Stock Market Today: Trump's Tariff Threat And UK Trade Deal Impact

Table of Contents

Trump's Tariff Threats: A Looming Shadow

The specter of renewed protectionist policies under a potential future Trump administration casts a long shadow over the stock market today. The memory of previous trade wars and the imposition of import and export tariffs remains fresh in investors' minds. The impact of these past tariffs on specific sectors like manufacturing and agriculture serves as a stark reminder of the potential consequences.

- The potential resurgence of protectionist policies: The possibility of a return to widespread tariffs remains a significant risk factor. Trump's past pronouncements suggest a willingness to use tariffs as a bargaining chip, potentially disrupting global trade once again. This uncertainty breeds volatility in the market.

- Impact on specific sectors: Previous tariffs disproportionately affected certain sectors. For example, the agricultural sector faced significant challenges due to retaliatory tariffs imposed by other countries. Similarly, the manufacturing sector felt the pinch from increased input costs.

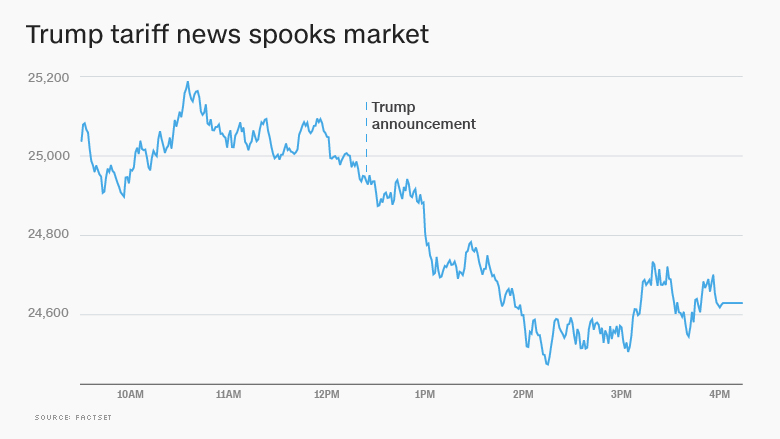

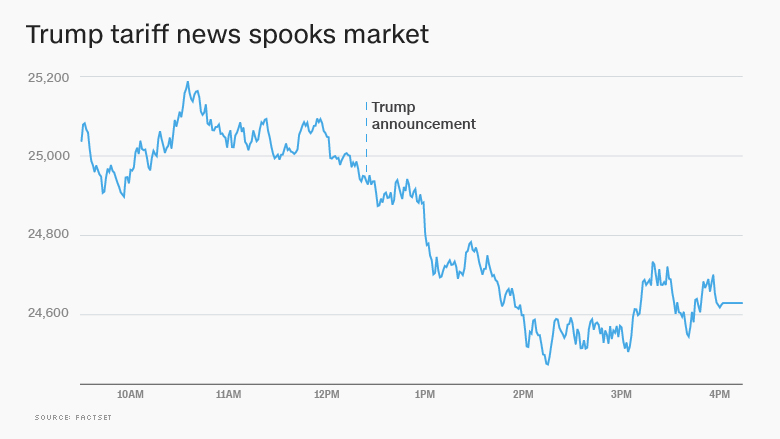

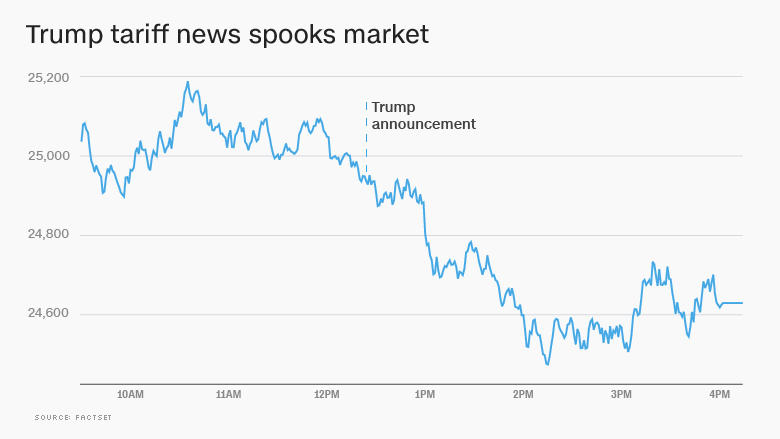

- Market reactions to past tariff announcements: Analyzing past market reactions to tariff announcements provides valuable insight. We can see clear correlations between tariff escalations and market dips, highlighting the sensitivity of investor sentiment to trade policy.

