U.S. Dollar's Weak Start: Worst 100 Days Since Nixon?

Table of Contents

The US dollar is stumbling. Its recent weakness has sparked concerns, prompting comparisons to the tumultuous period following President Nixon's closure of the gold window in 1971 – a decision that drastically altered the global monetary system. This article delves into the factors behind the current US dollar weakness, examining inflationary pressures, geopolitical uncertainties, and the Federal Reserve's response, comparing them to the aftermath of the "Nixon shock" and exploring potential implications for the future of the dollar's value.

H2: The Dollar's Dismal Performance: A Quantitative Analysis

The US dollar's decline in [current year]'s initial 100 days is undeniable. Visual representations using charts and graphs (insert relevant charts and graphs here showing the US Dollar Index (DXY) and the dollar's performance against major currencies like the Euro, Yen, and Pound) clearly illustrate this downward trend. Comparing this performance to historical data, particularly the period following Nixon's decision to end the Bretton Woods system, reveals some striking similarities, though crucial differences exist.

The US Dollar Index (DXY), a widely used measure of the dollar's value against other major currencies, has experienced a [insert percentage]% drop in the first 100 days of [current year]. This compares to a [insert percentage]% drop in the equivalent period following the Nixon shock (provide source).

- Specific data points:

- The dollar has fallen [percentage]% against the Euro.

- The dollar has fallen [percentage]% against the Japanese Yen.

- The dollar has fallen [percentage]% against the British Pound.

These figures highlight a significant weakening of the dollar, raising questions about the sustainability of this trend and its potential long-term consequences.

H2: Inflationary Pressures and the Federal Reserve's Response

High inflation erodes the purchasing power of a currency, weakening its value. The current inflationary environment, characterized by rising Consumer Price Index (CPI) and Producer Price Index (PPI) figures (insert data here), is a key driver of the dollar's decline. The Federal Reserve's response, primarily through interest rate hikes, aims to curb inflation and stabilize the dollar.

- Key Inflation Indicators:

- CPI: [insert current CPI data and source]

- PPI: [insert current PPI data and source]

- Current Interest Rate Levels: [Insert current Federal Funds Rate and source]

However, the effectiveness of these rate hikes remains debatable. While they aim to attract foreign investment and increase the dollar's demand, aggressively raising interest rates also risks slowing economic growth, potentially exacerbating the situation. Future rate hike predictions (insert predictions and source) will be crucial in determining the dollar's trajectory.

H2: Geopolitical Uncertainty and its Impact on the Dollar's Value

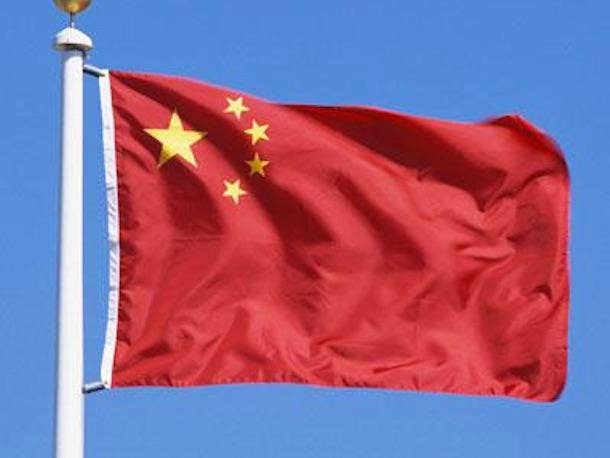

Geopolitical instability significantly impacts investor confidence and the dollar's safe-haven status. The ongoing war in Ukraine, heightened US-China tensions, and other global uncertainties contribute to capital flight and a reduction in demand for the dollar.

- Specific Geopolitical Events and their Impact:

- The war in Ukraine has created energy price volatility, impacting global markets and weakening the dollar. (Source)

- Increased US-China tensions have fueled concerns about trade disruptions, negatively affecting the dollar's appeal. (Source)

Sanctions imposed on various countries also influence international trade flows and the dollar's role in global finance, further complicating the situation. The resulting uncertainty makes it challenging to predict the dollar's future performance.

