The Economic Fallout Of Trump's Trade Offensive: Impact On US Finance

Table of Contents

Increased Tariffs and Their Ripple Effect on US Businesses

Trump's trade offensive was largely characterized by the imposition of substantial tariffs on imported goods. This had a ripple effect throughout the US economy, significantly impacting businesses across various sectors.

Manufacturing Sector Strain

The manufacturing sector bore the brunt of the increased tariffs.

- Increased input costs: Tariffs dramatically increased the price of imported raw materials and components, crucial for many US manufacturers. This squeezed profit margins and reduced competitiveness.

- Reduced export competitiveness: Higher production costs due to tariffs made US-manufactured goods less competitive in global markets. This led to a decline in exports and increased reliance on the domestic market.

- Job displacement: Reduced production, factory closures, and decreased competitiveness resulted in significant job losses in the manufacturing sector, contributing to economic uncertainty and social disruption. This was particularly evident in industries heavily reliant on imported components.

Impact on Supply Chains and Logistics

The trade war also severely disrupted global supply chains.

- Increased transportation costs: Trade wars and related logistical complexities led to a surge in shipping costs, adding further pressure on businesses already struggling with tariffs.

- Supply chain disruptions: Tariffs and trade tensions created delays and shortages of essential goods, forcing companies to scramble for alternative suppliers and impacting production schedules.

- Increased uncertainty for businesses: The volatile and unpredictable trade environment fostered by the Trump administration's policies significantly hampered business investment and long-term planning, creating a climate of uncertainty and hesitancy.

The Impact on the Stock Market and Investor Sentiment

The unpredictability inherent in Trump's trade policies created significant volatility in the US stock market and negatively impacted investor sentiment.

Market Volatility and Uncertainty

The constant threat of new tariffs and retaliatory measures led to frequent market swings.

- Increased market fluctuations: Announcements regarding trade policy were often directly correlated with sharp fluctuations in the stock market, creating a climate of anxiety and uncertainty for investors.

- Decline in investor confidence: The trade wars eroded investor confidence, leading to decreased investment in both domestic and international markets. Businesses postponed expansion plans due to the uncertain economic outlook.

- Flight to safety: During periods of heightened trade uncertainty, investors moved capital into safer assets, such as government bonds, further dampening investment in riskier sectors of the economy.

Currency Fluctuations and Their Consequences

Trade wars also influenced the value of the US dollar, impacting businesses and consumers alike.

- Dollar appreciation/depreciation: Depending on the specific trade actions and market reactions, the dollar experienced periods of both appreciation and depreciation, significantly impacting the cost of imports and exports.

- Impact on international trade balance: Currency fluctuations affected the US trade deficit, exacerbating existing imbalances and potentially creating further economic instability.

- Impact on tourism and international investment: Fluctuations in the dollar's value had a direct impact on the tourism sector and levels of foreign investment in the US, potentially affecting economic growth.

The Role of International Trade Agreements and Their Dissolution

Trump's administration actively pursued the renegotiation and withdrawal from key international trade agreements.

Withdrawal from the Trans-Pacific Partnership (TPP)

The US withdrawal from the TPP had significant negative consequences.

- Loss of market access: US businesses lost preferential trade terms and market access in the Asia-Pacific region, handing a competitive advantage to other nations.

- Strengthening of competitors: The withdrawal ultimately benefited competitors like China, allowing them to expand their influence and market share in the region.

- Impact on regional economic integration: The decision undermined efforts towards regional economic cooperation and integration, hindering economic growth and stability in the Asia-Pacific.

Renegotiation of NAFTA (USMCA)

The renegotiation of NAFTA, resulting in the USMCA, also had substantial consequences.

- Changes in trade rules and regulations: The USMCA introduced changes to trade rules and regulations, impacting various sectors, particularly the automotive industry.

- Impact on automotive industry: The changes significantly affected the North American automotive supply chain, altering manufacturing processes and potentially impacting job security.

- Overall effects on trilateral trade: While the USMCA aimed to update the agreement, the renegotiation process introduced uncertainty and potentially hindered the smooth flow of trade between the three participating countries.

Conclusion: Understanding the Long-Term Implications of Trump's Trade Policies on US Finance

Trump's trade offensive had demonstrably negative impacts on various sectors of US finance, including manufacturing, the stock market, and international trade relations. Increased tariffs, supply chain disruptions, and market volatility negatively affected business confidence and investment. The withdrawal from and renegotiation of key trade agreements further weakened US economic influence and competitiveness on the global stage. The long-term economic implications of these policies include potential lasting damage to US competitiveness and its standing in the global economy, hindering long-term growth and prosperity. Understanding the full economic fallout of Trump's trade offensive requires further investigation. Continue your research to gain a deeper understanding of the impact on US finance by exploring resources such as academic papers, news articles, and government reports on the topic of US trade policy under the Trump administration.

Featured Posts

-

Karen Reads Murder Case A Year By Year Timeline Of Legal Proceedings

Apr 22, 2025

Karen Reads Murder Case A Year By Year Timeline Of Legal Proceedings

Apr 22, 2025 -

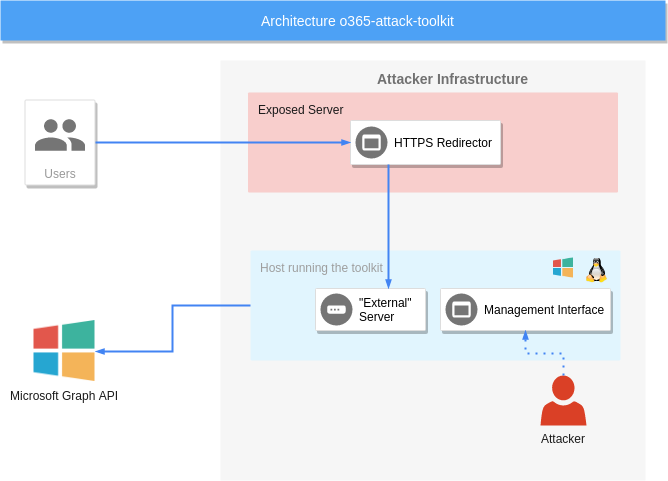

Millions Stolen Inside The Office365 Hacking Targeting Executives

Apr 22, 2025

Millions Stolen Inside The Office365 Hacking Targeting Executives

Apr 22, 2025 -

Trumps Economic Agenda Winners And Losers

Apr 22, 2025

Trumps Economic Agenda Winners And Losers

Apr 22, 2025 -

Google Breakup A Real Possibility Examining The Antitrust Concerns

Apr 22, 2025

Google Breakup A Real Possibility Examining The Antitrust Concerns

Apr 22, 2025 -

Bof As Reassurance Why Current Stock Market Valuations Shouldnt Concern Investors

Apr 22, 2025

Bof As Reassurance Why Current Stock Market Valuations Shouldnt Concern Investors

Apr 22, 2025