Bitcoin Mining Profits Surge: Understanding This Week's Increase

Table of Contents

The Role of Bitcoin's Price Increase

The most direct correlation to increased Bitcoin mining profits is the price of Bitcoin itself. A higher Bitcoin price translates directly into higher rewards for each block mined. When the price of Bitcoin rises, the revenue generated from mining increases proportionally, making the entire operation significantly more profitable.

[Insert chart/graph here showing Bitcoin price increase and its correlation with mining revenue]

- Higher Bitcoin price means higher rewards per block mined: Each successfully mined block yields a predetermined amount of Bitcoin. A higher Bitcoin price means each block is worth considerably more in fiat currency.

- Increased revenue offsets increased operational costs: While energy costs and hardware maintenance remain constant factors, increased revenue from higher Bitcoin prices can easily offset these expenses, leading to greater profits.

- Price volatility remains a risk factor to consider: While a price increase boosts profitability, the inherent volatility of Bitcoin's price remains a major risk. Sharp price drops can quickly erase profits and even lead to losses.

Changes in Mining Difficulty

Mining difficulty is a crucial factor affecting Bitcoin mining profits. It represents the computational difficulty of solving complex cryptographic puzzles to mine a block. This difficulty adjusts automatically every 2016 blocks (approximately every two weeks) based on the overall network hash rate.

This week, we saw [State whether difficulty increased or decreased and by what percentage]. A [decrease/increase] in mining difficulty directly impacts profitability.

- A decrease in difficulty makes mining more profitable: A lower difficulty means miners require less computational power to solve the puzzles, increasing their chances of successfully mining a block and thus earning rewards.

- Increased hash rate can lead to increased difficulty, potentially negating the price increase's impact: The introduction of new, more powerful mining hardware increases the network's overall hash rate, leading to a subsequent increase in difficulty which can counteract the positive effects of a rising Bitcoin price.

- Analyze the relationship between difficulty adjustment and network security: The automatic difficulty adjustment mechanism is vital for maintaining the security and stability of the Bitcoin network. It ensures that the average block time remains consistent even with fluctuations in the network's hash rate.

Energy Costs and Their Influence

Energy consumption is a significant operational cost in Bitcoin mining. The cost of electricity directly impacts the profitability of mining operations. Regions with lower electricity costs, such as those with access to hydroelectric power or other renewable energy sources, enjoy a significant competitive advantage.

- Lower energy costs directly translate to higher profit margins: A reduction in energy costs directly increases the net profit from mining activities.

- Regions with cheaper energy sources have a competitive advantage: Miners often relocate their operations to areas with lower energy costs to maximize profitability.

- The sustainability of mining operations and the adoption of renewable energy sources are crucial factors: Environmental concerns surrounding Bitcoin mining are increasing, leading to a growing focus on sustainable energy solutions within the industry.

The Impact of New Mining Hardware

Advancements in Application-Specific Integrated Circuit (ASIC) technology play a crucial role in shaping Bitcoin mining profitability. Newer, more efficient ASIC miners offer improved hash rates and lower energy consumption.

- Increased hash rate due to new hardware can impact mining difficulty: The introduction of more efficient mining hardware increases the overall network hash rate, potentially leading to a rise in mining difficulty.

- Higher efficiency translates to lower energy consumption per Bitcoin mined: More efficient ASICs reduce energy costs, directly impacting the profitability of mining operations.

- The cost of acquiring new hardware needs to be considered in profitability calculations: While new hardware enhances efficiency, the upfront investment cost must be factored into the overall profitability assessment.

Future Outlook for Bitcoin Mining Profits

Predicting future Bitcoin mining profits is challenging due to the inherent volatility of the market. However, based on current trends, several factors will likely influence profitability:

- Potential regulatory changes impacting the industry: Government regulations can significantly alter the landscape of Bitcoin mining, potentially impacting profitability.

- Predictions on Bitcoin price fluctuations and their effects on mining revenue: Future Bitcoin price movements remain the single biggest factor influencing mining profits.

- The long-term sustainability of Bitcoin mining in the context of environmental concerns: The industry's commitment to sustainability will play a role in its long-term viability and acceptance.

