The Impact Of Margin Compression On Westpac (WBC) Profitability

Table of Contents

Understanding Margin Compression in the Banking Sector

Margin compression, in the banking context, refers to the narrowing of a bank's net interest margin (NIM). The NIM is the difference between the interest income a bank earns on loans and the interest it pays on deposits and other borrowings, expressed as a percentage of earning assets. It's a crucial indicator of a bank's profitability. A shrinking NIM means the bank is earning less on its lending activities relative to its funding costs.

Several factors contribute to margin compression:

- Increased competition among banks: Intense competition forces banks to lower lending rates to attract and retain customers, impacting their NIM.

- Low interest rate environment: Periods of low interest rates, while beneficial for borrowers, reduce the income banks generate from lending.

- Pressure on lending rates: Economic downturns or increased regulatory scrutiny can put downward pressure on the rates banks can charge for loans.

- Rising deposit costs: Banks may need to offer higher interest rates on deposits to attract and retain funds, increasing their funding costs.

The Australian banking sector has experienced notable margin compression in recent years, with several banks reporting declining NIMs. For example, [Insert relevant statistic or example about Australian bank NIMs here, citing a reputable source]. This highlights the industry-wide challenge presented by margin compression.

Westpac's (WBC) Exposure to Margin Compression

Westpac (WBC), like other Australian banks, is significantly exposed to margin compression. Its recent financial performance shows a [Insert data on Westpac's NIM, citing source]. This reflects the pressure on lending rates and the rising cost of deposits. Westpac's lending portfolio, heavily weighted towards [Insert details about Westpac's lending portfolio composition], is particularly sensitive to interest rate changes. A rise in interest rates might improve the NIM, but it also carries risks, potentially impacting customer loan repayments and increasing non-performing loans.

To mitigate the effects of margin compression, Westpac is pursuing several strategies:

- Cost-cutting measures: Reducing operational expenses to improve overall profitability.

- Fee income diversification: Expanding revenue streams beyond interest income through fees from services like wealth management and transaction processing.

- Focus on higher-margin products: Shifting towards lending products with higher interest rates and lower risk profiles.

The Impact on Westpac's Profitability and Share Price

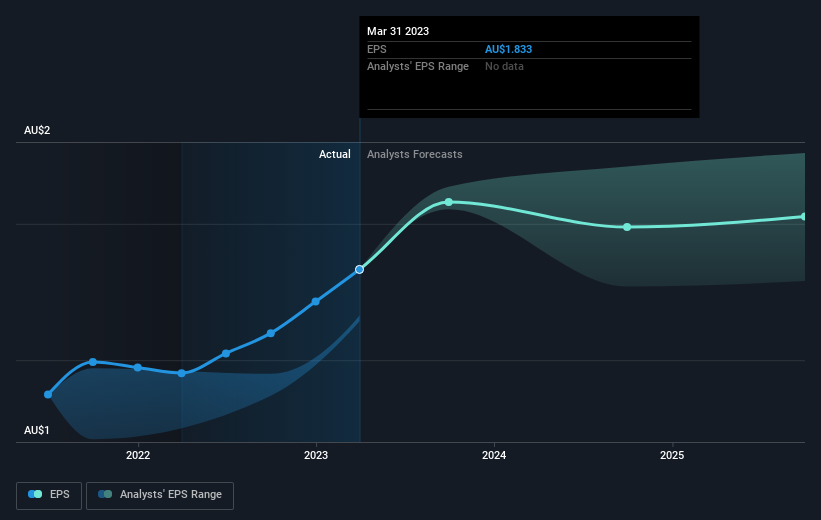

The direct correlation between margin compression and Westpac's profitability is undeniable. A declining NIM directly translates to lower net interest income, impacting the bank's overall earnings. This effect is clearly visible in Westpac's earnings per share (EPS), which has [Insert data on Westpac's EPS, citing source].

[Insert chart or graph here illustrating the relationship between Westpac's NIM and its profitability/share price. Cite the source of the data.]

The reduced profitability, in turn, affects investor confidence and Westpac's share price. Investors react negatively to shrinking NIMs, as they signal decreased future earnings potential.

Future Outlook and Potential Strategies for Westpac

The future outlook for Westpac's NIM depends heavily on the trajectory of interest rates. [Insert analysis of potential future interest rate trends and their likely impact on Westpac's NIM]. The bank needs to proactively address the ongoing challenges posed by margin compression.

Potential strategies for improvement include:

- Innovation in banking products and services: Developing new, higher-margin products and services to cater to evolving customer needs.

- Improved operational efficiency: Streamlining processes and leveraging technology to reduce operational costs.

- Strategic acquisitions or mergers: Expanding market share and capabilities through strategic acquisitions.

- Expansion into new markets: Diversifying geographically to reduce reliance on the Australian market.

Conclusion: Navigating Margin Compression at Westpac (WBC)

Margin compression presents a significant challenge to Westpac's profitability. The factors contributing to this, including increased competition, a fluctuating interest rate environment, and pressure on lending rates, are impacting the bank's net interest margin and, consequently, its earnings per share and share price. While Westpac is employing strategies to mitigate the effects, the future outlook remains dependent on various economic factors. It's crucial for investors and stakeholders to stay informed about Westpac's financial performance and the evolving impact of margin compression on the company and the broader banking sector. For further information on Westpac's financial performance, visit their investor relations website: [Insert link to Westpac's investor relations website]. Continued monitoring of Westpac’s margin compression strategies will be vital for understanding its future trajectory.

