The Coca-Cola UK Beverage Portfolio: Why No Dasani?

Table of Contents

The Competitive Bottled Water Market in the UK

The UK bottled water market is fiercely competitive, presenting a significant challenge for new entrants like Dasani. This competitive landscape significantly impacts the success of any new bottled water brand attempting to gain a foothold.

Established Brands and Strong Market Share:

The UK market is dominated by established bottled water brands with significant market share and strong consumer loyalty. These brands have invested heavily in building brand recognition and extensive distribution networks, creating a high barrier to entry for newcomers.

- Existing brands hold strong brand recognition and distribution networks. Brands like Buxton, Highland Spring, and Volvic have enjoyed decades of brand building, securing prime shelf space in retailers across the country.

- Consumers demonstrate established purchasing habits and brand preferences. Many consumers have strong preferences for specific brands, often driven by familiarity, taste, and perceived quality. Switching established brand loyalty requires significant effort.

- Significant marketing investment is required to compete effectively. Successfully launching a new bottled water brand requires a substantial marketing budget to build brand awareness and overcome consumer inertia.

Consumer Preferences and Pricing:

UK consumers exhibit nuanced preferences regarding bottled water, considering factors beyond just hydration. Dasani's potential success hinges on aligning with these preferences.

- Analysis of UK consumer preferences for water characteristics. Consumers often prefer specific water types (still, sparkling, naturally sourced), packaging sizes, and levels of mineralisation.

- Pricing strategies of existing brands and their impact on market share. Existing brands have established price points that cater to various consumer segments. A new entrant needs a competitive pricing strategy.

- Potential consumer resistance to a new, unfamiliar water brand. Overcoming ingrained brand loyalty and convincing consumers to try a new brand is a significant challenge.

