Toronto Real Estate Market Update: Sales Down 23%, Prices Dip 4%

Table of Contents

Significant Drop in Toronto Real Estate Sales

Year-over-Year Sales Comparison

The 23% year-over-year decrease in sales is stark. Data from the Toronto Real Estate Board (TREB) shows a dramatic fall in transactions compared to the same period last year.

- Q3 2022 vs. Q3 2023: A 23% reduction in total sales across all property types.

- Downtown Core: Experienced a 28% decrease in sales, highlighting the impact on high-demand areas.

- Suburban Areas: Saw a comparatively smaller drop (18%), suggesting some market resilience in less central locations.

- Condos: Sales decreased by 25%, indicating reduced demand in the condo market.

- Detached Homes: Experienced a 20% sales decline, reflecting the impact on the luxury home segment.

This significant drop reflects a cooling market, significantly impacting various neighborhoods and property types within the Toronto real estate landscape.

Impact of Rising Interest Rates

Rising interest rates are a major factor influencing the decline in sales. Higher borrowing costs directly impact affordability, making it more expensive for buyers to secure mortgages.

- Increased Mortgage Payments: A 1% increase in interest rates can substantially increase monthly mortgage payments, reducing the purchasing power of many potential buyers.

- Reduced Buyer Affordability: Higher interest rates shrink the pool of qualified buyers, creating less competition and consequently lower sales.

- Interest Rate Forecasts: Experts predict that interest rates will remain elevated for the foreseeable future, potentially further impacting the market in the coming months.

Economic Uncertainty and its Influence

The broader economic climate is also impacting buyer confidence. Inflation, recessionary fears, and job market uncertainty are all contributing to a more cautious approach to large purchases like real estate.

- Inflationary Pressures: High inflation erodes purchasing power, making it harder for buyers to save for a down payment and manage higher monthly mortgage payments.

- Recessionary Fears: Concerns about a potential recession are causing many potential buyers to delay or postpone their purchase decisions.

- Economic Indicators: Negative economic indicators, such as declining consumer confidence, further fuel uncertainty in the market.

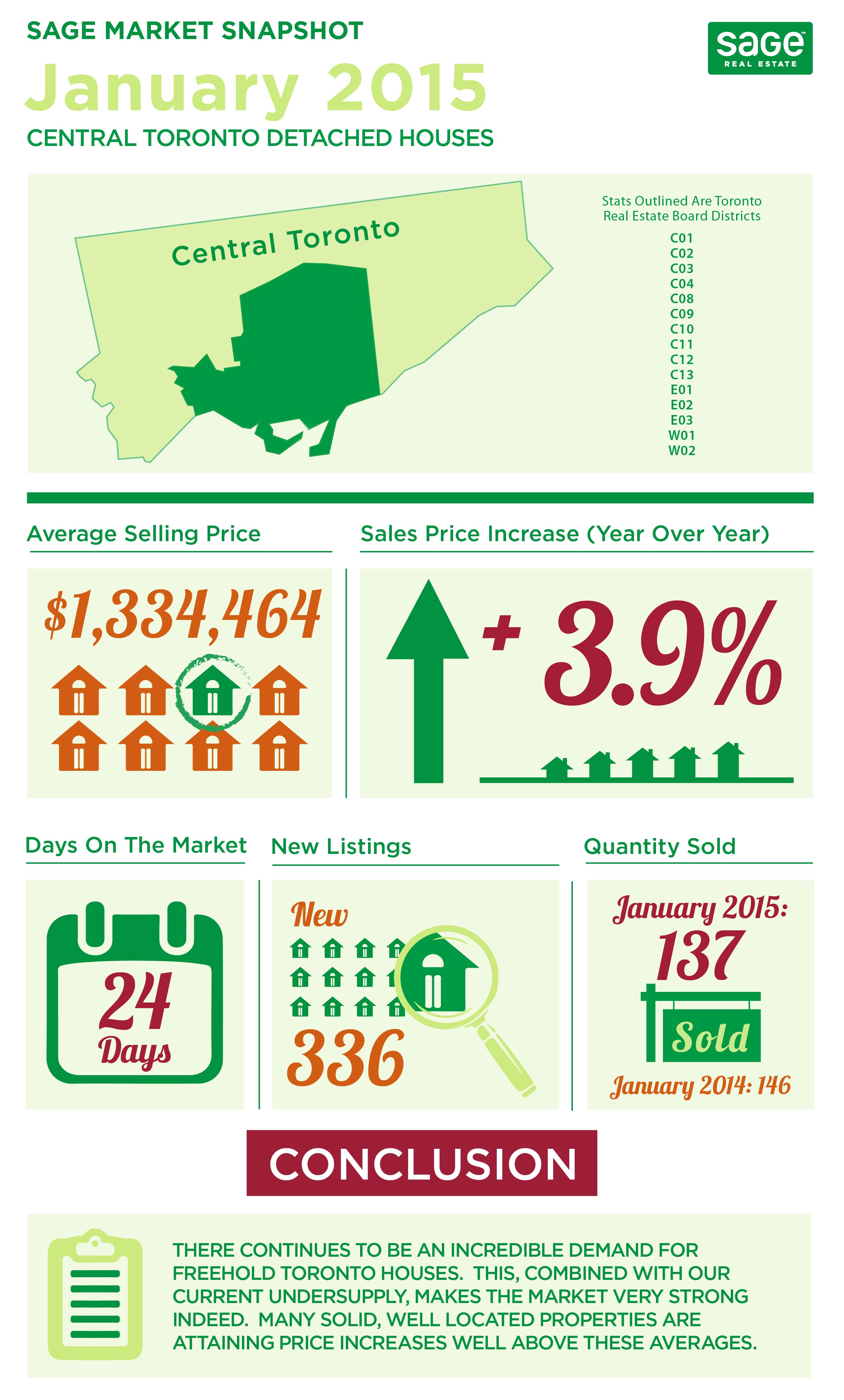

Moderate Price Decreases in the Toronto Housing Market

Average Price Drop Analysis

While sales have plummeted, the average price decrease of 4% is a more moderate adjustment. However, this average masks variations across different property types and neighborhoods.

