The Ultra-Wealthy's Safe Haven: Navigating Market Volatility In Luxury Real Estate

Table of Contents

Luxury Real Estate as a Hedge Against Inflation

Luxury properties represent a tangible asset, offering a hedge against inflation and currency devaluation. Unlike stocks or other volatile investments, physical property maintains intrinsic value, providing a sense of security that appeals to sophisticated investors.

Tangible Asset Protection

- Historically strong performance during inflationary periods: Luxury real estate has historically demonstrated resilience during inflationary periods, often outperforming other asset classes. The inherent scarcity of prime properties and consistent demand contribute to this robust performance.

- Provides a tangible asset to offset portfolio risk: Luxury homes serve as a counterbalance to more volatile investments, diversifying the portfolio and mitigating overall risk. This tangible asset offers a sense of security and stability, especially during periods of economic uncertainty.

- Potential for rental income to further mitigate inflation effects: High-end properties can generate substantial rental income, which can be adjusted to reflect inflationary pressures, offering an additional layer of protection. This passive income stream can further enhance the investment's overall resilience.

Location, Location, Location – Prime Property Resilience

Investment in prime locations, such as established affluent neighborhoods in major cities or exclusive resort destinations, proves significantly more resilient during market downturns. The demand for these properties remains consistently high, regardless of broader economic fluctuations.

- Demand remains strong for properties in highly desirable areas: Prime locations boast enduring appeal due to their desirable amenities, proximity to key infrastructure, and strong community networks. This consistent demand helps maintain price stability.

- Limited supply in these areas contributes to price stability: The limited supply of luxury properties in prime locations acts as a natural buffer against price declines, further reinforcing their value as a safe haven asset.

- Potential for long-term appreciation significantly outweighs short-term fluctuations: While short-term market corrections can occur, the long-term appreciation potential of luxury real estate in prime locations typically outweighs these fluctuations, providing substantial returns over time.

Diversification Strategies in the Luxury Real Estate Market

Diversification is key to mitigating risk in any investment portfolio, and luxury real estate is no exception. A strategic approach to diversification can significantly enhance the overall stability and growth potential of your investments.

Geographic Diversification

Spreading investments across different global markets minimizes risk associated with localized economic downturns. By diversifying geographically, investors can hedge against region-specific challenges.

- Investing in multiple countries offers a diversified portfolio: This approach reduces dependence on a single market and cushions against localized economic or political instability.

- Access to different markets and economic growth opportunities: Global diversification provides access to different markets with varying growth trajectories, maximizing potential returns.

- Mitigation of political and economic risks within individual nations: Spreading investments across various jurisdictions reduces the impact of any single nation's economic or political upheavals.

Property Type Diversification

A mix of residential, commercial, and even development projects offers further portfolio diversification. This approach reduces reliance on any single property type and its market fluctuations.

- Reduces reliance on a single property type and its market fluctuations: This reduces vulnerability to market downturns affecting a specific property sector, such as residential real estate.

- Potential for varied income streams and appreciation rates: Different property types offer various income streams and appreciation rates, smoothing overall portfolio performance.

- Creates a robust and balanced investment portfolio: A diversified portfolio is more resilient to market fluctuations, offering enhanced stability and security.

Due Diligence and Expert Advice in Luxury Real Estate

Navigating the complexities of luxury real estate requires a meticulous approach and expert guidance. The high value of these properties necessitates thorough due diligence and professional support.

The Importance of Professional Guidance

The luxury real estate market presents unique challenges, requiring specialized expertise. Engaging seasoned professionals is critical for a successful investment.

- Market analysis and valuation expertise: Professionals provide in-depth market analysis and accurate property valuations, ensuring you're making informed decisions.

- Negotiation and transaction management: They handle complex negotiations and manage transactions smoothly, ensuring a favorable outcome.

- Legal and tax implications guidance: Experienced professionals navigate the legal and tax implications, minimizing potential complications.

Thorough Due Diligence

Before any investment, comprehensive research and due diligence are crucial to avoid potential pitfalls. This process ensures a sound investment based on thorough fact-finding.

- Property condition assessment and inspection: A professional inspection identifies any potential issues, avoiding costly repairs or renovations.

- Title search and legal review: A comprehensive title search verifies ownership and identifies any encumbrances on the property.

- Market research and comparative analysis: Thorough market research ensures the property's value aligns with market trends and comparable properties.

Conclusion

Luxury real estate continues to be a favored safe haven for the ultra-wealthy seeking stability and growth amidst market volatility. By implementing diversification strategies, conducting thorough due diligence, and seeking expert advice, high-net-worth individuals can effectively navigate market fluctuations and leverage luxury real estate for long-term wealth preservation and appreciation. Contact a reputable luxury real estate specialist today to explore your investment opportunities in luxury real estate and build a secure financial future.

