Elon Musk's Net Worth: How US Policy Impacts Tesla's CEO Fortune

Table of Contents

Tax Policies and Their Influence on Elon Musk's Wealth

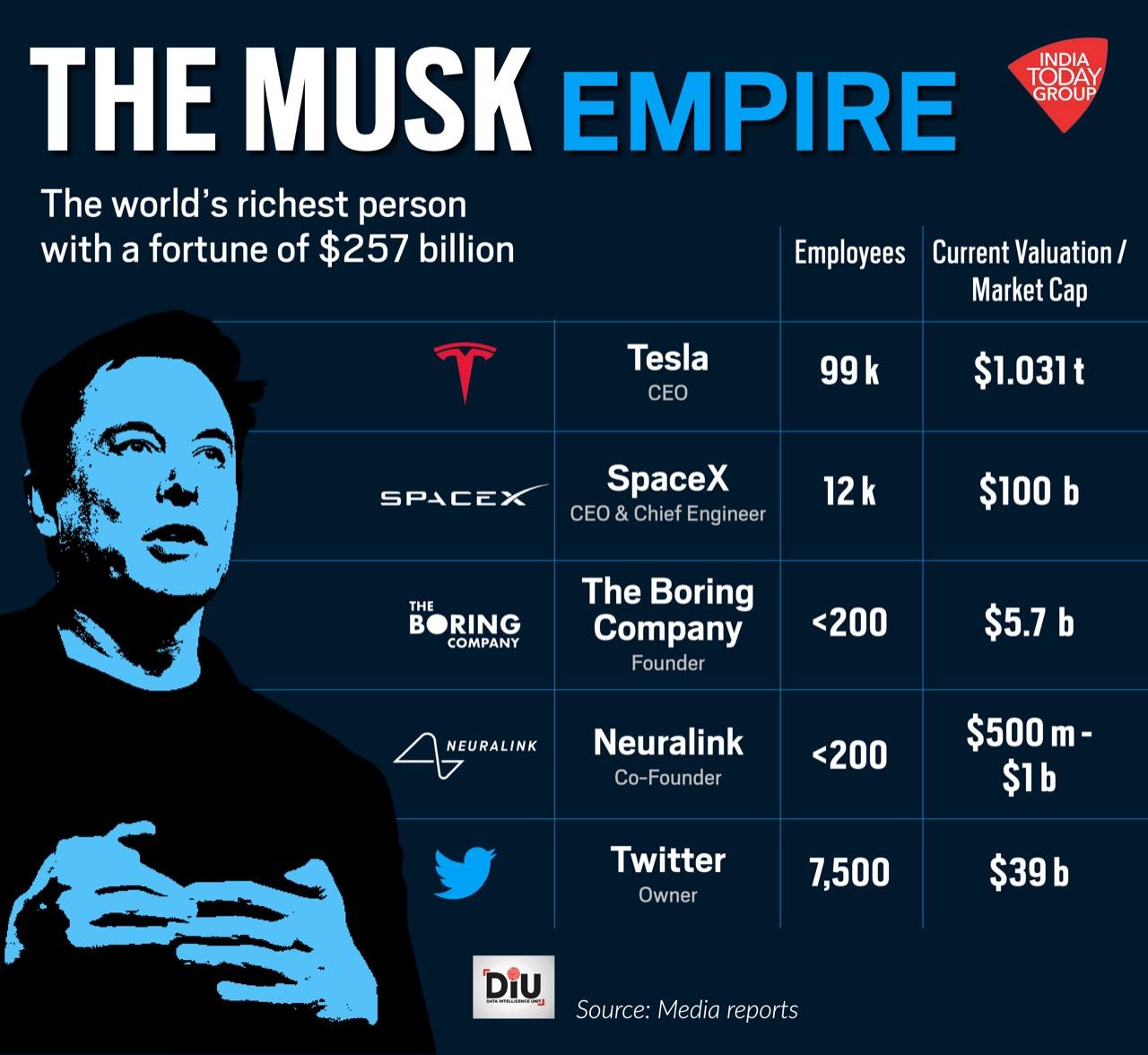

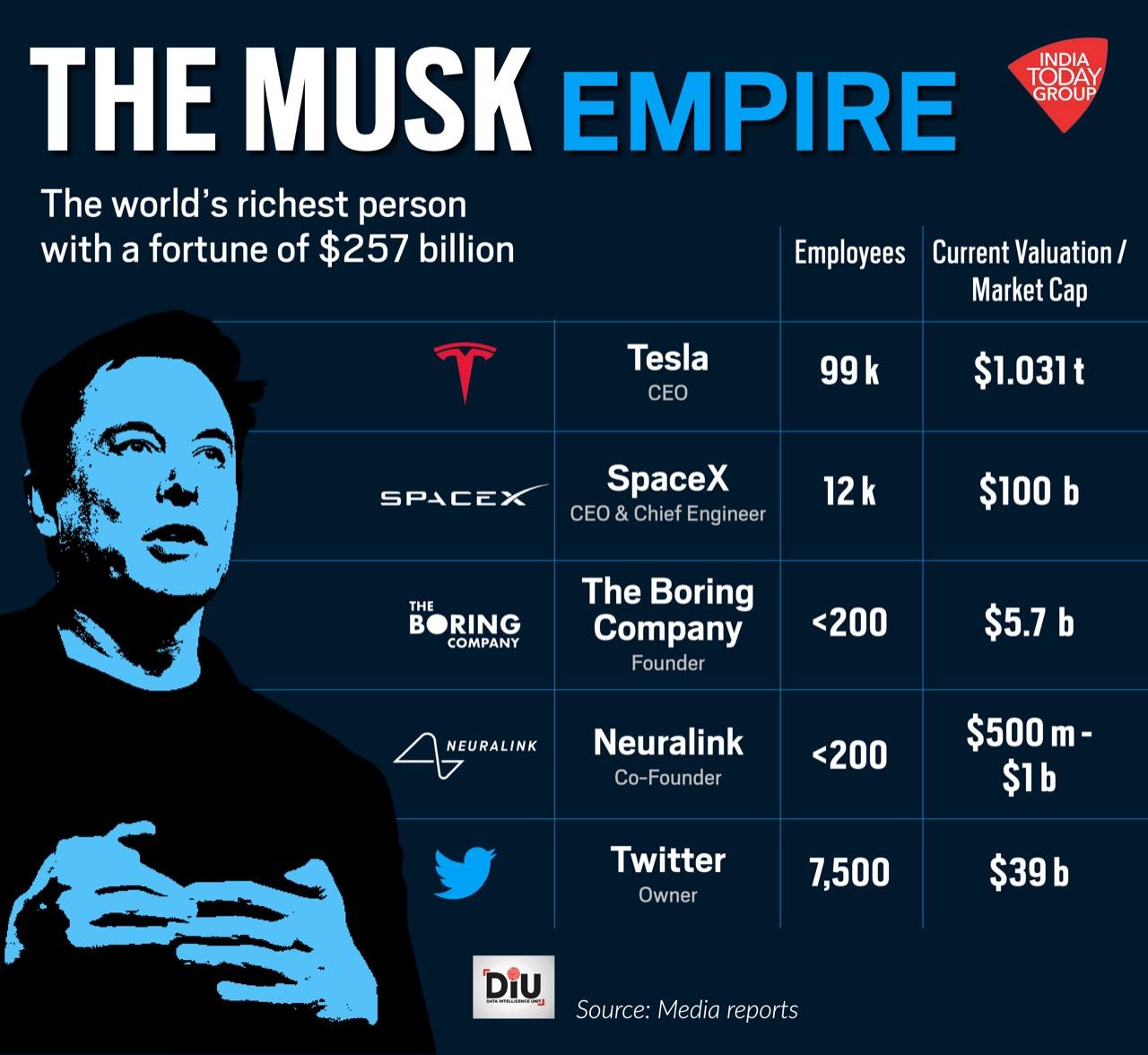

Elon Musk's immense wealth is largely tied up in Tesla stock. Therefore, US tax policies significantly impact his overall net worth.

Capital Gains Taxes

Capital gains taxes are levied on profits from the sale of assets, including stocks like Tesla. Musk's decisions regarding selling Tesla shares are heavily influenced by these taxes.

- Different Tax Brackets and Rates: The US employs a progressive tax system, meaning higher income levels are taxed at higher rates. This directly impacts Musk's tax liability on any Tesla stock sales. A change in tax brackets or rates could significantly alter his after-tax profits.

- Tax Avoidance Strategies: High-net-worth individuals often employ sophisticated tax planning strategies to minimize their tax burden. However, the ethical implications of these strategies are often debated, particularly regarding their fairness and potential impact on societal wealth distribution. Musk's own tax strategies have faced scrutiny in the past.

- Historical Correlation: Analyzing historical capital gains tax rates alongside Musk's net worth fluctuations reveals a correlation, though not necessarily a direct causation. Lower capital gains taxes might incentivize more frequent stock sales, leading to higher short-term gains but potentially impacting long-term investment strategies.

