Uber Stock: A Comprehensive Investment Analysis

Table of Contents

The rollercoaster ride of Uber stock has captivated investors, presenting both significant potential and considerable risk. This comprehensive analysis of Uber stock delves into the company's performance, market position, and future prospects, providing insights to help you determine if this volatile yet potentially rewarding investment is right for your portfolio. Uber Technologies Inc. has rapidly established itself as a dominant player in the global ride-sharing and delivery markets, but its journey to sustained profitability continues. This article aims to provide a thorough evaluation of Uber stock as an investment opportunity, weighing its strengths and weaknesses to inform your investment decisions.

Uber's Business Model and Market Position:

Ride-Sharing Dominance:

Uber's dominance in the ride-sharing sector is undeniable. While facing competition from Lyft in the US and various regional players globally, Uber maintains a significant market share, particularly in major metropolitan areas.

- Market Share: While precise global market share figures vary depending on the source and methodology, Uber consistently holds a leading position, often exceeding 50% in many key markets.

- Geographic Reach: Uber operates in numerous countries across the globe, providing a broad and diverse revenue stream. This extensive reach is a significant competitive advantage.

- Competitive Advantages: Uber's brand recognition, robust technology platform, and sophisticated driver acquisition strategies contribute significantly to its competitive edge. Its network effects – the more drivers and riders, the more valuable the service – also provide a powerful barrier to entry for competitors.

Food Delivery and Other Services:

Uber Eats, Uber's food delivery platform, has experienced rapid growth, contributing significantly to revenue diversification. Beyond ride-sharing and food delivery, Uber is also expanding into other sectors, such as freight transportation and micromobility (e.g., scooter rentals).

- Market Share in Food Delivery: Uber Eats holds a substantial market share in numerous countries, competing with giants like DoorDash and Grubhub. However, competition in this sector is fierce.

- Growth Potential: The food delivery and other services segments present substantial growth potential, offering opportunities to mitigate reliance on the ride-sharing business and address fluctuating demand.

- Competitive Landscape: The food delivery market is highly competitive, with established players and new entrants constantly vying for market share. Uber's success in this space depends on innovation, efficient logistics, and aggressive marketing.

Technological Innovation:

Uber's substantial investments in technology, including self-driving car technology and artificial intelligence (AI), are crucial for long-term competitiveness and cost efficiency.

- Technological Advancements: Uber's ongoing development of autonomous vehicle technology has the potential to revolutionize its operations, reducing costs and improving efficiency. AI-powered features enhance ride matching, route optimization, and fraud detection.

- Potential Long-Term Benefits: Successful implementation of autonomous vehicles could significantly reduce operational expenses and improve profitability. AI-driven improvements enhance the customer experience and operational efficiency.

- Associated Risks and Challenges: The development and deployment of autonomous vehicles face significant technological and regulatory hurdles. The high cost of research and development also presents a considerable financial risk.

Financial Performance and Valuation:

Revenue Growth and Profitability:

Uber's historical financial performance reveals a pattern of significant revenue growth, though profitability has remained elusive in recent years. Analyzing key financial ratios is essential to assess the company's financial health.

- Revenue Figures: Uber's revenue has shown consistent growth over the past few years, driven by increased ridership and the expansion of its delivery services. Specific figures should be reviewed from Uber's financial reports.

- Profitability Trends: Uber has historically struggled with profitability due to substantial operational costs, particularly driver compensation and marketing expenses. Recent trends should be examined closely.

- Key Financial Metrics: Examining metrics like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and net income provides valuable insights into Uber's financial performance and its path to profitability.

Valuation Metrics:

Evaluating Uber's current valuation requires careful analysis of metrics like the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and other relevant metrics, considering the company's stage of growth. Comparisons with competitors are essential.

- Current Valuation Metrics: Uber's valuation fluctuates significantly based on market sentiment and financial performance. Analyzing current P/E and P/S ratios, along with other relevant metrics provides insights into its current valuation.

