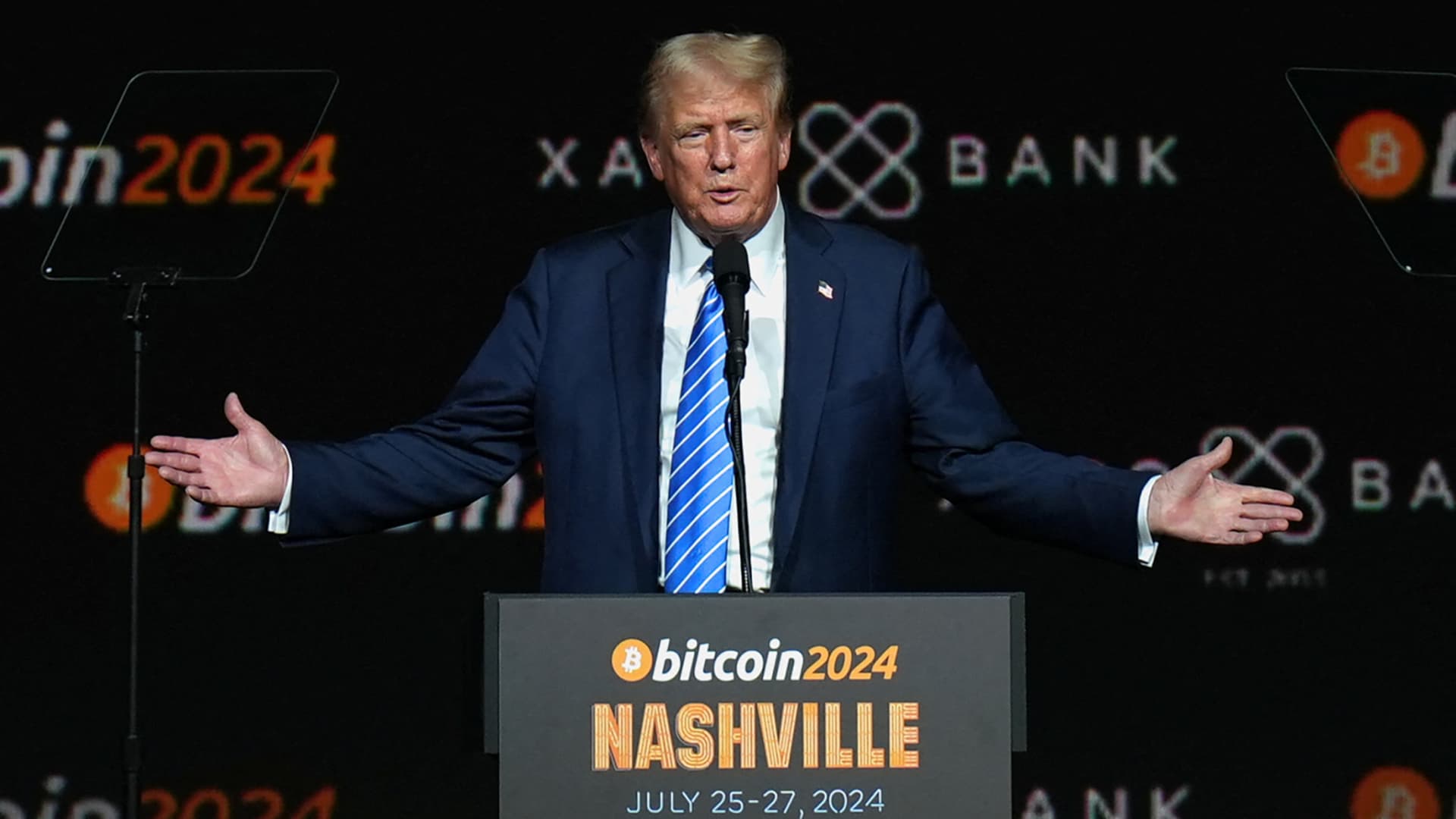

The Trump Presidency And The Rise Of His Crypto Holdings

Table of Contents

Trump's Public Stance on Cryptocurrency

Limited Public Statements: During his presidency, Donald Trump offered remarkably little public commentary on cryptocurrencies like Bitcoin, Ethereum, or other digital assets. He rarely, if ever, directly endorsed or condemned them in official statements or press conferences.

- Examples of Silence: A thorough search of his official statements, tweets, and press briefings reveals a surprising absence of direct engagement with the topic. This contrasts sharply with his frequent pronouncements on other economic issues.

- Reasons for Silence: Several reasons might explain this lack of engagement. Perhaps he lacked a deep understanding of the technology, or perhaps his advisors steered him away from publicly commenting on such a volatile and rapidly evolving market. Alternatively, the absence of comment could simply reflect his prioritization of other pressing political matters.

