The Extreme Cost Of Broadcom's VMware Acquisition: AT&T's Perspective

Table of Contents

Increased VMware Licensing Costs for AT&T

Broadcom's acquisition of VMware carries a significant risk of increased licensing costs for AT&T. This increase could manifest in several ways, impacting the company's substantial IT budget.

Direct Price Hikes

The most immediate concern is a direct hike in VMware licensing fees. Broadcom, known for its aggressive pricing strategies, may seek to leverage its newly acquired market power to increase prices for VMware products. Analysts predict potential increases ranging from 10% to 20% or even more for certain products.

- vSphere: AT&T's virtualization infrastructure heavily relies on vSphere. A 15% increase on existing vSphere licenses could translate into millions of dollars in added expense.

- vSAN: AT&T's use of vSAN for storage virtualization is also likely to see price increases, impacting storage costs significantly.

- NSX: Network virtualization via NSX could experience similar price hikes, affecting network infrastructure expenditure.

Financial reports and analyst predictions from firms like Gartner and Forrester support these projections, suggesting a significant upward trend in VMware licensing costs post-acquisition. The lack of strong competition in certain virtualization markets also exacerbates this concern.

Hidden Costs of Consolidation

Beyond direct price increases, AT&T faces potential hidden costs associated with the integration of VMware into Broadcom's portfolio. These indirect costs can significantly burden the company's IT expenditure.

- Integration fees: Migrating to new systems and integrating VMware's infrastructure into Broadcom's existing systems will incur significant consulting and implementation costs.

- Migration expenses: The process of transitioning AT&T's existing VMware infrastructure to a potentially new platform will require extensive resources and expertise, leading to high migration costs.

- Training and support: Retraining IT staff to manage the new systems and adapting to any changes in service models will add further expense.

"Large-scale acquisitions often result in unforeseen integration challenges and hidden costs," states Sarah Chen, a senior analyst at Gartner. "Companies need to thoroughly assess these potential expenditures when evaluating the long-term implications of such mergers."

Potential Service Disruptions and Downtime for AT&T

The integration of two large technology companies is inherently complex, and the Broadcom-VMware merger is no exception. This complexity increases the risk of service disruptions and downtime for AT&T.

Integration Challenges

Merging VMware's technology and support infrastructure into Broadcom's existing systems poses considerable challenges. These challenges can lead to unforeseen issues and potential service disruptions.

- Network outages: Integration-related issues could lead to temporary or extended network outages, significantly impacting AT&T's operations.

- Software glitches: Incompatibilities between different systems could cause software glitches, affecting service availability and potentially leading to data loss.

- Security vulnerabilities: Integration processes may temporarily create security vulnerabilities, increasing the risk of cyberattacks.

Past mergers and acquisitions involving major technology companies often experienced similar integration-related problems, highlighting the risks involved in such large-scale operations.

Reduced Innovation and Support

The acquisition might lead to a reduced focus on innovation and slower response times for customer support, particularly concerning legacy VMware products. Broadcom's prioritization of its own product lines could divert resources away from VMware's development and support teams.

- Slower feature updates: AT&T might experience slower updates and fewer new features for VMware products compared to the pre-acquisition period.

- Increased ticket resolution times: Support response times could increase due to resource allocation shifts or integration challenges.

- Reduced product innovation: Focus on cost-cutting measures post-acquisition could negatively impact innovation in VMware's product portfolio.

Analyzing similar post-acquisition scenarios in other companies shows a clear trend toward reduced innovation and slower support in the short to medium term.

Strategic Implications of Broadcom's VMware Acquisition for AT&T

Broadcom's acquisition of VMware has significant strategic implications for AT&T, impacting its competitiveness and vendor relationships.

Impact on AT&T's Competitiveness

The acquisition alters the competitive landscape for AT&T, particularly in cloud services and network infrastructure. The increased cost and potential service disruptions could put AT&T at a disadvantage against competitors who use alternative virtualization solutions.