H2: Comparing to the Nixon Era: Similarities and Differences

Nixon's decision to close the gold window marked a pivotal moment in global monetary history, ending the Bretton Woods system and ushering in an era of floating exchange rates. The current situation shares some similarities with the post-Nixon period, notably high inflation and a weakening dollar. However, crucial differences exist.

- Key Differences:

- The global financial system is far more interconnected now than in the 1970s.

- The role of emerging markets in the global economy is significantly larger today.

- Technological advancements, particularly in financial technology, have dramatically changed the landscape.

While the post-Nixon era saw a period of significant dollar devaluation, the current context presents a unique set of challenges and opportunities, making direct comparisons difficult. The long-term implications for global currency dominance remain uncertain.

H3: Conclusion

The US dollar's recent weakness is a complex issue stemming from a confluence of factors, including high inflation, the Federal Reserve's monetary policy response, and significant geopolitical uncertainties. While parallels can be drawn to the post-Nixon era, the current situation is unique due to the increased interconnectedness of the global economy and technological advancements. Understanding these intertwined forces is crucial for navigating the future of the US dollar and its potential for further decline.

Call to Action: Stay informed about the evolving situation impacting the US dollar. Monitor key economic indicators, follow reputable financial news sources, and understand the various forecasts to make informed decisions about your financial strategies. The future of the US dollar, its value and potential for further decline require continuous monitoring and analysis. Stay updated on the latest US dollar forecast and exchange rate predictions.

Featured Posts

-

Trump Supporter Ray Epps Defamation Suit Against Fox News Details On The January 6th Claims

Apr 28, 2025

Trump Supporter Ray Epps Defamation Suit Against Fox News Details On The January 6th Claims

