Ontario's $14.6 Billion Deficit: Tariff Impacts And Economic Outlook

Table of Contents

The Impact of Tariffs on Ontario's Economy

Tariffs, taxes imposed on imported goods, have significantly impacted Ontario's economy, contributing to the current $14.6 billion deficit. These increased costs ripple through the economy, affecting businesses and consumers alike.

Increased Costs for Businesses and Consumers

Tariffs directly increase the cost of imported goods, leading to higher prices for businesses and consumers in Ontario. This inflationary pressure reduces purchasing power and dampens economic activity.

- Affected Industries: The automotive sector, which relies heavily on imported parts, has been significantly affected. The manufacturing sector, as well as consumer goods retailers, experience increased costs for materials and finished goods.

- Examples of Price Increases: Tariffs on steel have increased the cost of construction projects. Tariffs on electronic components have raised the prices of appliances and electronics.

- Statistical Evidence: Studies show a direct correlation between tariff implementation and increased consumer prices, with some estimates showing a 5-10% increase in the cost of certain imported goods. (Source needed – replace with actual source)

Reduced Export Competitiveness

Retaliatory tariffs imposed by other countries on Ontario exports further exacerbate the problem. This reduces demand for Ontario-made goods and services in international markets.

- Industries Affected: Agricultural products, manufactured goods, and automotive exports are particularly vulnerable to retaliatory tariffs, reducing export volumes and impacting profitability.

- Ripple Effect: The decline in exports leads to job losses, reduced investment, and slower economic growth.

- Data on Export Volumes: (Source needed – replace with actual data comparing export volumes before and after tariff implementations) A decline in export volumes can be directly linked to reduced competitiveness due to tariffs.

Supply Chain Disruptions

Tariffs also disrupt global supply chains, leading to delays, increased transportation costs, and shortages. This adds further pressure on businesses and contributes to inflationary pressures.

- Examples of Supply Chain Issues: Delays in receiving imported parts can halt production lines, while increased transportation costs add to the overall cost of goods.

- Impact on Sectors: Manufacturing, logistics, and retail are particularly vulnerable to supply chain disruptions caused by tariffs. The unpredictable nature of these disruptions makes it difficult for businesses to plan and manage their operations effectively.

Other Contributing Factors to Ontario's Deficit

While tariffs play a significant role, other factors contribute to Ontario's $14.6 billion deficit.

Government Spending

Ontario's government spending patterns have contributed significantly to the deficit. Analyzing government expenditure is crucial for understanding the deficit's magnitude.

- Areas of Significant Spending Increases: Healthcare, education, and social services are major areas of government spending, and increases in these areas have impacted the budget.

- Comparison to Other Provinces: A comparative analysis of Ontario's spending levels relative to other provinces can reveal areas where cost-saving measures might be implemented. (Source needed – compare Ontario’s spending to other provinces using reputable sources).

