Analyzing The Market Volatility: The Impact Of 'Liberation Day' Tariffs On Stock Prices

Table of Contents

Immediate Impact of 'Liberation Day' Tariffs on Stock Prices

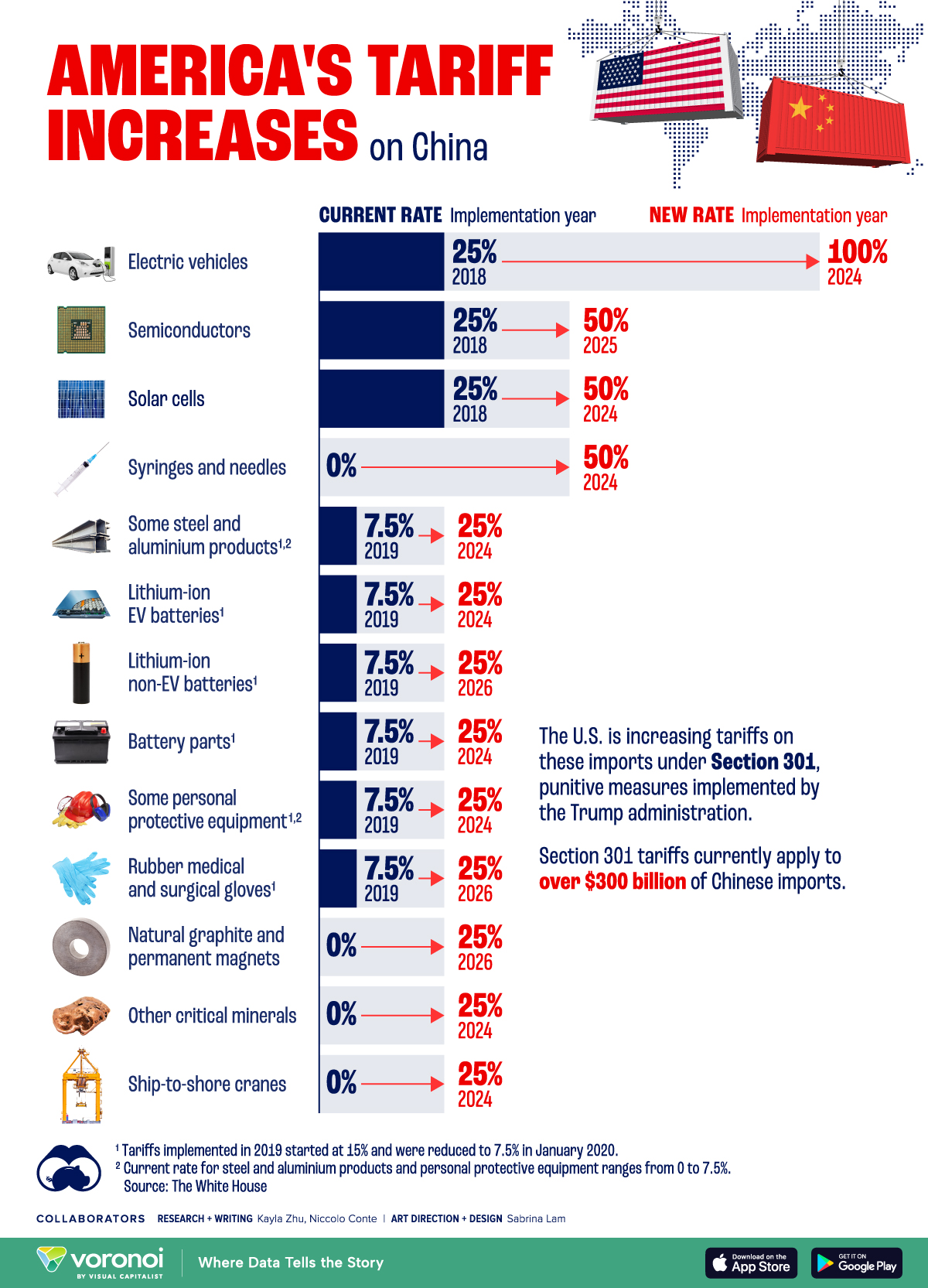

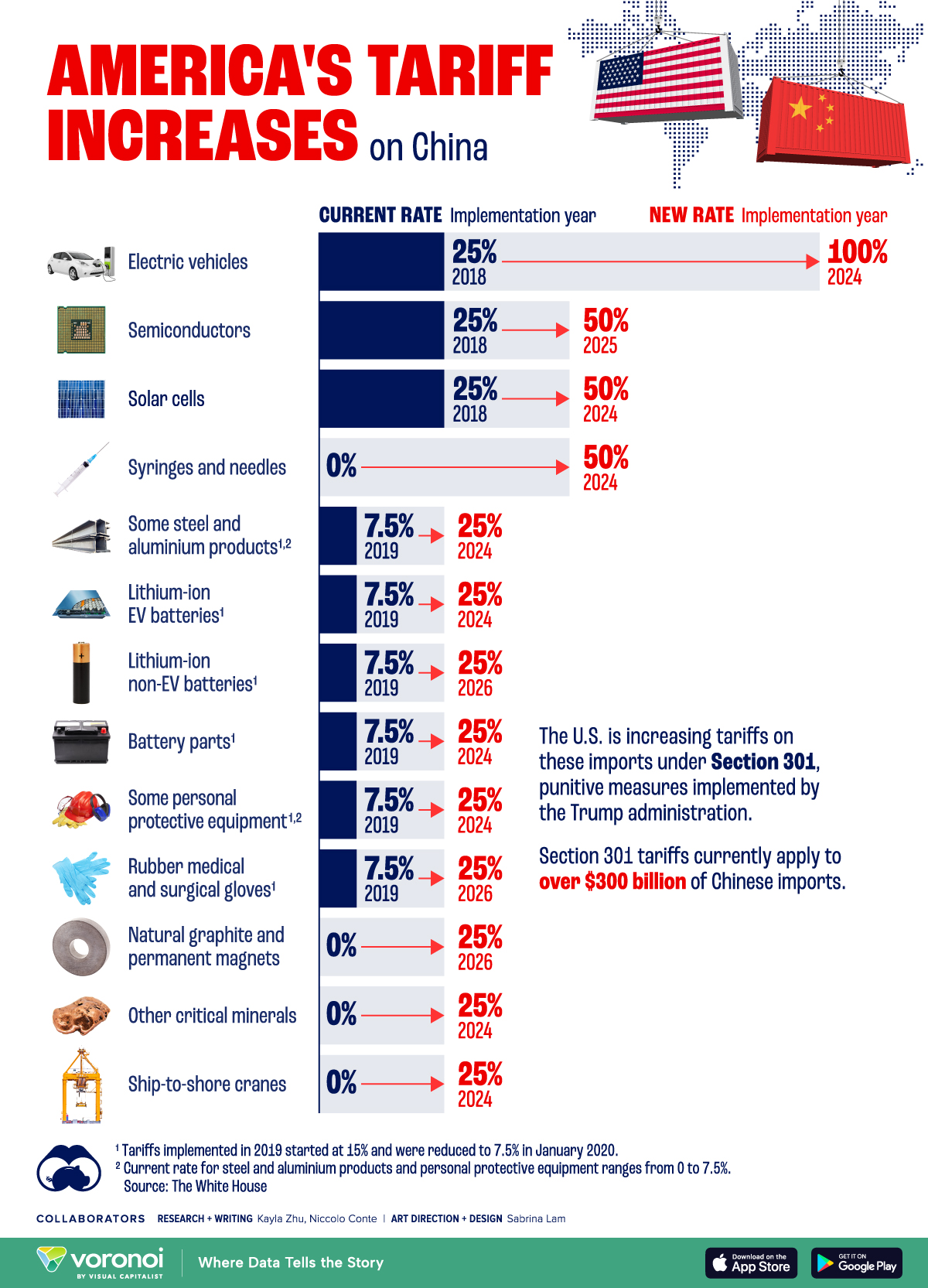

The immediate market reaction to the implementation of the "Liberation Day" tariffs on [Date of Implementation] was swift and dramatic. The imposition of tariffs on [Specific goods affected, e.g., steel, aluminum, agricultural products] from [Countries involved] sent shockwaves through global markets. The sectoral impact was particularly pronounced.

-

Sectoral Impact: The technology sector, heavily reliant on global supply chains, experienced a significant downturn. Manufacturing companies also faced immediate challenges due to increased input costs. The agricultural sector, already facing various challenges, suffered further setbacks due to reduced exports. This created a market downturn for many related stocks.