Apr 28, 2025 -

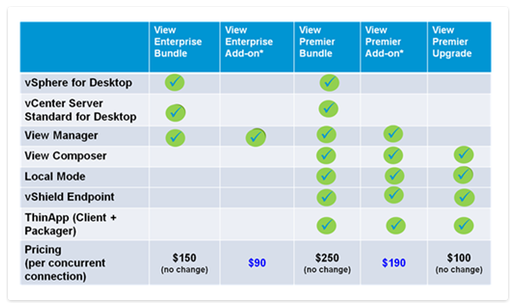

Broadcoms Proposed V Mware Price Increase At And T Reports A 1050 Jump

Apr 28, 2025

Broadcoms Proposed V Mware Price Increase At And T Reports A 1050 Jump

Apr 28, 2025 -

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 28, 2025

Hollywood Shutdown Double Strike Cripples Film And Television Production

Apr 28, 2025 -

Broadcoms V Mware Deal An Extreme Price Surge Of 1050 Claims At And T

Apr 28, 2025

Broadcoms V Mware Deal An Extreme Price Surge Of 1050 Claims At And T

Apr 28, 2025 -

Anchor Brewing Company To Shutter A Legacy Ends

Apr 28, 2025

Anchor Brewing Company To Shutter A Legacy Ends

Apr 28, 2025

Latest Posts

-

This Red Sox Outfielder Poised For A Duran Like Breakout

Apr 28, 2025

This Red Sox Outfielder Poised For A Duran Like Breakout

Apr 28, 2025 -

The End Of An Era Orioles Hit Streak Ends At 160 Games

Apr 28, 2025

The End Of An Era Orioles Hit Streak Ends At 160 Games

Apr 28, 2025 -

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025 -

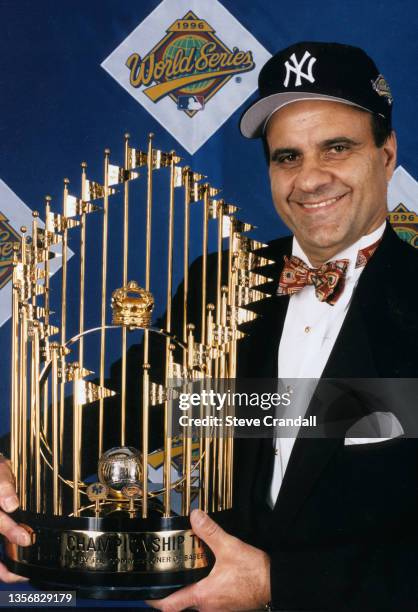

2000 Yankees Joe Torres Strategic Moves And Pettittes Shutout Against Minnesota

Apr 28, 2025

2000 Yankees Joe Torres Strategic Moves And Pettittes Shutout Against Minnesota

Apr 28, 2025 -

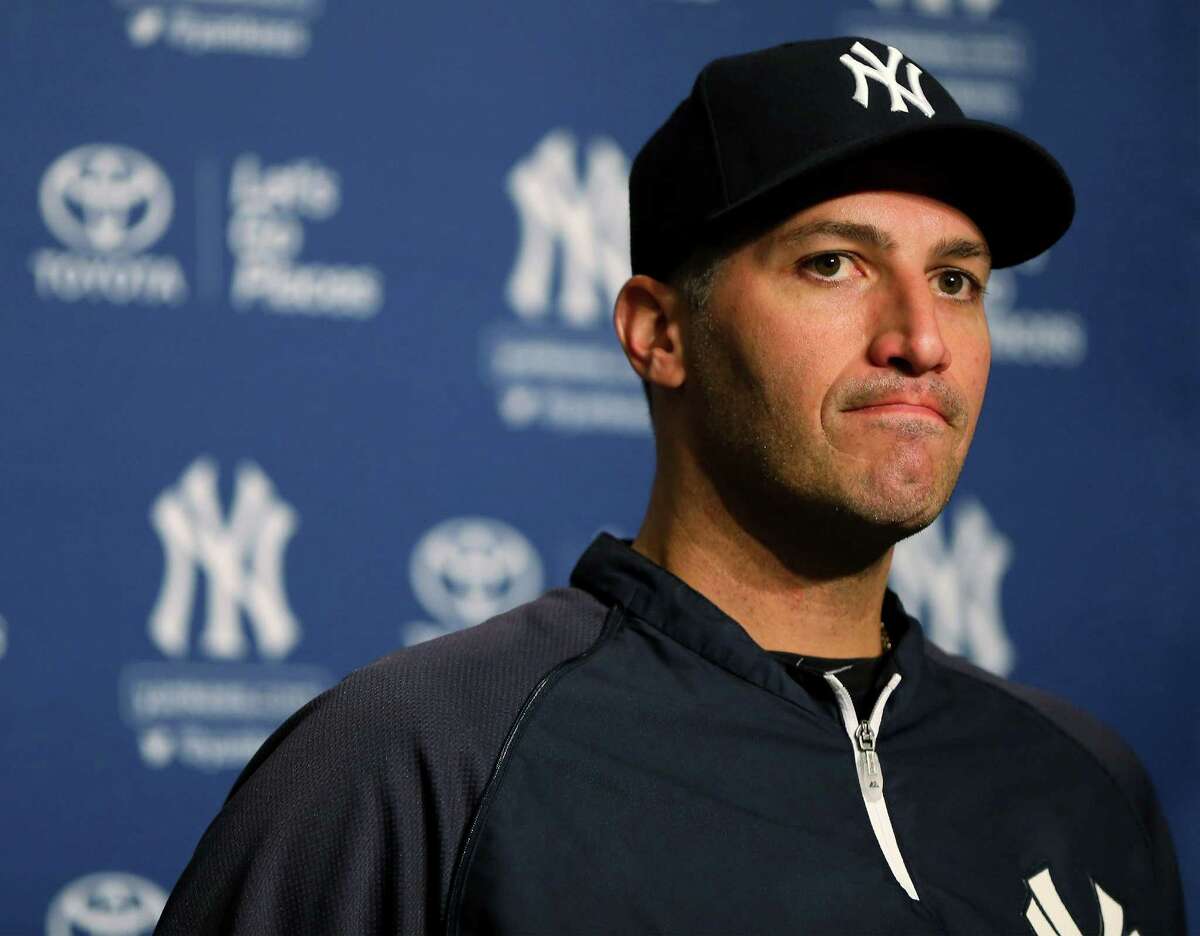

Andy Pettittes Gem Recalling The 2000 Yankees Victory Over The Twins

Apr 28, 2025

Andy Pettittes Gem Recalling The 2000 Yankees Victory Over The Twins

Apr 28, 2025