Westpac Bank (WBC) Reports Reduced Profitability Amidst Margin Pressure

Table of Contents

Declining Net Interest Margin (NIM): A Key Driver of Reduced Profitability

A crucial factor behind Westpac's reduced profitability is the decline in its Net Interest Margin (NIM). NIM represents the difference between the interest a bank earns on loans and the interest it pays on deposits and borrowed funds, expressed as a percentage. A healthy NIM is essential for bank profitability. Westpac's recent report revealed a significant contraction in its NIM, [insert quantifiable data from the report, e.g., a decrease of X%]. This decline can be attributed to several interconnected factors:

- Intensified Competition: The Australian banking sector is highly competitive. New entrants and existing players are vying for market share, leading to price wars and reduced lending rates. This directly impacts the bank's ability to maintain a high NIM.

- Regulatory Changes: Increased regulatory scrutiny and changes in lending practices, designed to protect consumers and maintain financial stability, have also impacted Westpac's lending strategies and profitability. These regulations often increase compliance costs and limit certain lending activities.

- Rising Funding Costs: The cost of funds for banks is increasing due to higher interest rates set by the Reserve Bank of Australia (RBA). This increased cost of borrowing directly erodes the NIM.

Rising Operating Expenses Impacting Westpac's Bottom Line

Beyond the shrinking NIM, Westpac's profitability is further squeezed by rising operating expenses. The bank's financial report indicates a substantial increase in overall operational costs. This increase can be broken down into several key categories:

- Staff Costs: Wage growth and increased demand for skilled employees in the financial sector are driving up staff costs.

- Technology Investments: Banks are under constant pressure to invest heavily in technology to improve efficiency, enhance customer experience, and comply with evolving cybersecurity regulations.

- Compliance Costs: The increasingly stringent regulatory environment necessitates significant investment in compliance measures, adding to the overall operating expenses.

Inflationary pressures and challenging economic conditions are exacerbating these rising costs. To counter this, Westpac is likely exploring and implementing various cost-cutting measures, such as streamlining operations and optimizing its workforce. Keywords: Operating expenses, staff costs, technology investment, compliance costs, inflation, cost-cutting measures, efficiency improvements.

Impact of Economic Headwinds on Loan Demand and Credit Quality

The current economic climate, characterized by rising interest rates and economic uncertainty, is significantly impacting loan demand and credit quality. Higher interest rates discourage borrowing, leading to reduced demand for loans, particularly in sectors sensitive to interest rate changes, such as housing and construction.

Furthermore, economic uncertainty can lead to an increase in non-performing loans (NPLs) as borrowers struggle to meet their repayment obligations. A rise in NPLs directly impacts profitability as banks have to set aside funds to cover potential losses. This deterioration in credit quality further contributes to Westpac's reduced profitability. Keywords: Interest rates, economic uncertainty, loan demand, credit quality, non-performing loans, loan portfolio, economic headwinds.

Westpac's Response to Margin Pressure and Future Outlook

To address the margin pressure and improve profitability, Westpac is likely implementing various strategic initiatives. These may include:

- Strategic pricing adjustments: Reviewing and adjusting pricing strategies for various loan products to better align with market conditions and maintain competitiveness.

- Operational efficiency improvements: Streamlining internal processes and operations to reduce costs and enhance productivity.

- Focus on higher-margin products: Shifting focus towards higher-margin products and services to offset the impact of reduced NIM on lower-margin products.

Westpac's future outlook will depend heavily on its ability to effectively implement these strategies and navigate the prevailing economic challenges. The bank's financial guidance will provide further insight into its anticipated performance. Keywords: Strategic response, future outlook, growth strategy, profitability improvement, margin improvement, financial guidance.

Conclusion: Analyzing Westpac Bank's (WBC) Reduced Profitability

In summary, Westpac Bank's reduced profitability is a multifaceted issue driven by a confluence of factors. The declining NIM, rising operating expenses, and the impact of economic headwinds on loan demand and credit quality have all played significant roles. The bank's response to these challenges will be crucial in determining its future financial performance and its ability to maintain its position in the competitive Australian banking market. To stay updated on Westpac Bank's (WBC) financial performance and the ongoing pressure on its profitability and margins, regularly check financial news sources for the latest updates and analysis. Consider subscribing to reputable financial news outlets for in-depth coverage of Westpac Bank profitability and Westpac Bank margin pressure.