- Comparison to Industry Benchmarks: Comparing Uber's valuation metrics to those of its competitors provides context and helps determine whether the stock is overvalued or undervalued.

- Potential Overvaluation or Undervaluation: Determining whether Uber stock is overvalued or undervalued requires a comprehensive analysis of its financial performance, future growth potential, and risks.

Risks and Challenges Facing Uber Stock:

Regulatory Hurdles:

The ride-sharing and food delivery industries face numerous regulatory challenges globally. Licensing requirements, labor laws, and safety regulations can significantly impact operations and profitability.

- Examples of Regulatory Challenges: These challenges include issues related to driver classification as employees versus independent contractors, data privacy concerns, and safety regulations for autonomous vehicles.

- Potential Impact on Profitability and Operations: Stringent regulations can increase operational costs, limit expansion, and affect profitability.

Competition and Market Saturation:

The intense competition and potential for market saturation in key markets represent significant risks for Uber.

- Key Competitors and Their Strategies: Uber faces competition from Lyft, regional ride-sharing services, and numerous food delivery platforms. Each competitor employs various strategies to gain market share.

- Potential for Price Wars: Competitive pressure can lead to price wars, reducing profitability margins.

- Challenges in Expanding into New Markets: Entering new markets requires significant investment and overcoming local regulatory and cultural hurdles.

Economic Factors:

Macroeconomic conditions, such as inflation and recession, can significantly affect Uber's performance and stock price.

- Sensitivity to Economic Downturns: During economic downturns, consumer spending on ride-sharing and food delivery services tends to decrease, impacting Uber's revenue.

- Impact of Fuel Prices: Fluctuations in fuel prices directly affect Uber's operational costs and profitability.

- Consumer Spending Patterns: Changes in consumer spending habits and preferences can influence demand for Uber's services.

Future Outlook and Investment Considerations:

Growth Projections:

Analysts' projections for Uber's future revenue growth and profitability vary. Understanding the range of these projections is crucial for informed investment decisions.

- Consensus Estimates from Financial Analysts: Reviewing consensus estimates from reputable financial analysts provides insights into the market's expectations for Uber's future performance.

- Potential Upside and Downside Scenarios: Considering potential upside and downside scenarios helps assess the range of possible outcomes and the associated risks.

Investment Strategy:

Developing an investment strategy for Uber stock requires careful consideration of risk tolerance and investment goals. Long-term vs. short-term investment horizons influence the decision-making process.

- Buy, Hold, or Sell Recommendations (with appropriate caveats): Investment recommendations should be made with caution, taking into account individual risk profiles and market conditions.

- Diversification Strategies: Diversifying your investment portfolio is recommended to mitigate risks associated with investing in a single stock, particularly one as volatile as Uber stock.

Conclusion:

This analysis of Uber stock highlights its significant market position, growth potential in diverse sectors, and considerable technological innovation. However, challenges remain, including intense competition, regulatory hurdles, and sensitivity to economic factors. Profitability remains a key concern. Whether Uber stock is a worthwhile investment depends heavily on your risk tolerance, investment timeframe, and assessment of the company's ability to overcome these challenges and achieve sustained profitability. Before making any investment decisions regarding Uber stock, conduct thorough independent research, considering all aspects discussed in this analysis. Regularly revisit your assessment as the market and Uber's performance evolve. Remember, investing in Uber stock carries inherent risk, and past performance is not indicative of future results.

