Suncor's Record Production: Inventory Build Impacts Sales Volumes

Table of Contents

Suncor Energy, a major player in Canada's oil and gas sector, recently announced record production levels. This seemingly positive achievement is, however, counterbalanced by a significant increase in inventory, resulting in lower sales volumes. This article examines the factors contributing to this paradox, analyzing its implications for Suncor and the broader energy market. We will delve into the reasons behind the increased production, the impact of the inventory build-up, and the strategies Suncor might employ to overcome this challenge.

Record Production Levels at Suncor

Increased Upstream Production

Suncor's impressive production figures are a testament to operational efficiency improvements across its upstream operations. These gains are attributable to several key factors:

- New technology implementation: Suncor has invested heavily in advanced technologies, including enhanced oil recovery techniques and automation, leading to increased well productivity and reduced operational costs. This technological upgrade has significantly boosted their oil and gas output.

- Optimized extraction processes: Streamlining extraction processes, improving logistics, and refining operational workflows have contributed to a more efficient and productive output.

- Increased well productivity: Improvements in drilling techniques and well design have resulted in higher yields from existing and new wells, significantly impacting overall production capacity.

While precise figures may vary depending on the reporting period, Suncor's production increase compared to the previous year represents a substantial jump in output, showcasing the effectiveness of its operational strategies.

Factors Contributing to Higher Production

Several factors beyond operational improvements contributed to Suncor's record production:

- Successful exploration and development projects: New discoveries and successful development projects have added to Suncor's overall production capacity. These projects represent significant investments in future growth.

- Strategic acquisitions: Acquisitions of smaller companies with established assets have expanded Suncor's footprint and production capabilities.

- Effective workforce management: Investing in employee training and fostering a culture of operational excellence has undoubtedly played a crucial role in achieving these record production levels.

The Impact of Inventory Build-up

Reasons for Increased Inventory

Despite record production, Suncor faces a challenge: a substantial inventory build-up. This is primarily due to:

- Weak global demand: Fluctuations in global economic growth have dampened demand for oil and gas, leaving Suncor with a surplus.

- Refining capacity constraints: Limitations in refining capacity, both domestically and internationally, have hampered Suncor's ability to process its increased production into refined products.

- Logistical bottlenecks: Supply chain disruptions and transportation constraints have also contributed to the inventory buildup, delaying the movement of oil and gas to markets.

- Price volatility affecting sales decisions: Uncertainty in commodity prices might have influenced Suncor's sales decisions, leading them to hold onto inventory in anticipation of more favorable market conditions. This further contributes to the inventory surplus. Storage capacity limitations also play a significant role; holding excessive inventory incurs substantial storage and maintenance costs.

Financial Implications of High Inventories

Maintaining large inventories has significant financial consequences for Suncor:

- Increased financing costs: Financing the storage and handling of vast oil and gas reserves puts pressure on Suncor’s financial resources.

- Potential write-downs on inventory: If commodity prices decline significantly, Suncor may need to write down the value of its inventory, impacting profitability.

- Impact on profitability: The increased storage costs, potential write-downs, and reduced cash flow directly affect Suncor's bottom line.

Lower Sales Volumes Despite Record Production

Market Dynamics Affecting Sales

Suncor's inability to translate record production into higher sales volumes reflects broader market dynamics:

- Global economic slowdown: A weakening global economy reduces demand for oil and gas, impacting sales.

