Why Bitcoin Miner Revenue Soared This Week

Table of Contents

The Role of Bitcoin's Price in Miner Revenue

Bitcoin Price Increase and its Direct Impact

The most significant factor contributing to the soaring Bitcoin miner revenue is the recent increase in Bitcoin's price. A higher Bitcoin price directly translates into higher revenue for miners. This is a fundamental principle of Bitcoin mining: miners receive Bitcoin as a reward for successfully solving complex cryptographic puzzles.

- Bitcoin's price increased by 15% this week, reaching a high of $[Insert Current Price].

- This price increase directly boosted miner revenue. If a miner previously received 6.25 BTC per block, the revenue increase is substantial.

- Example: If the price was $[Previous Price] before the surge, a 6.25 BTC reward was worth $[Previous Price * 6.25]. Now, at $[Current Price], that same reward is worth $[Current Price * 6.25], a significant difference.

Market Sentiment and Investor Confidence

Positive market sentiment and increased investor confidence play a crucial role in driving Bitcoin's price upwards. When investors are optimistic about Bitcoin's future, they are more likely to buy, increasing demand and pushing the price higher.

- Recent positive news regarding Bitcoin ETF applications fueled investor confidence. This increased buying pressure contributed to the price surge.

- Positive market sentiment creates a self-fulfilling prophecy. As the price rises, more investors jump on the bandwagon, further increasing demand.

- Trading volume increased by [Percentage]% this week, indicating heightened investor activity and reinforcing the positive market sentiment.

Bitcoin Mining Difficulty Adjustment and its Effect

Understanding Bitcoin's Difficulty Adjustment Mechanism

Bitcoin's network automatically adjusts its mining difficulty approximately every two weeks to maintain a consistent block generation time of around 10 minutes. This mechanism is vital for the network's stability and security.

- Bitcoin mining difficulty refers to the computational difficulty of solving the cryptographic puzzles required to mine a block.

- Difficulty adjustments affect miner revenue. A decrease in difficulty makes mining easier, increasing the likelihood of miners finding blocks and earning Bitcoin, while an increase has the opposite effect.

- The recent difficulty adjustment resulted in a [Increase/Decrease] of [Percentage]%, impacting miner profitability.

The Recent Difficulty Adjustment and its Impact on Miner Revenue

The recent difficulty adjustment played a significant, albeit less impactful role compared to the price increase, in shaping Bitcoin miner revenue.

- The difficulty adjustment was a [Increase/Decrease], which [positively/negatively] impacted miner profitability.

- This adjustment [increased/decreased] the average time to mine a block, leading to [higher/lower] revenue per miner.

