Tesla's Q1 Profit Decline: Impact Of Musk's Trump Administration Ties

Table of Contents

Economic Policies of the Trump Administration and Tesla's Performance

The Trump administration implemented several significant economic policies that may have influenced Tesla's profitability. Understanding these policies is crucial to assessing their potential role in the Q1 decline.

-

Tax Cuts: The 2017 Tax Cuts and Jobs Act significantly lowered the corporate tax rate in the US. While this initially benefited many companies, including Tesla, its long-term effect on Tesla's bottom line is a subject of debate. Some argue the tax cuts fueled increased investment, while others contend the benefits were offset by other factors.

-

Trade Wars: Trump's trade wars, particularly with China, impacted global supply chains. Tesla, reliant on global sourcing for components and materials, potentially faced increased import costs and disruptions to its manufacturing processes. This could have contributed to higher production costs and squeezed profit margins.

-

Government Subsidies and Incentives: During the Trump era, Tesla, like other electric vehicle manufacturers, likely benefited from various federal and state incentives. However, the extent to which these offset the negative impacts of other policies remains unclear and requires further investigation.

Musk's Public Support for the Trump Administration and its Fallout

Elon Musk's public displays of support for the Trump administration generated considerable controversy. This public alignment might have had unforeseen consequences for Tesla's brand and financial health.

-

Alienating Consumers: Many Tesla customers identify with environmentally conscious and progressive values. Musk's association with a politically conservative administration potentially alienated a segment of this crucial customer base.

-

Brand Image Damage: The perception of Tesla's brand image might have been negatively impacted by Musk's outspoken political stances. This could have affected consumer trust and purchasing decisions.

-

Impact on Investor Confidence: Investors often react negatively to perceived political risks. Musk's strong support for the Trump administration could have negatively influenced investor confidence, leading to fluctuations in Tesla's stock price. Examples include his controversial tweets supporting Trump's policies and his public appearances alongside the former president.

Alternative Factors Contributing to Tesla's Q1 Profit Decline

It's important to acknowledge that factors beyond Musk's political connections likely played a significant role in Tesla's Q1 profit decline.

-

Increased Competition: The electric vehicle market is becoming increasingly competitive, with established automakers and new entrants vying for market share. This intense competition pressures pricing and profit margins.

-

Global Supply Chain Disruptions: Beyond the trade wars, broader global supply chain disruptions, exacerbated by the pandemic and geopolitical instability, impacted Tesla's production and logistics.

-

Rising Raw Material Costs: The cost of raw materials essential for electric vehicle production, such as lithium and cobalt, has risen significantly, impacting Tesla's manufacturing costs.

-

Increased R&D Spending: Tesla's substantial investment in research and development, while crucial for long-term growth, can also put pressure on short-term profitability.

Analyzing the Correlation: Trump Ties and Tesla's Financial Performance

Establishing a direct causal link between Musk's political stances and Tesla's Q1 profit decline is challenging and requires careful analysis. While correlation doesn't equal causation, it's important to examine the financial data during the relevant periods. A comprehensive analysis needs to consider various financial indicators, such as revenue, production costs, and profit margins, and compare Tesla's performance with its competitors during the same period. Visualizing this data with charts and graphs can help illustrate potential relationships.

Conclusion: Tesla's Q1 Decline – A Complex Picture

Tesla's Q1 profit decline is a multifaceted issue. While Elon Musk's past support for the Trump administration and the related economic policies might have played a contributing role, it's crucial to acknowledge other significant factors such as increased competition, supply chain disruptions, and rising raw material costs. A thorough understanding of Tesla's Q1 decline requires a nuanced analysis that considers the interplay of all these factors. We encourage you to delve deeper into the topic, exploring related articles on Tesla's financial performance, Elon Musk's political engagements, and the broader electric vehicle market. Share your insights and opinions on "Tesla's Q1 Profit Decline: Impact of Musk's Trump Administration Ties," and contribute to a more complete understanding of this complex situation involving Elon Musk, Tesla stock, and the future of electric vehicles.

Featured Posts

-

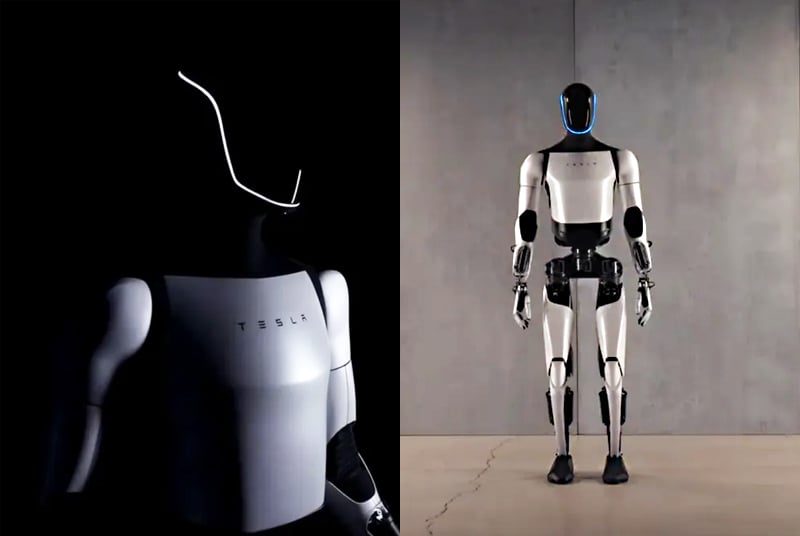

Teslas Optimus Robot Development Navigating The Complexities Of Rare Earth Supply Chains

Apr 24, 2025

Teslas Optimus Robot Development Navigating The Complexities Of Rare Earth Supply Chains

Apr 24, 2025 -

The Extreme Cost Of Broadcoms V Mware Acquisition At And Ts Perspective

Apr 24, 2025

The Extreme Cost Of Broadcoms V Mware Acquisition At And Ts Perspective

Apr 24, 2025 -

Is Betting On Natural Disasters Like The La Wildfires Becoming Normalized

Apr 24, 2025

Is Betting On Natural Disasters Like The La Wildfires Becoming Normalized

Apr 24, 2025 -

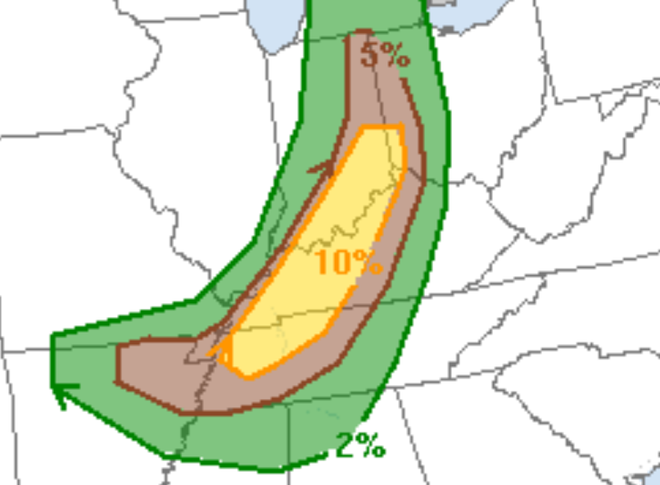

Increased Tornado Risk During Season Experts Blame Trumps Cuts

Apr 24, 2025

Increased Tornado Risk During Season Experts Blame Trumps Cuts

Apr 24, 2025 -

Trumps Softer Tone On The Fed Fuels Us Dollars Advance

Apr 24, 2025

Trumps Softer Tone On The Fed Fuels Us Dollars Advance

Apr 24, 2025