Corporate Tax Rates

Tesla's profitability directly influences Musk's wealth, as his stock holdings represent a significant portion of his net worth. Corporate tax rates influence Tesla's bottom line and therefore impact Musk's overall wealth.

- Investment Decisions: Lower corporate tax rates can incentivize Tesla to reinvest profits in research and development, expansion, and job creation, potentially boosting the company's value and Musk's net worth.

- Tax Incentives: The US government sometimes offers tax incentives to companies investing in specific sectors, such as clean energy. Tesla, as a leader in electric vehicles, has likely benefited from such incentives, positively influencing Musk's wealth.

- International Comparison: Comparing US corporate tax rates with those of other countries where Tesla operates provides context. A higher US corporate tax rate compared to other nations could reduce Tesla's competitiveness and potentially negatively affect Musk's net worth.

Environmental Regulations and Tesla's Success

Tesla's core business is centered around electric vehicles, making it highly susceptible to environmental regulations and incentives.

Clean Energy Incentives

Government support for clean energy plays a crucial role in Tesla's success.

- Government Investment: US government investments in clean energy infrastructure, including charging stations and grid modernization, create a more favorable environment for electric vehicle adoption, benefiting Tesla directly.

- State-Level Incentives: Many states offer additional tax credits and incentives for purchasing electric vehicles, further boosting Tesla sales and indirectly impacting Musk's wealth. Variations in these incentives across states create a complex landscape impacting regional sales.

- Future Policy Changes: Changes in clean energy policies, such as potential reductions in subsidies or tax credits, could significantly impact Tesla's competitiveness and Musk's net worth.

Emission Standards

Stricter emission standards drive demand for electric vehicles, benefiting Tesla.

- Competition: The level of competition from other EV manufacturers is heavily influenced by emission regulations. Stricter standards can create a more level playing field for Tesla, while relaxed standards might increase competition.

- Regulatory Rollbacks: Potential rollbacks or weakenings of environmental regulations could negatively impact Tesla's market position and reduce demand for its vehicles, thus potentially reducing Musk's net worth.

- Future Standards: Projections for future emission standards are critical for assessing the long-term prospects of Tesla and the influence on Musk's wealth. More stringent future regulations could be highly beneficial to Tesla.

Infrastructure Spending and Tesla's Charging Network

The development of charging infrastructure is vital for the widespread adoption of electric vehicles.

Government Investment in Charging Infrastructure

Government investment in electric vehicle charging stations directly impacts Tesla's Supercharger network and market share.

- Benefits of Widespread Infrastructure: Extensive charging infrastructure makes EVs more appealing to consumers, leading to increased demand and boosting Tesla's sales and, consequently, Musk's net worth.

- Public-Private Partnerships: Public-private partnerships can accelerate the development of charging infrastructure, benefiting Tesla and potentially increasing its market share.

- Government Funding Levels: The level of government funding significantly impacts the rate of charging station deployment, influencing Tesla's ability to expand its Supercharger network and its overall market competitiveness.

Conclusion

Elon Musk's net worth is significantly influenced by US policies on taxation, environmental regulations, and infrastructure spending. Understanding these interconnected factors is crucial for comprehending the complex dynamics of his wealth and the future of Tesla. From capital gains taxes to clean energy incentives, governmental actions directly impact Tesla's profitability, its market position, and ultimately, Elon Musk's vast fortune. Staying informed about evolving US policies is key to predicting the future trajectory of Elon Musk's net worth and the continued success of his ventures. Continue learning about the impact of US policy on Elon Musk's net worth by researching current legislation and its potential consequences.

Featured Posts

-

Imfs Review Of Pakistans 1 3 Billion Package Amidst India Tensions And Other News

May 09, 2025

Imfs Review Of Pakistans 1 3 Billion Package Amidst India Tensions And Other News

May 09, 2025 -

Germaniya Riski Novogo Naplyva Bezhentsev Iz Ukrainy Iz Za Politiki S Sh A

May 09, 2025

Germaniya Riski Novogo Naplyva Bezhentsev Iz Ukrainy Iz Za Politiki S Sh A

May 09, 2025 -

Dakota Johnson And Chris Martin A Look At Career Choices

May 09, 2025

Dakota Johnson And Chris Martin A Look At Career Choices

May 09, 2025 -

Analyzing Figmas Ai Update Implications For Adobe Word Press And Canva

May 09, 2025

Analyzing Figmas Ai Update Implications For Adobe Word Press And Canva

May 09, 2025 -

Bone Bruise Sidelines Jayson Tatum Game 2 Status In Question

May 09, 2025

Bone Bruise Sidelines Jayson Tatum Game 2 Status In Question

May 09, 2025