Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Assessment of Current Stock Market Valuations

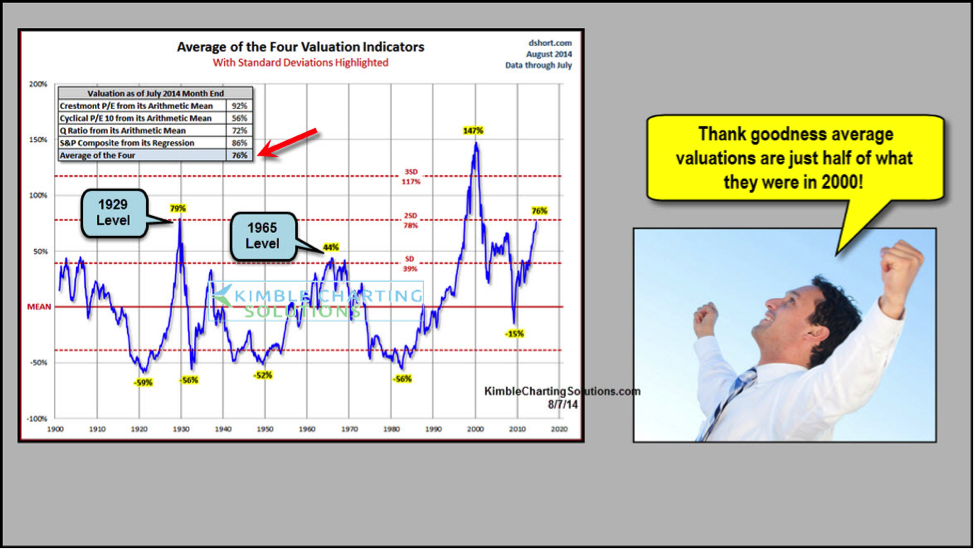

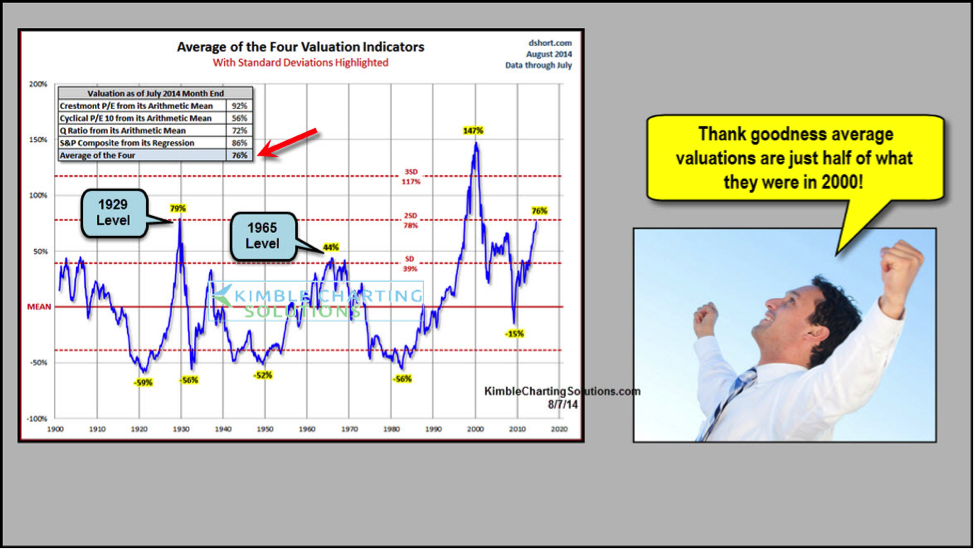

BofA's analysis of stock market valuations likely incorporates a multifaceted approach, considering various valuation metrics to paint a comprehensive picture. They probably utilize a combination of traditional methods and more sophisticated models to determine if the market is overvalued, undervalued, or fairly valued.

-

Methodology: BofA likely employs a combination of techniques. This might include examining price-to-earnings ratios (P/E ratios) across different sectors and comparing them to historical averages and industry benchmarks. Further, they may use discounted cash flow (DCF) analysis, a more complex method that projects future cash flows and discounts them back to their present value to estimate intrinsic value. Market capitalization and other valuation multiples also play a significant role in their assessment.

-

Sector-Specific Findings: BofA's reports often break down their analysis by sector. For instance, they may find that the technology sector, known for its high growth potential, is trading at a premium compared to its historical P/E ratios, while more mature sectors like utilities might be trading at a discount. Their analysis of the S&P 500, a broad market index, provides a holistic view of overall market valuation.

-

Fair Value vs. Market Price: A key aspect of BofA's analysis involves comparing their calculated fair value of various assets or indices against their current market prices. Discrepancies between these figures highlight potential overvaluation or undervaluation. For example, if BofA's DCF model suggests a fair value for the S&P 500 significantly below its current level, they might interpret this as a signal of overvaluation.

