China's Trade Talks With US Fuel Copper Price Increase

Table of Contents

The Impact of US-China Trade Relations on Copper Demand

China's role as a crucial consumer of copper makes it highly susceptible to the effects of US-China trade relations. The ebb and flow of trade tensions directly impacts Chinese demand for this vital metal, influencing the overall copper price increase.

- Increased tariffs lead to reduced Chinese imports, impacting copper demand. Higher tariffs on imported goods, including those containing copper or copper components, make them more expensive for Chinese businesses, thus reducing import volumes and overall copper demand. This decreased demand contributes directly to a slowdown in price increases or even price decreases depending on other market factors.

- Easing of trade tensions boosts Chinese economic activity and copper consumption. When trade tensions ease, Chinese economic activity tends to rebound, leading to increased demand for copper across various sectors. This surge in demand, driven by renewed confidence and investment, can significantly fuel a copper price increase.

- Infrastructure projects in China are heavily reliant on copper, making them sensitive to trade policy. China's ambitious infrastructure projects, including its Belt and Road Initiative, consume vast quantities of copper. Uncertainty or disruptions caused by trade disputes can delay or even halt these projects, significantly impacting China copper demand and consequently the global copper price. The resulting decrease in demand contributes to a slower copper price increase or even a price decrease.

Global Copper Supply Chain Disruptions and Price Volatility

Trade disputes between the US and China don't just affect demand; they also disrupt the global copper supply chain, contributing to price volatility and influencing the copper price increase.

- Tariffs and sanctions can impact the transportation and processing of copper. Restrictions on shipping or processing of copper-related materials can lead to delays, increased costs, and potential shortages, thus affecting the global copper market.

- Uncertainty surrounding trade policy discourages investment in new copper mines and production facilities. The uncertainty inherent in fluctuating trade relations makes it risky for companies to invest in expanding copper production. This lack of investment can lead to future supply shortages, driving up prices.

- Geopolitical risks related to trade create volatility in the copper futures market. The uncertainty surrounding US-China trade relations creates volatility in the copper futures market, as investors react to news and developments. This speculation can amplify price swings, leading to both sharp increases and decreases in the copper price.

Speculative Trading and the Copper Price Increase

Speculative trading plays a significant role in driving up the copper price, particularly during periods of trade uncertainty. Investors view copper as a safe haven asset in times of geopolitical instability.

- Investors view copper as a safe haven asset during times of geopolitical instability. When trade tensions rise, investors often seek safe haven assets, and copper, with its industrial uses and relatively stable long-term demand, is seen as a comparatively secure investment. This increased demand from investors contributes to a copper price increase.

- Increased uncertainty in the trade relationship can lead to increased investment in copper futures. Uncertainty fuels speculation, leading to increased trading activity in copper futures contracts. This increased trading volume can push prices higher, regardless of underlying supply and demand fundamentals.

- Short-term market fluctuations can be influenced by speculative trading activity. Short-term movements in the copper price are often heavily influenced by speculative trading, leading to rapid price increases or decreases that might not fully reflect underlying market conditions.

Analyzing the correlation between specific trade agreements and copper prices

Analyzing historical data reveals a clear correlation between specific trade agreements (or the lack thereof) and copper prices. For instance, the escalation of the US-China trade war in 2018 coincided with a period of copper price volatility. Conversely, periods of de-escalation often saw a stabilization or even a decrease in copper prices. (Further analysis with charts and graphs would be included here, citing specific data points and reputable sources).

The Future Outlook for Copper Prices in Light of Ongoing Trade Talks

The future of copper prices remains intertwined with the ongoing US-China trade talks.

- Positive trade developments should lead to a more stable copper price. A resolution to trade tensions would likely lead to greater stability in the copper market, reducing price volatility.

- Continued uncertainty could trigger further price increases. Prolonged trade disputes will likely continue to drive speculation and price volatility, potentially leading to further copper price increases.

- Long-term outlook considers factors like global economic growth and green energy initiatives. Beyond trade tensions, factors such as global economic growth and the increasing demand for copper in renewable energy technologies (green energy transition) will significantly influence long-term copper price forecasts.