-

Specific Stock Price Changes:

- Company A (Technology): Stock price fell by X% on the day of implementation.

- Company B (Manufacturing): Experienced a Y% drop, reflecting increased production costs.

- Company C (Agriculture): Saw a Z% decrease in value due to reduced export opportunities.

[Insert chart/graph visually representing stock price fluctuations on the day of implementation].

Investor response was immediate. Many opted for selling off assets perceived as high-risk, seeking safer investments like government bonds, leading to a flight to safety. This initial market crash highlighted the immediate sensitivity of stock prices to these new tariffs.

Short-Term Volatility and Market Uncertainty

The weeks following the tariff implementation were characterized by increased market uncertainty and risk aversion. While the "Liberation Day" tariffs were a primary driver, other factors contributed to this volatility.

- Contributing Factors:

- A slowing global economy already created headwinds for businesses.

- Geopolitical instability in [Region] added to investor anxieties.

- Uncertainty surrounding future policy decisions further fueled market apprehension.

These events, compounded by the "Liberation Day" tariffs, created a perfect storm of market uncertainty. Speculation and media coverage played a significant role in amplifying investor sentiment, often exacerbating short-term volatility. Negative news cycles further impacted investor confidence, creating a vicious cycle of selling and further price drops.

Long-Term Implications and Economic Effects

The long-term economic impact of the "Liberation Day" tariffs remains uncertain but carries significant potential consequences.

-

Inflationary Pressures: Increased import costs due to tariffs will likely translate into higher consumer prices, potentially fueling inflation. This could erode purchasing power and impact consumer spending, slowing down economic growth.

-

Trade Wars and Retaliation: The tariffs could spark retaliatory measures from affected countries, escalating into a full-blown trade war with far-reaching global implications. This would likely disrupt global supply chains and trade flows further.

-

Supply Chain Disruptions: Companies may be forced to restructure their global supply chains, shifting production away from affected countries. This process is costly and time-consuming, impacting profitability and competitiveness.

Analyzing Investor Behavior and Strategies

Facing increased market volatility, investors adopted various strategies to mitigate risk.

- Investment Strategies:

- Increased hedging: Many investors increased their use of hedging strategies to protect against potential losses.

- Shift to safer assets: A significant shift towards safer assets like government bonds and cash was observed.

- Portfolio diversification: Investors diversified their portfolios to reduce exposure to specific sectors or regions.

The performance of different asset classes varied significantly. While government bonds performed well, equity markets experienced considerable volatility, reflecting investor uncertainty. This period highlighted the critical importance of risk management and adaptable investment strategies.

Understanding the Market Volatility Caused by 'Liberation Day' Tariffs

In conclusion, the "Liberation Day" tariffs have had a significant and multifaceted impact on stock prices and market volatility. The immediate impact was a sharp decline in certain sectors, followed by a period of heightened uncertainty and risk aversion. The long-term implications include potential inflationary pressures, the risk of escalating trade wars, and disruptions to global supply chains. Understanding this market volatility is crucial for investors. Analyzing market volatility and its drivers, like the "Liberation Day" tariffs, requires diligent monitoring of global economic events and proactive risk management. To effectively manage your investments during times of market volatility, regularly consult reliable financial news sources and seek professional financial advice. Understanding market volatility is key to navigating economic uncertainty.

Featured Posts

-

Ethereums Bullish Run Breaking Resistance Eyes On 2 000

May 08, 2025

Ethereums Bullish Run Breaking Resistance Eyes On 2 000

May 08, 2025 -

Surge In Dwp Home Visits Impact On Benefit Claimants

May 08, 2025

Surge In Dwp Home Visits Impact On Benefit Claimants

May 08, 2025 -

Taiwan Dollars Surge A Call For Economic Reform

May 08, 2025

Taiwan Dollars Surge A Call For Economic Reform

May 08, 2025 -

Andor Book Scrapped The Impact Of Ai On Star Wars Publishing

May 08, 2025

Andor Book Scrapped The Impact Of Ai On Star Wars Publishing

May 08, 2025 -

First Look The Long Walk Trailer Promises A Faithful Stephen King Adaptation

May 08, 2025

First Look The Long Walk Trailer Promises A Faithful Stephen King Adaptation

May 08, 2025