Tesla Stock Decline Impacts Elon Musk's Net Worth: Below $300 Billion For First Time Since November

Table of Contents

Elon Musk's reign as the world's richest person has experienced a significant setback. Recent declines in Tesla stock have pushed his net worth below $300 billion for the first time since November, a substantial drop from his peak valuation. This dramatic shift underscores the volatility inherent in fortunes heavily reliant on a single company's stock performance. This article will delve into the factors contributing to this decline, its implications for Musk's vast business empire, and the broader impact on the electric vehicle market and investor sentiment.

Tesla Stock Performance and its Correlation to Musk's Net Worth

Understanding the Direct Relationship

A substantial portion of Elon Musk's immense wealth is directly tied to his significant ownership stake in Tesla. This creates a direct correlation between Tesla's stock price fluctuations and the ebb and flow of his net worth.

- Direct Proportionality: Musk's ownership stake represents a massive percentage of his total assets. Therefore, any increase in Tesla's stock price translates directly into a proportional increase in his net worth.

- Inverse Relationship in Decline: Conversely, a decrease in Tesla's stock price, as witnessed recently, results in a proportionate decrease in his net worth. This inverse relationship is crucial to understanding the magnitude of the recent drop.

- Market Cap Influence: Tesla's market capitalization is intrinsically linked to Musk's wealth. A shrinking market cap directly diminishes his overall net worth.

Analyzing Recent Stock Price Decreases

Several factors have contributed to the recent decline in Tesla's stock price:

- Heightened EV Competition: The electric vehicle market is becoming increasingly competitive, with established automakers and new entrants launching compelling alternatives to Tesla's offerings. This intensified competition is impacting Tesla's market share and growth projections.

- Production and Delivery Challenges: Concerns regarding Tesla's ability to meet its ambitious production targets and delivery timelines have also weighed on investor sentiment. Reports of production bottlenecks and delays have fueled negative narratives.

- Broader Tech Sector Sell-off: The recent market-wide sell-off impacting the technology sector has also negatively affected Tesla's stock price. This broader market trend has amplified the downward pressure on Tesla.

- Musk's Diversified Activities: Investor concerns regarding Musk's involvement in other ventures, such as SpaceX and Twitter (now X), have also played a role. Some investors worry about a potential distraction from Tesla's core business.

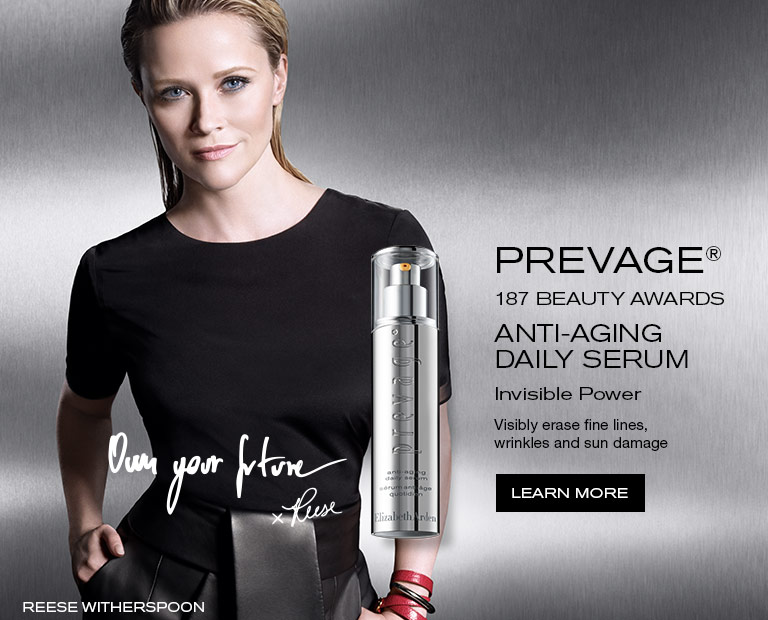

Impact on Musk's Business Ventures and Investments

Ripple Effect Across Musk's Empire

The Tesla stock decline isn't merely a personal financial setback for Musk; it has ripple effects across his vast business empire. His ability to fund and expand his other ventures is directly impacted.