Conclusion

The relationship between China's trade talks with the US and the copper price increase is complex and multifaceted. Fluctuations in trade policy significantly influence copper demand in China, disrupt global supply chains, and trigger speculative trading activity. Understanding these dynamics is crucial for investors, businesses, and policymakers alike. To stay informed on the latest developments and the continued impact on the copper market, stay updated on the progress of US-China trade negotiations and their effect on this vital commodity. Monitoring the copper price increase and its underlying factors will remain essential for navigating the complexities of the global market.

Featured Posts

-

Celtics Vs Heat February 10 Find Game Time Tv Channel And Live Streaming

May 06, 2025

Celtics Vs Heat February 10 Find Game Time Tv Channel And Live Streaming

May 06, 2025 -

Thrifty Shopping Getting The Best Bang For Your Buck

May 06, 2025

Thrifty Shopping Getting The Best Bang For Your Buck

May 06, 2025 -

Celebrating Independence Day Traditions History And Festivities

May 06, 2025

Celebrating Independence Day Traditions History And Festivities

May 06, 2025 -

How To Watch Celtics Vs Heat Live Stream And Tv Guide

May 06, 2025

How To Watch Celtics Vs Heat Live Stream And Tv Guide

May 06, 2025 -

Patrick Schwarzenegger Reflects On Failed Superman Audition

May 06, 2025

Patrick Schwarzenegger Reflects On Failed Superman Audition

May 06, 2025

Latest Posts

-

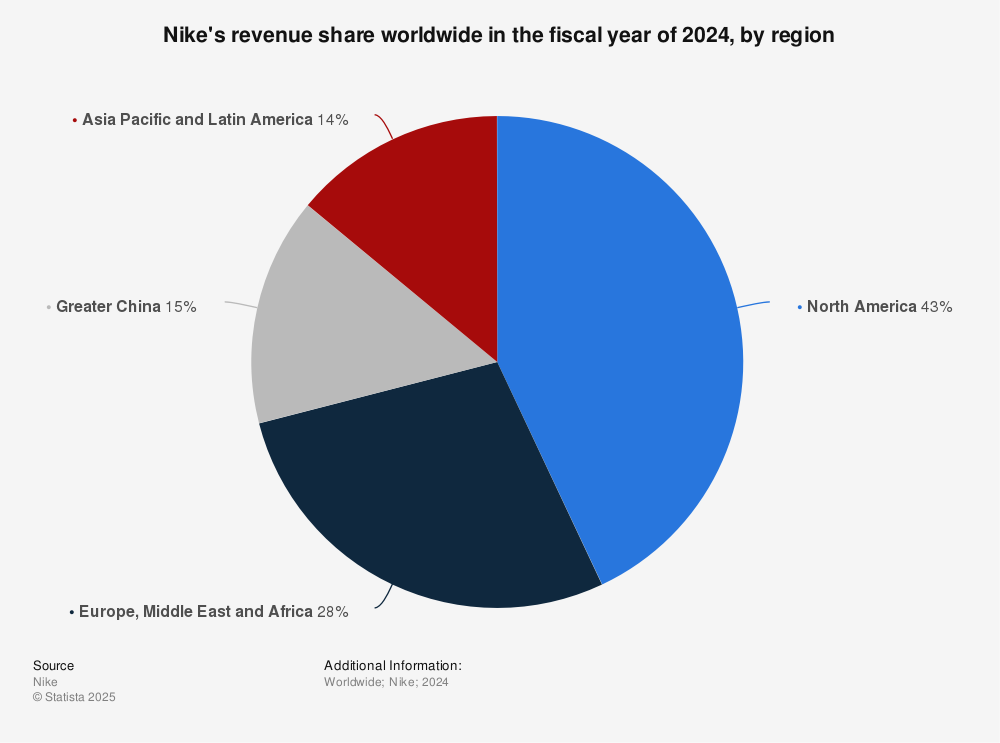

Nike X Hyperice A New Collaboration Unveiled

May 06, 2025

Nike X Hyperice A New Collaboration Unveiled

May 06, 2025 -

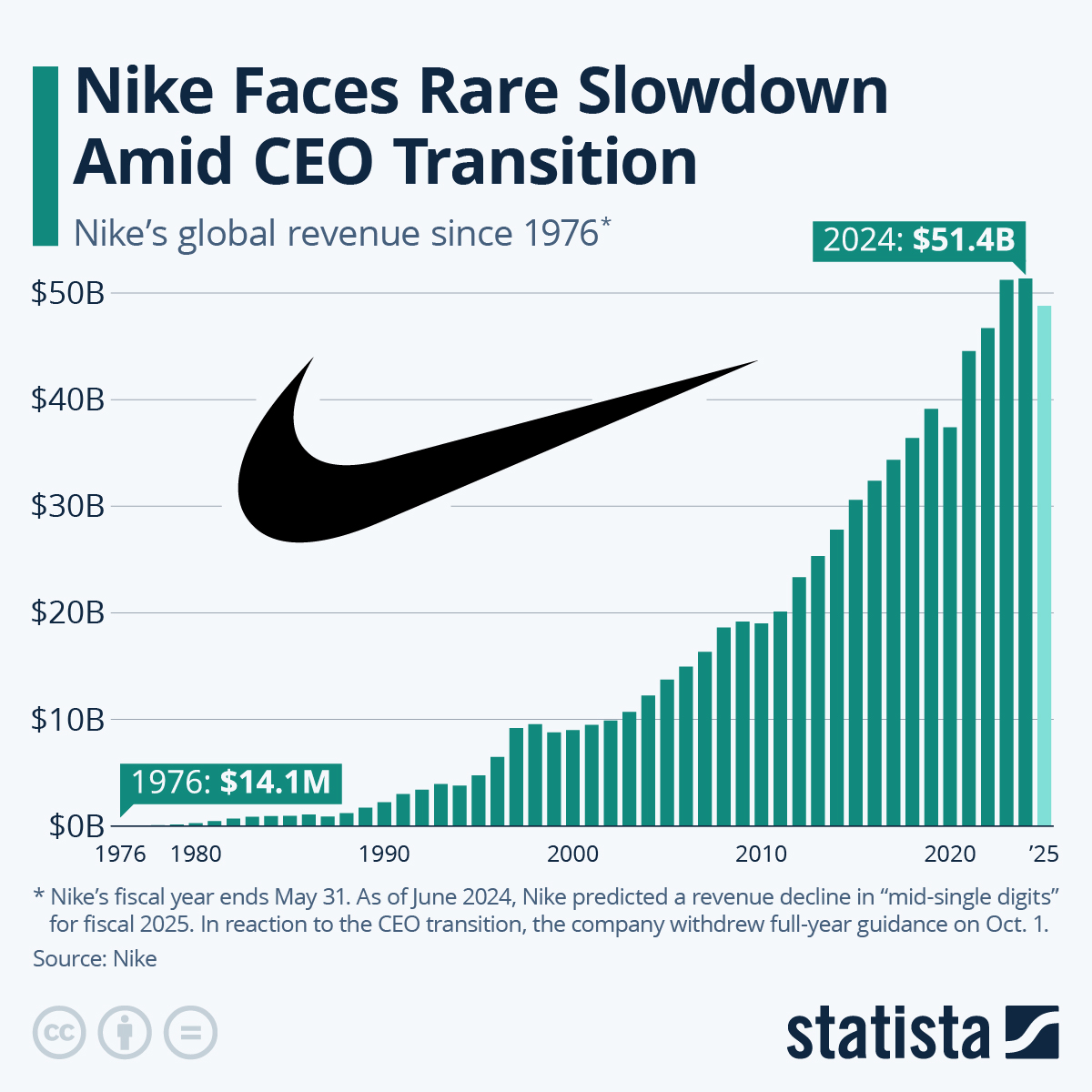

Five Year Low Predicted For Nikes Revenue Whats Next

May 06, 2025

Five Year Low Predicted For Nikes Revenue Whats Next

May 06, 2025 -

Nikes Plummeting Revenue Five Year Trend Analysis

May 06, 2025

Nikes Plummeting Revenue Five Year Trend Analysis

May 06, 2025 -

Is Nikes Revenue Set For A Five Year Low

May 06, 2025

Is Nikes Revenue Set For A Five Year Low

May 06, 2025 -

Nike Revenue Projections A Five Year Decline

May 06, 2025

Nike Revenue Projections A Five Year Decline

May 06, 2025