BofA's Analysis: Why Current Stock Market Valuations Shouldn't Deter Investors

Table of Contents

BofA's Positive Outlook Despite High Valuations

Despite acknowledging relatively high Price-to-Earnings (P/E) ratios and other valuation metrics, BofA maintains a positive market outlook. Their analysis suggests that the current valuations are not as alarming as they might initially appear.

- Valuation Metrics: BofA's analysis considered several key metrics, including the forward Price-to-Earnings ratio (forward P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other industry-standard valuation measures. While these metrics currently indicate higher-than-average valuations, BofA's analysis contextualizes these numbers.

- Reasons for Optimism: BofA's optimism stems from several factors: robust corporate earnings growth, positive economic growth projections, and the continued impact of low interest rates (although this is subject to change based on future Federal Reserve policy). The firm points to strong balance sheets of many companies and continued consumer spending as key supportive factors. Specific data points from BofA's report – which should be consulted for complete details – are crucial to fully understanding their reasoning. For example, they might highlight projected EPS growth exceeding the current valuation increases.

- Data Points (Illustrative): (Note: Replace these with actual data points from BofA's report if available. This is for illustrative purposes only.) For example, BofA might report that while the S&P 500 P/E ratio is currently at X, projected earnings growth over the next Y years is expected to be Z%, mitigating the apparent overvaluation.

Understanding the Context of High Valuations

Several factors contribute to the seemingly high valuations, creating a context often missed by those solely focusing on the numbers. Let's dispel some misconceptions.

- Low Interest Rates: Low interest rates, a prevailing condition in recent years, have historically driven up stock valuations as investors seek higher returns in the equity market compared to fixed-income investments.

- Technological Innovation: The rapid growth and innovation in technology sectors, particularly in areas like artificial intelligence and cloud computing, justify higher valuations for certain companies due to their disruptive potential and future earnings prospects.

- Inflation's Influence: While inflation can impact valuations, its effect is complex. Moderate inflation, if managed effectively, can actually support earnings growth, potentially offsetting concerns about high P/E ratios.

- Addressing Market Bubble Concerns: BofA's analysis likely addresses concerns about market bubbles by highlighting fundamental factors supporting valuations, as opposed to speculative frenzies. They might point to strong underlying economic conditions and robust company performance.

BofA's Recommended Investment Strategies

Based on their valuation assessment and market outlook, BofA likely suggests specific investment strategies.

- Sector Recommendations: BofA's recommendations may include overweighting certain sectors like technology, healthcare, or consumer staples, considered relatively resilient even in times of economic uncertainty. They might also suggest exposure to emerging markets which might present higher growth opportunities, but also come with higher risk.

- Rationale: The rationale behind these sector recommendations would link to BofA's analysis of growth prospects, valuation levels within those sectors, and their assessment of prevailing risks.

- Diversification and Risk Management: Given the current market environment, BofA's strategy will emphasize the critical importance of diversification across asset classes and geographies to mitigate risks and optimize portfolio performance.

- Specific Investments (Disclaimer): Any specific stocks or investment vehicles mentioned in BofA's report should be treated as suggestions for further research and not as direct investment recommendations. Always conduct your own due diligence and consider consulting a financial advisor.

Addressing Investor Concerns and Misconceptions

Many investors harbor misconceptions about high valuations. Addressing these head-on is crucial.

- High Valuations ≠ Impending Crash: High valuations alone don't automatically predict a market crash. BofA’s analysis likely focuses on long-term growth potential and the sustainability of current earnings.

- Short-Term vs. Long-Term: It's vital to distinguish between short-term market fluctuations and long-term investment horizons. High valuations may correct in the short term, but long-term growth potential remains significant.

- Long-Term Perspective: A long-term perspective is critical. Market cycles are inevitable, and short-term volatility should not overshadow long-term investment goals.

- Due Diligence: Before acting on any investment decision, thorough due diligence on individual companies and market conditions is essential.

Conclusion: Why You Shouldn't Let BofA's Stock Market Valuation Analysis Deter You

BofA's analysis of stock market valuations suggests that while current valuations might seem high, several factors contextualize these figures. Their positive outlook stems from strong corporate earnings, positive economic projections, and other key indicators. High valuations, in and of themselves, don't guarantee an impending downturn. Understanding the context, incorporating a long-term investment strategy, and practicing thorough due diligence are crucial.

Don't let high valuations deter you; learn more from BofA's comprehensive analysis and consider adjusting your investment strategy based on their findings. Explore the opportunities highlighted by BofA's stock market valuation report today to make informed investment decisions.