Featured Posts

-

Watch March Madness Live Streams A Guide To Cord Cutting

May 06, 2025

Watch March Madness Live Streams A Guide To Cord Cutting

May 06, 2025 -

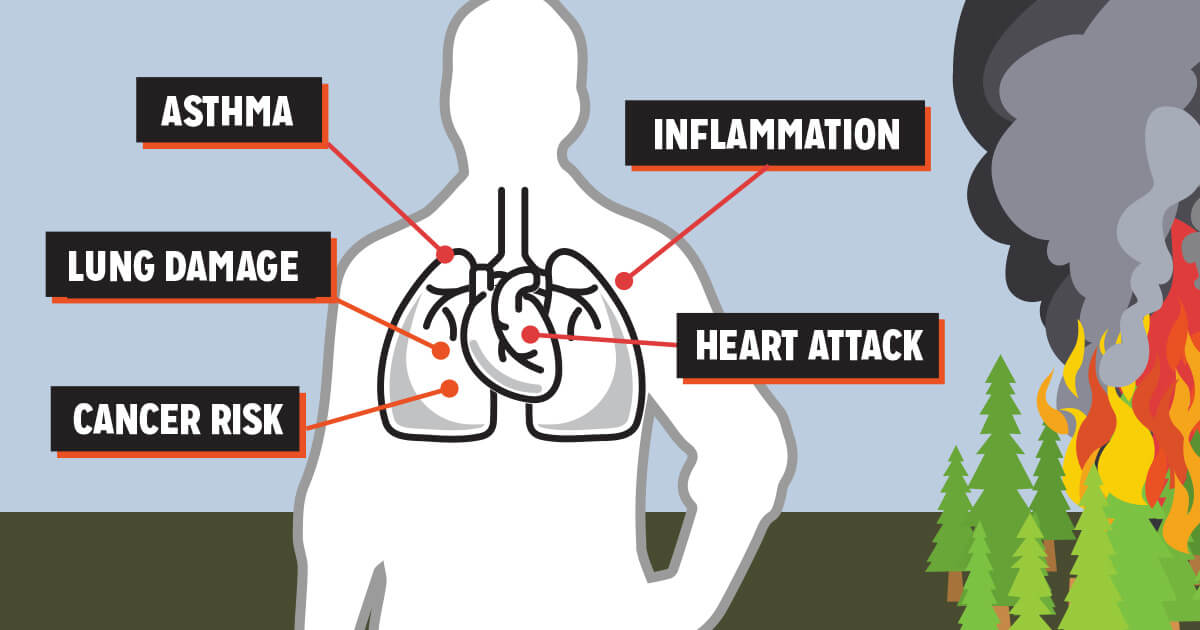

Wildfire Betting A Disturbing Reflection Of Our Times

May 06, 2025

Wildfire Betting A Disturbing Reflection Of Our Times

May 06, 2025 -

Option Traders Favor Aussie Dollar Over New Zealand Dollar

May 06, 2025

Option Traders Favor Aussie Dollar Over New Zealand Dollar

May 06, 2025 -

Patrik Svarceneger I Teret Prezimena Iskustvo U White Lotus

May 06, 2025

Patrik Svarceneger I Teret Prezimena Iskustvo U White Lotus

May 06, 2025 -

Sabrina Carpenter And Fun Size Co Star Surprise Snl Audience

May 06, 2025

Sabrina Carpenter And Fun Size Co Star Surprise Snl Audience

May 06, 2025

Latest Posts

-

Comparing Spielbergs New Ufo Film To His Previous Sci Fi Masterpieces

May 06, 2025

Comparing Spielbergs New Ufo Film To His Previous Sci Fi Masterpieces

May 06, 2025 -

Savage X Fenty Lingerie For The Bride To Be Rihannas Campaign

May 06, 2025

Savage X Fenty Lingerie For The Bride To Be Rihannas Campaign

May 06, 2025 -

Savage X Fenty Unveils Heavenly Bridal Collection By Rihanna

May 06, 2025

Savage X Fenty Unveils Heavenly Bridal Collection By Rihanna

May 06, 2025 -

Steven Spielbergs Ufo Movie How It Stacks Up Against His Past Alien Films

May 06, 2025

Steven Spielbergs Ufo Movie How It Stacks Up Against His Past Alien Films

May 06, 2025 -

Rihannas Wedding Night Inspiration The Savage X Fenty Collection

May 06, 2025

Rihannas Wedding Night Inspiration The Savage X Fenty Collection

May 06, 2025