- Increased cloud costs: Higher VMware licensing fees could increase AT&T's cloud operating costs, reducing its competitive edge.

- Reduced agility: Service disruptions and integration complexities could hinder AT&T's ability to adapt quickly to market changes.

- Loss of vendor neutrality: AT&T's increased dependence on Broadcom limits its ability to leverage multiple vendors and potentially negotiate better deals.

Market reports indicate a growing trend towards cloud-based infrastructure, making the cost and reliability of virtualization solutions crucial for competitiveness.

Shifting Vendor Landscape and Dependence

AT&T's reliance on VMware, now owned by Broadcom, creates a new dynamic in its vendor relationships. This increased dependence carries inherent risks.

- Vendor lock-in: AT&T faces potential vendor lock-in, reducing its bargaining power and limiting its options for future technology choices.

- Supply chain risks: AT&T's reliance on a single vendor increases its exposure to potential supply chain disruptions.

- Pricing power imbalance: Broadcom's ownership of VMware could lead to a significant power imbalance in pricing negotiations, potentially harming AT&T's financial position.

Experts on vendor management emphasize the importance of diversification to mitigate the risks of increased dependence on a single vendor. Strategies for reducing vendor lock-in should be explored to protect AT&T's long-term interests.

Conclusion: The Long-Term Costs of Broadcom's VMware Acquisition for AT&T

Broadcom's acquisition of VMware presents substantial long-term costs for AT&T, encompassing direct and indirect financial implications, potential service disruptions, and significant strategic challenges. Increased licensing fees, integration complexities, potential service downtime, and a shifting vendor landscape all contribute to a complex and potentially costly situation. Analyzing the full scope of these impacts is critical for AT&T's future IT planning and budget allocation.

We encourage readers to further research the impact of Broadcom's VMware acquisition on major corporations and to consider analyzing the cost of the Broadcom VMware deal in relation to their own IT strategies and vendor relationships. Understanding the ramifications of this merger is crucial for navigating the evolving technological landscape and mitigating potential risks.