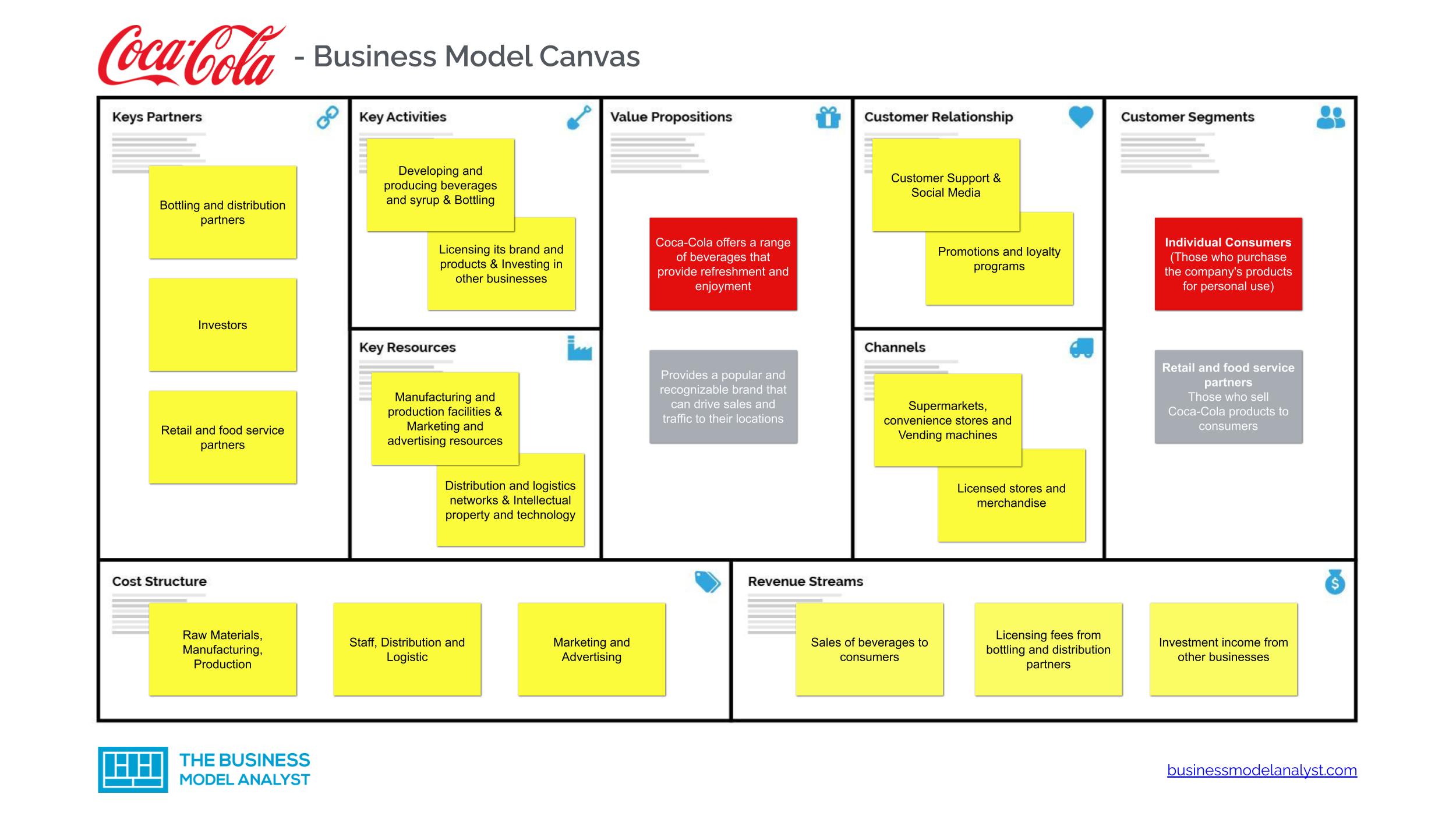

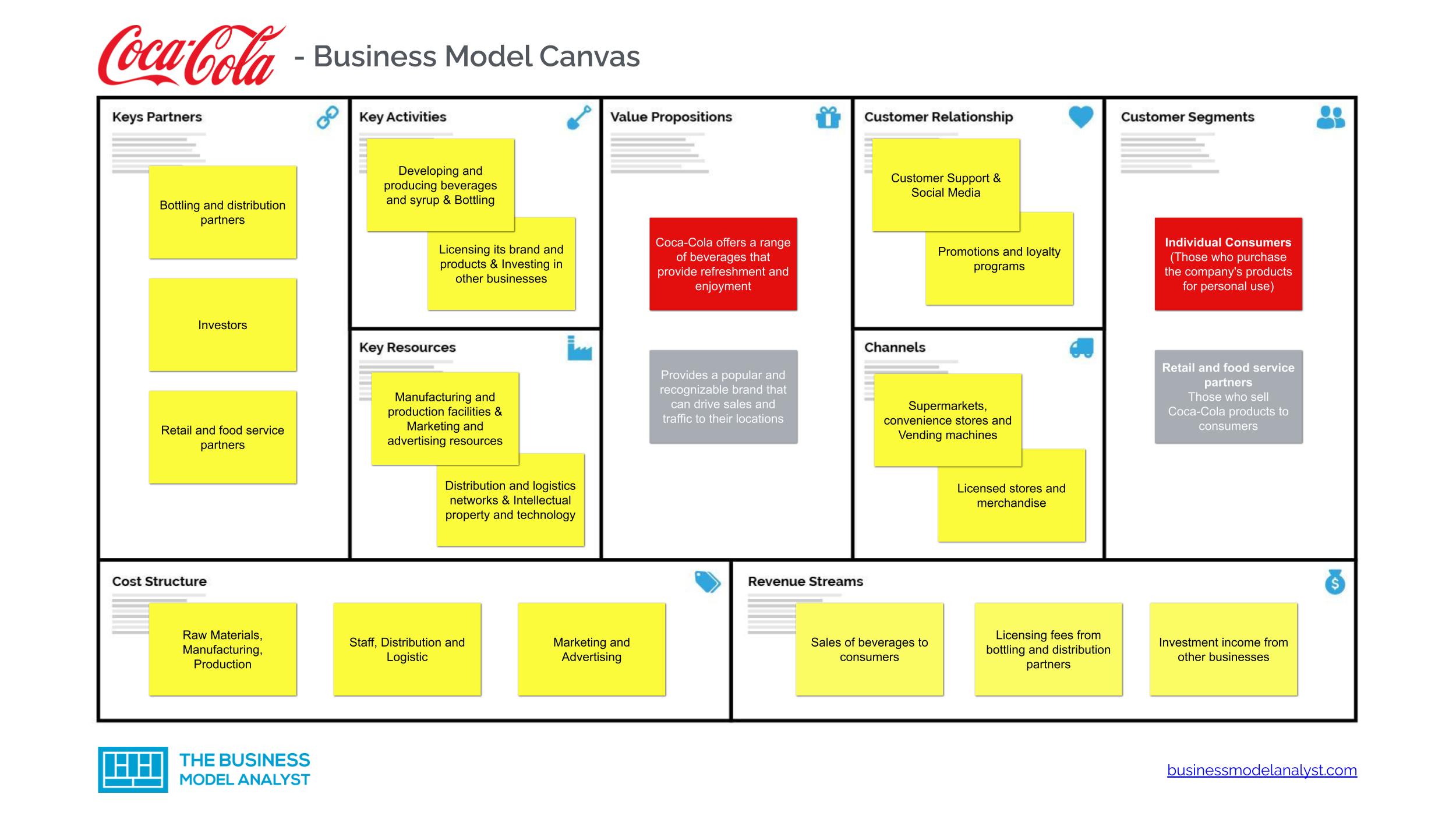

Coca-Cola's Existing Portfolio and Strategic Focus in the UK

Coca-Cola's existing UK portfolio significantly influences the decision to exclude Dasani. The company's brand strategy and resource allocation play a crucial role.

