Reduce Your Student Loan Burden: Advice From A Financial Planner

Table of Contents

Understanding Your Student Loan Situation

Before you can effectively reduce your student loan debt, you need a clear understanding of your current situation. This involves assessing your total debt and exploring available repayment plans.

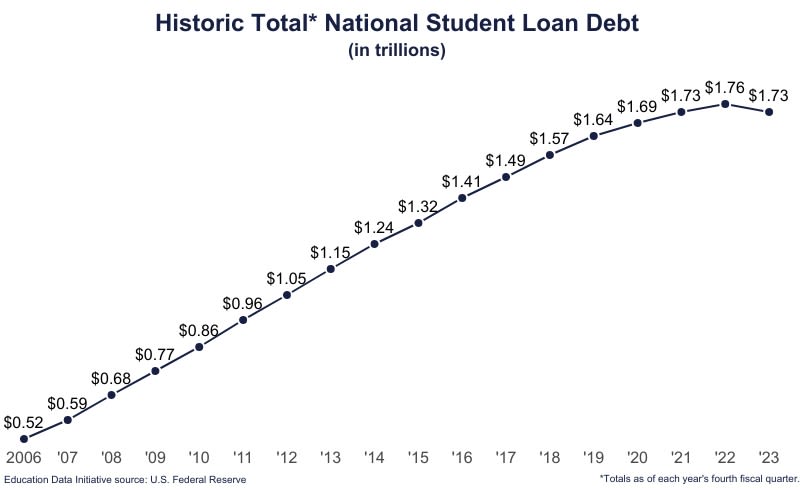

Assessing Your Total Debt

The first step is to get a complete picture of your student loan debt. This means calculating the principal balance, interest rates, and repayment terms for all your loans – both federal and private. Use online loan calculators or your loan statements to gather this information.

- Create a spreadsheet: This will help you organize and track each individual loan, making it easier to manage and monitor your progress. Include details like lender, loan type, interest rate, minimum payment, and outstanding balance.

- Identify loan types: Knowing whether your loans are subsidized, unsubsidized, or private is crucial. Subsidized federal loans, for example, don't accrue interest while you're in school (under certain conditions), while unsubsidized and private loans do. This impacts your repayment strategy.

- Determine your total monthly payment and overall debt: Add up all your monthly payments to understand your total student loan burden. This figure provides a clear picture of your financial commitment.

Exploring Repayment Plans

Federal student loans offer a variety of repayment plans, each with its own terms and conditions. Carefully research which plan best aligns with your current income and long-term financial goals.

- Standard Repayment: This plan typically involves fixed monthly payments over 10 years. It's the most straightforward option but can result in higher monthly payments.

- Extended Repayment: This plan stretches your repayment period, leading to lower monthly payments but potentially higher total interest paid over the life of the loan.

- Income-Driven Repayment (IDR) Plans: These plans, including ICR, PAYE, REPAYE, and IBR, base your monthly payments on your income and family size. They can significantly lower your monthly payments, but they often extend the repayment period.

- Deferment and Forbearance: These options provide temporary pauses in your payments. However, interest usually continues to accrue during deferment and forbearance (except for subsidized federal loans during deferment), potentially increasing your overall loan balance. Use these options cautiously and only when absolutely necessary.

Strategies to Reduce Your Student Loan Burden

Once you understand your student loan situation, you can implement effective strategies to reduce your burden and accelerate your path to financial freedom.

Income-Based Repayment (IBR) Optimization

If you qualify for an IDR plan, maximize its benefits. Ensure your income and family size are accurately reported to your loan servicer.

- Regularly update your income information: Changes in your income can affect your monthly payments. Keep your loan servicer updated to ensure you're receiving the correct payment amount.

- Explore legal options for reducing taxable income: While not directly impacting your loan amount, lowering your taxable income can improve your eligibility for lower payments under IDR plans. Consult a tax professional for advice.

- Understand long-term implications and potential forgiveness: Be aware that IDR plans often extend repayment periods and may lead to loan forgiveness after a certain number of years. Understand the implications for your taxes.

Debt Consolidation and Refinancing

Consolidating multiple loans into one can simplify repayment and potentially lower your interest rate. Refinancing involves replacing your existing loans with a new loan from a different lender, often at a better interest rate.

