Thailand's Central Bank Governor Search: Navigating Looming Tariff Challenges

Table of Contents

The Economic Landscape Facing the Next Governor

The incoming governor will inherit a Thai economy facing several significant challenges. Understanding these intricacies is paramount for effective monetary policy decisions. Key factors include:

-

Inflation Rate and Consumer Spending: Current inflation rates in Thailand [insert current data and analysis] are impacting consumer spending. The new governor must carefully balance the need to control inflation with the need to stimulate economic growth. This will require a nuanced approach to interest rate adjustments.

-

Economic Slowdown and Global Trade Uncertainties: The global economic climate, marked by uncertainties surrounding the US-China trade war and other geopolitical factors, threatens to slow Thailand's economic growth. The new governor must develop strategies to mitigate these external risks.

-

Foreign Investment and Policy Stability: Foreign investment plays a crucial role in the Thai economy. Maintaining confidence in the stability and predictability of Thailand's economic policies is essential to attracting and retaining this vital investment. The next governor's actions will significantly influence investor sentiment.

-

Baht Exchange Rate Volatility: Fluctuations in the baht exchange rate can impact both imports and exports. The new governor must manage monetary policy to maintain a stable and competitive exchange rate, promoting healthy trade balances.

The incoming governor will inherit an economy grappling with slowing export growth and rising household debt. Successfully navigating these issues requires a deep understanding of both domestic and global economic forces. Effective management of the baht exchange rate, in particular, will be critical in maintaining export competitiveness.

The Impact of Rising Tariffs on Thailand's Economy

Thailand's export-oriented economy is particularly vulnerable to escalating global trade tensions and the resulting tariffs. The impact of these tariffs needs careful consideration by the next central bank governor:

-

US-China Trade War and its Ripple Effects: The ongoing US-China trade war and associated tariffs have created significant uncertainty and disruption in global supply chains, directly affecting Thailand's export-oriented economy.

-

Market Vulnerability: Thailand's reliance on specific export markets, such as [mention key export markets and their vulnerability to tariff increases], makes it highly susceptible to tariff-related shocks. Diversification of export markets should be a priority.

-

Mitigation Strategies for Businesses: The new governor needs to work closely with the government to develop and implement strategies to help Thai businesses mitigate the negative impacts of tariffs, such as exploring new markets and enhancing competitiveness.

-

Regional Trade Agreements: Leveraging existing regional trade agreements, such as the RCEP (Regional Comprehensive Economic Partnership), will be crucial in reducing the negative impact of tariffs and fostering regional economic cooperation.

Thailand's economy is heavily reliant on exports, making it particularly vulnerable to the escalating trade war and resulting tariff increases. The next governor must develop strategies to protect Thai businesses and foster economic resilience in this challenging environment.

Essential Qualities of the Next Central Bank Governor

The selection process for the next Bank of Thailand governor must prioritize candidates with specific skills and attributes:

-

Monetary Policy Expertise: Extensive experience in managing monetary policy during periods of economic uncertainty and volatility is essential. A deep understanding of interest rate adjustments, inflation targeting, and other monetary policy tools is crucial.

-

Communication Skills: The ability to effectively communicate complex economic concepts to the public, the media, and international stakeholders is vital for maintaining confidence in the Bank of Thailand and its policies.

-

International Relations: Strong international relations skills are crucial for negotiating effectively with global organizations and fostering cooperation on issues impacting the Thai economy, including tariff negotiations and global economic stability.

-

Political Independence: Maintaining the central bank's independence from political influence is paramount for its credibility and effectiveness. The selected candidate must demonstrate a steadfast commitment to this principle.

-

Crisis Management: Expertise in crisis management and risk assessment is crucial for navigating potential economic shocks and maintaining stability.

The selection process must prioritize candidates with a proven track record in navigating complex economic challenges and communicating effectively with both domestic and international stakeholders. Independence from political pressures is also crucial to maintaining the credibility of the Bank of Thailand.

