Trump's 100-Day Speech: Impact On Bitcoin Price Prediction

Table of Contents

Keywords: Trump's 100-day speech, Bitcoin price prediction, cryptocurrency market, regulatory uncertainty, economic policy, Bitcoin price analysis, Trump administration, Bitcoin investment, crypto trading.

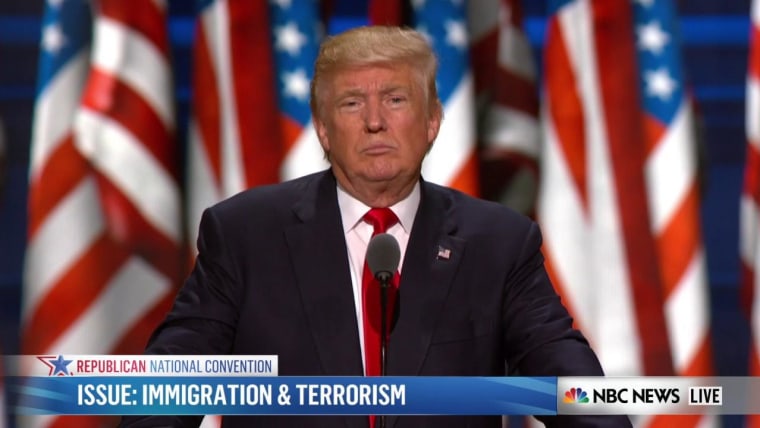

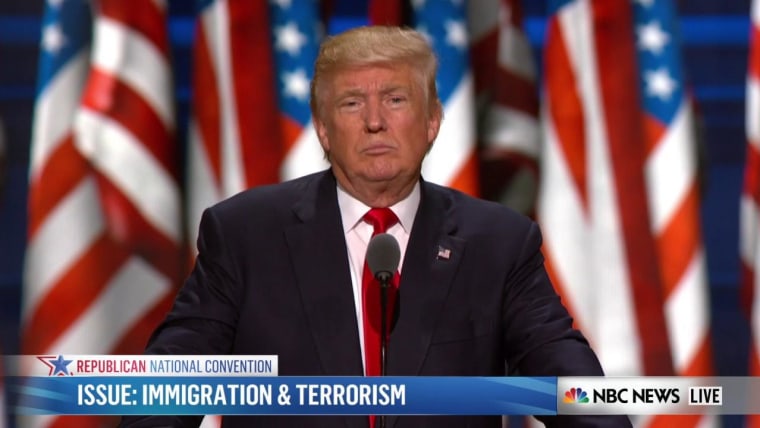

Trump's 100-day speech, delivered in April 2017, sent ripples through various sectors, including the burgeoning cryptocurrency market. Many wondered: How would his economic policies affect Bitcoin price predictions? This article delves into the speech's potential impact on Bitcoin's trajectory, examining market reactions and considering the long-term implications for investors.

Market Reactions to Trump's 100-Day Speech and Bitcoin

Immediate Price Volatility

Following Trump's 100-day speech, Bitcoin experienced a period of short-term price volatility.

- Price Changes: While pinpointing exact changes solely attributable to the speech is difficult due to the inherent volatility of the cryptocurrency market, some analysts noted a slight dip immediately following the address, followed by a period of consolidation. [Link to relevant price chart from a reputable source like CoinMarketCap].

- Investor Sentiment: Initial reactions within the crypto community were mixed. Some interpreted the speech as potentially positive for Bitcoin, viewing it as a catalyst for economic uncertainty that could drive demand for alternative assets. Others remained cautious, anticipating potential regulatory crackdowns.

Sentiment Analysis of Crypto Communities

Online crypto communities, such as Reddit's r/Bitcoin and various cryptocurrency-focused Twitter accounts, reflected this mixed sentiment.

- Forum Reactions: Analysis of posts and comments across these platforms revealed a range of opinions, from optimistic predictions of Bitcoin price surges to concerns about increased regulatory scrutiny under the Trump administration.