Indirect Influence through Regulatory Actions: While Trump himself remained largely silent on crypto, his administration’s actions indirectly influenced the cryptocurrency market. Regulatory decisions and policies implemented during his term had significant ramifications for the crypto industry.

- Financial Regulations: Various financial regulations introduced during his tenure, focusing on areas like anti-money laundering (AML) and Know Your Customer (KYC) compliance, had a ripple effect on the crypto space. These regulations often increased scrutiny on cryptocurrency exchanges and businesses dealing with digital assets.

- Impact on Adoption and Sentiment: The overall regulatory environment created during the Trump presidency, while not explicitly targeting cryptocurrencies, shaped investor sentiment and, to some extent, influenced the rate of crypto adoption in the United States.

Speculation on Trump's Personal Crypto Investments

The Lack of Transparency: A significant obstacle to understanding Trump’s potential involvement in the cryptocurrency market is the lack of transparency surrounding his personal finances. The notoriously opaque nature of his financial dealings makes it exceptionally challenging to verify any claims about his crypto holdings.

- Verification Challenges: Unlike publicly traded stocks, cryptocurrency transactions are often pseudonymous. Tracing ownership with absolute certainty is extremely difficult, barring explicit disclosures from Trump himself or leaks from reputable sources.

- Financial Disclosure Limitations: While Trump was required to file financial disclosure forms, these documents have inherent limitations in revealing the full extent of his assets. They often don't require detailed breakdowns of specific holdings within complex investment vehicles, making it difficult to pinpoint cryptocurrency ownership.

Potential Scenarios and Motivations: Given the lack of concrete evidence, speculation remains rife about Trump's potential crypto investments. Several hypothetical scenarios and motivations can be explored.

- Investment Motivations: If Trump did invest in crypto, potential motivations could include diversification of his investment portfolio beyond traditional assets or a belief in the long-term growth potential of this emerging asset class.

- Hypothetical Investment Strategies: His potential strategies might have ranged from direct ownership of various cryptocurrencies to indirect investments through hedge funds or other investment vehicles specializing in digital assets.

The Impact of Trump's Presidency on Crypto Regulations

The Regulatory Landscape During His Term: The Trump administration’s approach to cryptocurrency regulation was characterized by a blend of cautious observation and limited direct intervention. While no major, comprehensive crypto-specific legislation was enacted, several regulatory actions indirectly impacted the sector.

- Significant Regulatory Developments: The focus remained largely on combating illicit activities like money laundering and terrorist financing, often leading to increased regulatory scrutiny on cryptocurrency exchanges and businesses.

- Impact on Investor Confidence: This regulatory environment, while not overtly hostile, fostered uncertainty among some investors, affecting market sentiment and shaping investment decisions.

Comparison with Post-Trump Regulatory Approaches: Comparing the regulatory landscape during the Trump presidency with subsequent administrations reveals notable differences in approaches to cryptocurrency. Post-Trump, some jurisdictions have taken a more proactive approach to establishing clearer regulatory frameworks for cryptocurrencies.

- Key Differences: Subsequent administrations have, in some instances, shown a greater inclination towards establishing comprehensive regulatory frameworks that aim to balance innovation with consumer protection.

- Shifts in Regulatory Focus: The focus has shifted from primarily addressing illicit activities to also encompassing the broader regulatory landscape for cryptocurrencies, including areas such as stablecoins, decentralized finance (DeFi), and non-fungible tokens (NFTs).

Conclusion

The relationship between the Trump presidency and the potential rise of his crypto holdings remains largely shrouded in mystery. The lack of definitive information highlights the importance of transparency in the financial dealings of public figures. While speculation continues, the absence of concrete evidence underscores the need for more transparency in financial disclosures and clearer regulatory frameworks surrounding digital assets.

While concrete evidence remains elusive, the potential links between the Trump presidency and his crypto holdings warrant further investigation. Continued research into the financial disclosures of public officials and the evolving regulatory landscape surrounding cryptocurrencies is essential for both transparency and responsible investment. Continue exploring this fascinating relationship—stay informed and engage in thoughtful discussions around the topic of Trump Crypto Holdings.

