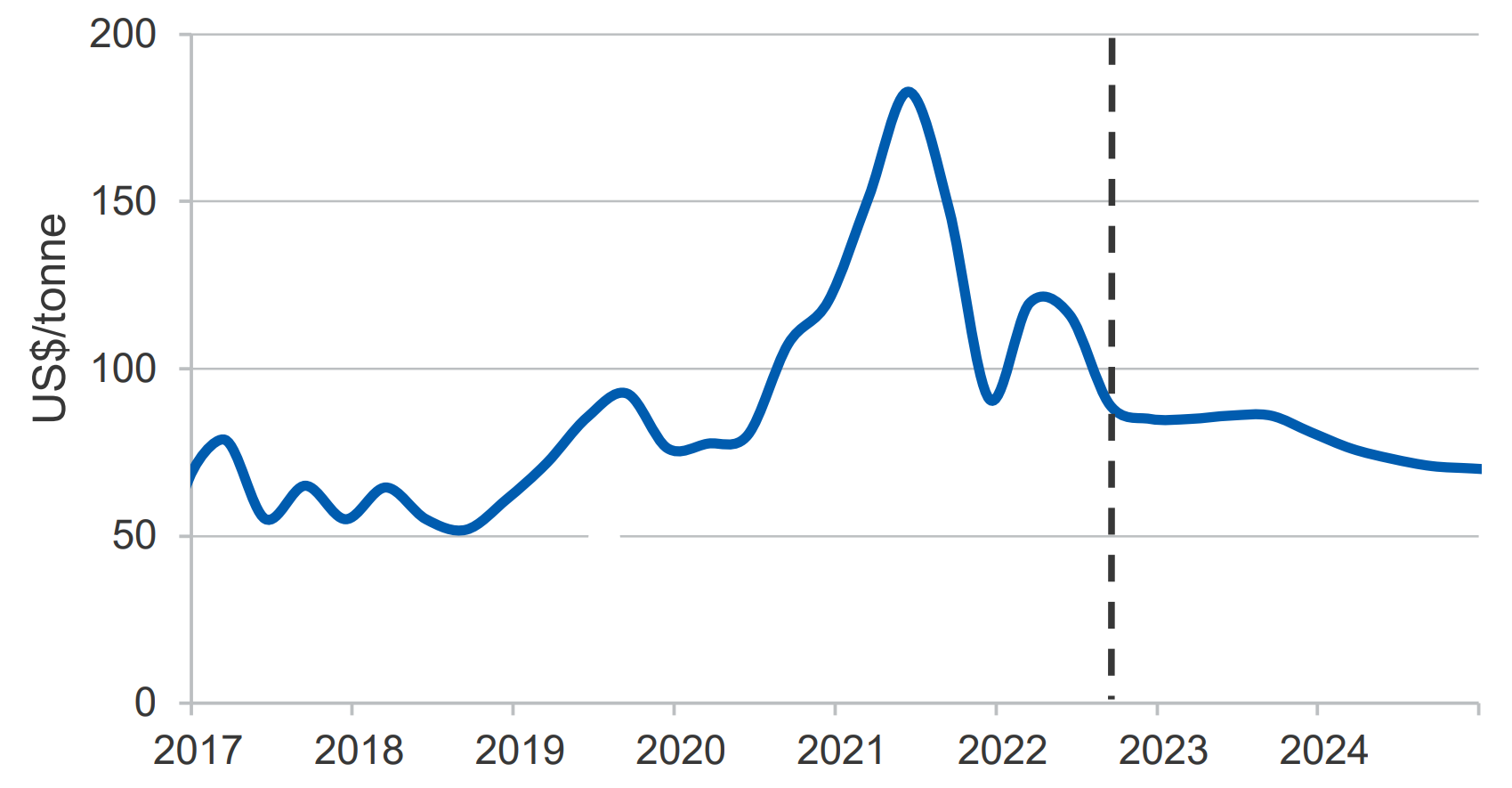

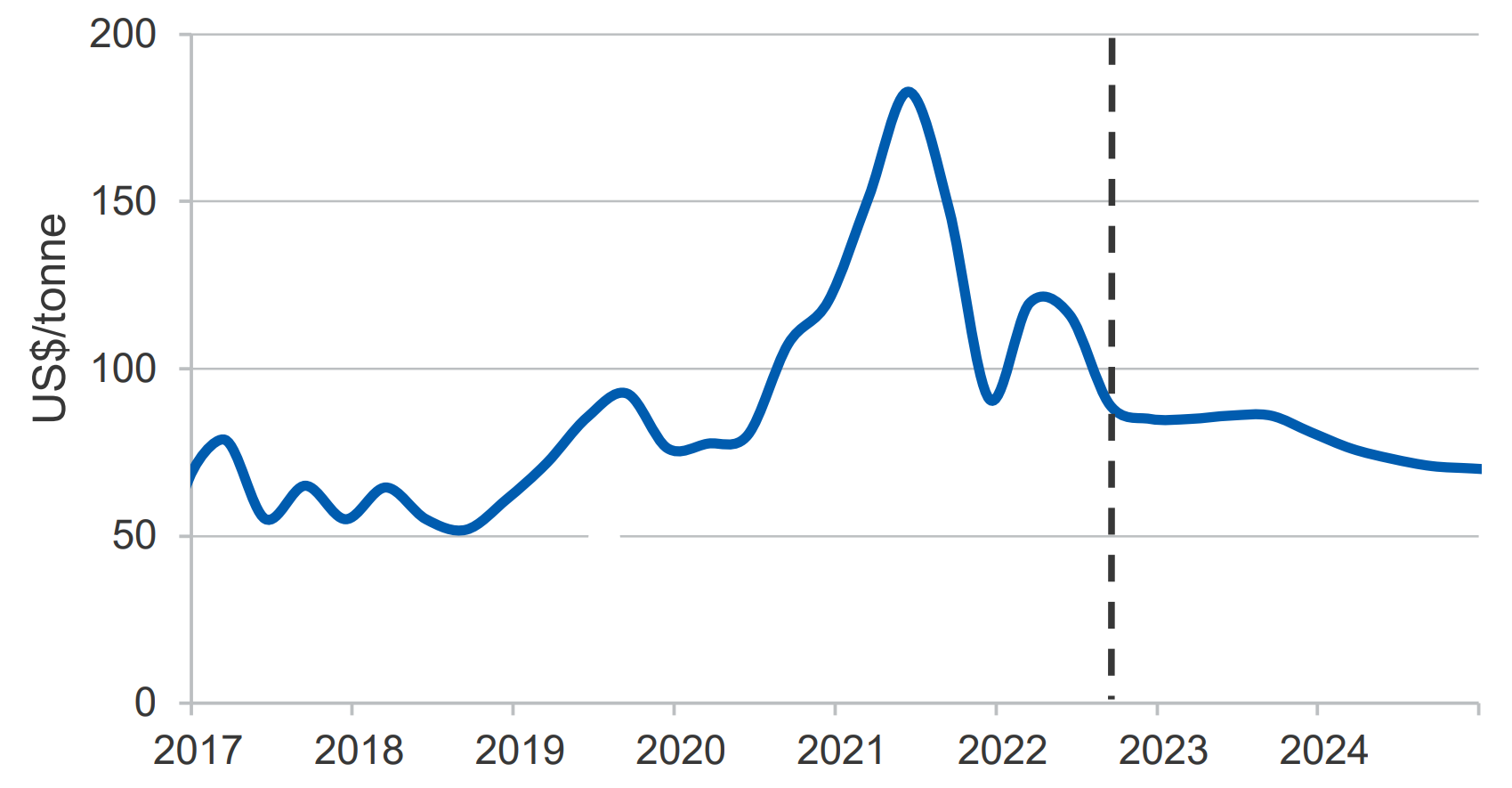

Falling Iron Ore Prices: The Role Of China's Steel Industry Slowdown

Table of Contents

China's Reduced Steel Production

China's reduced steel production is a primary driver of the current falling iron ore prices. This decline stems from several interconnected factors.

Impact of Government Policies

The Chinese government has implemented several initiatives to curb pollution and address overcapacity within its steel sector. These policies have directly impacted steel production and, consequently, iron ore demand.

- Carbon Emission Reduction Targets: Stringent emission reduction targets have forced steel mills to reduce production or invest heavily in cleaner technologies, leading to lower overall output.

- Production Quotas: The government has imposed production quotas on certain steel mills, limiting their output and contributing to the overall decline in steel production.

- Environmental Crackdowns: Increased scrutiny and stricter enforcement of environmental regulations have resulted in temporary shutdowns and reduced production at many steel plants.

These policies, while aimed at environmental sustainability, have had a significant impact on steel mills' output, reducing their need for iron ore and contributing directly to falling iron ore prices.

Weakening Real Estate Sector

China's struggling real estate sector is another major contributor to the decreased demand for steel. The construction industry is a massive consumer of steel, and its slowdown has significantly impacted steel demand.