Conclusion: Bitcoin Mining Profits Surge: Key Takeaways and Next Steps

The recent surge in Bitcoin mining profits is a result of a confluence of factors: a rise in Bitcoin's price, a decrease in mining difficulty, favorable energy costs in some regions, and the continued development of more efficient mining hardware. Understanding these interconnected elements is essential for anyone involved in or considering investment in Bitcoin mining.

Stay ahead of the curve and monitor the latest trends in Bitcoin mining profits to optimize your mining strategy. Understanding the factors affecting Bitcoin mining profits is crucial for success in this dynamic market; continue your research to stay informed.

Featured Posts

-

Improving Crime Control Through Swift And Decisive Directives

May 08, 2025

Improving Crime Control Through Swift And Decisive Directives

May 08, 2025 -

How Glen Powell Achieved Peak Physical Condition For The Running Man

May 08, 2025

How Glen Powell Achieved Peak Physical Condition For The Running Man

May 08, 2025 -

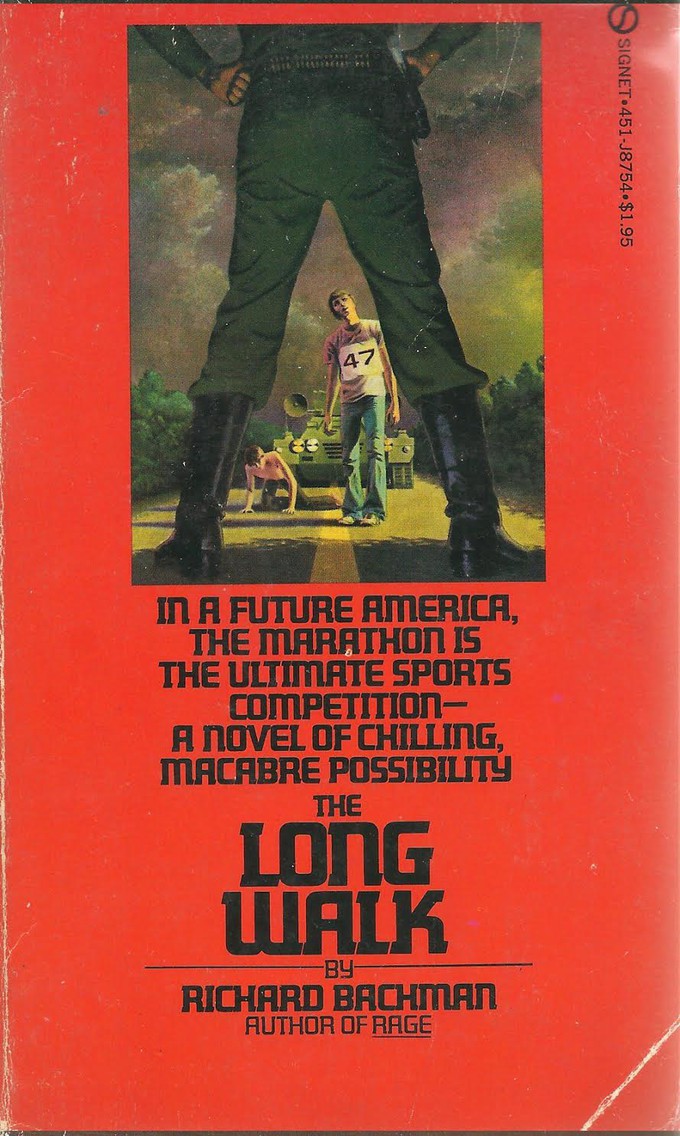

Is The The Long Walk Movie Trailer A Sign Of A Successful Stephen King Adaptation

May 08, 2025

Is The The Long Walk Movie Trailer A Sign Of A Successful Stephen King Adaptation

May 08, 2025 -

Informe Sobre La Situacion Del Club Atletico Central Cordoba Perspectivas Desde El Gigante De Arroyito

May 08, 2025

Informe Sobre La Situacion Del Club Atletico Central Cordoba Perspectivas Desde El Gigante De Arroyito

May 08, 2025 -

Lotto Results Check The Latest Numbers For Lotto Lotto Plus 1 And Lotto Plus 2

May 08, 2025

Lotto Results Check The Latest Numbers For Lotto Lotto Plus 1 And Lotto Plus 2

May 08, 2025