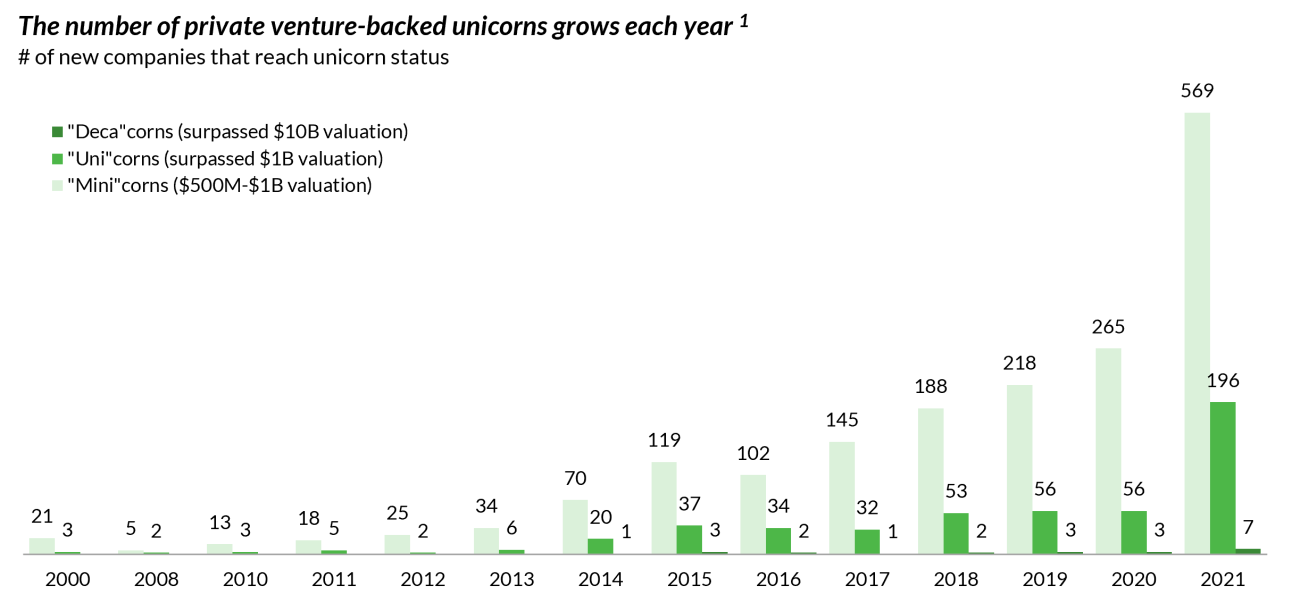

Venture Capital Secondary Market: A Hot Investment Opportunity

Table of Contents

Understanding the Venture Capital Secondary Market

What is the Secondary Market?

The venture capital secondary market is where existing investors in venture-backed companies sell their stakes to other investors. This contrasts with the primary market, where investments are made directly into startups by venture capital firms and other investors. Key players in the secondary market include:

- Limited Partners (LPs): Institutional investors (like pension funds and endowments) who invest in venture capital funds. They often seek liquidity for their venture capital holdings.

- General Partners (GPs): The management teams of venture capital funds who manage the investments and often participate in secondary transactions.

- Secondary Market Buyers: These can be other LPs, specialized secondary funds, family offices, and high-net-worth individuals seeking exposure to venture capital without the traditional primary market entry points.

Transactions in the secondary market take various forms:

- Individual Stake Sales: An LP sells a portion of their stake in a single portfolio company.

- Portfolio Divestitures: An LP sells a significant portion or all of their holdings in a venture capital fund's portfolio.

- Structured Transactions: More complex deals involving various financial instruments, often designed to manage risk and optimize returns.

Why Invest in the Secondary Market?

Investing in the venture capital secondary market offers several compelling advantages:

- Access to high-growth companies without early-stage risk: Secondary market investments provide access to established companies that have already navigated the early stages of growth, mitigating some of the inherent risks of early-stage investing.

- Enhanced portfolio diversification beyond traditional asset classes: Venture capital, traditionally an illiquid asset class, can be accessed more readily via the secondary market, offering diversification benefits for a broader range of investors.

- Liquidity for existing investors: The secondary market provides a mechanism for LPs to realize returns on their venture capital investments before the ultimate exit event (IPO or acquisition).

- Potentially higher returns compared to primary market investments: While not guaranteed, secondary market investments can potentially offer higher returns due to the established track record of the underlying companies.