- Compare interest rates from multiple lenders: Shop around for the best rates and terms before making a decision.

- Factor in fees: Some lenders charge fees for consolidation or refinancing. Consider these fees when comparing options.

- Consider your credit score: A higher credit score often qualifies you for more favorable interest rates.

Accelerated Repayment

Even small extra payments can dramatically reduce the total interest you pay and shorten the repayment period.

- Make extra payments whenever possible: Even an extra $50-$100 per month can make a significant difference over time.

- Set up automatic payments: This ensures consistent payments and helps you stay on track.

- Utilize bonuses and tax refunds: Treat these as opportunities to make larger lump-sum payments towards your principal balance.

Budgeting and Financial Planning

Create a detailed budget to identify areas for expense reduction and allocate more funds toward student loan repayment.

- Track income and expenses: Use budgeting apps or spreadsheets to monitor your spending habits.

- Identify non-essential expenses: Cut back on unnecessary spending to free up more money for loan repayment.

- Build an emergency fund: This will prevent you from having to take on additional debt in case of unexpected expenses.

Seeking Professional Help

Navigating student loan debt can be challenging. Don't hesitate to seek professional guidance.

Consulting a Financial Planner

A financial planner can provide personalized advice, create a comprehensive repayment strategy, and help you navigate complex financial situations.

- Find a fee-only financial planner: This avoids potential conflicts of interest.

- Schedule a consultation: Discuss your specific circumstances and goals.

- Ask about their experience: Ensure they have experience working with student loan debt management.

Utilizing Student Loan Counseling Services

Nonprofit credit counseling agencies offer free or low-cost advice and support for managing student loans. They can provide valuable guidance and resources.

Conclusion

Reducing your student loan burden requires a proactive approach, strategic planning, and potentially professional guidance. By understanding your loan situation, exploring repayment options, and implementing effective strategies, you can significantly reduce financial stress and work toward a debt-free future. Don't hesitate to seek professional help from a financial planner or credit counselor to create a personalized plan. Take control of your student loan debt today and start your journey toward reducing your student loan burden!