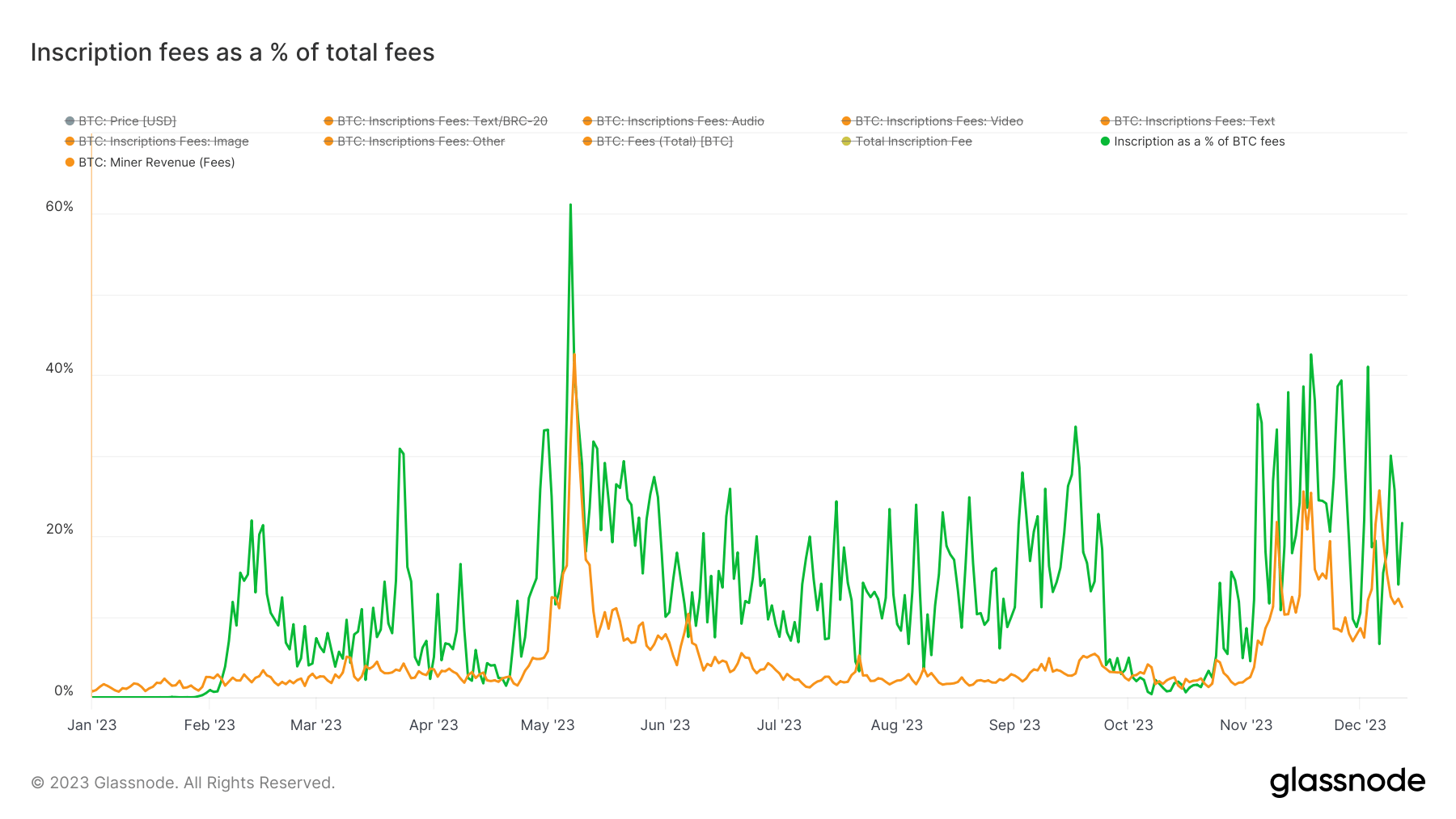

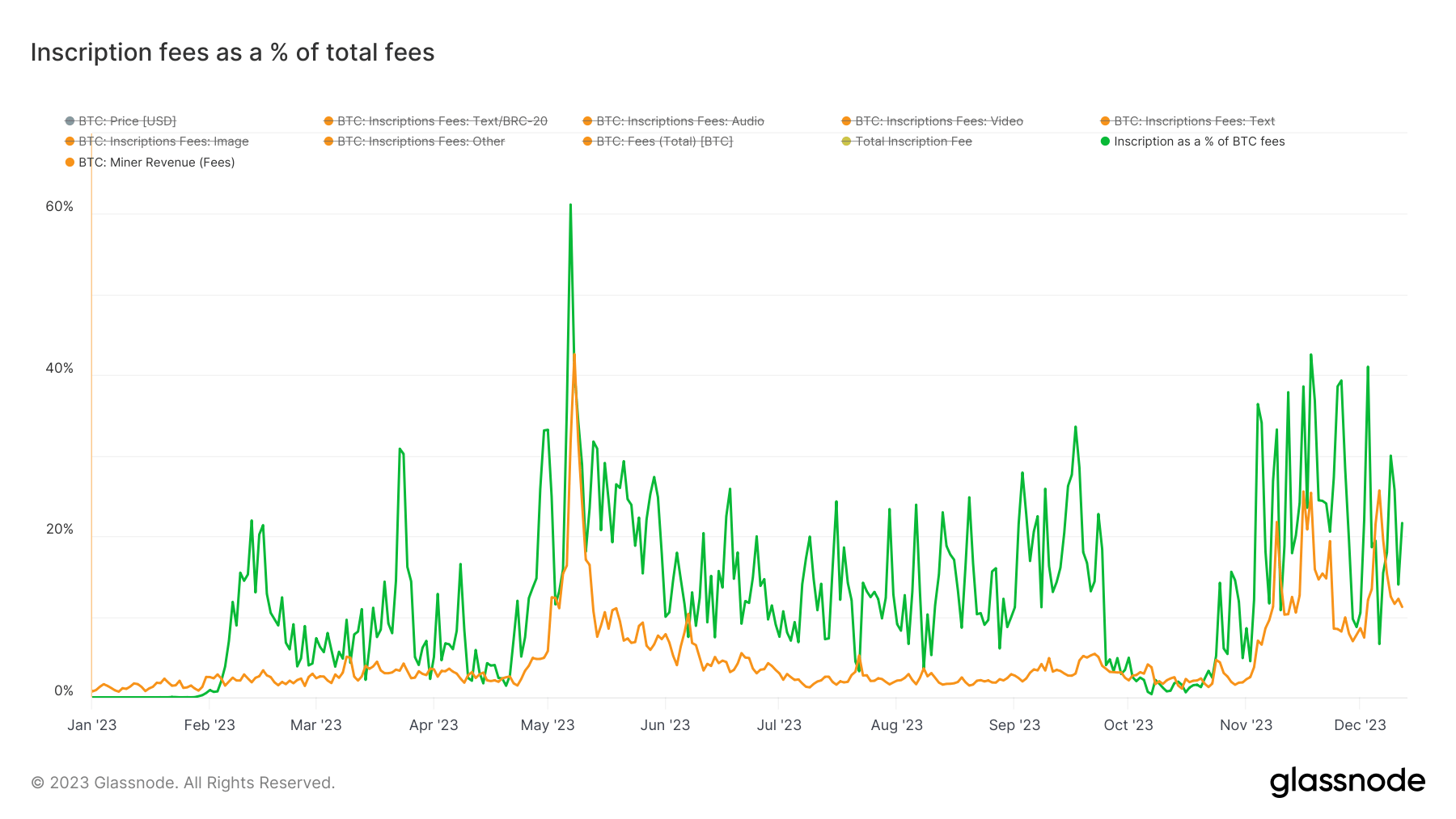

- [Insert chart or data illustrating the impact of the difficulty adjustment on revenue].

Hashrate and its Influence on Bitcoin Miner Revenue

Hashrate Explained

Hashrate is a crucial metric in Bitcoin mining, representing the total computational power dedicated to solving cryptographic puzzles across the network.

- Hashrate measures the processing power of all miners combined. It is expressed in hashes per second (H/s).

- A higher hashrate increases competition for block rewards. More miners mean a lower probability of any individual miner successfully mining a block.

- Hashrate and mining profitability are inversely related. A rapidly increasing hashrate can reduce the individual profitability of miners.

Recent Hashrate Changes and Their Impact

Changes in Bitcoin's hashrate also influenced Bitcoin miner revenue.

- The recent trend shows a [Increase/Decrease] in hashrate, indicating [more/fewer] miners participating in the network.

- This change in hashrate [increased/decreased] the average revenue per miner. The impact was less significant compared to the price surge but still notable.

- The increase/decrease in hashrate can be attributed to [factors such as new miners joining, older miners exiting due to reduced profitability, or changes in energy costs].

Conclusion

