Navigating Student Loans: A Financial Planner's Perspective

Table of Contents

Understanding Your Student Loan Landscape

Before tackling repayment, it's vital to understand the specifics of your student loan debt.

Types of Student Loans (Federal vs. Private)

- Federal Student Loans: These loans are offered by the U.S. government and often come with more borrower protections. They typically have lower interest rates than private loans and offer various repayment plans, including income-driven repayment (IDR) plans and loan forgiveness programs like Public Service Loan Forgiveness (PSLF). Federal student loan interest rates are set by the government and can vary.

- Private Student Loans: These loans are offered by banks and credit unions. They often have higher interest rates and fewer borrower protections than federal loans. Repayment options are generally less flexible, and government benefits like income-driven repayment and loan forgiveness are not usually available. Interest rates for private student loans are determined by the lender and your creditworthiness.

Understanding the differences between federal student loans and private student loans, including interest rates and repayment plans, is the first step in navigating student loans. The availability of loan forgiveness and income-driven repayment options significantly impacts your long-term repayment strategy.

Consolidating Your Student Loans

- Pros: Simplifies repayment by combining multiple loans into one, potentially reducing monthly payments and streamlining the process.

- Cons: May result in a higher overall interest rate over the life of the loan, depending on your individual circumstances and the type of consolidation you choose. Some consolidation options may not offer the same benefits or protections as original federal loans. Careful consideration of the terms is crucial before consolidating.

Loan consolidation and student loan consolidation can be a useful tool, but it's crucial to understand the potential implications on your interest rate reduction. Loan refinancing is a similar process, but it's important to research and compare options to ensure you choose the best strategy for your situation. Eligibility requirements vary based on the type of loan and lender.

Assessing Your Loan Debt

Before developing a repayment strategy, you must thoroughly assess your debt.

- Calculate your total debt: Add up the principal balance of all your loans.

- Understand your interest rates: Note the interest rate for each loan, as this significantly impacts the total cost of borrowing.

- Determine your monthly payments: Use a student loan calculator to determine your current monthly payment on each loan and after any consolidation or refinancing. Many free student loan calculators are available online. Understanding loan amortization is essential to grasp the impact of interest payments over time.

Use online resources to calculate your total debt, understand your interest calculation, and determine your monthly payment. Tools like student loan calculators can help you visualize your repayment journey.

Developing a Student Loan Repayment Strategy

Creating a sound strategy is crucial for successful student loan repayment.

Creating a Realistic Budget

- Track expenses: Monitor your income and expenses to understand where your money goes. Many budgeting apps can help.

- Prioritize debt repayment: Allocate a portion of your income towards debt repayment, based on your financial situation.

- Adjust your lifestyle: Make necessary adjustments to your spending habits to free up more funds for loan repayments.

Budgeting is essential for effective debt repayment. Accurately tracking expenses and creating a realistic debt repayment plan allows you to make informed financial decisions. Effective financial planning requires honesty and commitment. Accurate income and expense tracking is the foundation of a solid financial plan.

Choosing a Repayment Plan

Federal loans offer several repayment plans:

- Standard Repayment: Fixed monthly payments over a 10-year period.

- Extended Repayment: Longer repayment period (up to 25 years), resulting in lower monthly payments but higher overall interest.

- Income-Driven Repayment (IDR) Plans: Monthly payments based on your income and family size. These plans can lead to loan forgiveness after a specified period.

Understanding the repayment timeline and the implications of each plan on the total amount paid is critical. Income-driven repayment is a valuable option for those with lower incomes, potentially leading to loan forgiveness programs.

Exploring Loan Forgiveness Programs

Several programs offer potential loan forgiveness, but eligibility requirements are stringent.

- Public Service Loan Forgiveness (PSLF): Forgives remaining debt after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization.

- Teacher Loan Forgiveness: Forgives a portion of federal student loans for teachers who meet specific requirements.

Understanding the intricacies of loan forgiveness, PSLF, and Teacher Loan Forgiveness is vital. Know the eligibility requirements and the limitations before relying on these programs for complete loan repayment assistance.

Seeking Professional Guidance for Student Loan Management

While you can navigate student loans independently, professional guidance can be invaluable.

The Value of a Financial Advisor

A financial advisor or financial planner can:

- Create a personalized repayment plan tailored to your circumstances.

- Help you negotiate with lenders to potentially lower interest rates or modify repayment terms.

- Explore alternative debt management options.

A student loan expert can provide personalized guidance and support, leading to more effective debt management.

Finding Reputable Resources

- National Foundation for Credit Counseling (NFCC): Provides credit counseling and debt management services.

- U.S. Department of Education: Offers information on federal student loans and repayment options.

Utilize reliable student loan resources and seek information on financial literacy to make well-informed decisions. Debt management resources like credit counseling services are also valuable.

Conclusion: Mastering the Art of Navigating Student Loans

Successfully navigating student loans involves understanding your loan types, creating a strategic repayment plan, and seeking professional help when needed. Proactive management is key to minimizing debt and achieving financial freedom. Don't let student loan debt overwhelm you. Start navigating your student loans effectively today by creating a budget, exploring repayment options, and consulting a financial planner. Take control and build a path towards a brighter, debt-free financial future.