Macroeconomic Factors Influencing BofA's Outlook

BofA's valuation analysis doesn't exist in a vacuum; it’s deeply intertwined with the macroeconomic environment. Factors like inflation, interest rates, economic growth prospects, recessionary risks, and geopolitical events all play crucial roles in shaping their outlook.

-

Economic Predictions: BofA's economists regularly publish forecasts for key economic indicators such as inflation rates, GDP growth, and unemployment. These predictions inform their view on the overall economic climate and its influence on corporate earnings and stock valuations.

-

Interest Rate Impact: Rising interest rates generally increase borrowing costs for businesses, potentially dampening economic growth and reducing corporate profitability. BofA's analysis incorporates the expected trajectory of interest rates, considering the potential impact on both company earnings and investor sentiment.

-

Geopolitical Risks: Global events like the war in Ukraine, trade tensions, and other geopolitical uncertainties can significantly affect market sentiment and stock prices. BofA’s analysis incorporates an assessment of these risks and their potential impact on valuations. They may adjust their valuation models to reflect the uncertainty introduced by these factors.

BofA's Recommendations for Investors

Based on their valuation analysis and macroeconomic outlook, BofA likely offers specific recommendations to investors. These recommendations focus on building resilient investment strategies and navigating uncertainty.

-

Investment Strategies: BofA's advice might advocate for a diversified portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk. They may emphasize the importance of long-term investing, suggesting a buy-and-hold strategy rather than attempting to time the market.

-

Sector Selection: Depending on their valuation findings, BofA might suggest overweighting specific sectors they deem undervalued and underweighting those considered overvalued. This could mean favoring value stocks over growth stocks or vice versa, depending on their overall assessment.

-

Risk Management: Given the current market uncertainty, BofA likely stresses the importance of sound risk management techniques. This includes carefully considering risk tolerance and maintaining sufficient liquidity to withstand potential market downturns.

Conclusion

BofA's analysis of current stock market valuations suggests that while volatility exists, the market isn't necessarily overvalued to the point of imminent collapse. Their assessment, factoring in macroeconomic indicators and geopolitical risks, provides a more nuanced perspective than headline-grabbing short-term fluctuations. While they may identify sectors they see as overvalued, their overall message often leans towards a calm and measured approach for long-term investors. They generally advocate for diversification and a long-term investment strategy.

However, while BofA's analysis offers valuable insight, conducting your own thorough research and consulting with a financial advisor is crucial before making any investment decisions. Learn more about understanding stock market valuations and developing your own informed investment strategy to navigate this dynamic market effectively. Remember, understanding stock market valuations is an ongoing process, requiring constant monitoring and adaptation.

Featured Posts

-

Marvels Creative Challenges Maintaining Quality Across Its Expanding Universe

May 04, 2025

Marvels Creative Challenges Maintaining Quality Across Its Expanding Universe

May 04, 2025 -

Big Oils Production Stance Ahead Of Opec Meeting

May 04, 2025

Big Oils Production Stance Ahead Of Opec Meeting

May 04, 2025 -

Navigating The Belgian Merchant Market Financing Options For A 270 M Wh Bess

May 04, 2025

Navigating The Belgian Merchant Market Financing Options For A 270 M Wh Bess

May 04, 2025 -

Double Strike Cripples Hollywood Writers And Actors Demand Fair Compensation

May 04, 2025

Double Strike Cripples Hollywood Writers And Actors Demand Fair Compensation

May 04, 2025 -

Hong Kong Dollar Peg Recent Us Dollar Purchases And Market Impact

May 04, 2025

Hong Kong Dollar Peg Recent Us Dollar Purchases And Market Impact

May 04, 2025

Latest Posts

-

Anna Kendrick Remains Tight Lipped About Blake Lively Legal Dispute

May 04, 2025

Anna Kendrick Remains Tight Lipped About Blake Lively Legal Dispute

May 04, 2025 -

Anna Kendrick Silent On Blake Lively Lawsuit At Premiere

May 04, 2025

Anna Kendrick Silent On Blake Lively Lawsuit At Premiere

May 04, 2025 -

Anna Kendricks Body Language Fans React To Blake Lively Interview

May 04, 2025

Anna Kendricks Body Language Fans React To Blake Lively Interview

May 04, 2025 -

The Accountant 3 Making The Case For Anna Kendricks Return

May 04, 2025

The Accountant 3 Making The Case For Anna Kendricks Return

May 04, 2025 -

The Blake Lively And Anna Kendrick Feud Truth Or Fiction

May 04, 2025

The Blake Lively And Anna Kendrick Feud Truth Or Fiction

May 04, 2025