- Social Media Sentiment: While quantifying the exact influence of social media sentiment on Bitcoin trading is challenging, it's undeniable that the prevailing mood within online communities significantly influences trading behavior, contributing to both short-term price increases and decreases.

Regulatory Uncertainty and its Impact on Bitcoin Price Predictions

Trump's Stance on Financial Regulation

Trump's 100-day speech, while not explicitly addressing cryptocurrencies, hinted at his broader approach to financial regulation.

- Regulatory Proposals: His emphasis on deregulation in certain sectors raised questions about the future regulatory landscape for cryptocurrencies. The speech lacked specific proposals concerning crypto regulation, fostering uncertainty within the market.

- SEC Actions: The ongoing debate regarding the SEC's stance on initial coin offerings (ICOs) and security tokens highlighted the regulatory uncertainty surrounding the crypto space. This uncertainty directly impacted Bitcoin price predictions, as investors remained hesitant due to potential legal implications.

Impact on Institutional Investment

Regulatory clarity is crucial for attracting large-scale institutional investment in Bitcoin.

- Barriers to Adoption: Regulatory hurdles, including concerns about anti-money laundering (AML) compliance and know-your-customer (KYC) regulations, presented significant barriers to institutional adoption of Bitcoin. Risk assessments conducted by institutional investors often prioritized regulatory clarity.

- Attracting Institutional Investment: Reduced regulatory uncertainty could potentially unlock significant institutional investment, leading to substantial increases in Bitcoin’s price. The absence of a clear regulatory framework, however, made many institutional investors cautious.

Long-Term Implications for Bitcoin Price Prediction based on the Speech

Economic Policy Impacts

Trump's economic policies, such as tax cuts and increased government spending, had broader implications for Bitcoin's value.

- Inflationary Pressures: Some argued that inflationary pressures stemming from Trump's economic policies could drive demand for Bitcoin as a hedge against inflation, potentially boosting its price.

- Safe Haven Asset: Conversely, others argued that a strong US dollar, potentially boosted by Trump's policies, could negatively impact Bitcoin's value as a safe haven asset.

Global Adoption and its effect on Predictions

The long-term trajectory of Bitcoin is significantly tied to global adoption.

- Factors Influencing Adoption: Technological advancements, the development of user-friendly interfaces, and a more favorable regulatory environment globally would all contribute to increased adoption.

- Impact of Global Adoption: Regardless of the immediate market reactions to Trump's 100-day speech, increasing global adoption of Bitcoin and other cryptocurrencies remains a key factor in long-term Bitcoin price predictions. Widespread acceptance could significantly drive up its value.

Conclusion

The immediate impact of Trump's 100-day speech on Bitcoin price prediction was characterized by short-term volatility and mixed investor sentiment. Regulatory uncertainty, stemming from the lack of clear pronouncements on cryptocurrency regulation, created cautiousness within the market. However, long-term implications suggest that broader economic factors and global adoption will be more significant drivers of Bitcoin's price. Understanding the interplay between political events and cryptocurrency markets is crucial for informed Bitcoin investment. Continue researching Bitcoin price predictions and stay updated on market trends to make sound investment decisions. Informed analysis of Trump's policies and their potential impact on cryptocurrency remains crucial for navigating the Bitcoin market effectively.

Featured Posts

-

Finding A Ps 5 Before The Price Goes Up Your Guide To Retailers

May 08, 2025

Finding A Ps 5 Before The Price Goes Up Your Guide To Retailers

May 08, 2025 -

Productivity Dodges Call To Action For Carneys Economic Agenda

May 08, 2025

Productivity Dodges Call To Action For Carneys Economic Agenda

May 08, 2025 -

Billionaires Favorite Etf Projected 110 Surge In 2025

May 08, 2025

Billionaires Favorite Etf Projected 110 Surge In 2025

May 08, 2025 -

Descubre Cantina Canalla El Mejor Restaurante Mexicano De Malaga

May 08, 2025

Descubre Cantina Canalla El Mejor Restaurante Mexicano De Malaga

May 08, 2025 -

Surface Pro 12 Inch Price Specs And Review

May 08, 2025

Surface Pro 12 Inch Price Specs And Review

May 08, 2025