Featured Posts

-

How To Watch The Celtics Vs Trail Blazers Game On March 23rd Time And Streaming

May 06, 2025

How To Watch The Celtics Vs Trail Blazers Game On March 23rd Time And Streaming

May 06, 2025 -

Eksport Trotylu Z Polski Skala I Znaczenie Zamowienia

May 06, 2025

Eksport Trotylu Z Polski Skala I Znaczenie Zamowienia

May 06, 2025 -

Chinas Trade Talks With Us Fuel Copper Price Increase

May 06, 2025

Chinas Trade Talks With Us Fuel Copper Price Increase

May 06, 2025 -

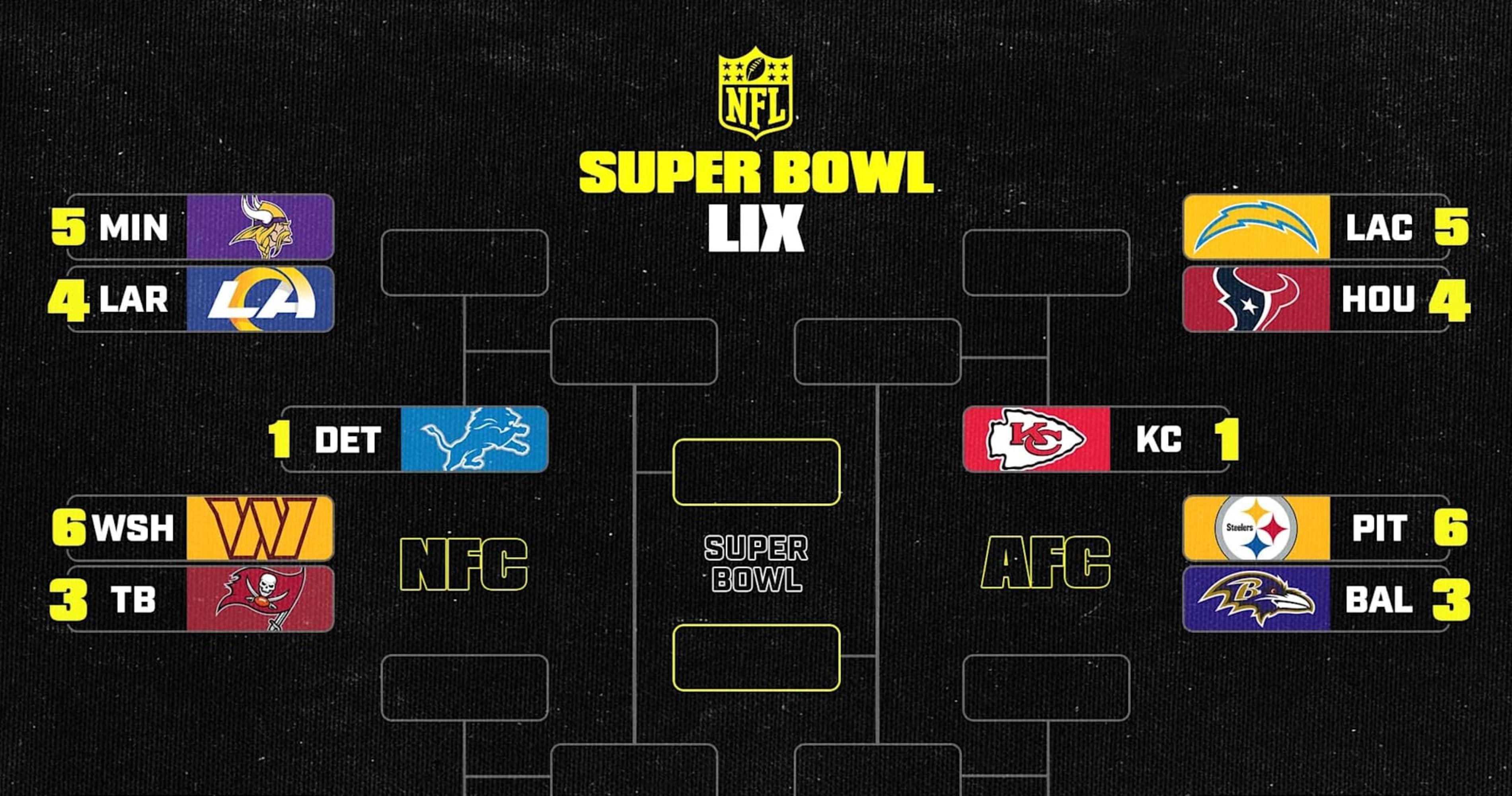

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025 -

Westpac Bank Wbc Reports Reduced Profitability Amidst Margin Pressure

May 06, 2025

Westpac Bank Wbc Reports Reduced Profitability Amidst Margin Pressure

May 06, 2025

Latest Posts

-

Fortnite Season 8 Sabrina Carpenter Takes Center Stage

May 06, 2025

Fortnite Season 8 Sabrina Carpenter Takes Center Stage

May 06, 2025 -

Sabrina Carpenter Fortnite Season 8 Festival Headliner

May 06, 2025

Sabrina Carpenter Fortnite Season 8 Festival Headliner

May 06, 2025 -

Sabrina Carpenters Virtual Fortnite Performance Details And Fan Reactions

May 06, 2025

Sabrina Carpenters Virtual Fortnite Performance Details And Fan Reactions

May 06, 2025 -

Fortnites Next Big Event Sabrina Carpenters Virtual Concert Announced

May 06, 2025

Fortnites Next Big Event Sabrina Carpenters Virtual Concert Announced

May 06, 2025 -

Sabrina Carpenters Fortnite Concert Fans React To Virtual Headline Performance

May 06, 2025

Sabrina Carpenters Fortnite Concert Fans React To Virtual Headline Performance

May 06, 2025