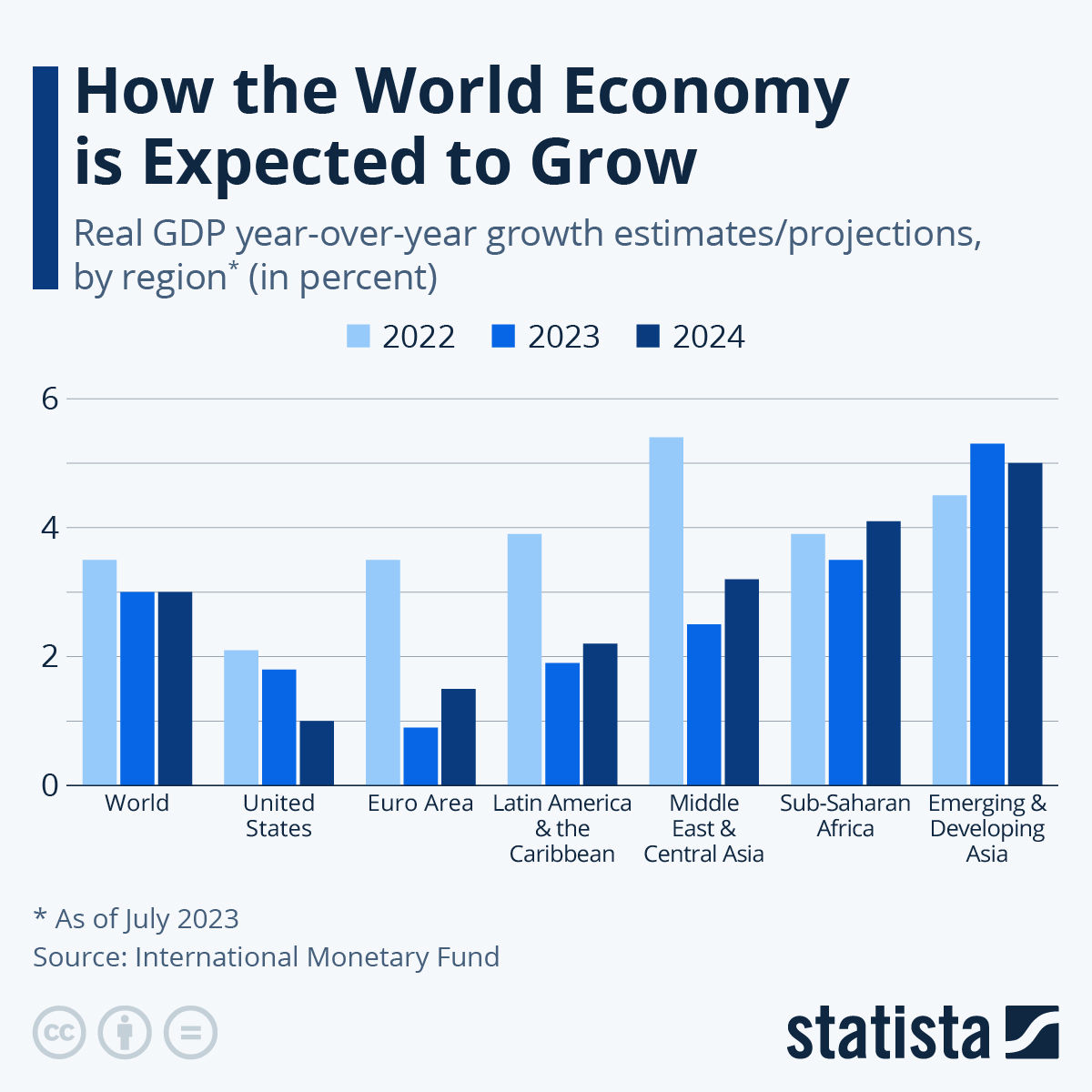

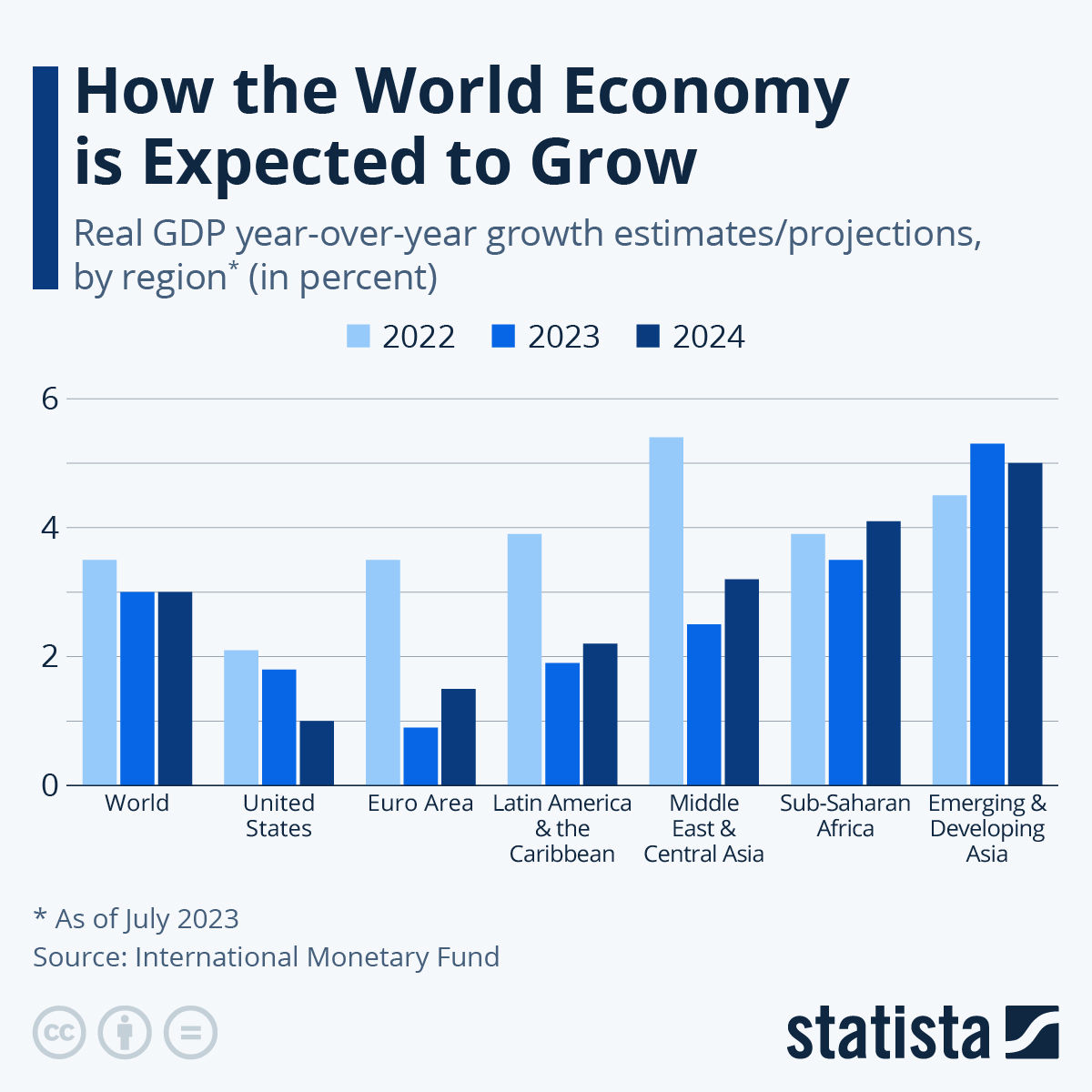

Economic Slowdown

Economic downturns significantly reduce government revenue, contributing to the deficit.