Featured Posts

-

Four Inter Milan Players Out Of Contract In 2026 Analysis And Implications

May 08, 2025

Four Inter Milan Players Out Of Contract In 2026 Analysis And Implications

May 08, 2025 -

Rogues Legacy Gambits Latest Weapon Unveiled

May 08, 2025

Rogues Legacy Gambits Latest Weapon Unveiled

May 08, 2025 -

Bof As Reassuring View Why Current Stock Market Valuations Shouldnt Worry Investors

May 08, 2025

Bof As Reassuring View Why Current Stock Market Valuations Shouldnt Worry Investors

May 08, 2025 -

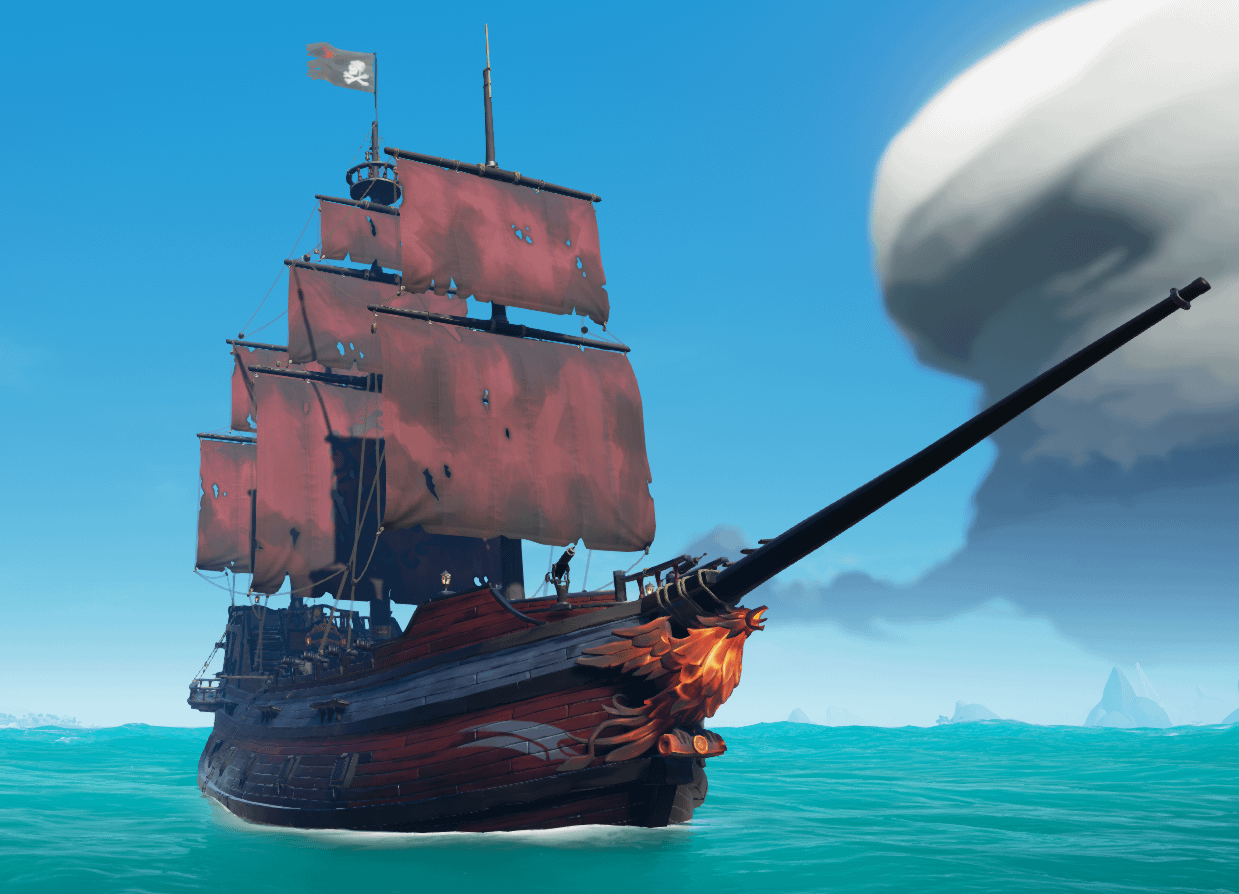

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025 -

Quick News F4 Elden Ring Possum And Superman Updates

May 08, 2025

Quick News F4 Elden Ring Possum And Superman Updates

May 08, 2025