can occur on the employer's side during the payroll process, leading to incorrect tax deductions.

How to Check if You Have an Unclaimed HMRC Refund

There are several ways to check if you have an unclaimed HMRC refund.

Accessing Your HMRC Online Account

The easiest and quickest way to check is through your HMRC online account.

- Registering for online access: If you don't already have an online account, you'll need to register. This involves verifying your identity using government-approved methods.

- Verifying identity: HMRC uses robust security measures to protect your information. You will likely need your National Insurance number and other personal details.

- Checking tax history: Once logged in, navigate to your tax history. You should find details of your tax returns and payments for previous years.

- Understanding statements: Review your tax statements carefully. Look for any discrepancies or indications of potential overpayments.

Contacting HMRC Directly

If you are unable to access your online account or need clarification on your tax statements, contact HMRC directly.

- Finding the correct contact number: The HMRC website provides various contact numbers depending on your specific enquiry.

- Preparing necessary information: Have your National Insurance number, tax year details, and any relevant documentation ready before calling.

- Understanding expected response times: Be aware that HMRC call waiting times can vary depending on demand.

Using a Tax Refund Service (Optional)

Consider using a tax refund service, but only after thorough research.

- Fees: These services typically charge a fee based on the refund amount or a fixed fee.

- Expertise: They often have expertise in navigating complex tax regulations.

- Potential time savings: They may streamline the process and save you time.

- Reputation checks: Always check reviews and ensure the service is reputable before using it.

Claiming Your Unclaimed HMRC Refund

Once you've identified a potential overpayment, you can begin the claim process.

The Claim Process

Submitting a claim is relatively straightforward, but accuracy is essential.

- Gathering evidence: Collect any relevant documentation, such as payslips, P60s, and self-assessment records.

- Completing forms accurately: Ensure all information on the claim form is correct and complete. Double-check everything before submitting.

- Submitting online or by post: HMRC provides online and postal claim options. Choose the method most convenient for you.

- Tracking your claim: Once submitted, you can usually track the progress of your claim online.

Timelines and Expected Processing Times

HMRC aims to process refund claims efficiently, but processing times can vary.

- Average processing times: While HMRC aims for quick processing, allow several weeks for your claim to be processed.

- Factors influencing processing speed: Complexity of the claim and the volume of applications can affect processing times.

- What to do if the process is delayed: If your claim is significantly delayed, contact HMRC to enquire about its status.

Conclusion: Don't Miss Out on Your Unclaimed HMRC Refund

Many people are unaware of the possibility of unclaimed HMRC refunds. We've explored common reasons for overpayment, how to check your eligibility, and how to successfully claim your money back. Don't let your hard-earned money go unclaimed. Check your eligibility for unclaimed HMRC refunds today! Don't let your money go unclaimed. Visit the HMRC website or contact them directly to start your claim.

