BofA's Reassurance: Why Current Stock Market Valuations Shouldn't Concern Investors

Table of Contents

BofA's Rationale: Understanding the Underlying Data

BofA's analysis challenges the prevailing narrative of excessively high stock market valuations. Their perspective incorporates a nuanced understanding of several key economic factors, going beyond simple price-to-earnings (P/E) ratios. Instead, they employ a more comprehensive approach.

-

Specific Metrics Used: BofA's analysis incorporates a range of market valuation metrics, including discounted cash flow models, which consider future earnings potential, and sector-specific P/E ratios adjusted for growth prospects. They also analyze historical data to contextualize current valuations within a longer-term perspective.

-

Sector-Specific Analysis: The report doesn't treat all sectors equally. BofA identifies specific sectors they believe are currently undervalued, presenting opportunities for investors willing to conduct further due diligence. Conversely, they also highlight sectors showing signs of overvaluation, suggesting a degree of caution might be warranted in those areas.

-

Historical Comparisons: To counter anxieties, BofA draws parallels between current valuations and those seen during previous periods of market uncertainty. Their analysis suggests that while valuations are elevated, they aren't unprecedented, and that similar levels have preceded periods of sustained growth in the past. The historical context offered helps to normalize the current market climate.

Addressing Common Investor Concerns about High Valuations

The current market environment inevitably sparks anxieties among investors. Fears of an imminent market correction or even a stock market bubble are widespread. Let's address these common concerns through the lens of BofA's findings:

-

Rebuttal of Correction Fears: BofA counters the correction narrative by emphasizing the underlying strength of corporate earnings. While valuations may seem high, they argue that these valuations are supported by robust profit growth and projections for continued expansion in several key sectors.

-

Inflation's Impact: Inflation remains a significant concern. BofA acknowledges this, but their analysis suggests that while inflation has an impact, its effects are already largely priced into current valuations. They also project inflation to moderate over time.

-

Interest Rate Hikes: Similarly, the impact of interest rate hikes has been factored into BofA's analysis. They acknowledge the impact higher rates have on valuations, but maintain that the current level of rates doesn't signal an impending crash, especially considering the robust earnings picture.

Alternative perspectives suggest that a focus on long-term growth and a prudent approach to risk management can mitigate potential market downsides.

Long-Term Growth Prospects: Why BofA Remains Bullish

Despite acknowledging the short-term uncertainties, BofA maintains a bullish long-term outlook. Their optimism rests on several key pillars:

-

Future Earnings Growth: BofA predicts continued growth in corporate earnings, driven by technological innovation, expanding global markets, and ongoing economic recovery in certain regions.

-

Promising Emerging Sectors: The firm highlights several emerging sectors poised for significant growth, such as renewable energy, artificial intelligence, and biotechnology. These offer investors avenues for diversification and potentially higher returns.

-

Geopolitical Factors: While geopolitical instability presents risks, BofA's analysis suggests that many potential negative factors are already priced into the market, and the long-term positive trends outweigh these risks.

Diversification and Risk Management: A Prudent Approach

Even with a positive long-term outlook, diversification and risk management remain crucial. No investment strategy is without risk.

-

Diversified Portfolios: A well-diversified investment portfolio, spread across various asset classes and sectors, is essential to mitigating risk and capitalizing on opportunities across the market.

-

Risk Management Strategies: Employing strategies such as dollar-cost averaging and stop-loss orders can help manage the risk inherent in stock market investments.

-

Professional Financial Advice: Seeking advice from a qualified financial advisor can provide personalized guidance based on your individual financial situation and risk tolerance. A professional can help you navigate the complexities of the market and develop an investment strategy aligned with your goals.

Conclusion

BofA's analysis presents a compelling case that current stock market valuations, while appearing high, do not necessarily signal impending doom. By understanding BofA's detailed rationale, addressing common investor concerns, and focusing on the long-term growth potential, investors can approach the market with a more informed and confident perspective. Don't let unfounded fears about stock market valuations deter you from exploring potential investment opportunities. However, remember to conduct thorough research, diversify your portfolio, and consider seeking professional financial advice to make informed decisions about your investment strategy and your approach to BofA's perspective on stock market valuations.