Featured Posts

-

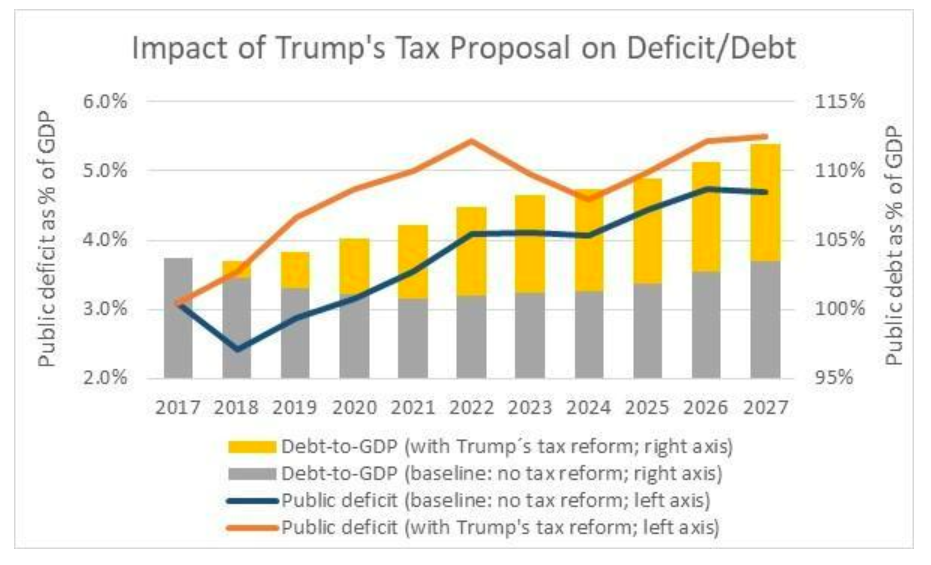

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025 -

Us Lawyers Face Judge Abrego Garcias Order To Stop Stonewalling

Apr 24, 2025

Us Lawyers Face Judge Abrego Garcias Order To Stop Stonewalling

Apr 24, 2025 -

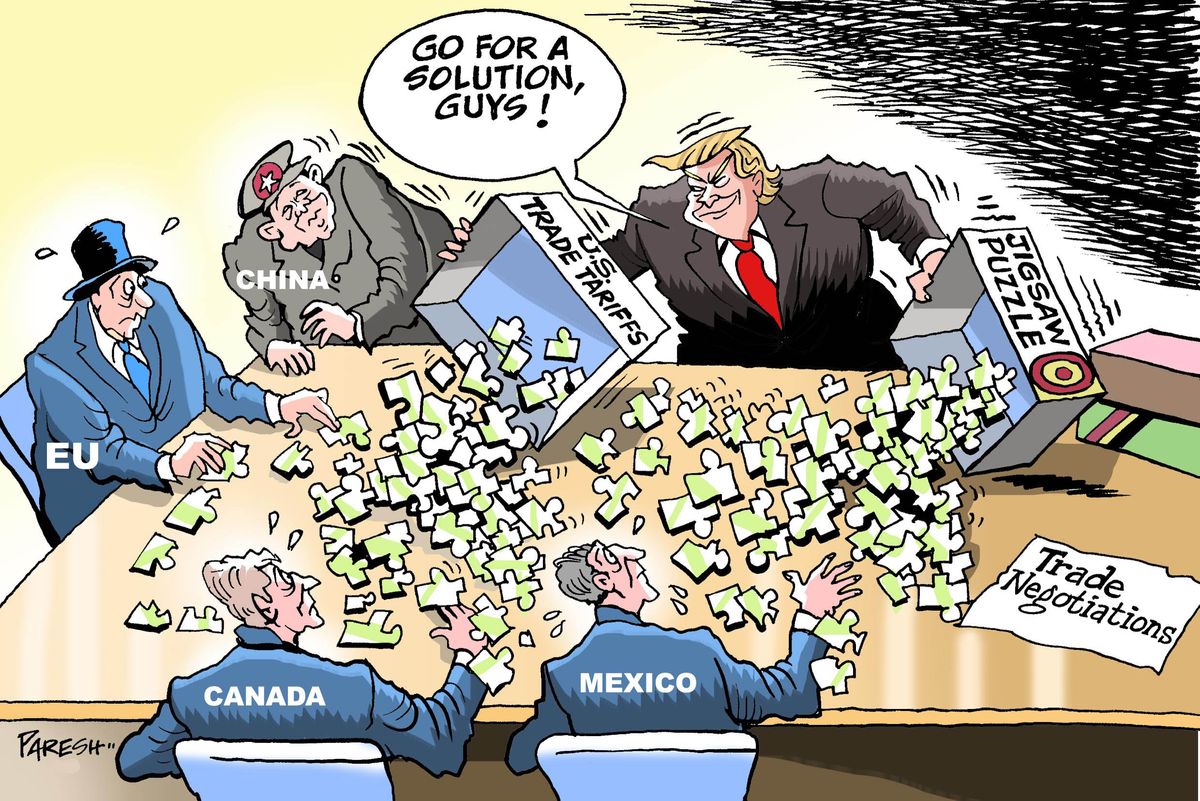

Chinas Shift To Middle Eastern Lpg A Response To Us Tariff Hikes

Apr 24, 2025

Chinas Shift To Middle Eastern Lpg A Response To Us Tariff Hikes

Apr 24, 2025 -

The Bold And The Beautiful April 3 Recap Liams Collapse After Explosive Bill Confrontation

Apr 24, 2025

The Bold And The Beautiful April 3 Recap Liams Collapse After Explosive Bill Confrontation

Apr 24, 2025 -

Understanding Indias Nifty Rally Key Factors And Future Outlook

Apr 24, 2025

Understanding Indias Nifty Rally Key Factors And Future Outlook

Apr 24, 2025