- Statistics on GDP Growth and Unemployment: (Source needed – include statistics on Ontario’s GDP growth and unemployment rates). A decline in economic activity directly reduces tax revenues.

- Impact on Tax Revenue: Reduced economic activity leads to lower income tax revenues, sales tax revenues, and corporate tax revenues.

Ontario's Economic Outlook: Challenges and Opportunities

Ontario faces significant economic challenges, but also opportunities for recovery. Addressing the $14.6 billion deficit requires a long-term strategy.

Short-Term Projections

The deficit's impact on public services and infrastructure is a major concern in the short term.

- Potential for Increased Taxes or Reduced Government Spending: To address the deficit, the government might consider increasing taxes or implementing austerity measures, both with potential negative social and economic consequences.

Long-Term Strategies for Recovery

Long-term recovery requires economic diversification, investments in education and infrastructure, and attracting foreign investment.

- Economic Diversification: Reducing reliance on specific sectors vulnerable to global economic shocks is essential.

- Investments in Education and Infrastructure: Investing in human capital and modernizing infrastructure will improve long-term economic productivity.

- Attracting Foreign Investment: Creating a business-friendly environment will attract investment and stimulate economic growth.

Risk Mitigation Strategies

Mitigation strategies include fiscal responsibility, economic forecasting, and proactive policy adjustments.

- Fiscal Responsibility: Implementing responsible budgeting practices will help control future deficits.

- Economic Forecasting: Accurate forecasting helps anticipate potential economic shocks and adjust policies accordingly.

Conclusion: Navigating Ontario's $14.6 Billion Deficit – A Path Forward

Ontario's $14.6 billion deficit is a complex issue with multiple contributing factors, including the impact of tariffs, government spending, and economic slowdowns. The economic outlook requires careful management and strategic policy decisions to address the challenges and capitalize on opportunities. Addressing this deficit requires a multi-pronged approach that combines fiscal responsibility, economic diversification, and investments in education and infrastructure. We need to encourage dialogue and collaboration among government, businesses, and citizens to find sustainable solutions. Learn more about Ontario's budget and economic plans by visiting the Ontario government's website (insert link here). Let's work together to navigate Ontario's $14.6 billion deficit and build a stronger, more prosperous future for the province.

Featured Posts

-

Toxic Chemicals From Ohio Train Derailment Prolonged Presence In Buildings

May 17, 2025

Toxic Chemicals From Ohio Train Derailment Prolonged Presence In Buildings

May 17, 2025 -

Air Traffic Controller Prevents Midair Collision An Exclusive Interview

May 17, 2025

Air Traffic Controller Prevents Midair Collision An Exclusive Interview

May 17, 2025 -

Prestamos Estudiantiles Impagados Nuevas Acciones Del Gobierno

May 17, 2025

Prestamos Estudiantiles Impagados Nuevas Acciones Del Gobierno

May 17, 2025 -

Lynas The First Heavy Rare Earths Producer Outside China

May 17, 2025

Lynas The First Heavy Rare Earths Producer Outside China

May 17, 2025 -

Jalen Brunson Injury The Latest Update For New York Knicks

May 17, 2025

Jalen Brunson Injury The Latest Update For New York Knicks

May 17, 2025

Latest Posts

-

North Dakotas Leading Businessperson Honored With Msum Honorary Degree

May 17, 2025

North Dakotas Leading Businessperson Honored With Msum Honorary Degree

May 17, 2025 -

Msum Awards Honorary Degree To North Dakotas Wealthiest Individual

May 17, 2025

Msum Awards Honorary Degree To North Dakotas Wealthiest Individual

May 17, 2025 -

Avaliacao Mec 4 Cursos Do Vale E Regiao Recebem Nota Maxima Descubra Quais

May 17, 2025

Avaliacao Mec 4 Cursos Do Vale E Regiao Recebem Nota Maxima Descubra Quais

May 17, 2025 -

North Dakotas Richest Receives Msum Honorary Degree

May 17, 2025

North Dakotas Richest Receives Msum Honorary Degree

May 17, 2025 -

Making The Decision To Refinance Federal Student Loans Or Not

May 17, 2025

Making The Decision To Refinance Federal Student Loans Or Not

May 17, 2025