Conclusion

The selection of Thailand's next central bank governor is of paramount importance, given the looming tariff challenges and the complex economic landscape. The ideal candidate will possess a deep understanding of monetary policy, international relations, and crisis management. They must be able to navigate the intricacies of global trade tensions while fostering sustainable economic growth in Thailand. The successful candidate will play a crucial role in shaping Thailand's economic future and ensuring its continued prosperity. The search for the right individual to lead the Bank of Thailand through these challenges is a critical step in securing Thailand's economic stability and long-term growth. Careful consideration of the factors outlined above is essential for the effective selection of a leader capable of navigating the complexities of the Thailand central bank governor role and effectively addressing the looming tariff challenges. The future of the Thailand central bank governor's role requires a proactive and insightful leader.

Featured Posts

-

Reaching Nome Challenges Faced By 7 First Time Iditarod Racers

May 09, 2025

Reaching Nome Challenges Faced By 7 First Time Iditarod Racers

May 09, 2025 -

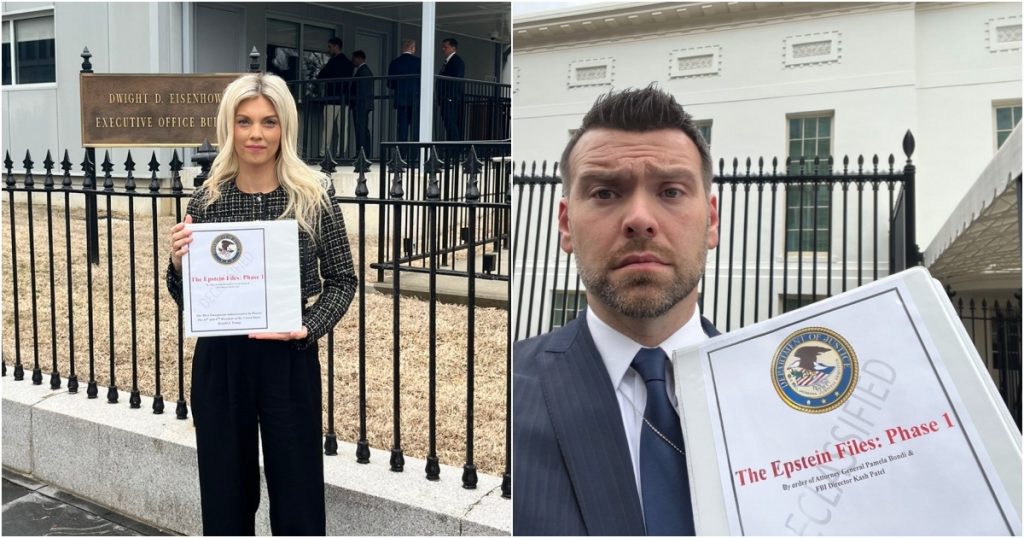

James Comer Epstein Files And Pam Bondis Response A Detailed Look

May 09, 2025

James Comer Epstein Files And Pam Bondis Response A Detailed Look

May 09, 2025 -

Trump To Announce New Trade Agreement With The Uk What To Expect

May 09, 2025

Trump To Announce New Trade Agreement With The Uk What To Expect

May 09, 2025 -

The Relationship Between Dakota Johnson And Chris Martin Impact On Acting Career

May 09, 2025

The Relationship Between Dakota Johnson And Chris Martin Impact On Acting Career

May 09, 2025 -

El Salvadoran Migrant Kilmar Abrego Garcia Becomes A Focal Point Of Us Political Debate

May 09, 2025

El Salvadoran Migrant Kilmar Abrego Garcia Becomes A Focal Point Of Us Political Debate

May 09, 2025

Latest Posts

-

Go Compares Wynne Evans Axed Following Strictly Come Dancing Scandal

May 09, 2025

Go Compares Wynne Evans Axed Following Strictly Come Dancing Scandal

May 09, 2025 -

Wynne Evans New Evidence To Clear Name After Strictly Scandal

May 09, 2025

Wynne Evans New Evidence To Clear Name After Strictly Scandal

May 09, 2025 -

Wynne Evans Responds To Allegations I Promise I Have Done Nothing Wrong

May 09, 2025

Wynne Evans Responds To Allegations I Promise I Have Done Nothing Wrong

May 09, 2025 -

Wynne Evans Denies Wrongdoing Amidst Show Of Support

May 09, 2025

Wynne Evans Denies Wrongdoing Amidst Show Of Support

May 09, 2025 -

Spring Fashion Elizabeth Stewarts Collaboration With Lilysilk

May 09, 2025

Spring Fashion Elizabeth Stewarts Collaboration With Lilysilk

May 09, 2025