- Overall Average Price Dip: A 4% decline in the average price of properties sold in Toronto.

- Neighborhood Variations: Some neighborhoods experienced more significant price drops than others, reflecting localized market dynamics.

- Visual Representation: [Insert chart/graph showcasing price changes by neighborhood and property type].

Price Adjustments by Property Type

The price decrease varies across different housing segments:

- Condos: Experienced a 3% price drop, showing relative resilience compared to other property types.

- Townhouses: Saw a 5% price reduction, reflecting higher sensitivity to interest rate hikes.

- Detached Homes: Prices decreased by 6%, representing a more significant correction in the high-end market.

- Inventory Levels: Increased inventory across most property types contributes to the downward pressure on prices.

Factors Influencing Price Reductions

The interplay of decreased demand, increased inventory, and increased buyer negotiation power is driving price reductions.

- Reduced Demand: Fewer buyers are competing for available properties, giving buyers more leverage to negotiate lower prices.

- Increased Inventory: A higher supply of properties on the market leads to more competition among sellers, resulting in price adjustments.

- Buyer Negotiation Power: Buyers have more negotiating power in this buyer’s market, successfully securing lower prices.

Outlook for the Toronto Real Estate Market

Predictions for the Coming Months

Predicting the future of the Toronto real estate market is challenging. However, based on current trends, several scenarios are possible.

- Gradual Recovery: Some experts predict a gradual recovery in the market as interest rates stabilize and economic uncertainty eases.

- Continued Slowdown: Others foresee a continued slowdown, with further price adjustments possible before a recovery begins.

- Expert Opinions: [Include quotes from real estate analysts offering their predictions].

Advice for Buyers and Sellers

The current market conditions present both challenges and opportunities for buyers and sellers.

- Buyers: Negotiate aggressively, explore financing options carefully, and take advantage of potentially lower prices.

- Sellers: Price properties competitively, prepare homes meticulously for showings, and consider professional marketing strategies to attract buyers in a less competitive market.

Conclusion: Navigating the Changing Toronto Real Estate Landscape

The Toronto real estate market is experiencing a significant shift, with a 23% drop in sales and a 4% decline in average prices. Rising interest rates and economic uncertainty are primarily driving this change. While challenges exist, opportunities also present themselves for both buyers and sellers willing to adapt to this evolving market. Staying informed about the latest trends is crucial for making sound real estate decisions. Stay updated on the latest trends in the Toronto real estate market by regularly checking our website for further analysis and insights. Contact a qualified real estate agent to discuss your specific needs in this evolving market.

Featured Posts

-

Economic Overhaul Urged Amidst Taiwan Dollars Appreciation

May 08, 2025

Economic Overhaul Urged Amidst Taiwan Dollars Appreciation

May 08, 2025 -

Trumps 100 Day Speech Impact On Bitcoin Price Prediction

May 08, 2025

Trumps 100 Day Speech Impact On Bitcoin Price Prediction

May 08, 2025 -

Daily Lotto Draw Tuesday April 15 2025

May 08, 2025

Daily Lotto Draw Tuesday April 15 2025

May 08, 2025 -

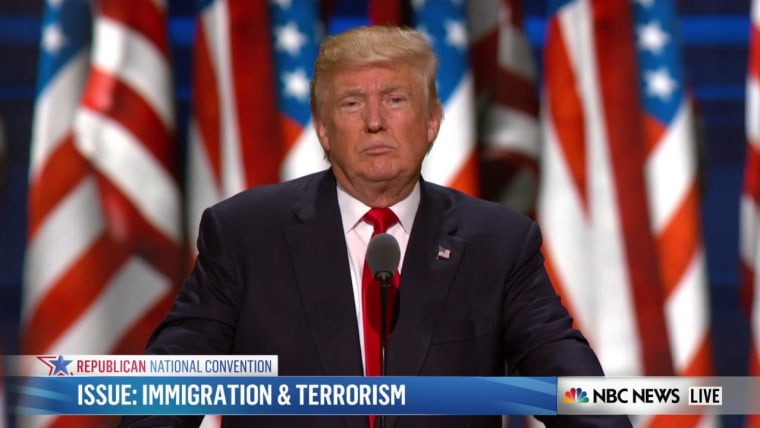

Analyzing The Market Volatility The Impact Of Liberation Day Tariffs On Stock Prices

May 08, 2025

Analyzing The Market Volatility The Impact Of Liberation Day Tariffs On Stock Prices

May 08, 2025 -

Oficial Sergio Hernandez Es El Nuevo Entrenador Del Flamengo

May 08, 2025

Oficial Sergio Hernandez Es El Nuevo Entrenador Del Flamengo

May 08, 2025