Trump's Billionaire Buddies: How Tariffs Impacted Their Fortunes After Liberation Day

Table of Contents

The Tariff Winners: Billionaire Beneficiaries of Protectionist Policies

Some billionaires found themselves in a position to profit from Trump's "Buy American" agenda and the resulting tariffs on imported goods. These gains, however, were often industry-specific and didn't necessarily translate into universal economic prosperity.

Real Estate Moguls and the Construction Boom

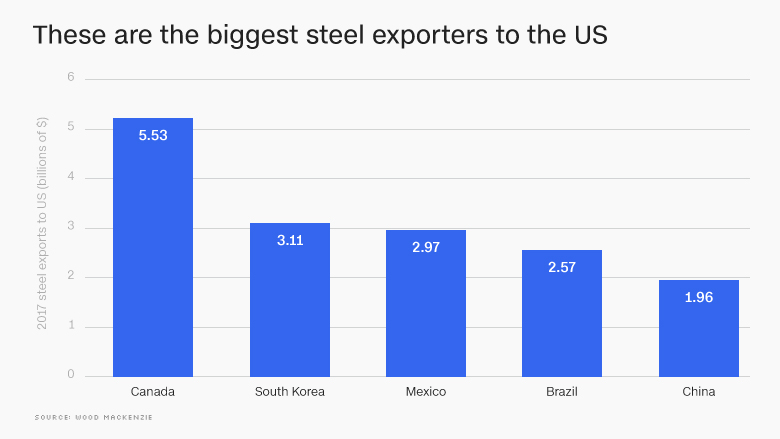

Tariffs on imported steel and lumber, key materials in construction, potentially inflated their prices. This, in turn, could have benefited some domestic real estate developers by making imported materials less competitive. However, the effects were nuanced.

- Specific Examples: While pinpointing exact financial gains tied directly to tariffs is difficult, one could analyze projects undertaken by billionaires like [insert example of a billionaire real estate developer and a specific project]. The increased cost of imported materials might have made their domestically sourced alternatives more attractive, potentially boosting profits.

- Estimated Financial Gains: Quantifying the impact of tariffs on specific real estate projects requires extensive financial analysis and is beyond the scope of this article. However, researchers could examine publicly available data on construction costs and profit margins for related projects.

- Potential Downsides: Increased material costs also increased the overall cost of projects, potentially impacting project feasibility and buyer affordability.

Domestic Manufacturers and the "Buy American" Agenda

Tariffs aimed to protect American manufacturers from foreign competition. Some billionaire-owned manufacturing businesses potentially benefited from reduced competition and increased domestic demand.

- Specific Examples: [Insert examples of billionaire-owned manufacturing businesses that might have benefited from tariffs. Note: Be cautious about making definitive claims; attribute any gains to plausible but not necessarily proven causation related to tariffs].

- Quantifiable Gains (if any): Determining specific financial gains due solely to tariffs is challenging. One would need to isolate the impact of tariffs from other market factors.

- Challenges Faced: Even with tariff protection, manufacturers still faced challenges like increased input costs and potential retaliatory tariffs from other countries.

The Tariff Losers: Billionaire Businesses Hurt by Trade Wars

Not all billionaires benefited from Trump's tariffs. Many experienced significant financial setbacks due to the trade wars that ensued.

Retail Giants and the Impact on Consumer Goods

Tariffs on imported goods directly impacted the pricing and availability of consumer goods, hitting retail giants particularly hard.

- Specific Examples: [Insert examples of billionaire-owned retail chains and describe the challenges they faced due to tariffs on imported goods. Use specific examples like increased costs of clothing, electronics, etc.].

- Impact on Stock Prices: Examine publicly available data on stock prices for major retailers to see how they fluctuated during periods of high tariff activity. Correlate stock price movements with tariff implementation timelines for a clearer picture, while acknowledging that many factors influence stock prices.

- Consumer Spending Shifts: Tariffs could have caused consumer spending shifts, affecting demand for certain goods and impacting profitability.

Tech Titans and the Global Supply Chain Disruptions

The global nature of tech manufacturing meant that tariffs caused major disruptions to supply chains, leading to increased costs and reduced profitability for many tech companies.

- Specific Examples: [Provide examples of billionaire-owned tech companies and explain how their supply chains were disrupted, potentially increasing production costs and product prices].

- Increased Production Costs: Analyze publicly available information regarding the increase in production costs for tech companies, comparing these costs during periods with and without heightened tariff activity.

- Strategies to Mitigate Losses: Describe the various strategies tech companies employed to mitigate the negative impact of tariffs, such as shifting production locations or absorbing increased costs.

Unintended Consequences: Ripple Effects on the Economy and Billionaire Wealth

The economic consequences of Trump's tariffs extended far beyond their direct impact on specific billionaires.

- Inflation Rates: Analyze inflation rates during periods of high tariff activity. Discuss how tariffs might have contributed to increased prices for consumers.

- Job Creation/Loss: Explore the net effect of tariffs on job creation and job losses in various sectors. Did tariff protection lead to job growth in some sectors, but job losses in others (e.g., retail)?

- GDP Growth Figures: Examine the correlation (or lack thereof) between tariff implementation and overall GDP growth.

- Long-Term Economic Forecasts: Discuss the long-term implications of the tariff policies on the US economy and how these might affect billionaire wealth in the future.

Conclusion

Trump's tariffs had a complex and often unpredictable impact on the fortunes of his billionaire buddies. While some benefited from protectionist policies, others suffered significant losses due to increased costs and disrupted supply chains. The overall effect highlights the intricate relationship between trade policy, billionaire wealth, and the broader economy. The unpredictability of economic outcomes emphasizes the need for careful consideration and robust analysis when implementing such sweeping trade policies.

Delve deeper into the complex world of Trump's Billionaire Buddies and the impact of tariffs – further research is crucial to fully understanding the long-term consequences of these policies on wealth inequality and the overall economic landscape.

Featured Posts

-

Federal Charges Millions Stolen Via Compromised Executive Office365 Accounts

May 10, 2025

Federal Charges Millions Stolen Via Compromised Executive Office365 Accounts

May 10, 2025 -

Tomas Hertls Second Hat Trick Of The Month Leads Golden Knights Past Red Wings

May 10, 2025

Tomas Hertls Second Hat Trick Of The Month Leads Golden Knights Past Red Wings

May 10, 2025 -

Understanding The Candidates In Your Nl Federal Riding

May 10, 2025

Understanding The Candidates In Your Nl Federal Riding

May 10, 2025 -

Find Out When Does The Next High Potential Episode Air On Abc

May 10, 2025

Find Out When Does The Next High Potential Episode Air On Abc

May 10, 2025 -

Wynne Evans Speaks Out A Post Strictly Come Dancing Career Announcement

May 10, 2025

Wynne Evans Speaks Out A Post Strictly Come Dancing Career Announcement

May 10, 2025