Featured Posts

-

Florida State University Security Gap Fuels Student Anxiety Despite Rapid Police Action

Apr 22, 2025

Florida State University Security Gap Fuels Student Anxiety Despite Rapid Police Action

Apr 22, 2025 -

Google Breakup A Real Possibility Examining The Antitrust Concerns

Apr 22, 2025

Google Breakup A Real Possibility Examining The Antitrust Concerns

Apr 22, 2025 -

Tik Tok And Trump Tariffs How Businesses Are Circumventing Them

Apr 22, 2025

Tik Tok And Trump Tariffs How Businesses Are Circumventing Them

Apr 22, 2025 -

Return To Classes At Fsu Following Deadly Shooting Too Soon For Some

Apr 22, 2025

Return To Classes At Fsu Following Deadly Shooting Too Soon For Some

Apr 22, 2025 -

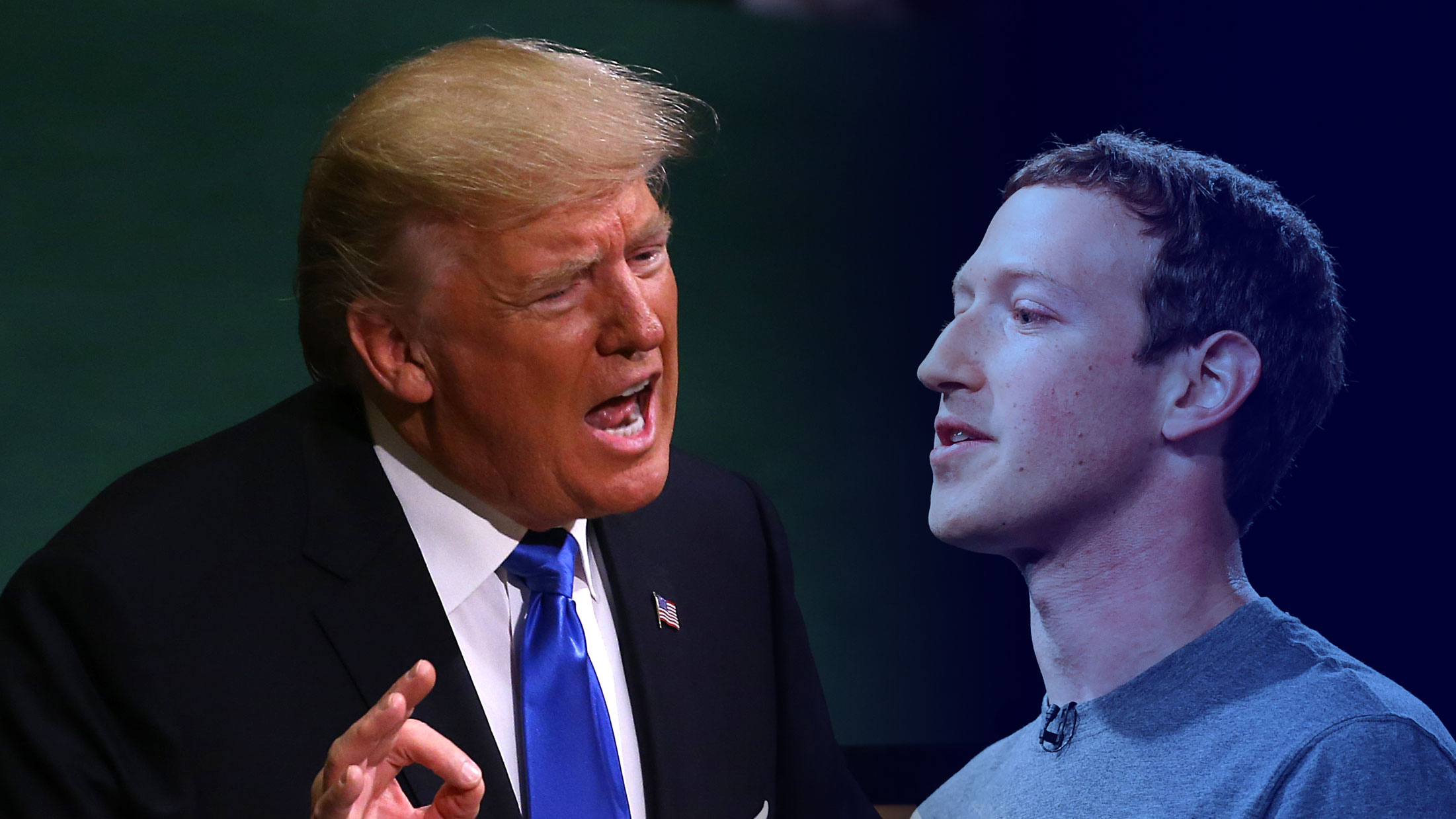

The Zuckerberg Trump Dynamic Implications For Facebook And Beyond

Apr 22, 2025

The Zuckerberg Trump Dynamic Implications For Facebook And Beyond

Apr 22, 2025