- Expert opinions: Many economic experts warn that a return to aggressive tariff policies could significantly destabilize global markets, leading to higher inflation and slower economic growth. These forecasts influence investor behavior and contribute to market volatility.

Bullet Points:

- Increased costs for consumers due to higher import prices.

- Supply chain disruptions caused by trade restrictions.

- Reduced international trade leading to slower global economic growth.

- Negative impact on company profits due to increased costs and reduced demand.

The UK Trade Deal: Navigating Post-Brexit Realities

The UK's post-Brexit trade deal continues to reverberate through global markets. Its impact on the stock market today is multifaceted, presenting both opportunities and challenges. Analyzing the current state of the UK-EU trade relationship and its consequences is key to understanding the broader market dynamics.

- UK-EU trade relationship: The new trade agreement, while aiming for frictionless trade, introduced new customs checks and regulatory hurdles. This complexity affects businesses on both sides of the Channel.

- Sectoral impact: The impact varies significantly across sectors. The financial services sector, for example, faces significant challenges due to reduced access to the EU market. Other sectors, like agriculture, are grappling with new trade barriers.

- Opportunities and challenges for UK businesses: While some UK businesses have adapted, others continue to struggle with navigating the new regulatory landscape. The deal presents both opportunities for businesses to explore new markets and significant hurdles to overcome.

- Long-term implications: The long-term implications of the Brexit trade deal for the UK and the global economy are still unfolding. It's crucial to monitor its evolution and assess its ongoing effects on market sentiment and investment decisions.

Bullet Points:

- New trade barriers and regulations increase transaction costs for businesses.

- Increased administrative costs for businesses complying with new regulations.

- Potential shifts in investment flows away from the UK due to uncertainty.

- Changes in consumer prices due to altered trade patterns and tariffs.

Market Volatility and Investment Strategies

The combined impact of Trump's tariff threats and the UK trade deal creates significant market volatility. Effective risk management and strategic investment approaches are essential for navigating this uncertain environment.

- Mitigating risk in a volatile market: Risk management strategies include diversification, hedging, and careful monitoring of market conditions. A conservative approach might be necessary in the face of uncertainty.

- Portfolio diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and geographical regions can help mitigate risk. This reduces the impact of negative events affecting a single sector or country.

- Hedging strategies: Employing hedging strategies, such as options or futures contracts, can help protect against potential market downturns. These strategies can offset potential losses but also involve their own risks.

- Long-term outlook: While short-term market fluctuations are inevitable, maintaining a long-term investment horizon is crucial. Focusing on long-term growth potential rather than short-term gains can help weather market volatility.

Bullet Points:

- Regularly review and adjust your investment portfolio based on market conditions.

- Diversify investments across different sectors and geographical locations.

- Consider hedging strategies to mitigate risk, but understand their inherent risks.

- Stay informed about current economic and political events that affect the market.

Conclusion

The stock market today is a dynamic landscape, significantly impacted by geopolitical factors like the potential return of Trump-era tariffs and the ongoing consequences of the UK's post-Brexit trade deal. Understanding these influences is vital for navigating market volatility and making informed investment decisions. By carefully analyzing the potential impacts of these events, you can develop a more resilient investment strategy.

Call to Action: Stay informed about the latest developments affecting the stock market today. By diligently monitoring the stock market today and carefully assessing the implications of Trump's tariff threats and the UK trade deal, you can make better-informed decisions and build a more robust investment portfolio. Continuously monitor and adapt your strategy as the situation evolves.

Featured Posts

-

Politiko Ne Vse Soyuzniki Ukrainy Posetyat Kiev 9 Maya

May 10, 2025

Politiko Ne Vse Soyuzniki Ukrainy Posetyat Kiev 9 Maya

May 10, 2025 -

Katya Jones Hints At Bbc Departure After Wynne Evans Fallout

May 10, 2025

Katya Jones Hints At Bbc Departure After Wynne Evans Fallout

May 10, 2025 -

Trumps Refusal To Drop Tariffs Senator Warners Assessment

May 10, 2025

Trumps Refusal To Drop Tariffs Senator Warners Assessment

May 10, 2025 -

Supporting Transgender Individuals An Allys Guide For International Transgender Day Of Visibility

May 10, 2025

Supporting Transgender Individuals An Allys Guide For International Transgender Day Of Visibility

May 10, 2025 -

Vegas Golden Knights Defeat Blue Jackets 4 0 Behind Hills 27 Saves

May 10, 2025

Vegas Golden Knights Defeat Blue Jackets 4 0 Behind Hills 27 Saves

May 10, 2025