- Reduced Investment Capital: The decrease in his net worth limits his personal investment capital available for new projects and expansions across SpaceX, The Boring Company, and other endeavors.

- Fundraising Challenges: The decline may make it more challenging to secure funding for ambitious projects, potentially requiring more reliance on external investors and potentially diluting ownership stakes.

- Focus Shift: Pressure to stabilize Tesla's performance and regain investor confidence could necessitate a shift in focus, potentially delaying or impacting progress in his other ventures.

Implications for Future Acquisitions and Expansion

Musk's reduced net worth significantly impacts his ability to engage in large-scale acquisitions or expansion projects.

- Funding Limitations: Large acquisitions now require heavier reliance on external financing rather than personal funds. This could make ambitious deals more difficult to execute.

- Increased Financial Scrutiny: Securing loans and investments becomes more challenging with a diminished net worth, leading to increased scrutiny from lenders and investors.

- Potential Delays: Expansion plans across his various companies might face delays as he navigates the financial constraints brought on by the Tesla stock decline.

Market Reactions and Investor Sentiment Towards Tesla

Investor Confidence and Tesla's Future Outlook

The Tesla stock decline has inevitably impacted investor sentiment and future outlooks.

- Analyst Ratings and Predictions: Analyst ratings and future stock price predictions for Tesla are being reassessed, reflecting the uncertainty and volatility in the market.

- Long-Term Growth Potential: While some investors remain bullish on Tesla's long-term growth potential in the EV market, others express concern over the company's ability to maintain its competitive edge and profitability.

- Market Volatility: The future direction of Tesla's stock price remains uncertain, with the potential for further declines or a market rebound depending on future performance and market conditions.

Broader Implications for the Electric Vehicle Market

The Tesla stock decline extends beyond Musk's personal wealth, impacting the broader electric vehicle market and investor confidence.

- Impact on Other EV Stocks: The decline could influence investor sentiment towards other EV manufacturers, leading to a ripple effect across the sector.

- Shifting Market Dynamics: The decline may lead to a reassessment of market valuations and growth projections for the entire EV industry.

- Long-Term EV Adoption: While the long-term adoption of electric vehicles remains promising, the Tesla stock decline highlights the inherent risks and volatility within the sector.

Conclusion

The recent decline in Tesla stock has significantly impacted Elon Musk's net worth, highlighting the inherent risks associated with fortunes heavily reliant on a single company's performance. The impact extends beyond Musk’s personal finances, influencing his investment capabilities and shaping broader market sentiment towards Tesla and the electric vehicle sector. Monitoring Tesla stock price fluctuations and understanding their implications remains crucial for investors and anyone interested in the future of the electric vehicle market and the world's wealthiest individuals. Stay informed on the changing dynamics of Tesla stock and its effect on the broader EV market to make informed decisions.

Featured Posts

-

Thailands Central Bank Governor Search Navigating Looming Tariff Challenges

May 09, 2025

Thailands Central Bank Governor Search Navigating Looming Tariff Challenges

May 09, 2025 -

Samuel Dickson Legacy Of A Canadian Lumber Baron

May 09, 2025

Samuel Dickson Legacy Of A Canadian Lumber Baron

May 09, 2025 -

Elizabeth Arden Skincare On A Budget Walmart

May 09, 2025

Elizabeth Arden Skincare On A Budget Walmart

May 09, 2025 -

Elon Musks Net Worth How Us Policy Impacts Teslas Ceo Fortune

May 09, 2025

Elon Musks Net Worth How Us Policy Impacts Teslas Ceo Fortune

May 09, 2025 -

The High Price Of Childcare One Mans 3 K To 3 6 K Experience

May 09, 2025

The High Price Of Childcare One Mans 3 K To 3 6 K Experience

May 09, 2025