Featured Posts

-

Knicks Mitchell Robinson Injury An Update After Back To Back Losses

May 17, 2025

Knicks Mitchell Robinson Injury An Update After Back To Back Losses

May 17, 2025 -

Knicks Vs Celtics Feb 23 Josh Hart Injury Report And Game Time Decision

May 17, 2025

Knicks Vs Celtics Feb 23 Josh Hart Injury Report And Game Time Decision

May 17, 2025 -

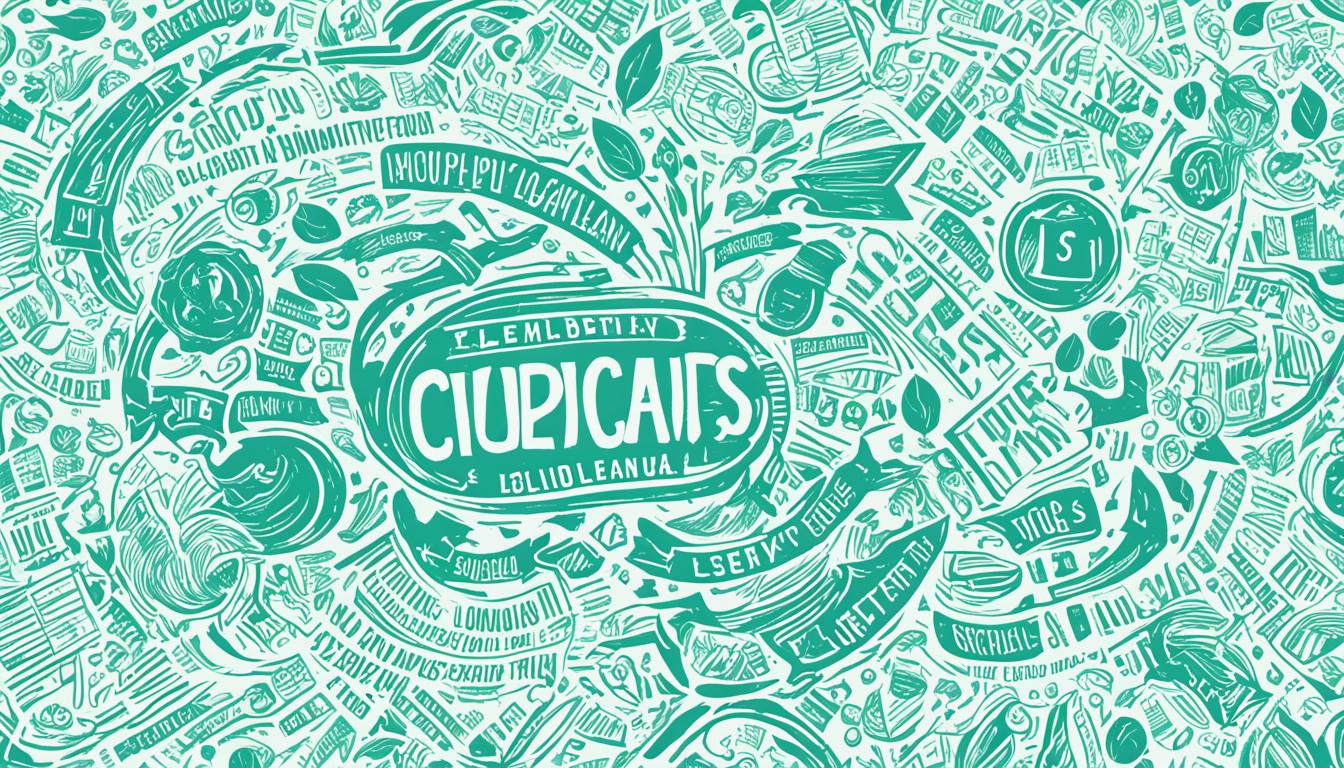

Shifting Sands How Us Tariffs Benefit Canadian Honda Exports

May 17, 2025

Shifting Sands How Us Tariffs Benefit Canadian Honda Exports

May 17, 2025 -

Severances Lumon Industries A Look At The Apple Comparison Made By Ben Stiller

May 17, 2025

Severances Lumon Industries A Look At The Apple Comparison Made By Ben Stiller

May 17, 2025 -

1 4 112

May 17, 2025

1 4 112

May 17, 2025

Latest Posts

-

Laporan Keuangan Jenis Pentingnya Dan Manfaat Untuk Bisnis Anda

May 17, 2025

Laporan Keuangan Jenis Pentingnya Dan Manfaat Untuk Bisnis Anda

May 17, 2025 -

1 4 112

May 17, 2025

1 4 112

May 17, 2025 -

112

May 17, 2025

112

May 17, 2025 -

40

May 17, 2025

40

May 17, 2025 -

13 Analysts Rate Principal Financial Group Nasdaq Pfg What Investors Should Know

May 17, 2025

13 Analysts Rate Principal Financial Group Nasdaq Pfg What Investors Should Know

May 17, 2025