The recent surge in Bitcoin miner revenue is primarily attributed to the significant increase in Bitcoin's price. While the difficulty adjustment and hashrate fluctuations also played roles, their impact was secondary to the price surge. Positive market sentiment and increased investor confidence further fueled this price increase, ultimately boosting the profitability of Bitcoin mining. Understanding the factors influencing Bitcoin miner revenue is crucial for anyone interested in the cryptocurrency market. Stay informed about the latest trends in Bitcoin price, mining difficulty, and hashrate to make informed decisions about your Bitcoin investments and potentially increase your own Bitcoin miner revenue.

Featured Posts

-

Made In Pakistan On The World Stage Ahsan Urges Tech Integration For Export Growth

May 08, 2025

Made In Pakistan On The World Stage Ahsan Urges Tech Integration For Export Growth

May 08, 2025 -

Bitcoins 10x Multiplier A Realistic Market Analysis

May 08, 2025

Bitcoins 10x Multiplier A Realistic Market Analysis

May 08, 2025 -

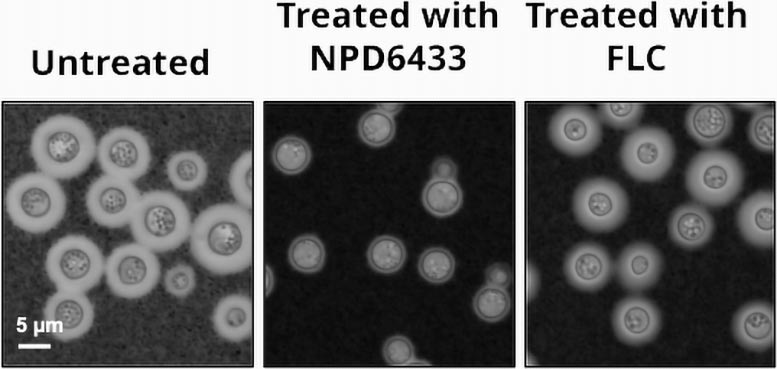

Deadly Fungi And The Urgent Need For New Antifungal Treatments

May 08, 2025

Deadly Fungi And The Urgent Need For New Antifungal Treatments

May 08, 2025 -

Gha Opposes Jhl Privatisation Plan

May 08, 2025

Gha Opposes Jhl Privatisation Plan

May 08, 2025 -

Analyzing The Visual Enhancements Of Assassins Creed Valhalla On The Ps 5 Pro

May 08, 2025

Analyzing The Visual Enhancements Of Assassins Creed Valhalla On The Ps 5 Pro

May 08, 2025