Featured Posts

-

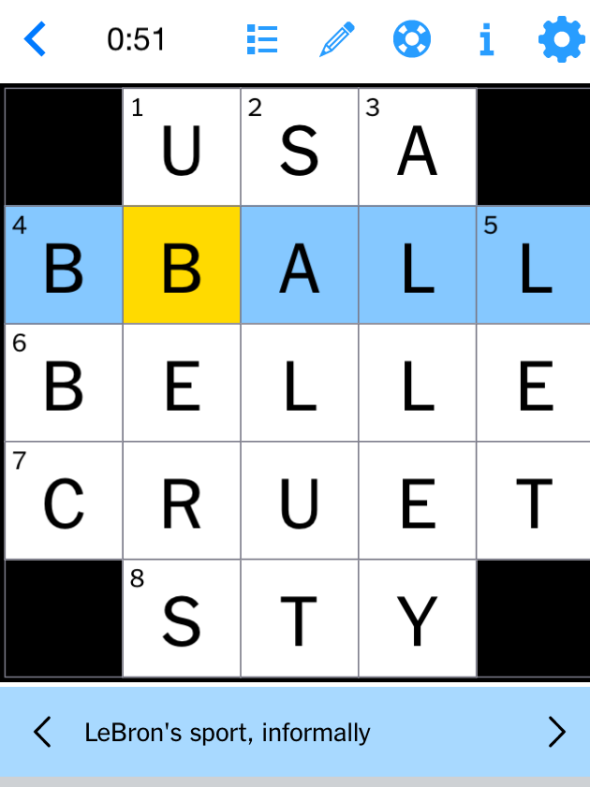

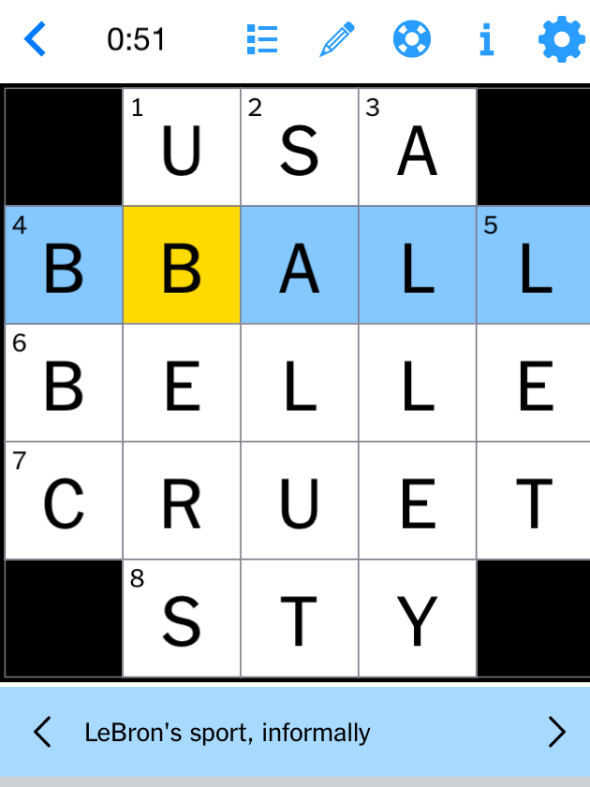

Complete Solutions Nyt Mini Crossword March 22

May 20, 2025

Complete Solutions Nyt Mini Crossword March 22

May 20, 2025 -

Find The Answers Nyt Mini Crossword March 15

May 20, 2025

Find The Answers Nyt Mini Crossword March 15

May 20, 2025 -

Michael Schumacher Viaje En Helicoptero De Mallorca A Suiza Para Ver A Su Nieta

May 20, 2025

Michael Schumacher Viaje En Helicoptero De Mallorca A Suiza Para Ver A Su Nieta

May 20, 2025 -

Suki Waterhouses Tik Tok The Twinks Video Explained Z94

May 20, 2025

Suki Waterhouses Tik Tok The Twinks Video Explained Z94

May 20, 2025 -

Des Cours D Ecriture Ia Agatha Christie Reinventee Innovation Ou Simple Copie

May 20, 2025

Des Cours D Ecriture Ia Agatha Christie Reinventee Innovation Ou Simple Copie

May 20, 2025

Latest Posts

-