- Opportunity to leverage the expertise of experienced fund managers: Secondary market investors can benefit from the due diligence and management expertise of the existing General Partners and the specialized knowledge of secondary market fund managers.

Benefits and Considerations for Investors

Benefits of Secondary Market Investments

Investing in the venture capital secondary market offers numerous benefits:

- Quicker access to established businesses: Investors bypass the lengthy process of identifying and vetting early-stage startups.

- Reduced risk compared to primary market investments: The companies have already demonstrated traction and overcome early-stage challenges.

- Improved portfolio diversification: Adding venture capital exposure through secondary investments can significantly improve overall portfolio diversification.

- Higher potential ROI: Successful secondary market investments can yield substantially higher returns than many traditional investment vehicles. For example, successful investments in companies like Uber or Airbnb, acquired via the secondary market early on, could have generated significant returns.

Potential Risks and Due Diligence

While promising, secondary market investments also carry risks:

- Illiquidity: Secondary market investments are not as easily traded as publicly listed securities.

- Valuation challenges: Accurately valuing private companies can be difficult and subjective.

- Limited information: Access to comprehensive financial information might be restricted compared to publicly traded companies.

- Thorough due diligence is crucial: Investors must conduct extensive due diligence to assess the company’s financial health, competitive landscape, management team, and the terms of the transaction.

Professional advice is crucial. Engaging legal and financial professionals with experience in the secondary market is strongly recommended before making any investment. Understanding the company's financials, competitive landscape, and management team are non-negotiable aspects of due diligence.

Strategies for Successful Secondary Market Investing

Identifying Attractive Investment Opportunities

Sourcing attractive deals requires a proactive approach:

- Networking: Building relationships with LPs, GPs, and secondary market brokers is essential.

- Working with specialized brokers: These brokers have extensive networks and expertise in identifying and structuring secondary market transactions.

- Direct outreach to LPs and GPs: Directly contacting LPs and GPs can lead to exclusive investment opportunities.

- Understanding market trends: Staying informed about industry trends and identifying undervalued assets is crucial.

Negotiating and Structuring Deals

Negotiation and due diligence are paramount:

- Effective negotiation: Achieving favorable terms, including price, deal structure, and protective provisions, is critical.

- Various deal structures: Understanding different deal structures (e.g., direct purchases, structured notes) and their implications for investors is important.

- Role of professionals: Legal and financial professionals play a vital role in guiding the negotiation and structuring process.

Conclusion

The venture capital secondary market presents a unique and compelling opportunity for investors seeking diversification, potentially higher returns, and access to established high-growth companies. While inherent risks exist, thorough due diligence and a well-defined investment strategy can significantly increase the chances of success. Are you ready to explore the exciting potential of the venture capital secondary market? Learn more about accessing this dynamic investment opportunity and connect with experienced professionals to guide your journey into the world of secondary market investments. Start your research on the venture capital secondary market today!

Featured Posts

-

Chainalysis Acquisition Of Alterya A Boost For Ai Powered Blockchain Security

Apr 29, 2025

Chainalysis Acquisition Of Alterya A Boost For Ai Powered Blockchain Security

Apr 29, 2025 -

Australias Lynas Seeks Us Funding For Texas Rare Earths Refinery Project

Apr 29, 2025

Australias Lynas Seeks Us Funding For Texas Rare Earths Refinery Project

Apr 29, 2025 -

Ramiro Helmeyers Dedication To Fc Barcelona

Apr 29, 2025

Ramiro Helmeyers Dedication To Fc Barcelona

Apr 29, 2025 -

Sons Anguish Ohio Doctor Seeks Parole After 36 Years In Prison For Wifes Death

Apr 29, 2025

Sons Anguish Ohio Doctor Seeks Parole After 36 Years In Prison For Wifes Death

Apr 29, 2025 -

Nyt Spelling Bee March 14 2025 Find The Pangram And All Answers

Apr 29, 2025

Nyt Spelling Bee March 14 2025 Find The Pangram And All Answers

Apr 29, 2025

Latest Posts

-

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025 -

Older Viewers Rediscovering Favorite Shows On You Tube

Apr 29, 2025

Older Viewers Rediscovering Favorite Shows On You Tube

Apr 29, 2025 -

Milly Alcock As Supergirl In Netflixs Sirens A Look At The New Trailer

Apr 29, 2025

Milly Alcock As Supergirl In Netflixs Sirens A Look At The New Trailer

Apr 29, 2025 -

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025 -

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025