Featured Posts

-

4 Cursos Com Nota Maxima Do Mec No Vale Do Nome Do Vale Veja Quais Sao

May 17, 2025

4 Cursos Com Nota Maxima Do Mec No Vale Do Nome Do Vale Veja Quais Sao

May 17, 2025 -

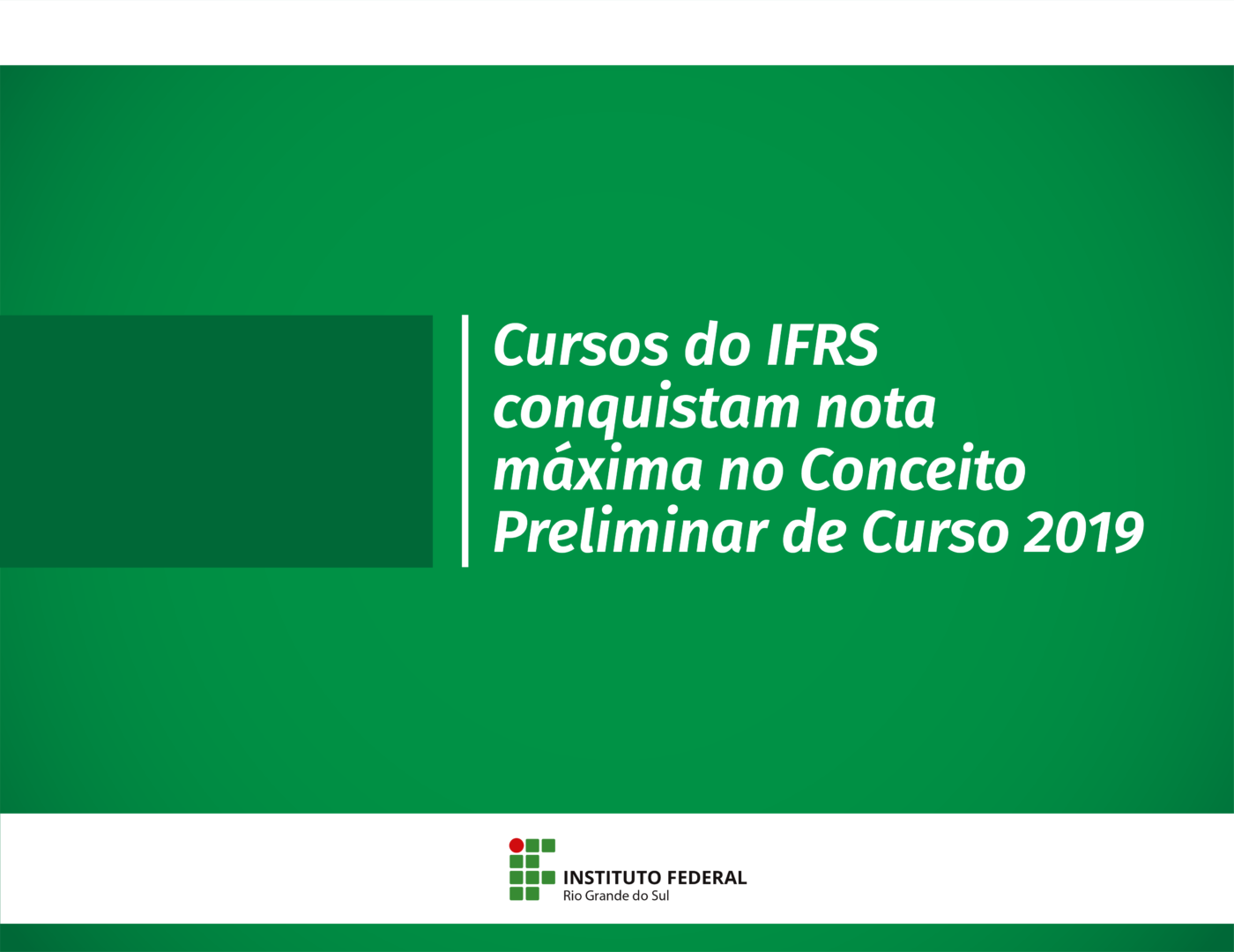

High Stock Market Valuations Bof As Reasons For Investor Calm

May 17, 2025

High Stock Market Valuations Bof As Reasons For Investor Calm

May 17, 2025 -

The Undervalued Asset How Middle Managers Contribute To Business Growth And Employee Wellbeing

May 17, 2025

The Undervalued Asset How Middle Managers Contribute To Business Growth And Employee Wellbeing

May 17, 2025 -

High Salary Tough Job Market Practical Advice For Successful Job Searching

May 17, 2025

High Salary Tough Job Market Practical Advice For Successful Job Searching

May 17, 2025 -

The Troubling Trend Of Wildfire Betting The Los Angeles Case

May 17, 2025

The Troubling Trend Of Wildfire Betting The Los Angeles Case

May 17, 2025

Latest Posts

-

Analiza Trzista Nekretnina Popularne Destinacije Za Srbe

May 17, 2025

Analiza Trzista Nekretnina Popularne Destinacije Za Srbe

May 17, 2025 -

Razvitie Biznesa V Usloviyakh Vysokoy Konkurentsii Industrialnykh Parkov

May 17, 2025

Razvitie Biznesa V Usloviyakh Vysokoy Konkurentsii Industrialnykh Parkov

May 17, 2025 -

Trendovi Na Trzistu Nekretnina Srbi I Kupovina Stanova U Inostranstvu

May 17, 2025

Trendovi Na Trzistu Nekretnina Srbi I Kupovina Stanova U Inostranstvu

May 17, 2025 -

Industrialnye Parki Strategii Dlya Dostizheniya Uspekha V Usloviyakh Vysokoy Konkurentsii

May 17, 2025

Industrialnye Parki Strategii Dlya Dostizheniya Uspekha V Usloviyakh Vysokoy Konkurentsii

May 17, 2025 -

Stan U Inostranstvu Vodic Za Srbe Koji Zele Da Kupe Nekretninu

May 17, 2025

Stan U Inostranstvu Vodic Za Srbe Koji Zele Da Kupe Nekretninu

May 17, 2025