Featured Posts

-

Chinas Response To Us Australia Missile Launcher Deployment

May 20, 2025

Chinas Response To Us Australia Missile Launcher Deployment

May 20, 2025 -

Balikatan 2024 Philippines And Us Plan Large Scale Military Drills

May 20, 2025

Balikatan 2024 Philippines And Us Plan Large Scale Military Drills

May 20, 2025 -

Miksi Lewis Hamilton Ei Aja Ferrarilla Syvaellinen Analyysi

May 20, 2025

Miksi Lewis Hamilton Ei Aja Ferrarilla Syvaellinen Analyysi

May 20, 2025 -

Eurovision 2025 Meet The Top 5 Favorite Acts

May 20, 2025

Eurovision 2025 Meet The Top 5 Favorite Acts

May 20, 2025 -

April 13 Nyt Mini Crossword Solutions

May 20, 2025

April 13 Nyt Mini Crossword Solutions

May 20, 2025

Latest Posts

-

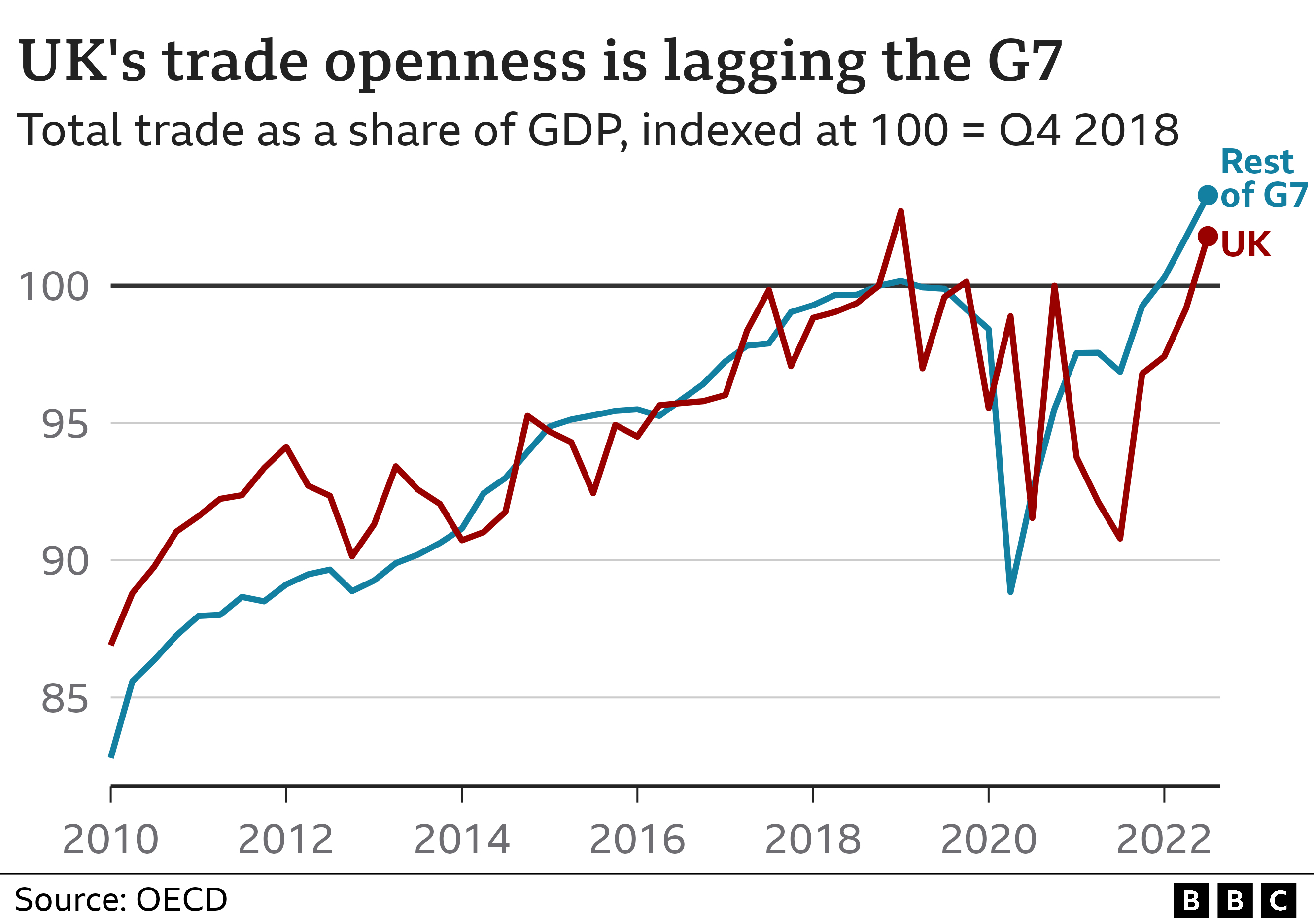

Uk Luxury Lobby Links Brexit To Export Slowdown In The Eu

May 20, 2025

Uk Luxury Lobby Links Brexit To Export Slowdown In The Eu

May 20, 2025 -

Examining The Potential For A Resurgence Of American Factory Jobs

May 20, 2025

Examining The Potential For A Resurgence Of American Factory Jobs

May 20, 2025 -

Analyzing Emerging Business Hubs A Nationwide Perspective

May 20, 2025

Analyzing Emerging Business Hubs A Nationwide Perspective

May 20, 2025 -

The Economic Impact Of Bringing Factory Jobs Back To The Us

May 20, 2025

The Economic Impact Of Bringing Factory Jobs Back To The Us

May 20, 2025 -

The Countrys Top Business Hot Spots Growth Trends And Opportunities

May 20, 2025

The Countrys Top Business Hot Spots Growth Trends And Opportunities

May 20, 2025