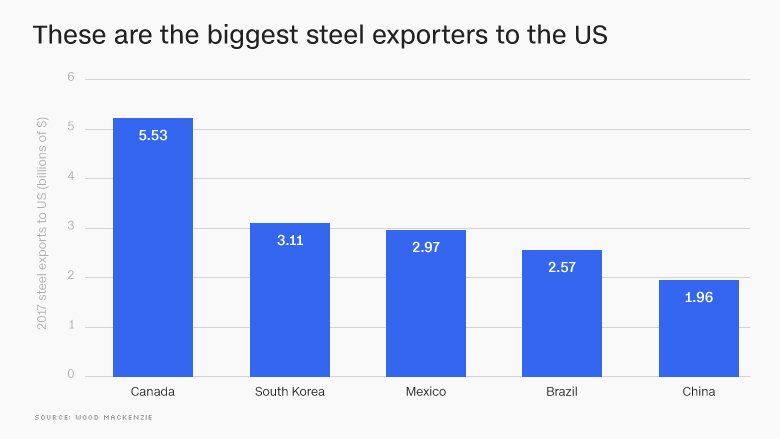

- Competition from other oil producers: Increased competition from other oil-producing nations impacts market share and sales prices.

- Changing consumer demand: The growing emphasis on renewable energy sources contributes to a shift in consumer preferences, impacting long-term demand.

- Geopolitical instability: Geopolitical events and uncertainties can significantly disrupt global energy markets and affect sales volumes.

Suncor's Sales Strategies and Adjustments

To address the inventory surplus, Suncor may employ several strategies:

- Potential price adjustments: Lowering prices to stimulate demand and reduce inventory levels.

- Increased marketing and sales efforts: Strengthening sales channels and intensifying marketing campaigns to attract more customers.

- Exploring new markets: Diversifying into new markets with stronger demand for oil and gas.

- Strategic partnerships: Collaborating with other companies to optimize refining, transportation, and distribution networks.

Long-Term Outlook and Implications for the Energy Sector

Projections for Future Production and Sales

Suncor's long-term outlook depends on several factors:

- Planned investments in new projects: Future investments will shape its production capacity and its ability to meet market demand.

- Expansion plans: Aggressive expansion plans can contribute to increased output, but this must align with market realities.

- Anticipated market conditions: Future market conditions will significantly influence Suncor's success in translating production into sales.

Broader Implications for the Oil and Gas Industry

Suncor's experience highlights critical issues for the wider oil and gas industry:

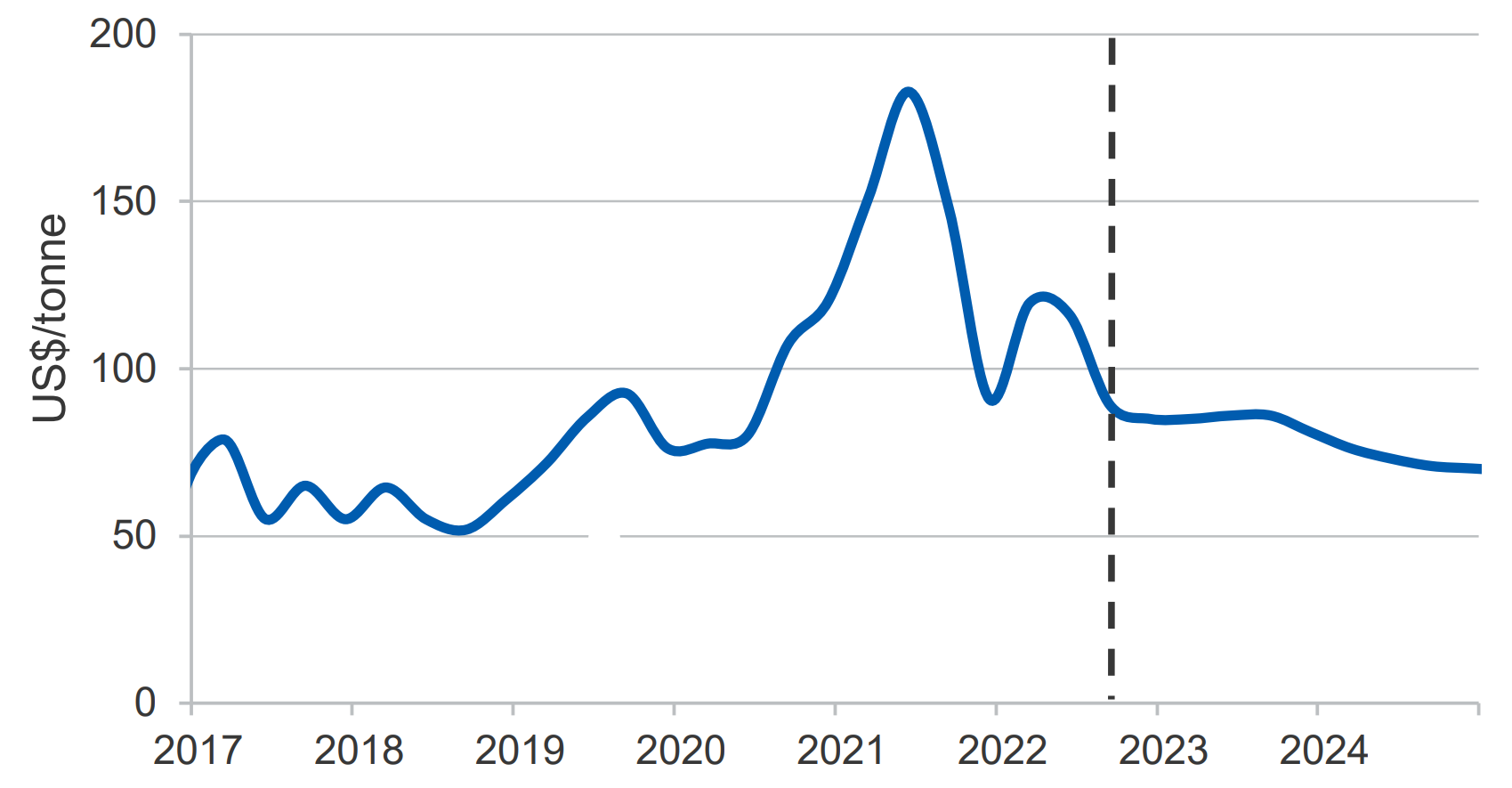

- Impact on commodity pricing: The imbalance between supply and demand can lead to price volatility and impact investor confidence.

- Implications for investor confidence: The current situation can affect investors' confidence in the oil and gas sector.

- Potential for industry consolidation: The need for efficient operations and market responsiveness might lead to increased industry consolidation.

Conclusion

Suncor's record production, coupled with a substantial inventory build-up resulting in lower sales volumes, illustrates the complexities of the energy market. The interplay between production capacity, market demand, and pricing is critical for success. This inventory surplus presents a challenge to Suncor's financial performance and strategic direction. The company's ability to adapt to the evolving market dynamics will be crucial for its long-term success.

Call to Action: Stay informed about Suncor's progress in managing its inventory and navigating the dynamic energy market. Follow our updates on Suncor’s oil production, sales volume fluctuations, and the evolution of its inventory levels. Understanding Suncor's challenges provides valuable insight into broader trends shaping the oil and gas industry.

Featured Posts

-

Rhlt Barys San Jyrman Nhw Alqmt Alawrwbyt

May 10, 2025

Rhlt Barys San Jyrman Nhw Alqmt Alawrwbyt

May 10, 2025 -

High Potential 5 Compelling Theories About David And The He Morgan Brother

May 10, 2025

High Potential 5 Compelling Theories About David And The He Morgan Brother

May 10, 2025 -

Makron I Tusk Oboronnoe Soglashenie 9 Maya Detali I Posledstviya Dlya Ukrainy

May 10, 2025

Makron I Tusk Oboronnoe Soglashenie 9 Maya Detali I Posledstviya Dlya Ukrainy

May 10, 2025 -

Falling Iron Ore Prices The Role Of Chinas Steel Industry Slowdown

May 10, 2025

Falling Iron Ore Prices The Role Of Chinas Steel Industry Slowdown

May 10, 2025 -

Trumps Billionaire Buddies How Tariffs Impacted Their Fortunes After Liberation Day

May 10, 2025

Trumps Billionaire Buddies How Tariffs Impacted Their Fortunes After Liberation Day

May 10, 2025