Tesla Stock Plunge: Elon Musk's Net Worth Dips Under $300 Billion

Table of Contents

Reasons Behind Tesla's Stock Decline

Several interconnected factors contributed to Tesla's recent stock market downturn.

Market Sentiment and Economic Uncertainty

The overall negative market sentiment plays a significant role. Rising interest rates, persistent inflation, and fears of a recession are impacting investor confidence across various sectors, and Tesla is no exception. This macroeconomic environment has led to a reassessment of valuations for high-growth companies, including Tesla.

- Increased competition in the EV market: Established automakers are rapidly expanding their EV offerings, challenging Tesla's dominance.

- Concerns about Tesla's production capacity and delivery timelines: Meeting ambitious production targets and ensuring timely deliveries remain crucial challenges for Tesla.

- Impact of global supply chain disruptions: Ongoing supply chain issues continue to impact Tesla's production efficiency and profitability.

- General market volatility impacting tech stocks: The tech sector, of which Tesla is a prominent member, has experienced significant volatility, further exacerbating the decline.

- Analyst downgrades: Several financial analysts have lowered their price targets for Tesla stock, reflecting concerns about the company's future performance.

Elon Musk's Controversies and Their Impact

Elon Musk's actions, particularly his controversial acquisition of Twitter and subsequent management decisions, have significantly influenced investor confidence in Tesla. His public statements and tweets have at times created uncertainty and volatility, impacting the company's brand image and investor sentiment.

- The Twitter acquisition and its financial implications: The considerable financial resources invested in Twitter have raised concerns among investors about Tesla's financial stability and strategic focus.

- Public statements and their impact on Tesla's brand image: Musk's outspoken nature and controversial tweets have occasionally overshadowed Tesla's positive news and achievements.

- Concerns regarding corporate governance at Tesla: Some investors have expressed concerns about corporate governance practices at Tesla, particularly in light of Musk's involvement with Twitter.

Competition in the Electric Vehicle Market

The electric vehicle market is rapidly evolving, with numerous established and emerging players vying for market share. This increased competition is putting pressure on Tesla's pricing strategies and market dominance.

- Growing market share of competitors like BYD, Volkswagen, and Ford: These and other automakers are aggressively expanding their EV lineups, offering competitive vehicles at various price points.

- Innovative technologies and features introduced by rival companies: Competitors are continuously innovating, introducing new technologies and features that could challenge Tesla's technological leadership.

- Aggressive pricing strategies impacting Tesla's profitability: The intense competition is forcing Tesla to adjust its pricing strategies, potentially impacting its profitability margins.

Impact on Elon Musk's Net Worth

The Tesla stock plunge has had a dramatic effect on Elon Musk's net worth.

Calculating the Net Worth Drop

Musk's net worth is heavily tied to his substantial stake in Tesla. As the stock price plummeted, so did his net worth. A significant percentage drop in Tesla's share price directly translates into a substantial reduction in his overall wealth.

- Percentage drop in Tesla stock price: Quantifying the precise percentage drop in Tesla's stock price within a specific timeframe provides crucial context.

- Musk's ownership stake in Tesla: The size of Musk's ownership stake in Tesla is a critical factor in calculating the impact of the stock decline on his net worth.

- Calculation of the net worth decrease based on stock price fluctuations: A clear calculation showing the direct correlation between the stock price drop and the reduction in Musk's net worth is necessary.

Comparison to Previous Net Worth Peaks

The recent decline marks a significant drop from Elon Musk's previous net worth peaks, highlighting the volatility of his wealth and the substantial impact of the Tesla stock plunge.

- Musk's highest recorded net worth: Providing data on Musk's highest recorded net worth allows for a clear comparison with his current net worth.

- Timeline of net worth fluctuations: Illustrating the timeline of Musk's net worth fluctuations provides context to the current decline.

- Percentage change compared to the peak: Expressing the net worth decline as a percentage change compared to the peak highlights the magnitude of the drop.

Conclusion

The Tesla stock plunge, driven by a confluence of market factors, intensifying competition, and Elon Musk's own influence, has resulted in a significant decrease in his net worth. The volatility underscores the interconnectedness of macroeconomic conditions, corporate performance, and the fortunes of high-profile individuals. Market sentiment, competitive pressures within the burgeoning EV sector, and the impact of Elon Musk's actions all played a critical role in this dramatic decline. Key takeaways include the fragility of immense wealth tied to single company performance and the importance of understanding broader market forces. Stay tuned for further updates on the Tesla stock plunge and its long-term implications.

Featured Posts

-

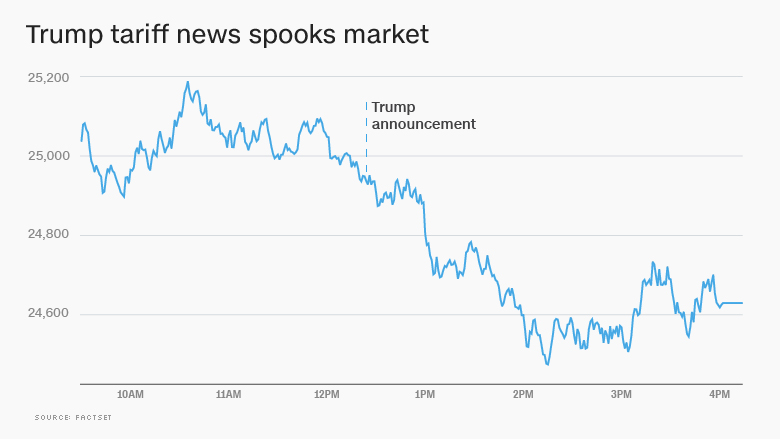

Stock Market Today Trumps Tariff Threat And Uk Trade Deal Impact

May 10, 2025

Stock Market Today Trumps Tariff Threat And Uk Trade Deal Impact

May 10, 2025 -

August Deadline Treasury Signals Potential Us Debt Limit Crisis

May 10, 2025

August Deadline Treasury Signals Potential Us Debt Limit Crisis

May 10, 2025 -

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Screening

May 10, 2025

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Screening

May 10, 2025 -

Elizabeth City Weekend Shooting Arrest Made Investigation Continues

May 10, 2025

Elizabeth City Weekend Shooting Arrest Made Investigation Continues

May 10, 2025 -

Broken By Hate Family Demands Justice After Racist Murder

May 10, 2025

Broken By Hate Family Demands Justice After Racist Murder

May 10, 2025