Portfolio Diversification and Brand Strategy:

Coca-Cola UK already possesses a robust portfolio of diverse beverages, potentially making the addition of another water brand redundant. This comprehensive offering could satiate market demand.

- List of key brands already in the Coca-Cola UK portfolio (e.g., innocent, Schweppes). Coca-Cola's portfolio includes established juice brands (innocent), mixers (Schweppes), and a variety of carbonated soft drinks, leaving less room for another water brand.

- Analysis of Coca-Cola's overall brand strategy in the UK market. Coca-Cola's strategy likely focuses on maximizing profits within its current portfolio rather than expanding into a highly saturated market.

- Discussion of potential resource allocation and market saturation. Launching Dasani requires substantial investment, potentially diverting resources from existing, more profitable brands.

Distribution and Logistics:

Establishing a new water brand necessitates substantial investment in distribution and logistics, especially within the UK's established network.

- Challenges of entering the UK's established distribution networks. Securing shelf space in major retailers requires considerable negotiation and investment.

- Cost analysis of establishing a new distribution channel for Dasani. The cost of transporting and distributing bottled water across the UK is substantial, adding to the overall financial burden.

- Comparison with existing Coca-Cola distribution efficiency for other brands. Leveraging the existing distribution network for other brands might be more efficient and cost-effective.

Potential Regulatory and Environmental Factors

UK regulations related to water sourcing and sustainability could influence the decision to exclude Dasani.

Water Source and Sustainability Concerns:

Strict UK regulations regarding water sourcing and sustainability could pose challenges for Dasani's entry. Public perception regarding water sourcing practices also plays a critical role.

- Discussion of UK water regulations and environmental concerns. The UK has stringent regulations concerning water extraction and environmental impact.

- Analysis of Dasani's water sourcing practices and their compatibility with UK standards. Dasani's sourcing practices in other markets might not meet UK standards, requiring significant adjustments.

- Potential public perception and consumer activism related to water sustainability. Consumers are increasingly conscious of environmental issues, and any perceived negative impact on water resources could result in consumer backlash.

Conclusion:

The absence of Dasani from the Coca-Cola UK beverage portfolio is likely due to a combination of factors: fierce competition in the UK bottled water market, Coca-Cola's strategic focus on its diverse existing portfolio, and potential logistical and regulatory hurdles. While the exact reasons remain unconfirmed by Coca-Cola, this analysis suggests a strategic decision rather than an oversight. To gain a deeper understanding, further research into Coca-Cola's specific UK market strategies and the competitive dynamics within the bottled water sector is necessary. So, the question remains: Why no Dasani in the Coca-Cola UK beverage portfolio? Further investigation into the company’s strategic planning is required to provide a definitive answer.

Featured Posts

-

How Apple Watches Are Changing Nhl Refereeing

May 16, 2025

How Apple Watches Are Changing Nhl Refereeing

May 16, 2025 -

Game 3 Update Tatum And Brown To Play Holiday Sidelined

May 16, 2025

Game 3 Update Tatum And Brown To Play Holiday Sidelined

May 16, 2025 -

Hokejove Ms Svedsko S Prevahou Hracu Nhl Proti Nemecku

May 16, 2025

Hokejove Ms Svedsko S Prevahou Hracu Nhl Proti Nemecku

May 16, 2025 -

Kh K Karolina Sokrushil Vashington Itogi Serii Pley Off N Kh L

May 16, 2025

Kh K Karolina Sokrushil Vashington Itogi Serii Pley Off N Kh L

May 16, 2025 -

Today I M Not Ok Master Sergeants Forced Discharge Sparks Outrage

May 16, 2025

Today I M Not Ok Master Sergeants Forced Discharge Sparks Outrage

May 16, 2025

Latest Posts

-

14 6 Billion Deficit How Tariffs Impact Ontarios Economy

May 17, 2025

14 6 Billion Deficit How Tariffs Impact Ontarios Economy

May 17, 2025 -

Atlantic Canada Lobster Industry Faces Crisis Low Prices And Global Economic Headwinds

May 17, 2025

Atlantic Canada Lobster Industry Faces Crisis Low Prices And Global Economic Headwinds

May 17, 2025 -

Ontario Budget 14 6 Billion Deficit Due To Tariffs And Other Factors

May 17, 2025

Ontario Budget 14 6 Billion Deficit Due To Tariffs And Other Factors

May 17, 2025 -

Hudsons Bay Brand Sale To Canadian Tire Details Of The 30 Million Agreement

May 17, 2025

Hudsons Bay Brand Sale To Canadian Tire Details Of The 30 Million Agreement

May 17, 2025 -

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025