- Falling Housing Starts: A sharp decline in new housing starts indicates a contraction in construction activity, resulting in reduced steel consumption.

- Decreased Property Sales: Lower property sales further signal weakening demand for construction materials, including steel.

- Construction Activity Slowdown: Overall construction activity has slowed considerably, impacting the demand for steel and driving down iron ore prices.

The ripple effect of China's real estate woes extends far beyond the property market, impacting related industries and ultimately affecting the demand for raw materials like iron ore.

Shifting Global Demand

While China's steel production decline is the dominant factor, the global steel market's dynamics also play a role in influencing iron ore prices. Are other countries compensating for China's reduced demand?

- India's Steel Production: India's steel industry is experiencing growth, but it is not currently sufficient to offset the decline in Chinese demand.

- European and US Steel Production: Steel production in Europe and the US remains relatively stable, but their combined consumption does not make up for China's reduced demand.

- Global Steel Market Dynamics: The overall global steel market shows a softened demand, contributing to the downward pressure on iron ore prices.

Though other nations' steel production plays a role, it's not enough to counterbalance the significant decrease in demand from China.

Increased Iron Ore Supply

The decline in iron ore prices is also exacerbated by an increase in global supply.

Rising Production from Major Exporters

Major iron ore-producing countries like Australia and Brazil continue to produce significant quantities of iron ore.

- Australian Iron Ore Production: Australia remains a leading exporter, and its consistent production levels contribute to the global supply surplus.

- Brazilian Iron Ore Production: Brazil is another major exporter, adding to the abundant global supply.

- Increased Production Levels: Overall, the combined production levels from these key exporters have led to a market saturated with iron ore.

This increased supply, coupled with reduced demand from China, exerts significant downward pressure on prices.

Inventory Levels and Stockpiles

High inventory levels of iron ore at ports and steel mills worldwide further contribute to the price decline.

- Port Stockpiles: Large stockpiles of iron ore at major ports indicate an oversupply in the market.

- Steel Mill Inventories: Elevated inventory levels at steel mills demonstrate reduced demand and a reluctance to purchase more iron ore.

- Buyer's Market: The abundance of iron ore creates a buyer's market, allowing purchasers to negotiate lower prices.

These high inventories translate to a buyer's market, pushing prices further down.

Speculative Trading and Market Sentiment

Market sentiment and speculative trading also influence the volatility of iron ore prices.

Investor Behavior and Market Volatility

Investor behavior and speculation play a crucial role in amplifying price movements.

- Market Uncertainty: Uncertainty surrounding China's economic outlook influences investor sentiment and contributes to price volatility.

- Speculative Trading Activity: Speculative trading can exacerbate both upward and downward price swings in the iron ore market.

- Market Events: Major market events, such as unexpected economic news, amplify price fluctuations.

The interplay between investor behavior and actual market dynamics significantly impacts the pricing of iron ore.

Conclusion

Falling iron ore prices are a complex issue with multiple contributing factors. China's slowing steel industry, driven by government policies, a weakening real estate sector, and shifting global demand, is the primary driver. Increased iron ore supply from major exporters and high inventory levels further exacerbate the downward pressure on prices. Finally, speculative trading and market sentiment amplify these price movements. Understanding the dynamics of falling iron ore prices is crucial for investors and industry professionals alike. Stay informed on the latest developments and market trends to navigate the challenges and opportunities presented by this volatile market. Monitor key indicators like Chinese steel production, global iron ore inventories, and investor sentiment to effectively manage risk and capitalize on potential opportunities within the shifting landscape of iron ore prices.

Featured Posts

-

Trump Team Explores Expedited Nuclear Power Plant Construction

May 10, 2025

Trump Team Explores Expedited Nuclear Power Plant Construction

May 10, 2025 -

France And Poland Strengthen Ties Friendship Treaty To Be Signed Next Month

May 10, 2025

France And Poland Strengthen Ties Friendship Treaty To Be Signed Next Month

May 10, 2025 -

Nyt Strands Answers And Hints For March 12 2024 Game 374

May 10, 2025

Nyt Strands Answers And Hints For March 12 2024 Game 374

May 10, 2025 -

10 Unmissable Film Noir Movies For Every Fan

May 10, 2025

10 Unmissable Film Noir Movies For Every Fan

May 10, 2025 -

Makron Starmer Merts I Tusk Boykotirovali Kiev 9 Maya Podrobnosti

May 10, 2025

Makron Starmer Merts I Tusk Boykotirovali Kiev 9 Maya Podrobnosti

May 10, 2025