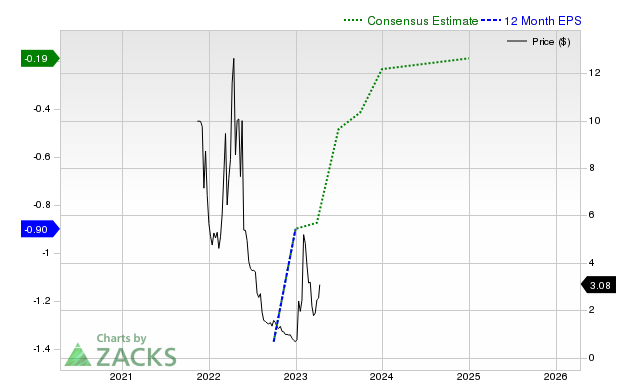

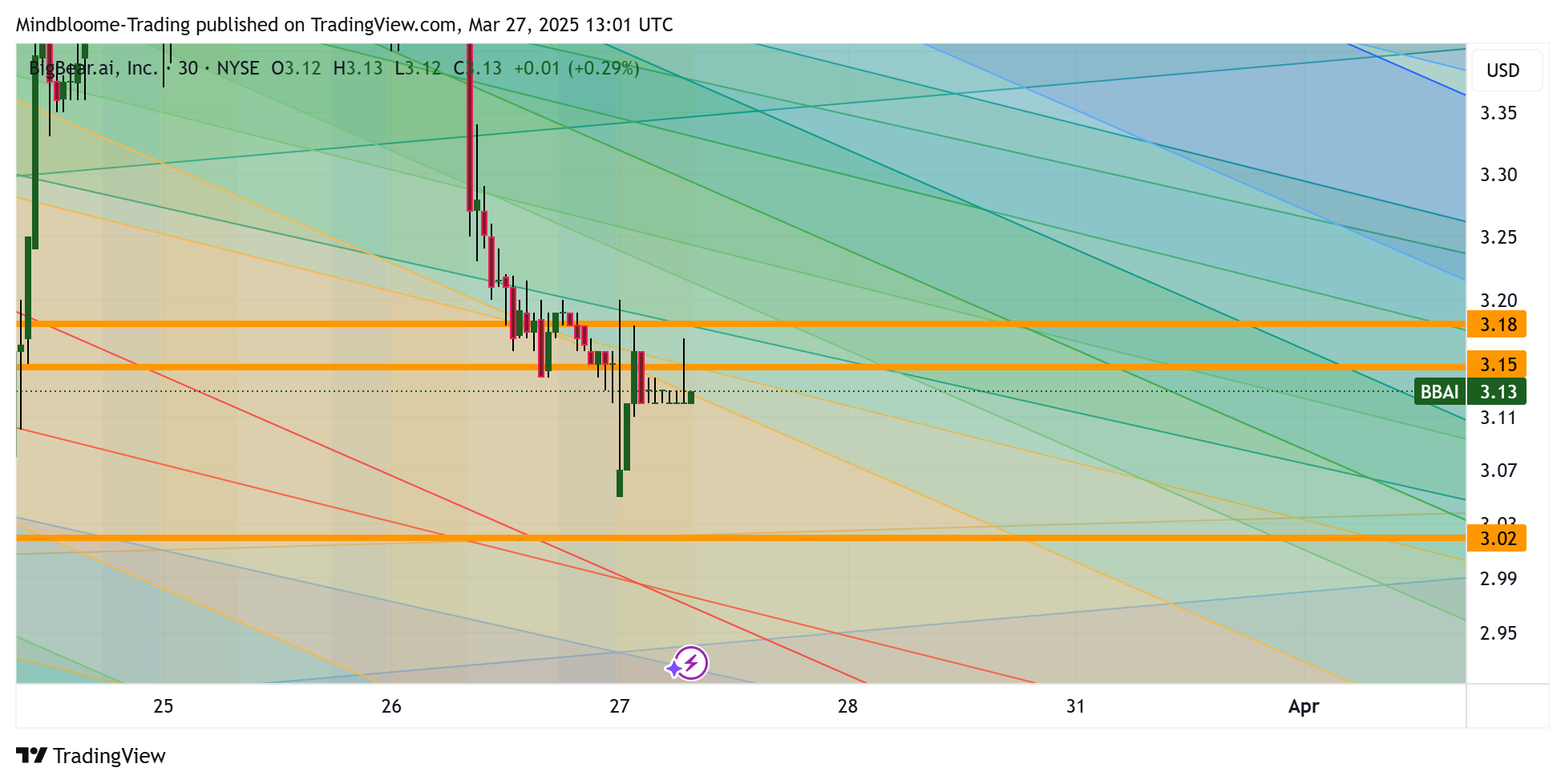

Big Bear Ai Holdings Bbai Reasons Behind The 2025 Stock Plunge

May 20, 2025

Big Bear Ai Holdings Bbai Reasons Behind The 2025 Stock Plunge

May 20, 2025 -

D Wave Quantum Inc Qbts Explaining The Stocks Thursday Price Movement

May 20, 2025

D Wave Quantum Inc Qbts Explaining The Stocks Thursday Price Movement

May 20, 2025 -

What Caused The Increase In D Wave Quantum Qbts Stock Price On Monday

May 20, 2025

What Caused The Increase In D Wave Quantum Qbts Stock Price On Monday

May 20, 2025 -

Is Big Bear Ai Holdings Inc Nyse Bbai A Top Penny Stock To Watch

May 20, 2025

Is Big Bear Ai Holdings Inc Nyse Bbai A Top Penny Stock To Watch

May 20, 2025 -

What Caused The Increase In D Wave Quantum Qbts Stock Value On Friday

May 20, 2025

What Caused The Increase In D Wave Quantum Qbts Stock Value On Friday

May 20, 2025