Featured Posts

-

Anthony Edwards And Ayesha Howard Custody Battle Resolution

May 07, 2025

Anthony Edwards And Ayesha Howard Custody Battle Resolution

May 07, 2025 -

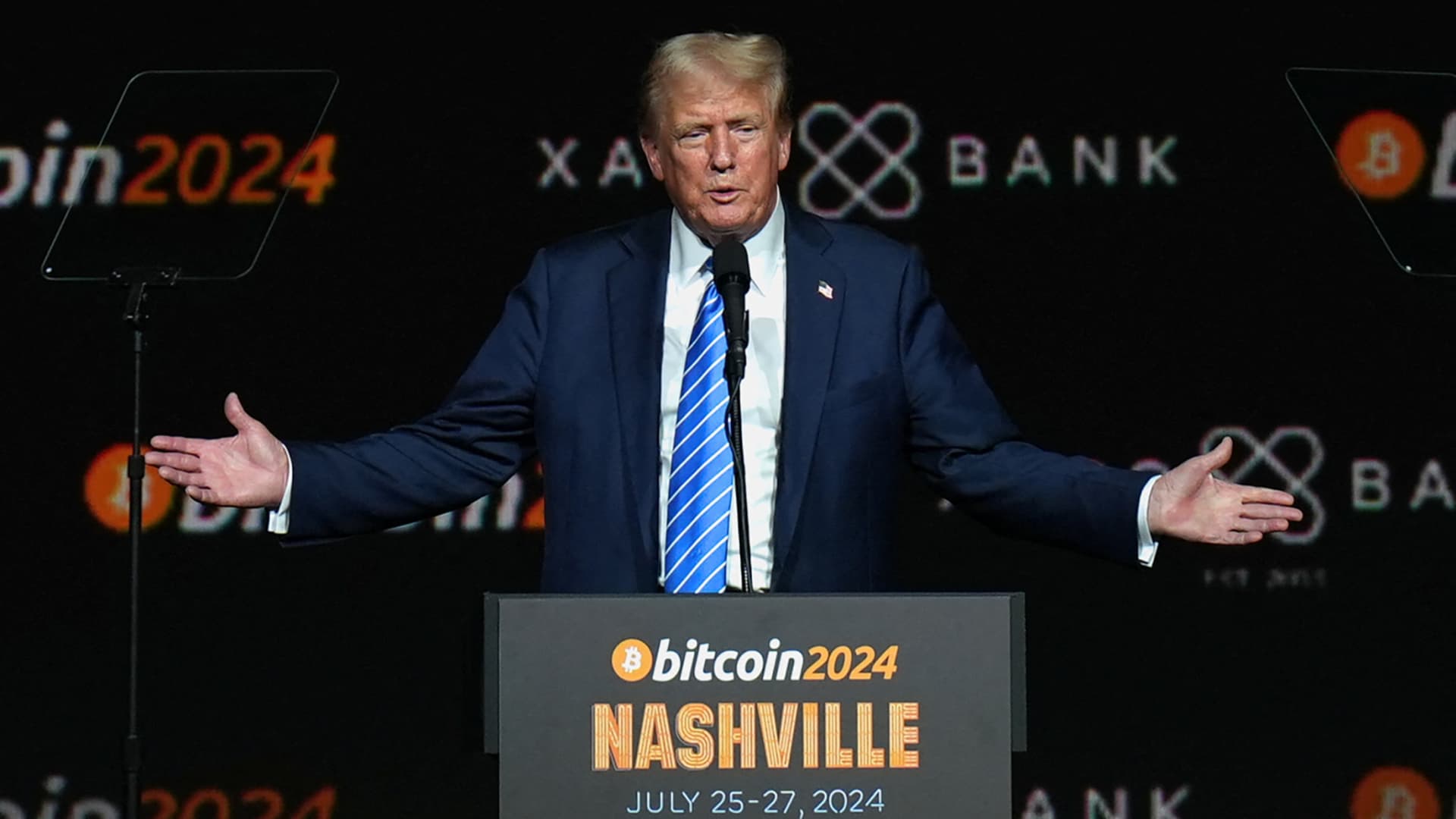

Macrons Plan For A European Streaming Giant Progress And Challenges

May 07, 2025

Macrons Plan For A European Streaming Giant Progress And Challenges

May 07, 2025 -

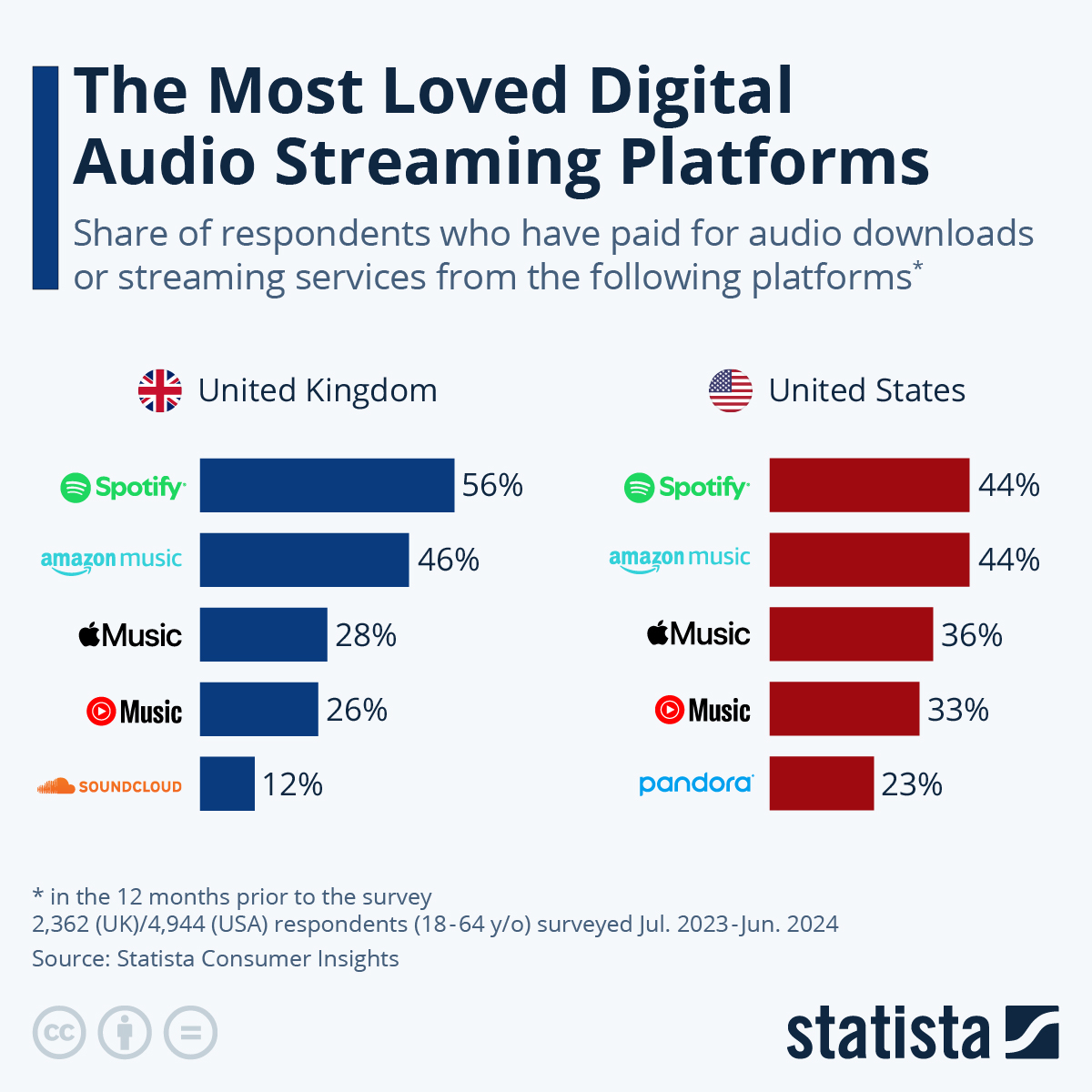

Las Vegas John Wick Experience Embody The Baba Yaga

May 07, 2025

Las Vegas John Wick Experience Embody The Baba Yaga

May 07, 2025 -

Mnenieto Na Ed Shiyrn Za Riana

May 07, 2025

Mnenieto Na Ed Shiyrn Za Riana

May 07, 2025 -

Podcast Onetu I Newsweeka Stan Wyjatkowy Najwazniejsze Informacje

May 07, 2025

Podcast Onetu I Newsweeka Stan Wyjatkowy Najwazniejsze Informacje

May 07, 2025

Latest Posts

-

Bitcoin Madenciliginin Sonu Yaklasiyor Mu

May 08, 2025

Bitcoin Madenciliginin Sonu Yaklasiyor Mu

May 08, 2025 -

Bitcoin Mining Profits Surge Understanding This Weeks Increase

May 08, 2025

Bitcoin Mining Profits Surge Understanding This Weeks Increase

May 08, 2025 -

Why Bitcoin Miner Revenue Soared This Week

May 08, 2025

Why Bitcoin Miner Revenue Soared This Week

May 08, 2025 -

Ripples Xrp Three Factors Suggesting A Potential Price Surge

May 08, 2025

Ripples Xrp Three Factors Suggesting A Potential Price Surge

May 08, 2025 -

Understanding The Recent Xrp Rally Trumps Involvement And Future Predictions

May 08, 2025

Understanding The Recent Xrp Rally Trumps Involvement And Future Predictions

May 08, 2025