Featured Posts

-

Ftc Challenges Microsofts Activision Blizzard Buyout A Legal Battle

May 17, 2025

Ftc Challenges Microsofts Activision Blizzard Buyout A Legal Battle

May 17, 2025 -

Diddy Trial Update Key Testimony From Cassie Ventura

May 17, 2025

Diddy Trial Update Key Testimony From Cassie Ventura

May 17, 2025 -

Mariners Giants Injury News April 4 6 Series Lineup Concerns

May 17, 2025

Mariners Giants Injury News April 4 6 Series Lineup Concerns

May 17, 2025 -

Kendrick Perkins Wants Jalen Brunson To End His Podcast

May 17, 2025

Kendrick Perkins Wants Jalen Brunson To End His Podcast

May 17, 2025 -

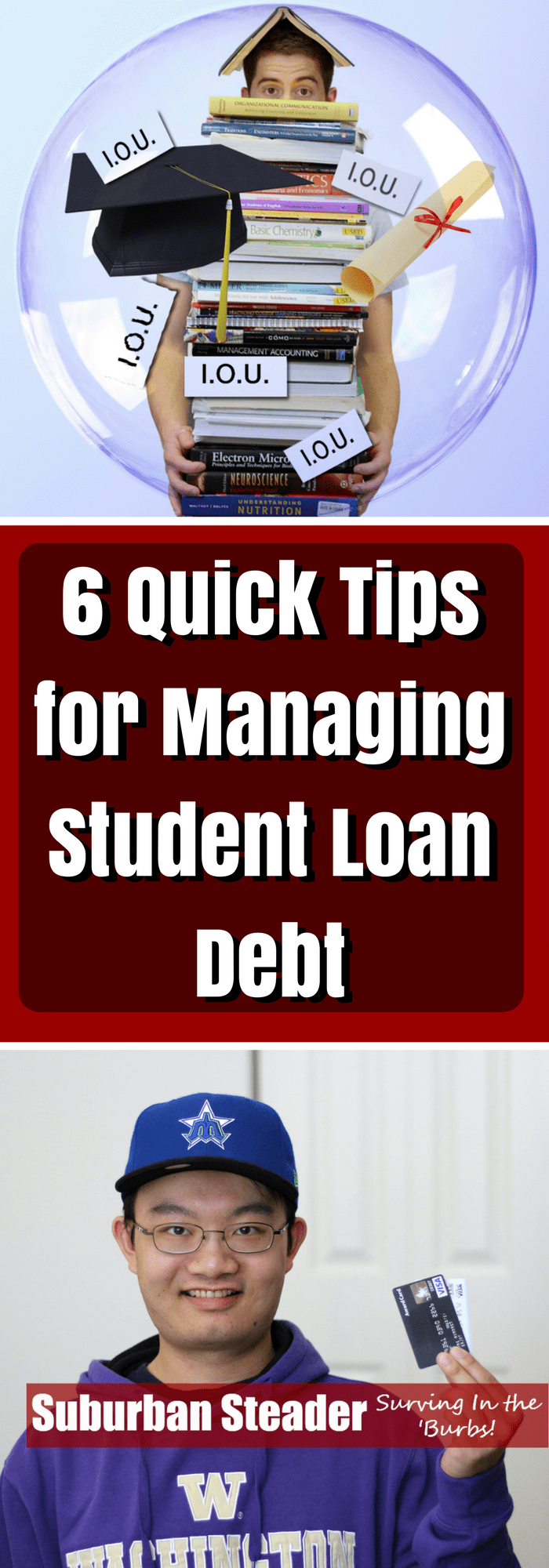

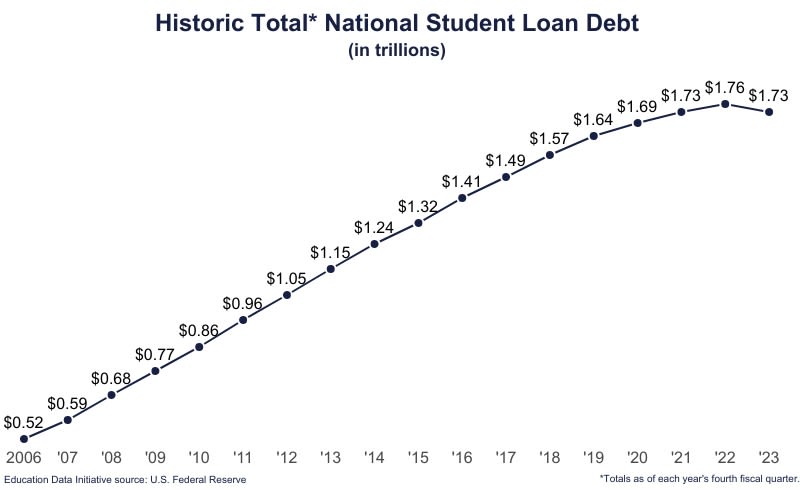

Student Loan Debt A Financial Planner Offers Expert Advice

May 17, 2025

Student Loan Debt A Financial Planner Offers Expert Advice

May 17, 2025

Latest Posts

-

Reduce Your Student Loan Burden Advice From A Financial Planner

May 17, 2025

Reduce Your Student Loan Burden Advice From A Financial Planner

May 17, 2025 -

Navigating Student Loans A Financial Planners Perspective

May 17, 2025

Navigating Student Loans A Financial Planners Perspective

May 17, 2025 -

Post Game 4 Outrage Pistons Slam Referees Over Missed Foul Call

May 17, 2025

Post Game 4 Outrage Pistons Slam Referees Over Missed Foul Call

May 17, 2025 -

Controversial Foul Call Pistons Bitter Game 4 Defeat

May 17, 2025

Controversial Foul Call Pistons Bitter Game 4 Defeat

May 17, 2025 -

Student Loan Debt A Financial Planner Offers Expert Advice

May 17, 2025

Student Loan Debt A Financial Planner Offers Expert Advice

May 17, 2025